Global Renewable Energy Certificate Market Size, Share, and COVID-19 Impact Analysis, By Energy Type (Solar Energy, Wind Power, Hydro-Electric Power, and Gas Power), By Capacity (0-1,000KWH, 1,100-5,000KWH, and More Than 5,000KWH), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033.

Industry: Energy & PowerGlobal Renewable Energy Certificate Market Insights Forecasts to 2033

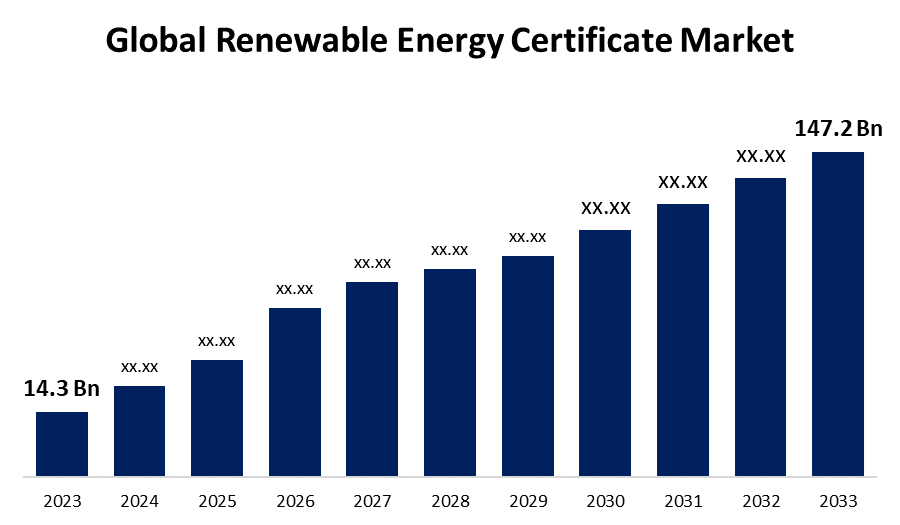

- The Global Renewable Energy Certificate Market Size was Valued at USD 14.3 Billion in 2023

- The Market Size is Growing at a CAGR of 26.26% from 2023 to 2033

- The Worldwide Renewable Energy Certificate Market Size is Expected to Reach USD 147.2 Billion by 2033

- Asia Pacific is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Renewable Energy Certificate Market Size is Anticipated to Exceed USD 147.2 Billion by 2033, Growing at a CAGR of 26.26% from 2023 to 2033.

Market Overview

A renewable energy certificate, or REC, is a market-based instrument representing the property rights to the environmental, social, and other non-power attributes of renewable electricity generation. RECs are issued when one megawatt-hour (MWh) of electricity is generated and delivered to the electricity grid from a renewable energy resource. RECs are the accepted legal instrument through which renewable energy generation and use claims are substantiated in the U.S. renewable electricity market. RECs are supported by several different levels of government, regional electricity transmission authorities, nongovernmental organizations (NGOs), and trade associations, as well as in U.S. case law. Utilities and other businesses buy RECs to meet legal requirements. Many states require utility companies to produce a minimum amount of renewable energy. Buying RECs allows companies to get credit for renewable production to meet these standards. For example, In January 2024, In a major stride towards environmental sustainability, PT PLN (Persero) entered into a collaboration with Coca-Cola Europacific Partners (CCEP) Indonesia, agreeing on a Renewable Energy Certificate (REC) collaboration of 90 Gigawatt hours (GWh). The collaboration was formalized through the signing of a Sale and Purchase Agreement utilizing PLN’s Green Energy As Services REC service for 90,211 units until 2025.

According to government of India, total number of renewable energy certificates (RECs) issued in year till year 2022 total are 69693635 and category wise are around 37581714 are issued to the distribution companies, Open Access/Captive Power Producers around 31818478, Voluntary 31342, and Regulatory 262101.

Report Coverage

This research report categorizes the market for renewable energy certificate based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the renewable energy certificate market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the renewable energy certificate market.

