Global Red Meat Market Size, Share, and COVID-19 Impact Analysis, By Type (Beef, Veal, Mutton, Pork, Lamb, Goat), By Form (Canned, Fresh / Chilled, Frozen, Processed), By Distribution Channel (Supermarkets/Hypermarkets, Convenient Stores, Specialty Stores, Online Retail), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033.

Industry: Food & BeveragesGlobal Red Meat Market Insights Forecasts to 2033

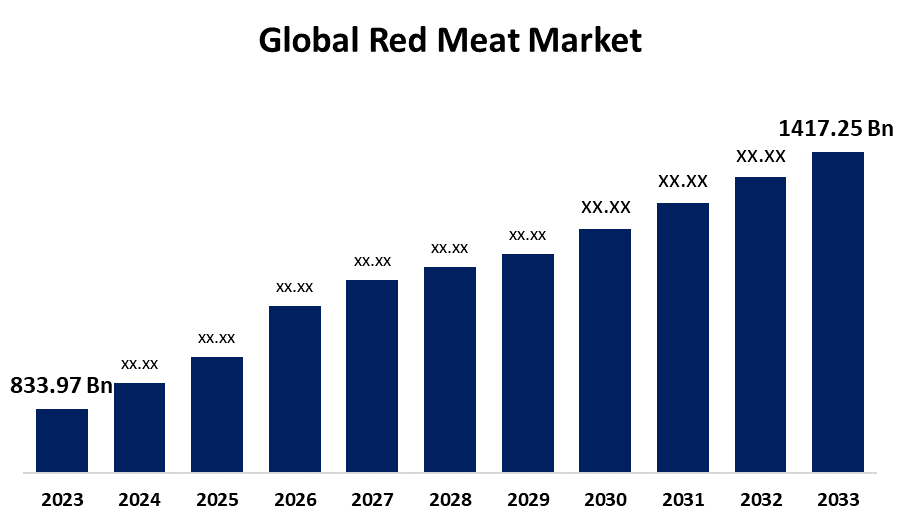

- The Global Red Meat Market Size was estimated at USD 833.97 Billion in 2023

- The Market Size is Expected to Grow at a CAGR of around 5.45% from 2023 to 2033

- The Worldwide Red Meat Market Size is Expected to Reach USD 1417.25 Billion By 2033

- Asia Pacific is expected to grow the fastest during the forecast period.

Get more details on this report -

The Global Red Meat Market size was worth around USD 833.97 Billion in 2023 and is predicted to Grow to around USD 1417.25 Billion By 2033 with a compound annual growth rate (CAGR) of 5.45% between 2023 and 2033. The global red meat market is driven by rising consumer demand for protein-based diets, urbanization, and growing disposable incomes. Red meat, encompassing beef, lamb, pork, and veal, is a staple food in many cuisines globally. It is valued for its nutritional value, such as high protein and necessary vitamins like B12 and iron.

Market Overview

The red meat market indicates the global consumption, production, and trade of red meat products, which may involve beef, pork, lamb, and goat meat. Red meat is still a mainstay in most people's diets owing to its nutrient density, proteins, vitamins, and minerals being the primary constituents. Red meat contains essential nutrients like Vitamin B12, which plays a key role in nerve function and red blood cell formation, as well as zinc, selenium, and phosphorus. Moreover, rising population, urbanization, and improving disposable incomes in developing economies are fueling demand for protein-based foods like red meat. In addition, red meat innovations are all about sustainable red meat practices like lab-grown meat, modern breeding methods, and enhanced processing that increases efficiency and minimizes waste. Furthermore, consumers are increasingly favoring plant-based meat alternatives that offer a healthier and environmentally friendly market option. All these drive the future of the red meat market towards expansion and change.

Report Coverage

This research report categorizes the red meat market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the red meat market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the red meat market.

Global Red Meat Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 833.97 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 5.45% |

| 2033 Value Projection: | USD 1417.25 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 108 |

| Segments covered: | By Type, By Form, By Distribution Channel, By Region |

| Companies covered:: | W.H. Group,, JBS USA Food Company,, Tyson Foods Inc.,, Kraft Heinz Company,, Cargill, Incorporated,, ConAgra Foods Inc.,, BRF SA,, OSI Group LLC.,, Tönnies Group,, SYSCO Corp.,, Smithfield Foods Inc.,, The Scottish Goat Meat Company,, Irish Country Meats., and other key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Red meat contains a nutrient-dense profile. Red meat is loaded with protein, amino acids, various essential vitamins, and minerals. Incorporating red meat into a daily diet guarantees proper muscle growth, immune health, and overall wellness, driving the demand for the red meat market. The health, food, and wellness awareness along with the trend of gyms, running, Pilates, and strength training have all added to the demand of the red meat market as a source of the daily diet.

