Global Reinsurance Market Size, Share, and COVID-19 Impact Analysis, By Type (Facultative Reinsurance and Treaty Reinsurance), By Mode (Online and Offline), By Distribution Channel (Brokers and Direct Writing), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Banking & FinancialGlobal Reinsurance Market Insights Forecasts to 2033

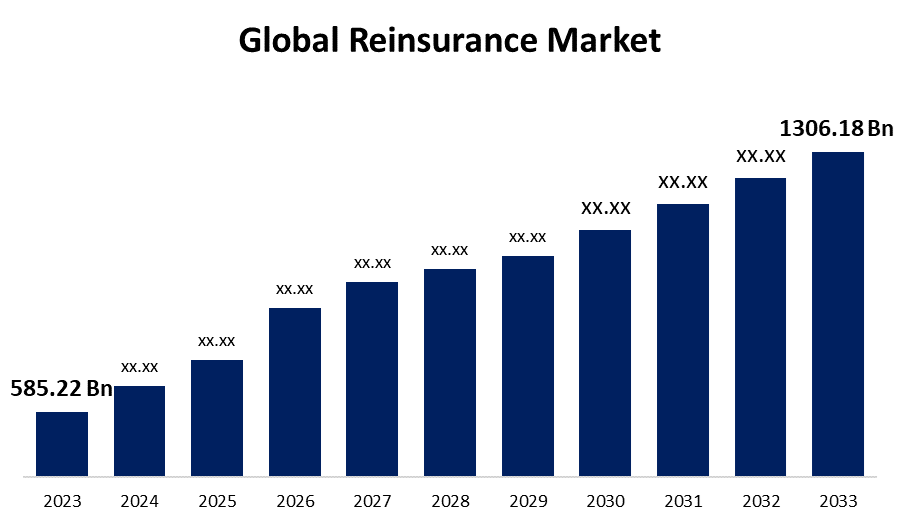

- The Global Reinsurance Market Size was Valued at USD 585.22 Billion in 2023

- The Market Size is Growing at a CAGR of 8.36% from 2023 to 2033

- The Worldwide Reinsurance Market Size is Expected to Reach USD 1306.18 Billion by 2033

- Asia Pacific is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Reinsurance Market Size is Anticipated to Exceed USD 1306.18 Billion by 2033, Growing at a CAGR of 8.36% from 2023 to 2033.

Market Overview

In a reinsurance contract, the reinsurance company, reinsurer, or reinsurer broker agrees to protect the ceding company or the insurance company against the risks specified in the contract. Its objectives are to improve the ceding company's surplus position and financial stability and decrease the net amount at risk from specific risks like insolvency and adverse market circumstances. Reinsurance also allows the ceding firm to take on more business and raises the maximum amount of risk it can assume on any given risk. In return for premium payments, reinsurers take on a portion of the obligation of the primary insurer. Due to its ability to distribute risk and shield individual insurers from disastrous financial consequences, this market is essential to the stability of the insurance sector. One can purchase reinsurance for a variety of risks, such as major events and natural disasters. Reinsurers function on a global scale, offering a financial safeguard that boosts the insurance industry's general resilience and fosters the capacity to manage significant claims without jeopardizing stability.

Report Coverage

This research report categorizes the market for the global reinsurance market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global reinsurance market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global reinsurance market.

Global Reinsurance Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 585.22 Billion |

| Forecast Period: | 2023 - 2033 |

| Forecast Period CAGR 2023 - 2033 : | 8.36% |

| 2033 Value Projection: | USD 1306.18 Billion |

| Historical Data for: | 2019 - 2022 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Type, By Mode, By Distribution Channel, By Region |

| Companies covered:: | Munich Re, Swiss Re, Hannover Re, Berkshire Hathaway Re, SCOR SE, Lloyd’s, Korean Re, China Re, Everest Re, PartnerRe, TransRe, Arch Capital Group, and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The need for reinsurance has been significantly fueled by the increasing frequency of catastrophic events, such as natural disasters and catastrophes related to climate change. Primary insurers face increased financial risks as these occurrences become more frequent and severe. Insurers are increasingly depending on reinsurers to share the cost of these significant risks to reduce possible losses and preserve financial stability. An essential layer of security is offered by reinsurance, which enables insurers to control their exposure and ensure they can meet their financial commitments even in the event of unanticipated circumstances. The global reinsurance market now has more liquidity and capacity owing to the rise of alternative financing sources, especially insurance-linked securities (ILS). Investors use ILS products like catastrophe bonds to actively participate in taking on insurance risks while they search for unconventional opportunities. The global reinsurance market's overall resilience is improved by this inflow of alternative capital.

