Global Remote Weapon Station Market Size, Share, and COVID-19 Impact Analysis, By Component (Human Machine Interface, Sensors, Weapons, and Armaments), By Platform (Land, Naval, and Airborne), By Weapon Type (Lethal Weapons and Non-lethal Weapons), By Application (Military and Homeland Security), By Technology (Close-in Weapon Systems, Remote Controlled Gun Systems, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Aerospace & DefenseGlobal Remote Weapon Station Market Insights Forecasts to 2033

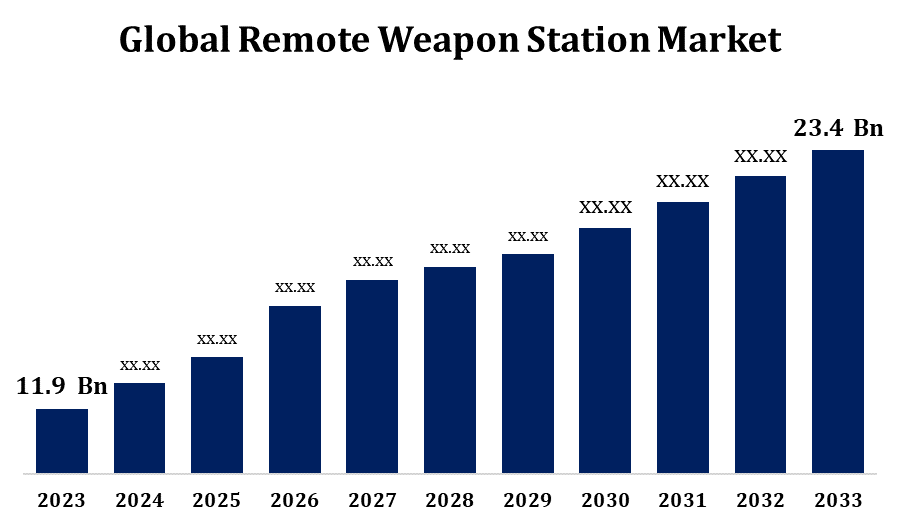

- The Remote Weapon Station Market Size was valued at USD 11.9 Billion in 2023.

- The Market Size is Growing at a CAGR of 7.00% from 2023 to 2033.

- The Global Remote Weapon Station Market Size is Expected to reach USD 23.4 Billion by 2033.

- Asia Pacific is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Remote Weapon Station Market Size is Expected to reach USD 23.4 Billion by 2033, at a CAGR of 7.00% during the forecast period 2023 to 2033.

The Remote Weapon Station market is experiencing significant growth, driven by rising defense budgets, increasing geopolitical tensions, and the need for advanced military technologies. Remote weapon stations enhance battlefield effectiveness by allowing operators to control weaponry from a protected position, reducing exposure to enemy fire. The demand for autonomous and AI-integrated systems is also shaping the market, with key players investing in innovations such as sensor fusion and automated targeting. North America and Europe dominate the market, while the Asia-Pacific region sees rapid expansion due to regional security concerns. Major companies like Rheinmetall, Elbit Systems, and Kongsberg Defence & Aerospace lead the sector. The market also benefits from dual-use applications in law enforcement and border security, making remote weapon stations a crucial component of modern defense strategies.

Remote Weapon Station Market Value Chain Analysis

The Remote Weapon Station market value chain consists of several key stages, from raw material suppliers to end users. It begins with component suppliers providing essential materials such as sensors, actuators, cameras, and weapon systems. Manufacturers and system integrators, including companies like Rheinmetall and Kongsberg Defence & Aerospace, assemble and test RWS for operational readiness. Research and development play a crucial role in enhancing automation, AI integration, and targeting accuracy. Defense contractors and procurement agencies then acquire these systems for military, law enforcement, and border security applications. Distribution channels include direct sales, government contracts, and defense exhibitions. Finally, after-sales services such as maintenance, training, and upgrades ensure long-term efficiency, making the value chain a critical factor in market growth and sustainability.

Remote Weapon Station Market Opportunity Analysis

The remote weapon station market presents significant opportunities driven by rising defense expenditures, technological advancements, and evolving security threats. The increasing demand for autonomous and AI-powered weapon systems creates growth prospects for manufacturers investing in automation, machine learning, and sensor fusion. Expanding military modernization programs, particularly in emerging economies across Asia-Pacific and the Middle East, provide lucrative opportunities for global defense contractors. Additionally, the rising need for border security and law enforcement applications fuels demand beyond traditional military use. The integration of remote weapon stations into unmanned vehicles and naval platforms further broadens market potential. Moreover, collaborations between defense firms and governments for localized production and technology transfer present new revenue streams, making the sector attractive for long-term investments and innovation.

