Global Remote Towers Market Size, Share, and COVID-19 Impact Analysis, By Technology (Remote Flight Operations, Air Traffic Management, Terminal Control Systems, Camera and Sensor Technology), By Application (Commercial Aviation, Military Aviation, Unmanned Aerial Vehicles, Airport Operations), By End Use (Airports, Defense Organizations, Aerospace Companies, Traffic Management Authorities), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Aerospace & DefenseGlobal Remote Towers Market Size Insights Forecasts to 2033

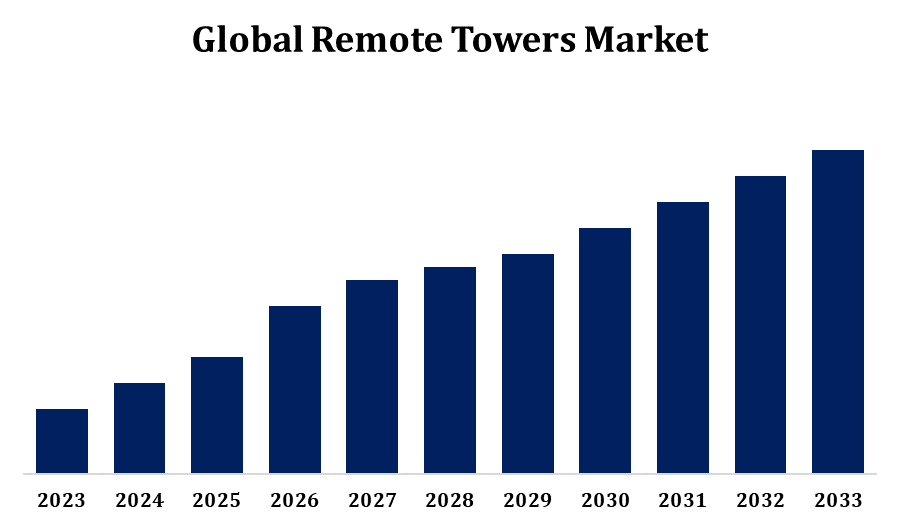

- The Remote Towers Market Size was valued at USD 3.3 Billion in 2023.

- The Market Size is Growing at a CAGR of 10.43% from 2023 to 2033.

- The Global Remote Towers Market Size is Expected to reach USD 8.9 Billion by 2033.

- Asia Pacific is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Remote Towers Market Size is Expected to reach USD 8.9 Billion by 2033, at a CAGR of 10.43% during the forecast period 2023 to 2033.

The remote towers market is growing rapidly as air traffic management authorities and airport operators seek cost-effective and efficient solutions. Remote tower technology enables air traffic controllers to manage multiple airports from a centralized location using high-resolution cameras, sensors, and AI-driven analytics. This enhances operational efficiency, reduces costs, and improves safety, particularly for regional and low-traffic airports. Market growth is driven by increasing air traffic, digital transformation in aviation, and regulatory support for remote tower deployments. Europe leads the market, with strong adoption in countries like Sweden, Germany, and the UK, while North America and Asia-Pacific are also expanding. Key players include Saab AB, Frequentis, and Indra Sistemas. Challenges include cybersecurity risks and regulatory complexities, but advancements in AI and automation continue to drive market evolution.

Remote Towers Market Value Chain Analysis

The remote towers market value chain consists of multiple key stages, starting with technology providers who develop high-resolution cameras, sensors, AI-driven analytics, and communication systems. System integrators then assemble these components into scalable remote tower solutions, ensuring seamless data transmission and real-time air traffic management capabilities. Regulatory bodies play a crucial role by setting standards and approving deployments. Service providers, including air navigation service providers (ANSPs) and airport operators, implement and manage remote tower operations, optimizing efficiency and reducing costs. End users, primarily regional and low-traffic airports, benefit from enhanced safety and operational flexibility. Supporting stakeholders include cybersecurity firms ensuring data protection and AI developers enhancing automation. The market's growth is driven by increasing air traffic, digital transformation, and regulatory support for remote air traffic control solutions.