Global Renewable Energy Certificate Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 14.3 Billion |

| Forecast Period: | 2023 - 2033 |

| Forecast Period CAGR 2023 - 2033 : | 26.26% |

| 2033 Value Projection: | USD 147.2 Billion |

| Historical Data for: | 2019 - 2022 |

| No. of Pages: | 273 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Energy Type, By Capacity, By Capacity, By Region |

| Companies covered:: | Environmental Tracking Network of North America, General Services Administration, Western Area Power Administration, The U.S. Environment Protection Agency, Green-e Energy, Defense Logistics Agency Energy, Central Electricity Regulatory Commission, Others, and |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, and Analysis |

Get more details on this report -

Driving Factors

Many countries and regions have set ambitious targets for the adoption of renewable energy sources, such as solar, wind, and hydropower. Governments often implement renewable energy certificates (REC) programs to incentivize the production of renewable electricity and help meet these targets. Utilities and energy providers are required to procure a certain percentage of their electricity from renewable sources, creating demand for renewable energy certificates (RECs). Businesses and organizations are increasingly seeking to reduce their carbon footprint and improve their environmental credentials. Purchasing renewable energy certificates (RECs) allows them to offset their conventional electricity usage and claim the environmental benefits of the renewable energy they support, aligning with their sustainability goals. In addition to regulatory requirements, there is growing voluntary demand for RECs from environmentally conscious consumers and corporations who want to demonstrate their commitment to renewable energy and green practices. Numerous government incentives, such as tax credits, feed-in tariffs, and renewable energy mandates, have been implemented to encourage renewable energy development and participation in renewable energy certificates markets, driving market growth.

Restraining Factors

The retraining factor refers to the periodic adjustment made to the number of RECs generated per unit of renewable energy produced. This adjustment is necessary to account for changes in renewable energy technology, costs, and adoption rates over time. As renewable energy technologies become more efficient and cost-effective, the retraining factor may be reduced, as fewer RECs may be needed to incentivize the same level of renewable energy generation. This dynamic adjustment helps to ensure the REC market continues to effectively drive renewable energy deployment and achieve broader sustainability goals.

Market Segmentation

The renewable energy certificate market share is classified into energy type and capacity.

- The solar energy segment is estimated to hold the highest market revenue share through the projected period.

Based on the energy type, the renewable energy certificate market is classified into solar energy, wind power, hydro-electric power, and gas power. Among these, the solar energy segment is estimated to hold the highest market revenue share through the projected period. Advancements in manufacturing processes, economies of scale, and improved efficiency of solar panels, have made solar power increasingly cost-competitive with traditional fossil fuel-based electricity generation. This has led to a surge in the deployment of solar energy projects worldwide, as solar has become an attractive option for utilities, businesses, and homeowners seeking to reduce their energy costs and carbon footprint. Additionally, supportive government policies, such as solar energy targets, tax incentives, and renewable energy mandates, have further bolstered the growth of the solar energy segment. The modular and scalable nature of solar PV systems, allowing for both large-scale utility-grade installations and distributed small-scale rooftop projects, has also contributed to the segment's dominance in the renewable energy certificate market. As the solar industry continues to experience technological advancements and cost reductions, the solar renewable energy segment is poised to maintain its leading market position throughout the projected period.

- The more than 5,000KWH segment is anticipated to hold the largest market share through the forecast period.

Based on the capacity, the renewable energy certificate market is divided into 0-1,000KWH, 1,100-5,000KWH, and more than 5,000KWH. Among these, the more than 5,000KWH segment is anticipated to hold the largest market share through the forecast period. As the global push for sustainability and emissions reduction continues, there is a rising need for utility-scale renewable energy installations that can generate significant amounts of clean electricity to meet the energy demands of large industrial facilities, commercial buildings, and even entire communities. The "More than 5,000 KWH" segment encompasses these large-scale renewable energy projects, which often involve solar farms, wind farms, or hydroelectric plants with significant power-generating capacities. These larger projects benefit from economies of scale, allowing for more efficient and cost-effective renewable energy generation, and making them an attractive option for major energy consumers and grid operators. Additionally, the increasing participation of corporations, institutions, and municipalities in renewable energy procurement through power purchase agreements (PPAs) and community solar programs further bolsters the growth of the "More than 5,000 KWH" segment, as these larger consumers seek to meet their substantial energy needs through renewable sources.

