Global Red Biotechnology Market Size, Share, Growth, and Industry Analysis, By Product Type (Gene Recombinant Drugs, Human Vaccines, Blood Products, Diagnostic Reagents, Personalized Medicines, Other), By Application (Pharmacogenomics, Gene Therapy, Genetic Testing, Biopharmaceutical Production), By End Use (Research Institutes, CMOs & CROs, Biopharmaceutical industries, Other), and Regional Insights and Forecast to 2033

Industry: HealthcareGlobal Red Biotechnology Market Insights Forecasts to 2033

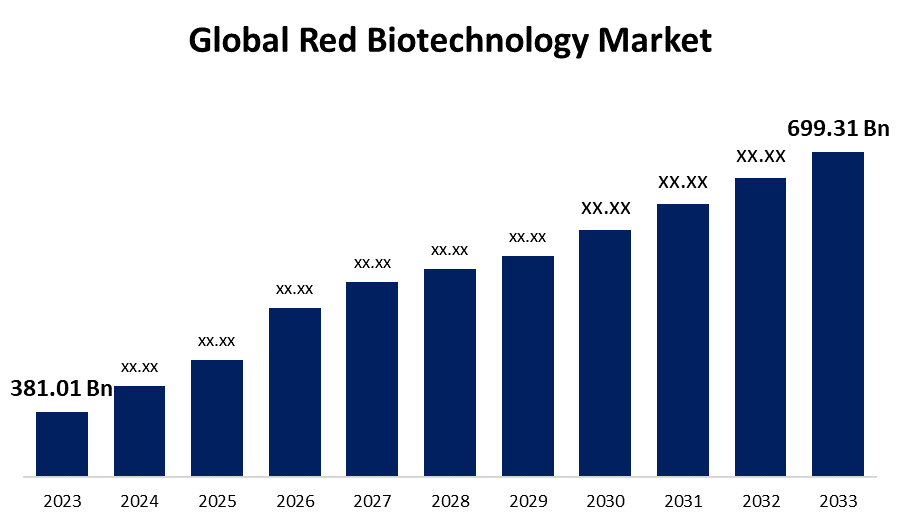

- The Global Red Biotechnology Market Size was Valued at USD 381.01 Billion in 2023

- The Market Size is Growing at a CAGR of 6.26% from 2023 to 2033

- The Worldwide Global Red Biotechnology Market Size is Expected to Reach USD 699.31 Billion by 2033

- Asia Pacific is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Red Biotechnology Market Size is Anticipated to Exceed USD 699.31 Billion by 2033, Growing at a CAGR of 6.26% from 2023 to 2033. Market growth is driven by several factors, including the increasing incidence and prevalence of chronic and rare diseases, as well as heightened funding in the healthcare sector. The growing need for red biotechnology in drug discovery, clinical trials, diagnostics, and carrier screening, coupled with the rise in genetic disorders, further fuels market expansion.

Global Red Biotechnology Market REPORT OVERVIEW

Red biotechnology is a branch of biotechnology focused on the application of biological processes and organisms in medicine and healthcare. It involves the use of genetic engineering, molecular biology, and microbiology to develop new treatments, vaccines, and diagnostic tools for various diseases, including chronic, rare, and genetic disorders. Red biotechnology plays a crucial role in drug discovery, development, and production, as well as in improving patient care through innovative medical technologies and therapies. Its advancements contribute significantly to addressing complex medical challenges and enhancing overall healthcare outcomes.

Numerous pharmaceutical companies are actively developing and manufacturing pipeline products for the treatment of diabetes and neurological disorders, including Alzheimer's and Parkinson's disease. These companies are investing in cutting-edge research and development to create innovative therapies aimed at managing and potentially curing these conditions. By focusing on both diabetes and neurological disorders, pharmaceutical firms are addressing significant medical challenges that affect millions of people worldwide. This concerted effort involves advancing drug formulations, enhancing delivery systems, and conducting extensive clinical trials to ensure safety and efficacy.

For instance, In April 2023, Pfizer Inc., a pharmaceutical company, announced that the U.S. Food and Drug Administration (FDA) has approved PREVNAR 20, a 20-valent Pneumococcal Conjugate Vaccine, for preventing invasive pneumococcal disease (IPD) caused by the 20 Streptococcus pneumoniae serotypes included in the vaccine. This approval applies to infants and children aged six weeks to 17 years. Additionally, PREVNAR 20 is approved for preventing otitis media in infants aged six weeks to five years, caused by the original seven serotypes in PREVNAR.

