Global Refinery Process Chemicals Market Size, Share, and COVID-19 Impact Analysis, By Type (Catalysts, PH Adjustors, Anti-fouling Agents, Corrosion Inhibitors, and Demulsifiers), By Application (Crude Oil Distillation, Hydrotreating, Catalytic Cracking, Alkylation, and Isomerization), By End-Use (Petroleum Refineries, Petrochemical Plants, Chemical Processing Facilities, and Oil & Gas Exploration Companies), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033.

Industry: Chemicals & MaterialsGlobal Refinery Process Chemicals Market Insights Forecasts to 2033

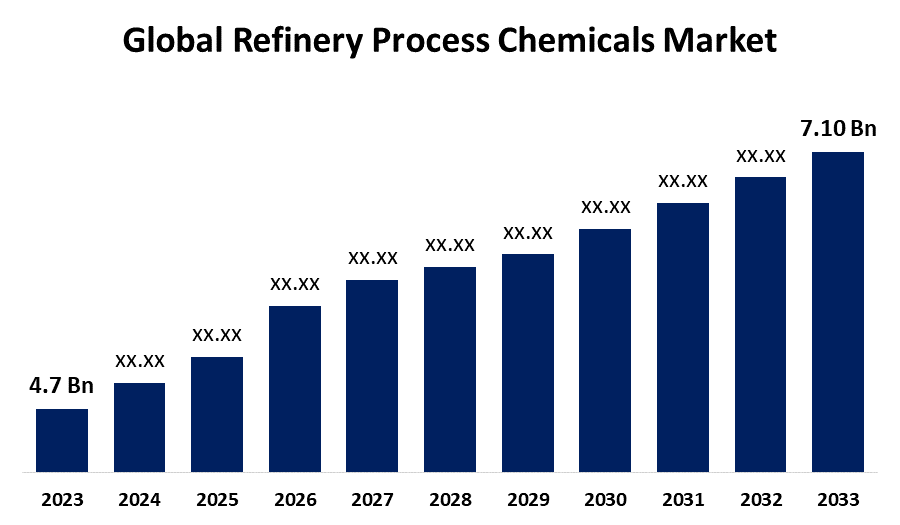

- The Global Refinery Process Chemicals Market Size was Valued at USD 4.7 Billion in 2023

- The Market Size is Growing at a CAGR of 4.21% from 2023 to 2033

- The Worldwide Refinery Process Chemicals Size is Expected to Reach USD 7.10 Billion by 2033

- Europe is expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Refinery Process Chemicals Market Size is Anticipated to Exceed USD 7.10 Billion by 2033, Growing at a CAGR of 4.21% from 2023 to 2033.

Market Overview:

Refinery process chemicals are used to transform crude oil into products such as jet fuel, diesel, and gasoline. In the refinery process chemicals sector, efficiency and sustainability are becoming increasingly popular trends. Refineries are investing in eco-friendly chemicals to lower emissions and boost energy efficiency in response to tightening environmental rules and rising public awareness of climate change. Manufacturers of refinery process chemicals are focused on innovation, sustainability, and customization in their strategies to suit changing market demands. To increase productivity and lessen the impact on the environment, manufacturers are funding research and development to create environmentally friendly additives that are suited to particular refining procedures. In addition, producers are fortifying their alliances with refineries in order to provide all-encompassing solutions and enhance client assistance. To keep a competitive advantage in the market, industries are also utilizing digital technology for real-time monitoring and optimization, guaranteeing product quality and regulatory compliance. For instance, The UNIPOL PE Process Technology from Univation has been chosen by Bharat Petroleum Corporation Ltd. (BPCL) for two global production lines that will be situated at the Bina Refinery location in Madhya Pradesh, India.

Report Coverage:

This research report categorizes the market for the global refinery process chemicals market based on various segments and regions forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global refinery process chemicals market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global refinery process chemicals market.

Global Refinery Process Chemicals Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 4.7 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 4.21% |

| 2033 Value Projection: | USD 7.10 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 245 |

| Tables, Charts & Figures: | 117 |

| Segments covered: | By Type, By Application, By End-Use, and By Region |

| Companies covered:: | ExxonMobil Chemical, Honeywell, Albemarle Corporation, Evonik Industries AG, Arkema Group, Baker Hughes, Nalco Champion, BASF SE, The Dow Chemical Company, SABIC, Chevron Phillips Chemical Company, Clariant, and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors:

Fuel consumption of gasoline, diesel, and jet fuel is driving up global demand for refined petroleum products, which in turn is driving up the market for refinery process chemicals. By increasing efficiency and yield and requiring more sophisticated chemicals, technological developments in refining processes also support the market for refinery process chemicals. Refineries are also compelled by strict environmental laws to use chemicals that lower emissions and enhance process sustainability.

Restraining Factors:

In the refinery process chemicals sector, high initial investment costs are a major concern. Market penetration might be restricted if smaller refineries are discouraged from implementing novel chemicals due to the exorbitant costs.

Market Segmentation:

The global refinery process chemicals market share is classified into type, application, and end-use.

- The catalyst segment is expected to drive the market growth over the forecast period.