Remote Towers Market Opportunity Analysis

The remote towers market presents significant opportunities driven by rising air traffic, cost pressures on airport operations, and advancements in AI and digitalization. Small and regional airports, which struggle with high operational costs, can benefit from remote tower solutions that enhance efficiency and safety while reducing expenses. Emerging markets in Asia-Pacific, the Middle East, and Latin America offer growth potential as governments invest in modernizing air traffic management infrastructure. Technological advancements, including AI-powered automation, 5G connectivity, and enhanced cybersecurity, create new possibilities for real-time, multi-airport management. Additionally, defense and military applications present an untapped segment for remote air traffic control. With regulatory bodies increasingly supporting remote tower adoption, companies specializing in smart aviation solutions, data analytics, and cybersecurity can capitalize on the expanding global demand.

Global Remote Towers Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 10.43% |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 230 |

| Tables, Charts & Figures: | 95 |

| Segments covered: | By Technology, By Application, By End Use, By Region and COVID-19 Impact Analysis |

| Companies covered:: | Boeing, General Dynamics, AeroVironment, Drone Aviation Holding Corp, Lockheed Martin, Northrop Grumman, Airbus, Honeywell, Thales, SITA, Indra, Commsoft, Elbit Systems, Saab, Raytheon Technologies, and Others Key Vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis. |

Get more details on this report -

Market Dynamics

Remote Towers Market Dynamics

Technological Innovations and Automation Enhancements

Technological innovations and automation enhancements are key drivers of growth in the remote towers market. Advanced high-resolution cameras, AI-powered analytics, and sensor fusion technologies enable real-time monitoring and efficient air traffic management. Automation reduces the reliance on manual operations, enhancing safety, accuracy, and cost efficiency. The integration of 5G connectivity and cloud computing further improves data transmission and remote accessibility. AI-driven predictive maintenance and automated decision-making optimize operational efficiency, reducing downtime and human errors. Augmented Reality (AR) and Virtual Reality (VR) are also being explored to enhance situational awareness for air traffic controllers. As regulatory bodies support digital transformation in aviation, ongoing advancements in cybersecurity, automation, and AI will continue to drive the adoption of remote towers across global airports and military applications.

Restraints & Challenges

The remote towers market faces several challenges that could slow its adoption. Regulatory complexities and slow approval processes make it difficult for airports and air navigation service providers (ANSPs) to implement remote tower solutions quickly. Cybersecurity threats pose a major risk, as remote operations rely on digital networks that could be vulnerable to hacking and data breaches. High initial investment costs for AI-driven analytics, high-resolution cameras, and secure communication infrastructure may deter smaller airports. Resistance from air traffic controllers and unions, concerned about automation’s impact on jobs, also creates adoption barriers. Connectivity issues, particularly in remote or underdeveloped regions, can affect real-time data transmission and operational reliability. Overcoming these challenges requires strong cybersecurity measures, industry collaboration, and regulatory support to ensure safe and efficient deployment.

Regional Forecasts

North America Market Statistics

Get more details on this report -

North America is anticipated to dominate the Remote Towers Market from 2023 to 2033. The U.S. and Canada are leading the adoption, with regulatory bodies like the FAA and NAV CANADA actively exploring remote tower solutions to enhance efficiency, particularly at regional and low-traffic airports. High investments in AI, 5G connectivity, and cybersecurity further drive market expansion. Key players such as Saab, Raytheon, and Frequentis are developing cutting-edge remote tower technologies to improve operational safety and reduce costs. However, regulatory approvals, cybersecurity concerns, and integration with existing air traffic control infrastructure remain challenges. As digital transformation accelerates, North America is expected to play a crucial role in shaping the future of remote air traffic management.

Asia Pacific Market Statistics

Asia Pacific is witnessing the fastest market growth between 2023 to 2033. China, India, Australia, and Japan are leading adoption efforts, focusing on enhancing efficiency at regional and remote airports. Regulatory bodies are supporting digital transformation, with authorities such as the Civil Aviation Administration of China (CAAC) and Airports Authority of India (AAI) exploring remote tower solutions. Advancements in AI, 5G, and automation are enabling real-time air traffic monitoring, improving operational safety and cost efficiency. However, challenges include regulatory complexities, cybersecurity risks, and infrastructure constraints in rural areas. With ongoing investments and partnerships between global and regional players, the Asia-Pacific market is poised for significant growth in the coming years.