Report Coverage

This research report categorizes the market for the global red biotechnology market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global red biotechnology market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global red biotechnology market.

Global Red Biotechnology Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023 : | USD 381.01 Billion |

| Forecast Period: | 2023 – 2033 |

| Forecast Period CAGR 2023 – 2033 : | 6.26% |

| 023 – 2033 Value Projection: | USD 699.31 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 245 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Product Type, By Application, By End Use, By Region |

| Companies covered:: | Amgen Inc., Gilead Sciences, Inc., Biogen, Pfizer Inc., Novartis AG, Hoffmann-La Roche, Johnson & Johnson Services, Inc., Sanofi, Merck & Co. Inc., AbbVie Inc., GSK plc., Ipsen, AstraZeneca, Eli Lilly and Company, Novo Nordisk A/S, Bayer AG, TriSalus Life Sciences, Bristol-Myers Squibb Company, Teva Pharmaceutical Industries Ltd., Takeda Pharmaceutical Company Limited, Boehringer Ingelheim International GmbH, Astellas Pharma Inc., Others |

| Pitfalls & Challenges: | Covid-19 Impact, Challenge, Future,Growth and Analysis |

Get more details on this report -

DRIVING FACTORS:

“Advancement in Precision Medicine”

The emerging field of precision medicine and the growing focus on targeted therapeutics tailored to an individual’s genetics are driving R&D in biologics. Biologics are well-suited to precision medicine due to their ability to interact with complex signaling proteins and regulate disease pathways based on a patient's genetic profile. Biopharma companies are leveraging biotechnology to develop precision medicines, such as CAR T-cell therapies for blood cancers and personalized cancer vaccines. Government initiatives in countries like the United States and those in the European Union to enhance precision medicine research are promising for biotech companies aiming to accelerate the development of these targeted treatments.

RESTRAINING FACTORS:

“Red biotechnology faces high failure rates”

Numerous trials, including human testing, are underway, with the FDA monitoring each stage. However, products can become unsustainable during these trials, which can span up to ten years. According to Ernst & Young, 36% of drugs fail in the early stages of development. Additionally, 40% of candidates are eliminated in the final stages, while the remaining 68% must pass through intermediate stages. R&D has already consumed significant time and money, and substantial technological advances during this process can negatively impact the final product. Consequently, the market for red biotechnology may expand despite these challenges.

Market Segmentation

The global red biotechnology market share is classified into product type, application, and end-use.

Which segment is expected to hold the largest share of the global red biotechnology market during the forecast period?

“The human vaccines segment dominates the market with the highest market share over the forecast period”

Based on the product type, the global red biotechnology market is categorized into gene recombinant drugs, human vaccines, blood products, diagnostic reagents, personalized medicines, and others. This expansion is driven by the vital role that vaccines play in preventing and controlling a wide range of diseases. The integration of biotechnological advancements into vaccine production is revolutionizing disease prevention. These innovations enhance the effectiveness and efficiency of vaccines, enabling the development of more targeted and robust immunizations. As a result, vaccines are becoming more capable of addressing emerging health threats and improving public health outcomes. This biotechnological progress not only broadens the scope of vaccine applications but also paves the way for novel approaches to combating infectious diseases and other health conditions, reinforcing the importance of continuous innovation in the field.

Why gene therapy is Preferred over pharmacogenomics, genetic testing, and biopharmaceutical production?

“Gene therapy offers direct, corrective treatments and will see the highest growth”

This dominance is highlighted by the extensive research efforts focused on improving therapeutics for treating genetic defects associated with rare diseases. Significant resources are being dedicated to understanding the underlying genetic causes of these conditions and developing targeted treatments. Advances in genomics and biotechnology are driving innovations in drug development, enabling more precise and effective therapies. These research initiatives aim to address the unique challenges posed by rare diseases, which often involve complex genetic mutations and require specialized treatment approaches. By investing in cutting-edge research and technology, the field is making substantial progress in creating novel therapies that offer hope to patients with rare genetic disorders. This commitment to advancing therapeutic options underscores the importance of continued innovation and research in addressing unmet medical needs.

Which segment is anticipated to dominate the global red biotechnology market during the forecast period?

