Global Ready-to-Eat Food Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Dairy Products, Instant Breakfast/Cereals, Bakery and Confectionary, Meat and Poultry, and Frozen Pizza), By Sales Channel (Food Service, Airport Retail, Travel Retail), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033.

Industry: Food & BeveragesGlobal Ready-to-Eat Food Market Insights Forecasts to 2033

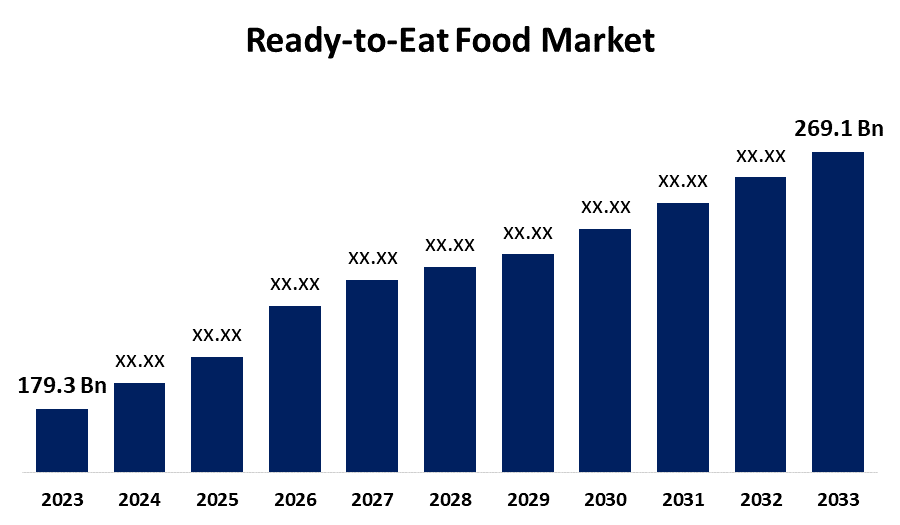

- The Global Ready-to-Eat Food Market Size was Valued at USD 179.3 Billion in 2023

- The Market Size is Growing at a CAGR of 4.14% from 2023 to 2033

- The Worldwide Ready-to-Eat Food Size is Expected to Reach USD 269.1 Billion by 2033

- North America is expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Ready-to-Eat Food Market Size is Anticipated to Exceed USD 269.1 Billion by 2033, Growing at a CAGR of 4.14% from 2023 to 2033. The surge in demand for frozen ready-to-eat food resulted in growing convenience trends towards increasing the market growth.

Market Overview:

Ready-to-eat food is described as food that has been precooked and packed for consumption by potential buyers. The modern lifestyle of consumers is increasingly adopting prepared meals which will drive the growth of the ready-to-eat food market. The rising acceptance of food service industries such as restaurants, hotels, and bakeries has played an important role in the market growth. The increased demand for frozen prepared food such as frozen meat, frozen vegetables, cheese, pizzas, and bread has significantly contributed to driving the growth of the ready-to-eat food market. The growing preference for healthier, plant-based, and sustainable alternative dietary habits is changing dramatically in the market. This shift reflects consumers' rising understanding of how their food choices affect their personal health and the environment.

According to Volza's United States Import data, the United States imports the majority of its ready-to-eat food items from India, Sri Lanka, and China. The United States imported 188 shipments of Ready to Eat Food Items (TTM) from February 2023 to January 2024. These imports were supplied by 9 foreign exporters to 17 United States customers, representing a 132% growth rate.

According to the Press Information Bureau, India's exports of ready-to-eat food increased by 24% to $394 million in 2021-22 (April-October) compared to 2020-21. In 2020-21, India's exports of final food products, such as Ready to Eat (RTE), Ready to Cook (RTC), and Ready to Serve (RTS), exceeded $2 billion. According to 2020-21 statistics, the top destinations for ready-to-eat exports are the United States (18.73%), the United Arab Emirates (8.64%), Nepal (5%), Canada (4.77%), Sri Lanka (4.47%), Australia (4.2%), Sudan (2.95%), the United Kingdom (2.88%), Nigeria (2.38%), and Singapore (2.01%).

Opportunity: Consumers endorse online buying

The industry improvements are the introduction of new applications that make it easier for users to select items and perform their grocery shopping online. Consumers like Internet purchasing due to more convenience and variety.

Report Coverage:

This research report categorizes the market for the global ready-to-eat food based on various segments and regions forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global ready-to-eat food market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global ready-to-eat food market.

Ready-to-Eat Food Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 179.3 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 4.14% |

| 2033 Value Projection: | USD 269.1 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 255 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Product Type, By Sales Channel and By Region |

| Companies covered:: | Nomad Foods, Danone, Vietnam Hanfimex Corporation, General Mills Inc., California Pizza Kitchen, McCain Foods Ltd., MTR Foods Private Limited, Conagra Brands, Inc., Atkins Nutritionals, Inc., MZ Food Products Pvt. Ltd., Nutririte Foods Private Limited, Nestlé, Dr. Oetker, Campbell Soup Company, SATS Ltd., Masala Mama, and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors:

The fluctuations in meal patterns and current food habits could drive the growth of the ready-to-eat food market. The augmented spending on food and beverages, and consciousness about healthy foods will increase the market growth. Ready-to-eat food items complement the lifestyle choices of dual-income households, providing a realistic answer for achieving a work-life balance.