Restraining Factors

The demand for the reinsurance market is significantly constrained by low interest rates, lower investment returns, and volatility in the financial markets. First of all, due to reinsurers manage their portfolios under more uncertainty, greater financial market volatility makes their investment methods more difficult. Changes in the value of assets can lead to lower investment income, which can affect reinsurers' overall profitability and their ability to take on new risks.

Market Segmentation

The global reinsurance market share is segmented into type, mode, and distribution channel.

- The treaty reinsurance segment dominates the market with the largest market share through the forecast period.

Based on the type, the global reinsurance market is segmented into facultative reinsurance and treaty reinsurance. Among these, the treaty reinsurance segment dominates the market with the largest market share through the forecast period. The growing size and complexity of insurance portfolios are two significant drivers of the need for treaty reinsurance. Effective risk management techniques are therefore necessary due to primary insurers frequently cover high-risk volumes across a variety of business lines. By transferring a sizeable amount of their risks to reinsurers through treaty reinsurance, insurers can optimize their capital allocation and lower the possibility of financial result volatility. Throughout the projection period, these variables will increase category growth.

- The offline segment is anticipated to grow at the fastest CAGR growth through the forecast period.

Based on the mode, the global reinsurance market is segmented into online and offline. Among these, the offline segment is anticipated to grow at the fastest CAGR growth through the forecast period. Purchasing a life insurance policy offline entails visiting a company's branch office or collaborating with a nearby insurance agent. By taking this approach, a person can talk with agents who are knowledgeable about different plans and can assist in selecting the best one. Furthermore, asking questions and receiving tailored guidance are made possible via in-person meetings with insurance agents.

- The direct writing segment accounted for the largest revenue share through the forecast period.

Based on the distribution channel, the global reinsurance market is segmented into brokers and direct writing. Among these, the direct writing segment accounted for the largest revenue share through the forecast period. In direct writing distribution, there are no middlemen involved; instead, the reinsurer deals directly with the primary insurer. More transparency and control over underwriting and price choices are provided by this method. Furthermore, data from the reinsurance market show that direct writing encourages stronger ties between the ceding business and the reinsurer, which might result in more specialized reinsurance solutions. Direct writing can improve productivity and lower administrative expenses for all parties involved by streamlining communication and claims-handling procedures.

Regional Segment Analysis of the Global Reinsurance Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the global reinsurance market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of the global reinsurance market over the predicted timeframe. A prominent development in the reinsurance business is the growing emphasis on creative risk management strategies, which is a result of an increase in natural disasters. Reinsurance coverage for climate-related risks, like hurricanes and wildfires, is actively sought after by insurers. Furthermore, developments in data analytics and insurtech are influencing product development and improving risk modeling skills.

Asia Pacific is expected to grow at the fastest CAGR growth of the global reinsurance market during the forecast period. The increasing economies and increased awareness of insurance in the Asia-Pacific region are driving the market's robust expansion in reinsurance. Reinsurers are being used by insurers more and more to manage risk, especially in emerging countries. The Asia-Pacific region's reinsurance landscape is becoming more sophisticated and adaptable due to regulatory advancements and a boom in insurtech use.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global reinsurance market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Munich Re

- Swiss Re

- Hannover Re

- Berkshire Hathaway Re

- SCOR SE

- Lloyd's

- Korean Re

- China Re

- Everest Re

- PartnerRe

- TransRe

- Arch Capital Group

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In May 2024, The US$ 5.5 billion reinsurance plan for 2024 was revealed by Citizens Property Insurance Corporation. The plan is developed to handle Florida's growing property risk and adjust to changing reinsurance market conditions.

- In April 2024, To increase the availability of insurance for specific buildings with flammable cladding and other fire safety risks, Swiss Re-established the UK Fire Safety Reinsurance Facility.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the global reinsurance market based on the below-mentioned segments:

Global Reinsurance Market, By Type

- Facultative Reinsurance

- Treaty Reinsurance

Global Reinsurance Market, By Mode

- Online

- Offline

Global Reinsurance Market, By Distribution Channel

- Brokers

- Direct Writing

Global Reinsurance Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1.Which are the key companies that are currently operating within the market?Munich Re, Swiss Re, Hannover Re, Berkshire Hathaway Re, SCOR SE, Lloyd's, Korean Re, China Re, Everest Re, PartnerRe, TransRe, Arch Capital Group and Others.

-

2.What is the size of the global reinsurance market?The Global Reinsurance Market Size is Expected to Grow from USD 585.22 Billion in 2023 to USD 1306.18 Billion by 2033, at a CAGR of 8.36% during the forecast period 2023-2033.

-

3.Which region is holding the largest share of the market?North America is anticipated to hold the largest share of the global reinsurance market over the predicted timeframe.

Need help to buy this report?