Global Remote Weapon Station Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 7.00% |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 123 |

| Segments covered: | By Component, By Platform, By Weapon Type, By Application, By Technology, and By Region and COVID-19 Impact Analysis |

| Companies covered:: | Kongsberg Gruppen, Raytheon Company, Elbit Systems, ST Engineering, Saab AB, Leonardo S.p.A., Thales, Electro Optic Systems, BAE Systems, Moog, IMI Systems, General Dynamics, Rheinmetall AG, ASELSAN A.S, Norinco, FN Herstal, Rafael Advanced Defense Systems, and Others Key Vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis. |

Get more details on this report -

Market Dynamics

Remote Weapon Station Market Dynamics

The increasing demand for remote weapon stations among armed forces is fueling market growth

The increasing demand for remote weapon stations among armed forces is fueling market growth, driven by the need for enhanced soldier protection, precision targeting, and operational efficiency. As modern warfare evolves, defense forces worldwide are investing in advanced weapon systems that minimize direct human involvement in combat zones. The integration of AI, automation, and sensor-based technologies is further enhancing the effectiveness of these systems. Countries in North America, Europe, and Asia-Pacific are actively modernizing their defense capabilities, leading to increased procurement of remote-controlled weapon systems. Additionally, growing border security concerns and the rise in asymmetric warfare are driving adoption. Defense contractors are focusing on innovation and localization to meet regional demands, making remote weapon stations a crucial element in future military strategies.

Restraints & Challenges

The remote weapon station market faces several challenges despite its growing demand. High development and procurement costs limit adoption, especially in budget-constrained defense programs. Integration complexities with existing military platforms pose technical hurdles, requiring extensive modifications and testing. Cybersecurity threats are a rising concern, as remote-operated systems are vulnerable to hacking and electronic warfare. Additionally, strict government regulations and export controls restrict market expansion, particularly in regions with complex defense procurement policies. Dependence on advanced sensor and AI technologies also creates challenges related to system reliability and maintenance. Furthermore, geopolitical uncertainties and shifting defense priorities can impact long-term investments. Addressing these challenges through cost-effective production, robust cybersecurity measures, and strategic partnerships is crucial for sustained market growth and innovation.

Regional Forecasts

North America Market Statistics

Get more details on this report -

North America is anticipated to dominate the Remote Weapon Station Market from 2023 to 2033. The United States leads the region, with the Department of Defense heavily investing in advanced weapon systems to enhance combat effectiveness and troop safety. The integration of artificial intelligence, automation, and sensor-based targeting in remote weapon stations further accelerates demand. Major defense contractors such as General Dynamics, Lockheed Martin, and Kongsberg Defence & Aerospace play a crucial role in market expansion. Additionally, increasing border security measures and counterterrorism efforts contribute to the adoption of these systems. Canada is also investing in modernizing its armed forces, supporting regional market growth. Overall, North America remains a key hub for innovation and procurement in the remote weapon station industry.

Asia Pacific Market Statistics

Asia Pacific is witnessing the fastest market growth between 2023 to 2033. China, India, Japan, and South Korea are investing heavily in advanced weapon systems to strengthen their armed forces. Territorial disputes, border tensions, and counterterrorism efforts are further driving demand for remote-controlled weapon solutions. Governments in the region are focusing on indigenous defense production, leading to collaborations between global defense firms and local manufacturers. The integration of remote weapon stations into armored vehicles, naval vessels, and unmanned platforms is expanding market opportunities. Additionally, increasing interest in AI-driven and autonomous weapon systems is fueling innovation. With sustained defense spending and technological advancements, the Asia-Pacific region is set to become a significant market for remote weapon stations.

Segmentation Analysis

Insights by Component

The sensors segment accounted for the largest market share over the forecast period 2023 to 2033. The integration of various sensors, including electro-optical/infrared (EO/IR) sensors, radar, and acoustic sensors, enables precise identification and engagement of targets in diverse combat environments. The growing demand for automation and AI-driven systems has increased the reliance on advanced sensors for autonomous decision-making and real-time data processing. Additionally, sensors help improve the safety of operators by providing crucial information in high-risk situations. With military forces across the globe prioritizing modernized defense technologies, investments in sensor innovations are accelerating. This trend is expected to continue, making the sensor segment a key driver of growth in the remote weapon station market.

