Global Renewable Energy Insurance Market Size, Share, and COVID-19 Impact Analysis, By Coverage Type (Property Insurance, Liability Insurance, Business Interruption Insurance, Equipment Breakdown Insurance, and Cyber Insurance), By End-Use (Residential, Commercial, Industrial, and Utility), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033.

Industry: Energy & PowerGlobal Renewable Energy Insurance Market Insights Forecasts to 2033

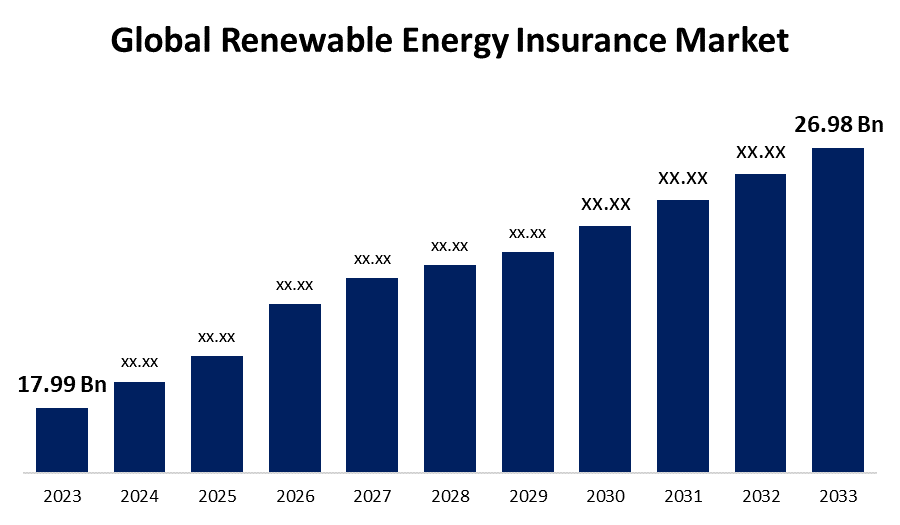

- The Global Renewable Energy Insurance Market Size was Valued at USD 17.99 Billion in 2023

- The Market Size is Growing at a CAGR of 4.14% from 2023 to 2033

- The Worldwide Renewable Energy Insurance Market Size is Expected to Reach USD 26.98 Billion by 2033

- Asia-Pacific is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Renewable Energy Insurance Market Size is Anticipated to Exceed USD 26.98 Billion by 2033, Growing at a CAGR of 4.14% from 2023 to 2033.

Market Overview

Renewable energy insurance protects policyholders from financial losses related to the generation, transmission, and storage of renewable energy sources. Considering the risks involved in projects, such as natural disasters, failures of equipment, and construction delays, the demand for ways to protect them through the use of insurance solutions is also rapidly increasing. Renewable energy projects are becoming more complex with multiple technologies and components. In addition, these projects involve high risks which are hard to insure. As a result, different insurance products and services are developed by insurers to satisfy the requirements of the renewable energy industry. Global investment in clean technologies is set to rise to USD 1.7 trillion in 2023, while around USD 1 trillion will be invested in fossil fuels, according to the International Energy Agency (IEA) World Energy Investment 2023 report, published in May. The renewable energy sector, primarily solar, wind, hydro, and biomass, will play a critical role in the transformation. The recent global energy crisis has been the catalyst for the acceleration of renewable power installations, with the world set to as add as much renewable power in the next five years as it did in the past 20, noted the Renewables 2022 report by the IEA in December 2022.

In addition, the 2023 IEA report indicates that investors will spend more on solar power than on oil production in 2023 for the first time, clearly signposting the speed and scale of the global shift to low-carbon sources. Recent initiatives like the infrastructure law and Inflation Reduction Act (IRA) have accelerated the transition and made the US “irresistible” for clean energy investments. But with more than USD 374 billion in incentives, many countries are looking to attract capital for large-scale clean-energy projects. The path to 2050 is terms of cost, scope, ambition and complexity, and the multi-faceted risks to the renewable energy sector and global insurance companies, including If Insurance, are projected to be significant in the years to come

Report Coverage

This research report categorizes the market for renewable energy insurance based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the renewable energy insurance market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the renewable energy insurance market.

Global Renewable Energy Insurance Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 17.99 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 4.14% |

| 2033 Value Projection: | 26.98 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 115 |

| Segments covered: | By Coverage Type, By End-Use, By Region |

| Companies covered:: | American International Group (AIG), Liberty Mutual Insurance, Swiss Re, Marsh McLennan, Lloyd’s of London, Munich Re, XL Catlin, Everest Reinsurance, Chubb, Willis Towers Watson, Allianz, Zurich Insurance Group, AXA XL, RSA Insurance Group, and other key companies. |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis. |

Get more details on this report -

Driving Factors

One of the main drivers contributing to the growth of the renewable energy insurance market industry is the increasing demand for renewable energy sources, such as solar and wind power. With more and more governments and businesses worldwide implementing policies and various types of initiatives aimed at reducing carbon emissions and moving towards a more sustainable way of living, the number of renewable energy projects is bound to continue growth. The insurance offers cover all risks as the risks peculiar to renewable energy projects, such as performance guarantees, cyber risks, or supply chain problems. The renewable energy regulatory landscape is in a constant state of flux, with new policies and regulations being introduced to advance the development and deployment of renewable energy technology. Top of FormBottom of Form

Restraining Factors

The major issue in the renewable energy market is the lack of uniform regulations and standards. The cost of insurance premiums has been steadily rising over the past few years, making it difficult for businesses to remain competitive in the renewable energy insurance market. Insurers are being forced to raise their rates to remain profitable, which is making it difficult for businesses to afford the necessary coverage. Other restraining factors are a lack of flexibility in coverage options, limited availability of specialized insurance policies, and high barriers to entry for new players.