Segmentation Analysis

Insights by Technology

The Remote Flight Operations segment accounted for the largest market share over the forecast period 2023 to 2033. This segment enables air traffic controllers to manage multiple airports from centralized locations, improving operational efficiency and cost-effectiveness. Increasing air traffic and the need for optimized airspace management are key growth factors. Airports, particularly in remote and low-traffic areas, benefit from enhanced surveillance, reduced operational costs, and improved safety. The adoption of cloud-based air traffic management systems and 5G connectivity further enhances real-time monitoring capabilities. However, regulatory challenges, cybersecurity risks, and initial infrastructure costs remain hurdles. With continued technological advancements and regulatory support, remote flight operations are expected to play a crucial role in the future of air traffic management.

Insights by Application

The Commercial Aviation segment accounted for the largest market share over the forecast period 2023 to 2033. The growth is fueled by increasing air traffic, airport expansion, and the demand for cost-efficient air traffic management solutions. Airlines and airport operators are adopting remote tower technology to enhance operational efficiency, particularly at regional and low-traffic airports. Advanced AI-powered surveillance, real-time data analytics, and automation are improving safety and reducing dependency on traditional control towers. Regulatory bodies, including the FAA and EASA, are supporting digital transformation, enabling wider adoption. Additionally, the integration of 5G and cloud-based solutions enhances remote monitoring capabilities. However, challenges such as cybersecurity risks, regulatory approvals, and infrastructure investments persist. With continuous technological advancements, remote towers are set to revolutionize commercial aviation by offering scalable and cost-effective air traffic management solutions.

Insights by End Use

The airports segment accounted for the largest market share over the forecast period 2023 to 2033. Regional and low-traffic airports, in particular, are adopting remote tower technology to reduce costs while maintaining high safety standards. Advanced AI-powered surveillance, high-resolution cameras, and automation allow airports to centralize air traffic control, optimizing resource allocation. Regulatory support from bodies like the FAA, EASA, and ICAO is accelerating adoption. Additionally, the integration of 5G and cloud-based solutions enhances real-time monitoring and decision-making. However, challenges such as cybersecurity threats, high initial investments, and regulatory approvals remain. As digital transformation progresses, remote towers are expected to become a key solution for managing air traffic at airports worldwide.

Recent Market Developments

- In July 2024, Indra Sistemas S.A. has entered into an agreement to provide technology for the surveillance and monitoring of surface aircraft at airports in the U.S.

Competitive Landscape

Major players in the market

- Boeing

- General Dynamics

- AeroVironment

- Drone Aviation Holding Corp

- Lockheed Martin

- Northrop Grumman

- Airbus

- Honeywell

- Thales

- SITA

- Indra

- Commsoft

- Elbit Systems

- Saab

- Raytheon Technologies

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2033.

Remote Towers Market, Technology Analysis

- Remote Flight Operations

- Air Traffic Management

- Terminal Control Systems

- Camera and Sensor Technology

Remote Towers Market, Application Analysis

- Commercial Aviation

- Military Aviation

- Unmanned Aerial Vehicles

- Airport Operations

Remote Towers Market, End Use Analysis

- Airports

- Defense Organizations

- Aerospace Companies

- Traffic Management Authorities

Remote Towers Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the market size of the Remote Towers Market?The global Remote Towers Market is expected to grow from USD 3.3 billion in 2023 to USD 8.9 billion by 2033, at a CAGR of 10.43% during the forecast period 2023-2033.

-

Who are the key market players of the Remote Towers Market?Some of the key market players of the market are the Boeing, General Dynamics, AeroVironment, Drone Aviation Holding Corp, Lockheed Martin, Northrop Grumman, Airbus, Honeywell, Thales, SITA, Indra, Commsoft, Elbit Systems, Saab, Raytheon Technologies.

-

Which segment holds the largest market share?The airports segment holds the largest market share and is going to continue its dominance.

Need help to buy this report?