Based on the type, the global refinery process chemicals market is categorized into catalysts, PH adjustors, anti-fouling agents, corrosion inhibitors, and demulsifiers. Among these, the catalyst segment is expected to drive market growth over the forecast period. Catalysts with increased selectivity, activity, and stability are becoming more and more important in order to meet strict product criteria, increase yields, and use less energy. Furthermore, the development of catalysts specifically designed for these alternative refining processes is being driven by the transition towards renewable and bio-based feedstocks, which reflects a dynamic and changing market scenario. Developments in modern science along with new characterization technologies like computational chemistry, artificial intelligence, and high-throughput screening will lead to a continuous deepening of the theoretical understanding of catalysts, which will advance the development of catalysts that can improve refinery processes.

- The crude oil distillation segment has the largest share of the market during the forecast period.

Based on the application, the global refinery process chemicals market is categorized into crude oil distillation, hydrotreating, catalytic cracking, alkylation, and isomerization. Among these, the crude oil distillation segment has the largest share of the market during the forecast period. Efficiency and sustainability are becoming more and more popular in crude oil distillation. To maximize yields of vital products like gasoline, diesel, and jet fuel while reducing energy consumption and emissions, refineries are investing in cutting-edge chemical additives. In order to ensure compliance with strict environmental standards and increase operational performance, there is an increasing demand for specific distillation aids such as heat transfer enhancers, corrosion inhibitors, and antifoam agents. This demand is propelling innovation in the market.

- The petroleum refineries segment holds the biggest share of the market throughout the forecast period.

Based on the end-use, the global refinery process chemicals market is categorized into petroleum refineries, petrochemical plants, chemical processing facilities, and oil & gas exploration companies. Among these, the petroleum refineries segment holds the biggest share of the market throughout the forecast period. One prominent development in the refinery process chemicals sector is the move towards automation and digitalization in petroleum refineries. Refineries are using digital technologies in conjunction with sophisticated chemical solutions to monitor and optimize their processes in real-time. The need to improve operational effectiveness, decrease downtime, and guarantee consistent product quality is what is driving this trend. Furthermore, sustainability is becoming more and more important. Refineries are looking for environmentally friendly chemicals to reduce their influence on the environment and comply with regulations, which is changing the dynamics of the industry.

Regional Segment Analysis of the Global Refinery Process Chemicals Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia-Pacific is projected to hold the largest share of the global refinery process chemicals market over the forecast period.

Get more details on this report -

The market for refinery process chemicals in the area is seeing a shift toward sustainability and innovation. To meet strict regulations, cut emissions, and increase efficiency, refineries in the region are investing in cutting-edge chemical solutions. Eco-friendly catalysts and additives are in greater demand as a way to reduce environmental impact and maximize refining process efficiency. Furthermore, data analytics and digitization are being incorporated into chemical management systems more frequently to improve operational efficiency and guarantee adherence to changing industry laws, which is propelling market expansion.

Europe region is also expected to fastest CAGR growth during the forecast period. Industrialization and urbanization have intensified due to Europe's rapid economic growth. The increase in demand for refining catalysts in European nations can be attributed to the restructuring of the current refining complexes and new optimization methods. Crude oil is primarily imported by Germany from Russia.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global refinery process chemicals market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies:

- ExxonMobil Chemical

- Honeywell

- Albemarle Corporation

- Evonik Industries AG

- Arkema Group

- Baker Hughes

- Nalco Champion

- BASF SE

- The Dow Chemical Company

- SABIC

- Chevron Phillips Chemical Company

- Clariant

- Others

Key Market Developments:

- In November 2023, The Indian company ONGC declared its intention to invest USD 5.38 billion to build two petrochemical plants that can convert crude oil into valuable chemicals.

- In September 2023, Part of its long-term expansion goal to deliver superior-value goods from refining and chemical operations in the United States Gulf Coast, Texas-based ExxonMobil announced the opening of two innovative chemical production units at its manufacturing location.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the global refinery process chemicals market based on the below-mentioned segments:

Global Refinery Process Chemicals Market, By Type

- Catalyst

- PH Adjustors

- Anti-fouling Agents

- Corrosion Inhibitors

- Demulsifiers

Global Refinery Process Chemicals Market, By Application

- Crude Oil Distillation

- Hydrotreating

- Catalytic Cracking

- Alkylation

- Isomerization

Global Refinery Process Chemicals Market, By End-Use

- Petroleum Refineries

- Petrochemical Plants

- Chemical Processing Facilities

- Oil & Gas Exploration Companies

Global Refinery Process Chemicals Market, By Regional

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the global refinery process chemicals market over the forecast period?The global refinery process chemicals market size is expected to grow from USD 4.7 Billion in 2023 to USD 7.10 Billion by 2033, at a CAGR of 4.21 % during the forecast period 2023-2033.

-

2. Which region is expected to hold the highest share in the global refinery process chemicals market?Asia-Pacific is projected to hold the largest share of the global refinery process chemicals market over the forecast period.

-

3. Who are the top key players in the refinery process chemicals market?ExxonMobil Chemical, Honeywell, Albemarle Corporation, Evonik Industries AG, Arkema Group, Baker Hughes, Nalco Champion, BASF SE, The Dow Chemical Company, SABIC, Chevron Phillips Chemical Company, Clariant, and Others.

Need help to buy this report?