Global Regional Jet Market Size, Share, and COVID-19 Impact Analysis, By Platform (Commercial Aircraft, Military Aircraft), By Engine Type (Turboprop, Turbofan), By Maximum Take-off Weight (20,000 lbs to 80,000 lbs, 81,000 lbs to 1,60,000 lbs), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Aerospace & DefenseGlobal Regional Jet Market Insights Forecasts to 2033

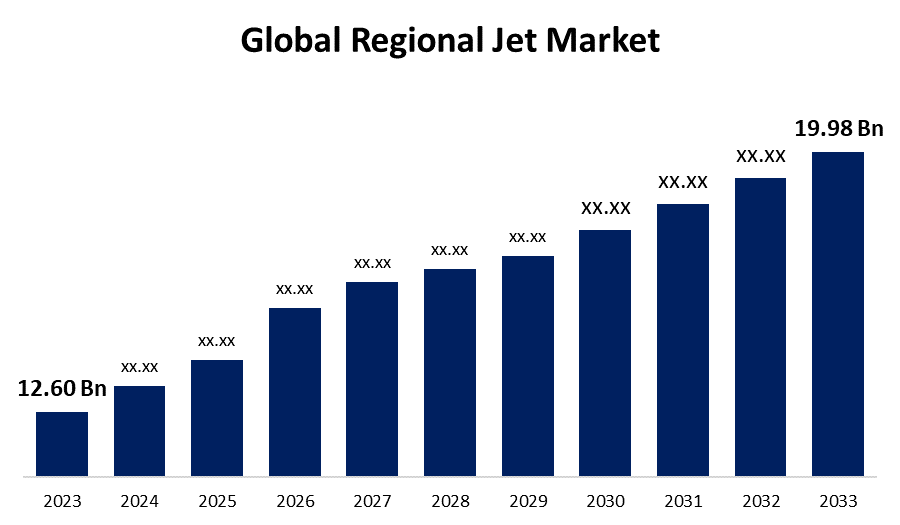

- The Global Regional Jet Market Size was Valued at USD 12.60 Billion in 2023

- The Market Size is Growing at a CAGR of 4.72 % from 2023 to 2033

- The Worldwide Regional Jet Market Size is Expected to Reach USD 19.98 Billion by 2033

- Europe is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Regional Jet Market Size is Anticipated to Exceed USD 19.98 Billion by 2033, Growing at a CAGR of 4.72% from 2023 to 2033.

Market Overview

Regional jets are commercial aircraft with a seating capacity of 50–100 people that are intended for passenger transportation on shorter trips. These aircraft provide a balance between passenger capacity and operating efficiency by bridging the gap between turboprops and bigger narrow-body jets. They are essential for establishing connections between smaller towns and cities, which promotes accessibility and regional economic growth. The demand for regional jets has been driven by the growing need for convenient and effective transportation solutions in regional areas. For instance, in June 2024, the government-funded UDAN programmer for regional connections helped India's regional aviation. SpiceJet, which was once active on numerous of these routes, is currently weak, making the market more profitable for new competitors. Travelers appreciate that flying saves them time, and regional planes are a good option for shorter distances. Improvements in aircraft technology, including better avionics, lower emissions, and increased fuel efficiency, have benefited the regional jet market. These improvements are intended to comply with environmental standards and improve regional planes' overall performance.

Report Coverage

This research report categorizes the market for the regional jet market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the regional jet market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the regional jet market.

Regional Jet Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023 : | USD 12.60 Billion |

| Forecast Period: | 2023 – 2033 |

| Forecast Period CAGR 2023 – 2033 : | 4.72% |

| 023 – 2033 Value Projection: | USD 19.98 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 226 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Platform, By Engine Type, By Maximum Take-off Weight, By Region |

| Companies covered:: | Embraer, Airbus, Leonardo Spa, Mitsubishi Heavy Industries, De Havilland Aircraft of Canada Ltd, Commercial Aircraft Corporation of China, United Aircraft Corporation, Antonov Company, Others |

| Pitfalls & Challenges: | Covid-19 Impact, Challenge, Future,Growth and Analysis |

Get more details on this report -

Driving Factors

An essential component of profitability for local aircraft producers is the latest generation of aircraft fitted with innovative technologies. By giving passengers a better in-flight experience, it raises demand and benefits customers. Adoption of new and improved technology will also result in decreased fuel burn, maintenance costs, and airport and navigation fees, all of which will cut operational costs. It will therefore be financially advantageous for travelers as well as airline operators. One of the main reasons driving market expansion is manufacturers' emphasis on introducing more sophisticated flight control systems and avionics

Restraining Factors

A significant contributing element to the unfulfilled promises of aircraft deliveries is the backlog of orders with OEMs. Aside from outstanding orders, the early 2020 coronavirus outbreak was a huge blow to the aviation sector as a whole, resulting in large losses, order cancellations, and delivery delays.