The renewable energy insurance market share is classified into coverage type and end-use.

- The property insurance segment is estimated to hold the highest market revenue share through the projected period.

Based on the coverage type, the renewable energy insurance market is classified into property insurance, liability insurance, business interruption insurance, equipment breakdown insurance, and cyber insurance. Among these, the property insurance segment is estimated to hold the highest market revenue share through the projected period. The growth of the property insurance segment is driven by the increasing number of renewable energy projects being developed around the world. These projects require specialized insurance coverage to protect against the risks associated with renewable energy generation, such as weather damage, equipment failure, and business interruption.

- The industrial segment is anticipated to hold the largest market share through the forecast period.

Based on the end-use, the renewable energy insurance market is divided residential, commercial, industrial, and utility. Among these, the industrial segment is anticipated to hold the largest market share through the forecast period. The increasing demand for renewable energy in industries to reduce carbon footprint and comply with government regulations is driving the growth of this segment. Moreover, the rising adoption of renewable energy technologies, such as solar PV systems and wind turbines, in industrial facilities is further contributing to the market growth.

Regional Segment Analysis of the Renewable Energy Insurance Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Europe is anticipated to hold the largest share of the renewable energy insurance market over the predicted timeframe.

Get more details on this report -

Europe is anticipated to hold the largest share of the renewable energy insurance market over the predicted timeframe. The primary drivers of growth in the Europe renewable energy insurance market are the increasing demand for renewable energy, the need for risk management, and the emergence of new technologies. Risk management is becoming increasingly important as companies face a variety of risks, including natural disasters, cyber-attacks, and other threats. Finally, new technologies are emerging that are making energy insurance more accessible and affordable. The increasing demand for renewable energy, the need for risk management, and the emergence of new technologies are all contributing to this growth. As the industry continues to expand, the demand for renewable energy insurance will continue to increase, providing opportunities for businesses to capitalize on this growing market.

Asia-Pacific is expected to grow at the fastest CAGR growth of the renewable energy insurance market during the forecast period. Approximately half of the total investment in power generation across Asia-Pacific is projected to be allocated to renewable energy sources, including energy storage. Significant investments are being made in the development of large offshore wind farms in South Korea, Japan, and Vietnam, mirroring the initiatives previously seen in Taiwan. For instance, IHI Corp. is set to install a sea turbine in the Kochi prefecture near Japan as part of the increasing trend of solar and onshore wind projects in the area. Green investments have been concentrated on solar, offshore wind, and hydroelectric power. The region is also a global leader in lithium-ion battery production, with China accounting for a leading market share. China’s large population and high electricity demand will drive the development of renewable energy sources. Many global companies, including Chinese companies, are investing in renewable energy with the support of China’s federal and provincial governments.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the renewable energy insurance market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- American International Group (AIG)

- Liberty Mutual Insurance

- Swiss Re

- Marsh McLennan

- Lloyd's of London

- Munich Re

- XL Catlin

- Everest Reinsurance

- Chubb

- Willis Towers Watson

- Allianz

- Zurich Insurance Group

- AXA XL

- RSA Insurance Group

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In July 2024, Zurich Insurance Group (Zurich) and Aon introduced an innovative insurance facility for clean energy, offering extensive coverage worldwide for blue and green hydrogen projects costing up to USD 250 million. Zurich leads as the insurer with Aon serving as the exclusive broker.

- In July 2024, Gard announced its acquisition of Codan’s global Marine and Energy (M&E) portfolio. With this, Gard continues to expand its portfolio and takes a leading position within the renewable energy segment.

- In June 2024, Climate risk-solving insurance provider Understory announced the closing of its series funding round, securing USD 15 million to drive its expansion into the renewable energy sector.

- In May 2024, TotalEnergies is teaming up with a Chinese innovation investment fund co-developed by Cathay Capital and Dajia Insurance, to finance and operate solar power projects for commercial and industrial customers in China.

- In April 2024, kWh Analytics, Inc., the industry leader in climate insurance, announced a significant increase in its capacity agreement with Aspen Insurance (“Aspen”) to support its property insurance offering for renewable energy projects

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the renewable energy insurance market based on the below-mentioned segments:

Global Renewable Energy Insurance Market, By Coverage Type

- Property Insurance

- Liability Insurance

- Business Interruption Insurance

- Equipment Breakdown Insurance

- Cyber Insurance

Global Renewable Energy Insurance Market, By End-Use

- Residential

- Commercial

- Industrial

- Utility

Global Renewable Energy Insurance Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the renewable energy insurance market over the forecast period?The renewable energy insurance market is projected to expand at a CAGR of 4.14% during the forecast period.

-

2. What is the market size of the renewable energy insurance market?The Global Renewable Energy Insurance Market Size is Expected to Grow from USD 17.99 Billion in 2023 to USD 26.98 Billion by 2033, at a CAGR of 4.14% during the forecast period 2023-2033.

-

3. Which region holds the largest share of the renewable energy insurance market?Europe is anticipated to hold the largest share of the renewable energy insurance market over the predicted timeframe.

Need help to buy this report?