Restraining Factors:

The increased rivalry could impede market growth. As the market grows, more firms enter, resulting in increasing rivalry for market share. Existing RTE food businesses have issues in differentiating their products and maintaining consumer loyalty.

Market Segmentation:

The global ready-to-eat food market share is classified into product type and sales channel.

- The dairy products have the largest share of the market during the forecast period.

Based on the product type, the global ready-to-eat food market is categorized into dairy products, instant breakfast/cereals, bakery and confectionary, meat and poultry, and Frozen pizza. Among these, dairy products have the largest share of the market during the forecast period. Ready-to-eat dairy-based meals for children are specifically designed to suit the nutritional requirements of growing youngsters. Ready-to-eat milk-based choices including cheese, yogurt, paneer, and milk-based sweets are convenient, nutritious, and appealing to a wide spectrum of consumers. India is the world's largest milk producer, accounting for 25% of total output. In 2023-24, India exported 63,738.47 metric tons of dairy products to the world, valued at $272.64 million.

- The food service segment owing to the largest share of the market over the forecast period.

Based on the sales channel, the global ready-to-eat food market is categorized into food service, airport retail, and travel retail. Among these, the food service segment has the largest share of the market over the forecast period. The food service industry offers diverse customer needs such as hotels, cafes, bakeries & patisseries, and fast-service restaurants. The ability of ready-to-eat items to meet a variety of dietary needs and cuisines reinforces their market domination and places them as a crucial factor in the sector's growth. The pre-made meals are ideal for the fast-paced food service industry due to their efficiency and ease.

Regional Segment Analysis of the Global Ready-to-Eat Food Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia-Pacific is projected to hold the largest share of the global ready-to-eat food market over the forecast period.

Get more details on this report -

Asia-Pacific is projected to hold the largest share of the global ready-to-eat food market over the forecast period. Asia-Pacific leads the ready-to-eat food market. The market is driven by increased demand for frozen and ready meals, such as frozen meat products, as well as frozen snacks including pizza, frozen cereals, soups, and so on. The introduction of more exotic products, the entry of private labels, and product premiumization are some of the drivers driving market demand. Consumers' perceptions of ready meals are steadily increasing, with convenience and fast cooking times being particularly appealing. China and India are expected to drive regional demand due to their significant growth and potential.

North America region is also expected to fastest CAGR growth during the forecast period. The region has a well-established culture of convenience and time efficiency, which complements customers' fast-paced lifestyles. RTE food products are well-accepted and widely available in North America. Furthermore, a strong and modern distribution network, combined with the presence of major market participants, guarantees that RTE products are easily accessible and visible across a variety of retail channels.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global ready-to-eat food market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies:

- Nomad Foods

- Danone

- Vietnam Hanfimex Corporation

- General Mills Inc.

- California Pizza Kitchen

- McCain Foods Ltd.

- MTR Foods Private Limited

- Conagra Brands, Inc.

- Atkins Nutritionals, Inc.

- MZ Food Products Pvt. Ltd.

- Nutririte Foods Private Limited

- Nestlé

- Dr. Oetker

- Campbell Soup Company

- SATS Ltd.

- Masala Mama

- Others

Key Market Developments:

- In July 2024, Masala Mama, a developer of Indian-inspired cooking sauces, launched a range of ready-to-eat beans. The range, which debuted at Sprouts locations nationally, has four flavors: Ooh La La Lentils, Cha Cha Chickpeas, La Bamba Black Beans, and Rah-Rah Red Beans.

- In May 2024, SATS Food Solutions' Bengaluru plant focuses on automation and IoT to capitalize on India's expanding ready-to-eat industry. The company intends to preserve taste consistency and develop new recipes through chef collaboration.

- In March 2024, Sats opens its largest innovative food solutions facility in Bengaluru, fueling the ready-to-eat food era in India.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the global ready-to-eat food market based on the below-mentioned segments:

Global Ready-to-Eat Food Market, By Product Type

- Dairy Products

- Instant Breakfast/Cereals

- Bakery and Confectionary

- Meat and Poultry

- Frozen Pizza

Global Ready-to-Eat Food Market, By Sales Channel

- Food Service

- Airport Retail

- Travel Retail

Global Ready-to-Eat Food Market, By Regional

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the global ready-to-eat food market over the forecast period?The global ready-to-eat food market size is expected to grow from USD 179.3 Billion in 2023 to USD 269.1 Billion by 2033, at a CAGR of 4.14 % during the forecast period 2023-2033.

-

2. Which region is expected to hold the highest share in the global ready-to-eat food market?Asia-Pacific is projected to hold the largest share of the global ready-to-eat food market over the forecast period.

-

3. Who are the top key players in the ready-to-eat food market?Nomad Foods, Danone, Vietnam Hanfimex Corporation, General Mills Inc, California Pizza Kitchen, McCain Foods Ltd, MTR Foods Private Limited, Conagra Brands Inc, Atkins Nutritionals, Inc, MZ Food Products Pvt. Ltd, Nutririte Foods Private Limited, Nestlé, Dr. Oetker, Campbell Soup Company, SATS Ltd, Masala Mama, and, Others.

Need help to buy this report?