Regional Segment Analysis of the Renewable Energy Certificate Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Europe is anticipated to hold the largest share of the renewable energy certificate market over the predicted timeframe.

Get more details on this report -

Europe is anticipated to hold the largest share of the renewable energy certificate market over the predicted timeframe. This is due to its well-established policy frameworks, rapid growth of renewable energy capacity, strong corporate sustainability commitments, supportive government incentives, and mature trading infrastructure. The region has implemented robust renewable portfolio standards and other mandates that drive utility-scale procurement of renewable energy, creating substantial demand for RECs. Additionally, numerous large corporations headquartered in the region have pledged ambitious renewable energy and emissions reduction goals, fueling voluntary REC demand. Coupled with favorable government policies and a developed REC trading ecosystem,

Asia Pacific is expected to grow at the fastest CAGR growth of the renewable energy certificate market during the forecast period. Firstly, the region is rapidly expanding its renewable energy capacity, especially in solar and wind power, creating a significant demand for RECs as countries work to meet their ambitious renewable energy targets set through supportive government policies. Secondly, corporate sustainability initiatives are gaining traction, with multinational and domestic companies in Asia Pacific increasingly procuring RECs to fulfill their renewable energy and emissions reduction goals. Additionally, the declining costs of renewable energy technologies are making these sources more accessible, further boosting REC demand. Finally, the development of REC trading infrastructure in the region is facilitating the efficient exchange of these certificates and enabling the Asia Pacific to capitalize on its immense growth potential in the renewable energy sector, positioning it as the fastest-growing REC market during the forecast period.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the renewable energy certificate market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Environmental Tracking Network of North America

- General Services Administration

- Western Area Power Administration

- The U.S. Environment Protection Agency

- Green-e Energy

- Defense Logistics Agency Energy

- Central Electricity Regulatory Commission

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In August 2024, PT PLN (Persero) announced a significant step in its commitment to sustainable energy through the sale of Renewable Energy Certificates (RECs) to PT Agincourt Resources. The gold mining company has purchased 275,000 REC units, equivalent to 275 Megawatt hours of renewable energy, from PLN’s North Sumatra Main Distribution Unit (UID).

- In April 2024, Asia-Pacific & Japan (APJ) hyperscale data centre specialist, AirTrunk, and Hong Kong’s major power utility, CLP Power Hong Kong Limited (CLP Power) announced the largest site-specific renewable energy certificate (REC) procurement in Hong Kong to support its customer, Microsoft’s goal of achieving 100% renewable energy by 2025.

- In March 2024, KBank, INNOPOWER to launch the Renewable Energy Certificate platform.

- In March 2024, Petrobras acquires international certificates that guarantee the 100% renewable origin of the electricity used in its operations.

- In January 2024, Clearway Energy signed a corporate renewable energy certificate deal with SFK.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the renewable energy certificate market based on the below-mentioned segments:

Global Renewable Energy Certificate Market, By Energy type

- Solar Energy

- Wind power

- Hydro-electric power

- Gas power

Global Renewable Energy Certificate Market, By Capacity

- 0-1,000KWH

- 1,100-5,000KWH

- More than 5,000KWH

Global Renewable Energy Certificate Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1.What is the CAGR of the renewable energy certificate market over the forecast period?The renewable energy certificate market is projected to expand at a CAGR of 26.26% during the forecast period.

-

2.What is the market size of the renewable energy certificate market?The Global Renewable Energy Certificate Market Size is Expected to Grow from USD 14.3 Billion in 2023 to USD 147.2 Billion by 2033, at a CAGR of 26.26% during the forecast period 2023-2033.

-

3.Which region holds the largest share of the renewable energy certificate market?Europe is anticipated to hold the largest share of the renewable energy certificate market over the predicted timeframe.

Need help to buy this report?