Market Segmentation

The regional jet market share is classified into platform, engine type, and maximum take off weight.

- The commercial aircraft segment is expected to hold the largest share of the regional jet market during the forecast period.

Based on the platform, the regional jet market is categorized into commercial aircraft and military aircraft. Among these, the commercial aircraft segment is expected to hold the largest share of the regional jet market during the forecast period. Commercial aircraft that have been tailored to suit regional flight routes. These aircraft are designed to service shorter routes and connect smaller airports within a certain region. They are smaller than their larger counterparts, such as wide-body and narrow-body jets. The increasing necessity for effective means of transportation to link regional and secondary airports has led to a rise in the demand for commercial regional jets.

- The turbofan segment is expected to grow at the fastest CAGR during the forecast period.

Based on the engine type, the regional jet market is categorized into turboprop and turbofan. Among these, the turbofan segment is expected to grow at the fastest CAGR during the forecast period. These aircraft are generally used for shorter distances and in places with less infrastructure because of their reputation for fuel economy and their capacity to operate on short runways.

- The 81,000 lbs to 1,60,000 lbs segment is expected to hold a significant share of the regional jet market during the forecast period.

Based on the maximum takeoff weight, the regional jet market is categorized into 20,000 lbs to 80,000 lbs, and 81,000 lbs to 1,60,000 lbs. Among these, the 81,000 lbs to 1,60,000 lbs segment is expected to hold a significant share of the regional jet market during the forecast period. The maximum weight that the pilot is permitted to lift off because of structural or other constraints. According to the International Civil Aviation Organization (ICAO), a jet with a maximum takeoff weight (MTOW) of more than 15,750 pounds is classified as a medium aircraft. Aircraft under the 81,000 lbs to 1,60,000 lbs weight range are seeing consistent growth in the market. New technical advancements are being included by aircraft manufacturers, which will undoubtedly improve passenger safety and comfort when travelling across regional airspace.

Regional Segment Analysis of the Global Regional Jet Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is projected to hold the largest share of the regional jet market over the forecast period.

Get more details on this report -

North America is projected to hold the largest share of the regional jet market over the forecast period. The increasing use of these aerial vehicles for business purposes is the reason behind the expansion of the regional market in the area. Among the largest fleets of regional jets are well-known airline operators like American Airlines and Delta. Large assembly lines for various aircraft sizes and uses are also present in the area. by changing travel habits, improvements in technology, and a significant need for convenient and effective air travel. Regional jets are becoming an increasingly important part of the aviation business as it grows, revolutionizing regional connectivity and improving the traveler experience as a whole.

Europe is expected to grow at the fastest CAGR growth of the regional jet market during the forecast period. The presence of well-known OEMs and key players, including United Aircraft Corporation, Airbus, and Leonardo Spa, which are among the top companies profiled in the region and hold some potential customers worldwide. New technology development must be prioritized if Europe's aviation industry is to regain its position as a global leader.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the regional jet market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Embraer

- Airbus

- Leonardo Spa

- Mitsubishi Heavy Industries

- De Havilland Aircraft of Canada Ltd

- Commercial Aircraft Corporation of China

- United Aircraft Corporation

- Antonov Company

- Others

Key Market Developments

- On March 2024, The American Airlines Group declared that it has made an order with Embraer for 133 aircraft in order to accommodate the growing demand for flying operations and domestic flights within the United States. The need for more regional aircraft has been spurred by the increased frequency of flights in the United States as a result of expanding public and passenger transportation.

- On January 2024, American Airlines subsidiary Envoy Air revealed that it has ordered nineteen more Embraer big regional jets to supplement its current fleet of flying aircraft. In the next years, the firm will start receiving the new jets.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the global regional jet market based on the below-mentioned segments:

Global Regional Jet Market, By Platform

- Commercial Aircraft

- Military Aircraft

Global Regional Jet Market, By Engine Type

- Turboprop

- Turbofan

Global Regional Jet Market, By Maximum Take Off Weight

- 20,000 lbs to 80,000 lbs

- 81,000 lbs to 1,60,000 lbs

Global Regional Jet Market, By Regional

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the global Regional Jet market over the forecast period?The Regional Jet Market Size is Expected to Grow from USD 12.60 Billion in 2023 to USD 19.98 Billion by 2033, at a CAGR of 4.72% during the forecast period 2023-2033.

-

2. Which region is expected to hold the highest share in the global Regional Jet market?North America is projected to hold the largest share of the regional jet market over the forecast period.

-

3. Who are the top key players in the Regional Jet market?Embraer, Airbus, Leonardo Spa, Mitsubishi Heavy Industries, De Havilland Aircraft of Canada Ltd, Commercial Aircraft Corporation of China, United Aircraft Corporation, Antonov Company, and others.

Need help to buy this report?