Global Real Estate Tokenization Market Size, Share, and COVID-19 Impact Analysis, By Asset Type (Residential, Commercial, Industrial), By Token Type (Security Tokens, Utility Tokens), By End-User (Investors, Developers), and By Region (North America, Europe, Asia Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Consumer GoodsGlobal Real Estate Tokenization Market Insights Forecasts to 2033

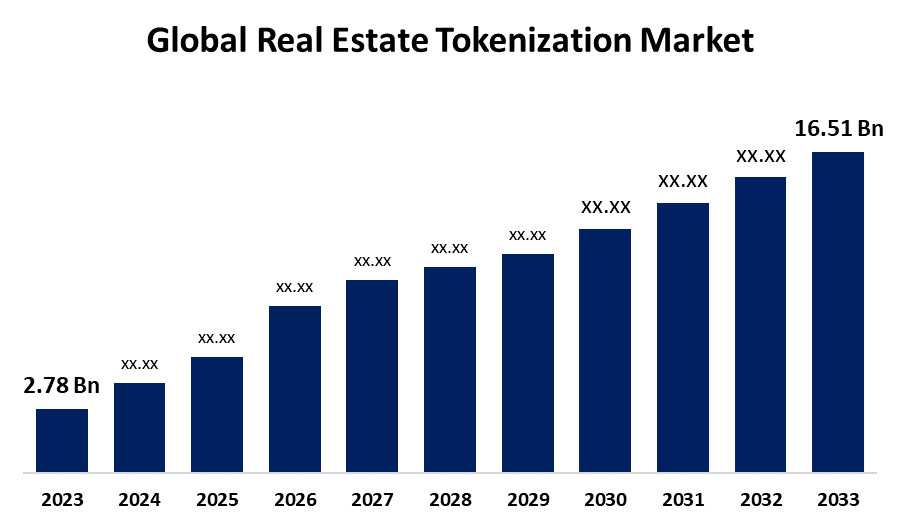

- The Global Real Estate Tokenization Market Size was Valued at USD 2.78 Billion in 2023

- The Market Size is Growing at a CAGR of 19.50% from 2023 to 2033

- The Worldwide Real Estate Tokenization Market Size is Expected to Reach USD 16.51 Billion by 2033

- Europe is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Real Estate Tokenization Market Size is anticipated to exceed USD 16.51 Billion by 2033, Growing at a CAGR of 19.50% from 2023 to 2033. North America will lead the real estate tokenization market due to its strong financial markets and regulatory clarity, while Europe will be the second prominent player based on its forward move of financial sectors, high progress in regulations, and the increased demand for innovative investment solutions.

Market Overview

The real estate tokenization market is experiencing fast growth, with growing blockchain adoption and demand for accessible investments. The major drivers of this growth include fractional ownership, increased liquidity and transparency, access to the global market, and decreased transaction costs. With continued technology and regulatory advancement, real estate investments are bound to change through tokenization, providing more opportunities and more efficient processes for investors. Moreover, the global market for real estate tokenization is a large opportunity in fractional ownership as it opens up access to high-value properties. Such trends include the increasing adoption of blockchain technology, increased liquidity and transparency in investments, and increased possibility of investment across borders. Tokenization is bringing greater efficiency, reducing costs and transforming traditional models of investing in real estate. For instance, In June 2024, an online company specializing in investing in commercial real estate marked a major milestone as members now place $1 billion into multiple company or "sponsor" real estate projects worth more than $5.9 billion since launch, having enjoyed a good balance of the product and the marketplace for faster involvement by members. More than half of its over 250,000 members have invested more than half of those funds just in the last three years. Still, investors are interested in areas other than Wall Street, though the economy is still unstable. Future growth is expected with ongoing evolution in regulations.

Report Coverage

This research report categorizes the global real estate tokenization market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global real estate tokenization market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global real estate tokenization market.

Global Real Estate Tokenization Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 2.78 Billion |

| Forecast Period: | 2023 - 2033 |

| Forecast Period CAGR 2023 - 2033 : | 19.50% |

| 2033 Value Projection: | USD 16.51 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 241 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Asset Type, By Token Type, By End-User, By Region and COVID-19 Impact Analysis. |

| Companies covered:: | Realty Mogul, Templum, Smartlands, Brickblock, RealBlocks, Slice, SolidBlock, Elevated Returns, Harbor, RealtyBits, RealT, Fluidity, AssetBlock, and other key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The real estate tokenization market is driven by increasing demand for fractional ownership, which allows broader access to high-value properties. Blockchain technology improves transparency, liquidity, and transaction efficiency while reducing costs. Regulatory advancements are creating a clear legal framework, ensuring legitimacy. Additionally, tokenization provides global market access, offering diverse investment opportunities. These factors collectively make real estate tokenization an attractive, cost-effective alternative to traditional real estate investment methods, driving market growth.