“The biopharmaceutical industries segment dominates the market with the highest market share over the forecast period”

Based on the end use, the global red biotechnology market is categorized into research Institutes, CMOs & CROs, biopharmaceutical industries, and others. Biopharmaceutical companies face several challenging trends. The rapid increase in global demand for COVID-19 vaccines and therapeutics is placing additional pressure on the industry. While the industry's capacity to innovate and provide COVID-19 vaccines amidst rising demand is impressive, the escalating global need remains a significant long-term challenge. Companies are also witnessing a surge in innovation, including new treatment modalities, advanced analytics, smart machines, and digital connectivity.

Regional Segment Analysis of the Global Red Biotechnology Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Which region is expected to hold the largest share of the global red biotechnology market over the forecast period?

“North America is anticipated to hold the largest share of the global red biotechnology market over the forecast period”

Get more details on this report -

The region's dominance can be largely attributed to the growing prevalence of chronic and rare diseases, coupled with escalating R&D activities and significant technological advancements. The rising incidence of cancer, particularly among the aging population, is a major factor driving market expansion in the region. This increase in cancer cases and the broader demographic trend of an older population create a higher demand for advanced medical solutions and innovations. Consequently, the combination of these factors stimulates regional market growth, as investments in research and technology accelerate the development of new therapies and diagnostic tools. The region's focus on addressing these health challenges further strengthens its position in the global market.

Why Asia Pacific is growing at the fastest CAGR in the global red biotechnology market?

“Emerging Asia-Pacific economies drive rapid growth”

The rapid growth of the Asia-Pacific region is significantly driven by emerging economies such as India and China. These countries are actively engaging in private-public partnerships and government initiatives that are accelerating market expansion. India and China are fostering collaborations between private companies and public institutions to enhance healthcare infrastructure, support innovation, and drive economic development. Government programs are providing crucial funding and policy support, further propelling the growth of the regional market. These concerted efforts are facilitating advancements in technology, improving access to healthcare, and creating a favorable environment for continued investment and development in the Asia-Pacific region.

Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global red biotechnology market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Amgen Inc.

- Gilead Sciences, Inc.

- Biogen

- Pfizer Inc.

- Novartis AG

- Hoffmann-La Roche

- Johnson & Johnson Services, Inc.

- Sanofi

- Merck & Co. Inc.

- AbbVie Inc.

- GSK plc.

- Ipsen

- AstraZeneca

- Eli Lilly and Company

- Novo Nordisk A/S

- Bayer AG

- TriSalus Life Sciences

- Bristol-Myers Squibb Company

- Teva Pharmaceutical Industries Ltd.

- Takeda Pharmaceutical Company Limited

- Boehringer Ingelheim International GmbH

- Astellas Pharma Inc.

- Others

Recent Developments

- In January 2023, Ipsen, a biopharmaceutical company based in France, and Albireo, a biotech firm specializing in pharmaceutical products and services, announced a binding merger agreement. Under this agreement, Ipsen will acquire Albireo, a leader in developing bile-acid modulators for treating cholestatic liver disorders in both children and adults.

- In November 2022, TriSalus Life Sciences, a privately held company specializing in oncology therapeutics, has announced a definitive merger agreement with MedTech Acquisition Corporation, a publicly traded special purpose acquisition company (SPAC).

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the global red biotechnology market based on the below-mentioned segments:

Global Red Biotechnology Market, By Product Type

- Gene Recombinant Drugs

- Human Vaccines

- Blood Products

- Diagnostic Reagents

- Personalized Medicines

- Other

Global Red Biotechnology Market, By Application

- Pharmacogenomics

- Gene Therapy

- Genetic Testing

- Biopharmaceutical Production

Global Red Biotechnology Market, by End Use

- Research Institutes

- CMOs & CROs

- Biopharmaceutical industries

- Other

Global Red Biotechnology Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the global red biotechnology market?The global red biotechnology market is projected to expand at 6.26% during the forecast period.

-

2. Who are the top key players in the global red biotechnology market?The key players in the global red biotechnology market are Amgen Inc., Gilead Sciences, Inc., Biogen, Pfizer Inc., Novartis AG, Hoffmann-La Roche, Johnson & Johnson Services, Inc., Sanofi, Merck & Co. Inc., AbbVie Inc., GSK plc., Ipsen, AstraZeneca, Eli Lilly and Company, Novo Nordisk A/S, Bayer AG, TriSalus Life Sciences, Bristol-Myers Squibb Company, Teva Pharmaceutical Industries Ltd., Takeda Pharmaceutical Company Limited, Boehringer Ingelheim International GmbH, Astellas Pharma Inc., Others.

-

3. Which region is expected to hold the largest share of the global red biotechnology market?The North America region is expected to hold the largest share of the global red biotechnology market.

Need help to buy this report?