Global Refinery and Petrochemical Filtration Market Size, Share, and COVID-19 Impact Analysis, By Filter Type (Coalescer Filter, Cartridge Filter, Electrostatic Precipitator, Filter Press, Bag Filter and Others), By Application (Liquid-liquid Separation, Liquid-gas Separation, and Others), by End User (Refineries and Petrochemical Industry), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Energy & PowerGlobal Refinery and Petrochemical Filtration Market Insights Forecasts to 2033

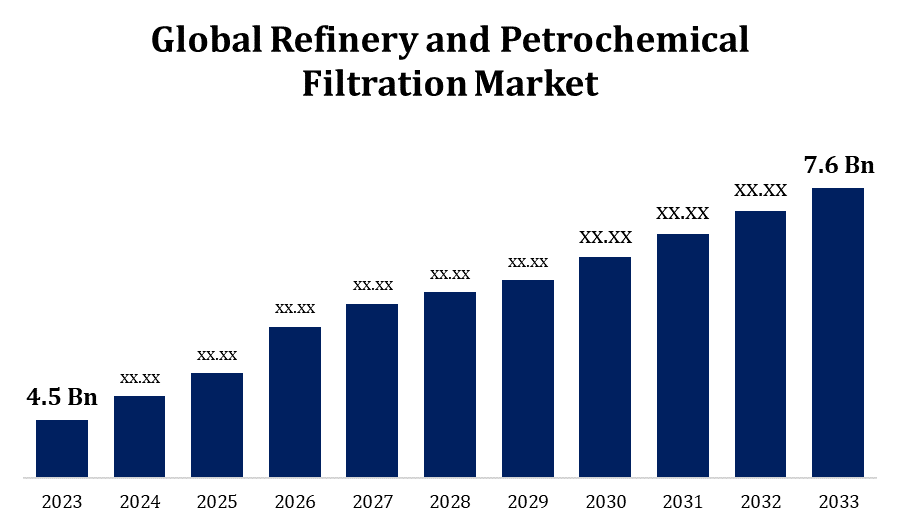

- The Refinery and Petrochemical Filtration Market Size was valued at USD 4.5 Billion in 2023.

- The Market Size is Growing at a CAGR of 5.38% from 2023 to 2033.

- The Worldwide Refinery and Petrochemical Filtration Market Size is expected to reach USD 7.6 Billion by 2033.

- Asia Pacific is expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Refinery and Petrochemical Filtration Market Size is expected to reach USD 7.6 Billion by 2033, at a CAGR of 5.38% during the forecast period 2023 to 2033.

The refinery and petrochemical filtration market is growing due to increased demand for clean fuels and the push for eco-friendly operations within the oil and gas industry. Filtration systems are essential for removing contaminants and ensuring the efficiency of refining and petrochemical processes. They help improve product quality, reduce environmental impact, and minimize equipment wear, which lowers operational costs. As regulatory standards tighten globally, particularly around emissions, companies are investing in advanced filtration technologies. Additionally, the need for reliable filtration solutions is spurred by the aging infrastructure in developed regions and rapid industrialization in developing economies. Key players are focusing on innovation, such as nanotechnology-based filters, to enhance filtration performance. This dynamic market is projected to grow as energy companies continue modernizing their operations.

Refinery and Petrochemical Filtration Market Value Chain Analysis

The refinery and petrochemical filtration market value chain begins with raw material suppliers providing essential components like specialized filter media, membranes, and filtration materials. Manufacturers then use these materials to produce filtration systems tailored for handling the complex contaminants and chemicals involved in refining and petrochemical processes. These systems are often designed with precise specifications to meet stringent industry standards for safety, efficiency, and environmental compliance. Distributors, including industry-specific suppliers, ensure the availability of filtration products to end-users like refineries and petrochemical plants. Service providers, such as maintenance and consulting firms, also play a significant role by helping facilities optimize and maintain filtration efficiency. At every stage, ongoing research, quality control, and innovation are crucial in advancing filtration technology to meet evolving regulatory demands and operational needs.

Refinery and Petrochemical Filtration Market Opportunity Analysis

The refinery and petrochemical filtration market presents significant growth opportunities driven by increasing environmental regulations and the need for efficient processing. As the global focus on sustainability intensifies, refineries are under pressure to enhance their filtration systems to minimize waste and emissions. The adoption of advanced filtration technologies, such as membrane filtration and nanofiltration, is gaining traction to meet stringent quality standards for process water and product purity. Additionally, the rise of renewable energy and biofuels is prompting refineries to invest in innovative filtration solutions to handle diverse feedstocks. Moreover, ongoing infrastructure upgrades and expansions in emerging economies further drive demand for efficient filtration systems. By leveraging technological advancements and improving operational efficiencies, stakeholders can capitalize on these opportunities for long-term growth in the filtration sector.