Restraining Factors

Red meat overconsumption has been associated with many diseases, such as heart disease, cancer, and high cholesterol, resulting in declining consumer demand, especially from health-conscious consumers, thus limiting red meat market growth. The price of raising livestock, such as feed and fuel, is on the rise, which could increase meat prices and restrict affordability for certain consumers, slowing down the demand for the red meat market.

Market Segmentation

The red meat market share is classified into type, form, and distribution channel.

- The beef segment dominated the market in 2023 and is projected to grow at a substantial CAGR during the forecast period.

Based on the type, the red meat market is divided into beef, veal, mutton, pork, lamb, and goat. Among these, the beef segment dominated the market in 2023 and is projected to grow at a substantial CAGR during the forecast period. The growth is attributed to beef being full of vital nutrients such as protein, iron, zinc, and Vitamin B12 and thus is a highly desired food by individuals looking for a good quality, high-protein diet. Beef is consumed in many parts of the world, it forms part of many people's diets, thereby being the most consumed form of red meat.

- The frozen segment accounted for a significant share in 2023 and is anticipated to grow at a remarkable CAGR during the forecast period.

Based on the form, the red meat market is divided into canned, fresh / chilled, frozen, and processed. Among these, the frozen segment accounted for a significant share in 2023 and is anticipated to grow at a remarkable CAGR during the forecast period. The growth is driven due to frozen red meat lasts longer than fresh meat and is therefore more convenient to store and less likely to spoil. Frozen red meat is generally cheaper than fresh meat owing to the lower wastage risk and longer shelf life, thus becoming a cost-effective choice for consumers.

- The supermarkets/hypermarkets segment accounted for the biggest share in 2023 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the distribution channel, the red meat market is divided into supermarkets/hypermarkets, convenient stores, specialty stores, and online retail. Among these, the supermarkets/hypermarkets segment accounted for the biggest share in 2023 and is anticipated to grow at a significant CAGR during the forecast period. The segmental growth is due to supermarkets and hypermarkets are within easy reach of a large consumer base. They provide a wide variety of red meat products such as fresh, frozen, packaged, and processed meats to suit various consumer tastes and budgets.

Regional Segment Analysis of the Red Meat Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the red meat market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of the red meat market over the predicted timeframe. The United States and Canada are large consumers of red meat, especially beef and pork. Red meat is deeply rooted in the diet, and the U.S. is a leading producer and exporter of beef and pork. North American supermarkets and hypermarkets provide a vast range of red meat products, which fuel consumption.

Asia Pacific is expected to grow at a rapid CAGR in the red meat market during the forecast period. Sustained growth in populations, urbanization, and increasing disposable incomes in nations such as China and India propelled demand for the red meat market in the Asia Pacific region. Consumption of beef, pork, and lamb is growing with these economies undergoing changes in diet trends, shifting toward more protein-based diets.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the red meat market along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- W.H. Group,

- JBS USA Food Company,

- Tyson Foods Inc.,

- Kraft Heinz Company,

- Cargill, Incorporated,

- ConAgra Foods Inc.,

- BRF SA,

- OSI Group LLC.,

- Tönnies Group,

- SYSCO Corp.,

- Smithfield Foods Inc.,

- The Scottish Goat Meat Company,

- Irish Country Meats.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In March 2024, Hormel Foods Corporation's Black Label brand announced the launch of ranch bacon. These products are available in grocery stores throughout the U.S. The company did this to keep pace with the growing demand for new and interesting flavors and innovations, particularly from younger generations.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the red meat market based on the below-mentioned segments:

Global Red Meat Market, By Type

- Beef

- Veal

- Mutton

- Pork

- Lamb

- Goat

Global Red Meat Market, By Form

- Canned

- Fresh / Chilled

- Frozen

- Processed

Global Red Meat Market, By Distribution Channel

- Supermarkets/Hypermarkets

- Convenient Stores

- Specialty Stores

- Online Retail

Global Red Meat Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the red meat market over the forecast period?The global red meat market is projected to expand at a CAGR of 5.45% during the forecast period.

-

2. What is the market size of the red meat market?The global red meat market size is expected to grow from USD 833.97 Billion in 2023 to USD 1417.25 Billion by 2033, at a CAGR of 5.45% during the forecast period 2023-2033.

-

3. Which region holds the largest share of the red meat market?North America is anticipated to hold the largest share of the red meat market over the predicted timeframe.

Need help to buy this report?