Insights by Platform

The airborne segment accounted for the largest market share over the forecast period 2023 to 2033. The growth is growth due to increasing demand for armed helicopters, unmanned aerial vehicles (UAVs), and fixed-wing aircraft with advanced combat capabilities. Military forces worldwide are integrating remote weapon stations into airborne platforms to enhance precision targeting, reduce pilot workload, and improve operational safety. The rise of drone warfare and the need for enhanced aerial defense systems further drive adoption. Advancements in lightweight weapon station designs, sensor technology, and AI-driven targeting solutions contribute to this growth. The United States, China, and European nations are heavily investing in airborne remote weapon stations for surveillance, border security, and counterterrorism operations. With the continued evolution of aerial warfare, this segment is expected to expand rapidly in the coming years.

Insights by Weapon Type

The lethal weapons segment accounted for the largest market share over the forecast period 2023 to 2033. The growth is due to rising demand for advanced firepower, precision targeting, and enhanced battlefield effectiveness. Military forces worldwide are equipping remote weapon stations with lethal systems such as heavy machine guns, automatic cannons, and anti-tank guided missiles to improve combat capabilities. The increasing focus on unmanned and autonomous warfare has further driven the need for remotely operated lethal weapons. Technological advancements, including AI-driven targeting, sensor fusion, and improved ammunition, are enhancing the effectiveness of these systems. Countries in North America, Europe, and Asia-Pacific are heavily investing in lethal remote weapon stations for armored vehicles, naval ships, and aerial platforms. As defense modernization programs expand, the lethal weapons segment is expected to see continued growth.

Insights by Application

The military segment accounted for the largest market share over the forecast period 2023 to 2033. Armed forces worldwide are prioritizing remote-operated weapon systems to enhance soldier safety, improve targeting accuracy, and increase battlefield effectiveness. These systems are being integrated into armored vehicles, naval vessels, and airborne platforms to provide superior firepower while minimizing human exposure to threats. Technological advancements, including AI-powered targeting, automation, and advanced sensor integration, are further boosting demand. Geopolitical tensions and border security challenges in regions like North America, Europe, and Asia-Pacific are driving large-scale procurement of remote weapon stations. As military forces continue to invest in cutting-edge defense solutions, the military segment is expected to experience sustained growth in the coming years.

Insights by Technology

The remote controlled gun systems segment accounted for the largest market share over the forecast period 2023 to 2033. Military forces worldwide are integrating these systems into armored vehicles, naval vessels, and unmanned platforms to improve operational efficiency and reduce human exposure to combat threats. Advancements in AI, sensor technology, and fire control systems are further enhancing the accuracy and effectiveness of remote-controlled gun systems. Rising defense budgets, geopolitical tensions, and border security concerns in regions like North America, Europe, and Asia-Pacific are fueling procurement. Additionally, the growing adoption of these systems by law enforcement and paramilitary forces is expanding market opportunities. As automation in defense continues to evolve, the remote-controlled gun systems segment is expected to see sustained growth.

Recent Market Developments

- In December 2022, Elbit Systems has announced that it will supply the Australian Army with the "Skylark I-LEX Unmanned Aerial Systems." This electric-powered system is designed for in-house operation by mobile forces and features a 40-km line-of-sight range. Its capabilities make it ideal for various roles, including force protection and reconnaissance missions.

Competitive Landscape

Major players in the market

- Kongsberg Gruppen

- Raytheon Company

- Elbit Systems

- ST Engineering

- Saab AB

- Leonardo S.p.A.

- Thales

- Electro Optic Systems

- BAE Systems

- Moog

- IMI Systems

- General Dynamics

- Rheinmetall AG

- ASELSAN A.S

- Norinco

- FN Herstal

- Rafael Advanced Defense Systems

- Others

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2033.

Remote Weapon Station Market, Component Analysis

- Human Machine Interface

- Sensors

- Weapons

- Armaments

Remote Weapon Station Market, Platform Analysis

- Land

- Naval

- Airborne

Remote Weapon Station Market, Weapon Type Analysis

- Lethal Weapons

- Non-lethal Weapons

Remote Weapon Station Market, Application Analysis

- Military

- Homeland Security

Remote Weapon Station Market, Technology Analysis

- Close-in Weapon Systems

- Remote Controlled Gun Systems

- Others

Remote Weapon Station Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Need help to buy this report?