Global Regtech Market Size, Share, and COVID-19 Impact Analysis, By Component (Solutions and Services), By Application (Anti-Money Laundering (AML) & Fraud Management, Regulatory Intelligence, Risk & Compliance Management, and Regulatory Reporting), By Deployment Mode (On-Premises and Cloud-Based), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Banking & FinancialGlobal Regtech Market Insights Forecasts to 2033

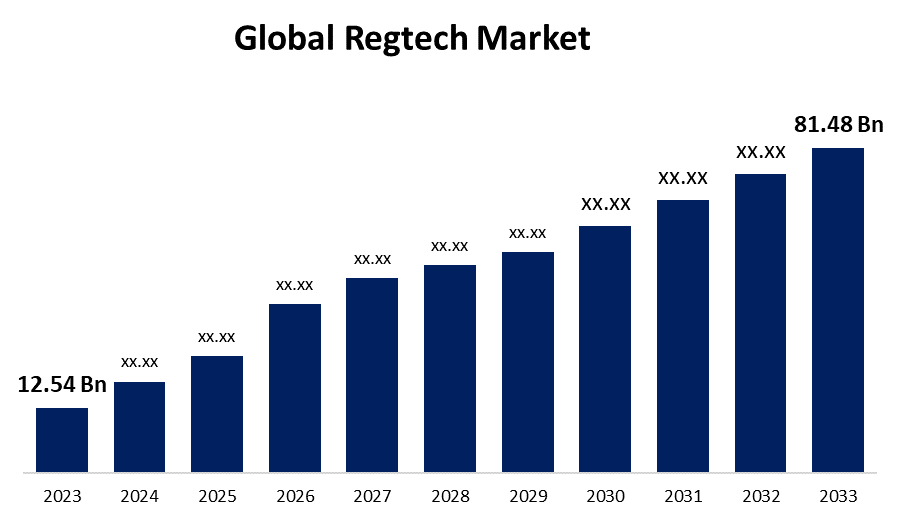

- The Global Regtech Market Size was Valued at USD 12.54 Billion in 2023

- The Market Size is Growing at a CAGR of 20.58% from 2023 to 2033

- The Worldwide Regtech Market Size is Expected to Reach USD 81.48 Billion by 2033

- Asia Pacific is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Regtech Market Size is Anticipated to Exceed USD 81.48 Billion by 2033, Growing at a CAGR of 20.58% from 2023 to 2033.

Market Overview

Regtech is the use of technology to manage regulatory procedures in the financial sector. Regtech uses software-as-a-service (SaaS) and cloud computing technology to make regulatory compliance easier for enterprises. In addition to offering several tools for real-time online transaction analysis to spot problems or anomalies in the world of digital payments, it supports regulatory monitoring, reporting, and compliance. Numerous tasks are automated by it, including fraud protection, compliance data management, staff surveillance, and audit trail features. Additionally, it enables businesses to repurpose time, money, and resources that were previously allocated to regulatory compliance. Currently, the market is expanding due to the rising demand for RegTech services, which offer improved data analytic skills and risk management. In addition, the market is expanding as a result of an increase in fraudulent activities including money laundering and phishing, illicit transactions, and money theft from other account holders. Furthermore, a positive market view is being provided by the increasing use of online shopping platforms to make purchases of products and services, as well as the rise in popularity of e-commerce companies that offer a large selection of products and doorstep delivery services.

Report Coverage

This research report categorizes the market for the global regtech market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global regtech market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global regtech market.

Global Regtech Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 12.54 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 20.58% |

| 2033 Value Projection: | USD 81.48 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Component, By Application, By Deployment Mode, By Region |

| Companies covered:: | 3M, PwC, NICE Actimize, Accuity, IBM, ACTICO GmbH, BWise, London Stock Exchange Group plc., Deloitte, Broadridge Financial Solutions Inc., Comprendo, Infrasoft Technologies Ltd., Wolters Kluwer, and other key companies. |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis. |

Get more details on this report -

Driving Factors

Online payment gateways and online payment methods give customers a seamless experience when making purchases of products and services. They are practical since they let people shop online without using cash. Additionally, they provide a variety of deals and cashback options, which encourages more individuals to use online payment gateways. Banks are being forced to provide their clients with advanced payment solutions due to the quick digital transformation of payment transaction processing. The need for RegTech services is being positively impacted by this as well as the regulatory environment altering as a result of an increase in online payments. Additionally, regtech, especially in the financial services industry, is the use of technology to deliver regulatory solutions. Due to compliance standards becoming more complicated and time-consuming, regtech is a useful tool for companies. Big data analytics, machine learning, and artificial intelligence are important regtech components. These technologies make automated risk assessment, reporting, and compliance monitoring possible.