Restraints & Challenges

Some of the restraints in the real estate tokenization market are regulatory uncertainty, lack of investor awareness, and slow adoption by traditional real estate players. Further, technological challenges like security for the platform and integration with existing legal frameworks have slowed down the growth of the broader market.

Market Segmentation

The global real estate tokenization market share is classified into asset type, token type, and end-user.

- The commercial segment is expected to hold the largest share of the global real estate tokenization market during the forecast period.

Based on asset type, the global real estate tokenization market is categorized as residential, commercial, and industrial. Among these, the commercial segment is expected to hold the largest share of the global real estate tokenization market during the forecast period. This is so because commercial properties, like offices, retail spaces, and warehouses, generate steady income flows with high values. Tokenizing commercial real estate opens the market to fractional ownership, hence enabling investors to tap into these high-value markets with low capital. In addition, commercial real estate increasingly is being considered as an institutional asset class, further increasing demand for tokenization.

- The security tokens segment is expected to grow at the fastest CAGR during the forecast period.

Based on the token type, the global real estate tokenization market is categorized as security tokens, and utility tokens. Among these, the security tokens segment is expected to grow at the fastest CAGR during the forecast period. This growth can be attributed to their regulatory compliance, fractional ownership, and liquidity, they afford legal protection, and are more appealing to institutional investors, while providing transparency through blockchain technology. Utility tokens, on the other hand have fewer applications in real estate, leaving security tokens preferred for investors with regulated, tradable, and efficient real estate investment options.

- The investors segment is expected to hold the largest share of the global real estate Tokenization market during the forecast period.

Based on end-user, the global real estate tokenization market is categorized as investors, and developers. Among these, the investors segment is expected to hold the largest share of the global real estate tokenization market during the forecast period. This is because tokenization provides investors with fractional ownership, increased liquidity, and a greater diversity of real estate assets with reduced entry barriers. It attracts both institutional and retail investors who seek diversified portfolios and efficient, transparent investment opportunities. Developers are important but benefit more from tokenization in that they provide investor access, making investors the dominant end-user group in the market.

Regional Segment Analysis of the Global Real Estate Tokenization Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is projected to hold the largest share of the global real estate tokenization market over the forecast period.

Get more details on this report -

North America is projected to hold the largest share of the global real estate tokenization market over the forecast period. This is majorly because of the region's advanced financial markets, regulatory clarity, and high adoption of blockchain technology. The U.S. has developed legal frameworks for security tokens, attracting institutional investors and real estate developers. Further, North America's solid technology infrastructure and growing interest in alternative investment opportunities further push the growth of real estate tokenization in the region.

Europe is expected to grow at the fastest CAGR growth of the global real estate tokenization market during the forecast period. This is due to increasing regulatory clarity around blockchain-based investments, with several European countries implementing progressive frameworks for digital assets. Furthermore, Europe's strong financial sector, high demand for real estate investments, and growing interest in innovative, fractional investment opportunities contribute to the rise of real estate tokenization. The region's focus on sustainable and transparent investments further supports its growth.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global real estate tokenization market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Realty Mogul

- Templum

- Smartlands

- Brickblock

- RealBlocks

- Slice

- SolidBlock

- Elevated Returns

- Harbor

- RealtyBits

- RealT

- Fluidity

- AssetBlock

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Key Market Developments

- In July 2024, Templum, Inc., operating system for private markets and alternative assets, is pleased to announce it has partnered with SoFi, the all-in-one digital personal finance company, to expand the availability of investment opportunities to everyday investors through the new branch, Alternative Investments by SoFi.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the global real estate tokenization market based on the below-mentioned segments:

Global Real Estate Tokenization Market, By Asset Type

- Residential

- Commercial

- Industrial

Global Real Estate Tokenization Market, By Token Type

- Security Tokens

- Utility Tokens

Global Real Estate Tokenization Market, By End-User

- Investors

- Developers

Global Real Estate Tokenization Market, By Regional

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the global real estate tokenization market over the forecast period?The global real estate tokenization market size is expected to grow from USD 2.78 Billion in 2023 to USD 16.51 Billion by 2033, at a CAGR of 19.50% during the forecast period 2023-2033.

-

2. Which region is expected to hold the highest share of the global real estate tokenization market?North America is projected to hold the largest share of the global real estate tokenization market over the forecast period.

-

3. Who are the top key players in the global real estate tokenization market?Realty Mogul, Templum, Smartlands, Brickblock, RealBlocks, Slice, SolidBlock, Elevated Returns, Harbor, RealtyBits, RealT, Fluidity, AssetBlock, and Others.

Need help to buy this report?