Global Refinery and Petrochemical Filtration Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 4.5 Billion |

| Forecast Period: | 2023 - 2033 |

| Forecast Period CAGR 2023 - 2033 : | 5.38% |

| 2033 Value Projection: | USD 7.6 Billion |

| Historical Data for: | 2019 - 2022 |

| No. of Pages: | 235 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Filter Type, By Application, By End User, and By Region |

| Companies covered:: | 3M, Amazon Filters Ltd., Brother Filtration, Camfil Ab, Compositech Products Manufacturing, Inc., Eaton, Filson Filter, Filtcare Technology Pvt. Ltd., Filtration Group, Filtration Technology Corporation, Huading Separator, Kel India Filters, Lenntech B.V., Norman Filter Company, Pall Corporation, Parker Hannifin Corp., Pentair Filtration Solutions, LLC, Porvair Filtration Group, Sungov Engineering, W.L. Gore & Associates, Inc., and Others |

| Growth Drivers: | The market’s expansion is being driven by advanced filtering technologies |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics

Refinery and Petrochemical Filtration Market Dynamics

The market's expansion is being driven by advanced filtering technologies

The expansion of the refinery and petrochemical filtration market is being significantly driven by advancements in filtering technologies. Innovations, such as nanotechnology-based and membrane filtration, enable higher efficiency in removing contaminants, leading to improved product quality and operational reliability. These advanced filtration systems are designed to meet stringent environmental regulations and reduce emissions, which is increasingly essential as governments worldwide enforce stricter standards. High-performance filters also contribute to lower maintenance costs by extending equipment life and reducing downtime, making them highly valuable in refining and petrochemical processes. Additionally, rising industrial activities, especially in developing regions, are creating demand for reliable, advanced filtration solutions. As companies prioritize eco-friendly operations and cost-effective production, the adoption of next-generation filtration technologies continues to support the market's growth.

Restraints & Challenges

One key challenge is the high cost of advanced filtration systems, which may deter smaller refineries from upgrading despite the benefits of improved filtration. Additionally, the need for continuous maintenance to ensure optimal performance adds operational complexity and increases costs. The diverse nature of contaminants in petrochemical processes, including harsh chemicals, corrosive substances, and fine particulates, demands specialized filtration solutions, which can be technically challenging to design and implement. Furthermore, stringent environmental regulations impose pressure on refineries to meet increasingly strict emission and waste disposal standards, necessitating frequent upgrades. Lastly, the volatility in oil prices and global economic uncertainties can hinder investment in new filtration technologies, slowing down market adoption and innovation.

Regional Forecasts

North America Market Statistics

Get more details on this report -

North America is anticipated to dominate the Refinery and Petrochemical Filtration Market from 2023 to 2033. The refinery and petrochemical filtration market in North America is experiencing steady growth, driven by increasing regulatory pressures to reduce emissions and environmental impact. The U.S. and Canada, with their well-established refining and petrochemical industries, are investing in advanced filtration systems to enhance efficiency, meet stringent environmental standards, and improve operational sustainability. Demand for high-performance filtration technologies, such as membrane and nanotechnology-based filters, is rising as companies strive to improve fuel quality and equipment longevity while minimizing maintenance costs. Furthermore, the aging infrastructure in North American refineries necessitates upgrades and retrofits with state-of-the-art filtration solutions. With continued focus on eco-friendly practices and operational optimization, the North American market is expected to see robust adoption of innovative filtration technologies to ensure compliance and efficiency in the coming years.

Asia Pacific Market Statistics

Asia Pacific is witnessing the fastest market growth between 2023 to 2033. Emerging nations are expanding their refining capacities, driving the need for advanced filtration systems to improve operational efficiency and meet rising environmental standards. Stringent regulations on emissions and pollutants have spurred investments in high-performance filtration technologies, such as nanotechnology-based and membrane filters, to enhance product quality and reduce environmental impact. Furthermore, the growing awareness of sustainable practices in the region’s refining and petrochemical industries has accelerated the adoption of eco-friendly filtration solutions. As Asia Pacific remains a key player in global oil and petrochemical production, the market for cutting-edge filtration technologies is expected to expand significantly.