Restraining Factors

Regtech products and services are currently not standardized by any organization, though. Due diligence requirements vary by industry, so it's critical to establish a standard for market participants. The creation of standards is being hampered by transparent operations and capabilities. These elements might, in part, make it more difficult for the solutions to be adopted.

Market Segmentation

The global regtech market share is segmented into component, application, and deployment mode.

- The solutions segment dominates the market with the largest market share through the forecast period.

Based on the component, the global regtech market is segmented into solutions and services. Among these, the solutions segment dominates the market with the largest market share through the forecast period. RegTech solutions use advanced technologies and tools to manage regulatory operations and processes, including compliance, reporting, and monitoring. Companies in both the public and commercial sectors use them to get around the ever-rising costs of complying with regulations and the constantly changing, overly complicated laws that apply to both domestic and foreign markets.

- The regulatory intelligence segment is anticipated to grow at the fastest CAGR growth through the forecast period.

Based on the application, the global regtech market is segmented into anti-money laundering (AML) & fraud management, regulatory intelligence, risk & compliance management, and regulatory reporting. Among these, the regulatory intelligence segment is anticipated to grow at the fastest CAGR growth through the forecast period. It is mainly driven by its growing prevalence in industries like banking, insurance, and financial services, among others. A vital tool for tracking, compiling, and evaluating regulatory data, regulatory intelligence is essential for negotiating a constantly changing environment. This procedure tracks changes in the regulatory landscape skillfully and allows for flexible research analysis.

- The on-premises segment accounted for the largest revenue share through the forecast period.

Based on the deployment mode, the global regtech market is segmented into on-premises and cloud-based. Among these, the on-premises segment accounted for the largest revenue share through the forecast period. The increasing digitization of company processes and the need for complete resource control are the primary drivers of this segment's growth. On-premises gives the firm total control over its resources, services, and data while providing higher data protection security and reduced latency. Along with an extensive range of customization options based on unique needs, it provides hardware and server access.

Regional Segment Analysis of the Global Regtech Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the global regtech market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of the global regtech market over the predicted timeframe. Strong financial institutions, complex and ever-evolving regulatory environments, extensive use of technology, and a proactive approach to compliance are all listed as contributing factors. Due to the significant number of financial institutions, tech-savvy startups, and regulatory concerns in the region, there is a high need for novel solutions that might expedite compliance procedures and help businesses better navigate complex legal frameworks.

Asia Pacific is expected to grow at the fastest CAGR growth of the global regtech market during the forecast period. This is attributed to the fact that a wide range of firms in the area, including China, India, Singapore, and Australia, are experiencing a rapid digital transformation and rapid adoption of new technologies. Effective regulatory compliance is becoming more and more important as international organizations expand and engage with a variety of regulatory frameworks. Thus, the growth of global regTech's market share is driven by its concentration on financial services and its regulatory diversity.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global regtech market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- 3M

- PwC

- NICE Actimize

- Accuity

- IBM

- ACTICO GmbH

- BWise

- London Stock Exchange Group plc.

- Deloitte

- Broadridge Financial Solutions Inc.

- Comprendo

- Infrasoft Technologies Ltd.

- Wolters Kluwer

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In March 2022, Actico, a global source of artificial intelligence-powered digital decision-making solutions, partnered with Coinfirm, a prominent crypto anti-money laundering and analytics firm. Due to the new agreement, financial service providers including banks will be able to investigate and assess risks associated with money laundering for crypto transactions within the ACTICO compliance suite immediately.

- In January 2022, Jumio, the leading provider of AI-powered end-to-end identity orchestration, eKYC, and AML solutions, announced the completion of its acquisition of 4Stop, the leading data marketplace and orchestration hub for KYB, KYC, compliance and fraud prevention.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the global regtech market based on the below-mentioned segments:

Global Regtech Market, By Component

- Solutions

- Services

Global Regtech Market, By Application

- Anti-Money Laundering (AML) & Fraud Management

- Regulatory Intelligence

- Risk & Compliance Management

- Regulatory Reporting

Global Regtech Market, By Deployment Mode

- On-Premises

- Cloud-Based

Global Regtech Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. Which are the key companies that are currently operating within the market?3M, PwC, NICE Actimize, Accuity, IBM, ACTICO GmbH, BWise, London Stock Exchange Group plc., Deloitte, Broadridge Financial Solutions Inc., Comprendo, Infrasoft Technologies Ltd., Wolters Kluwer, and others.

-

2. What is the size of the global regtech market?The Global Regtech Market Size is Expected to Grow from USD 12.54 Billion in 2023 to USD 81.48 Billion by 2033, at a CAGR of 20.58% during the forecast period 2023-2033.

-

3. Which region is holding the largest share of the market?North America is anticipated to hold the largest share of the global regtech market over the predicted timeframe.

Need help to buy this report?