Segmentation Analysis

Insights by Filter Type

The filter press segment accounted for the largest market share over the forecast period 2023 to 2033. Filter presses provide high filtration precision, making them ideal for applications that demand stringent contaminant removal and sludge management. As refineries and petrochemical plants aim to comply with environmental regulations and improve operational sustainability, demand for reliable filtration solutions like filter presses is rising. Advanced filter press technologies, such as automated and high-pressure systems, are being adopted to reduce maintenance costs and improve productivity. Additionally, the growing focus on minimizing wastewater and optimizing resource use is further propelling the segment’s expansion. With these advantages, the filter press segment is expected to see sustained growth as the industry prioritizes efficiency and compliance.

Insights by Application

The liquid-liquid separation segment accounted for the largest market share over the forecast period 2023 to 2033. With rising regulatory demands for cleaner products and lower emissions, companies are increasingly investing in advanced liquid-liquid separation technologies, such as coalescers and electrostatic separators, to improve efficiency and product quality. These systems enable effective removal of water and other contaminants from oil, reducing corrosion, and enhancing equipment lifespan. Moreover, the expansion of oil refining capacities in regions like Asia Pacific and the Middle East drives further demand for efficient separation solutions. As companies prioritize eco-friendly and cost-effective processes, the liquid-liquid separation segment is positioned for continued growth in the market.

Insights by End User

The petrochemical industry segment accounted for the largest market share over the forecast period 2023 to 2033. Filtration is essential in petrochemical processes, where removing impurities helps ensure the purity and performance of end products. Stringent environmental regulations and the need for sustainable operations push the industry toward advanced filtration technologies, such as nanofiltration and membrane filtration, which improve efficiency and reduce waste. Additionally, with rapid industrialization and increased production capacities in Asia Pacific and the Middle East, the petrochemical industry’s demand for effective filtration solutions is surging. As companies focus on meeting regulatory requirements and optimizing production, the petrochemical segment is expected to sustain strong growth in the filtration market.

Recent Market Developments

- On September 2022, Parker Hannifin Corporation finalized its acquisition of Meggitt, a strategic decision that strengthened its aerospace solutions portfolio.

Competitive Landscape

Major players in the market

- 3M

- Amazon Filters Ltd.

- Brother Filtration

- Camfil Ab

- Compositech Products Manufacturing, Inc.

- Eaton

- Filson Filter

- Filtcare Technology Pvt. Ltd.

- Filtration Group

- Filtration Technology Corporation

- Huading Separator

- Kel India Filters

- Lenntech B.V.

- Norman Filter Company

- Pall Corporation

- Parker Hannifin Corp.

- Pentair Filtration Solutions, LLC

- Porvair Filtration Group

- Sungov Engineering

- W.L. Gore & Associates, Inc.

- Others

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2033.

Refinery and Petrochemical Filtration Market, Filter Type Analysis

- Coalescer Filter

- Cartridge Filter

- Electrostatic Precipitator

- Filter Press

- Bag Filter

- Others

Refinery and Petrochemical Filtration Market, Application Analysis

- Liquid-liquid Separation

- Liquid-gas Separation

- Other

Refinery and Petrochemical Filtration Market, End Use Analysis

- Refineries

- Petrochemical Industry

Refinery and Petrochemical Filtration Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the market size of the Refinery and Petrochemical Filtration Market?The global Refinery and Petrochemical Filtration Market is expected to grow from USD 4.5 billion in 2023 to USD 7.6 billion by 2033, at a CAGR of 5.38% during the forecast period 2023-2033.

-

2. Who are the key market players of the Refinery and Petrochemical Filtration Market?Some of the key market players of the market are 3M, Amazon Filters Ltd., Brother Filtration, Camfil Ab, Compositech Products Manufacturing, Inc., Eaton, Filson Filter, Filtcare Technology Pvt. Ltd., Filtration Group, Filtration Technology Corporation, Huading Separator, Kel India Filters, Lenntech B.V., Norman Filter Company, Pall Corporation, Parker Hannifin Corp., Pentair Filtration Solutions, LLC, Porvair Filtration Group, Sungov Engineering, W.L. Gore & Associates, Inc.

-

3. Which segment holds the largest market share?The filter press segment holds the largest market share and is going to continue its dominance.

-

4. Which region dominates the Refinery and Petrochemical Filtration Market?North America dominates the Refinery and Petrochemical Filtration Market and has the highest market share.

Need help to buy this report?