Global Residential Battery Market By Type (Lithium-ion battery, Lead-Acid battery, Others), By Power Rating (3-6 kW, 6-10 kW), By Operation (Standalone, Solar); By Region (U.S., Canada, Mexico, Rest of North America, The UK, France, Germany, Italy, Spain, Nordic Countries (Denmark, Finland, Iceland, Sweden, Norway), Benelux Union (Belgium, the Netherlands, Luxembourg), Rest of Europe, China, Japan, India, New Zealand, Australia, South Korea, Southeast Asia (Indonesia, Thailand, Malaysia, Singapore, Rest of Southeast Asia), Saudi Arabia, UAE, Egypt, Kuwait, South Africa, Rest of Middle East & Africa, Brazil, Argentina, Rest of Latin America) - Global Insights, Growth, Size, Comparative Analysis, Trends and Forecast, 2021-2030

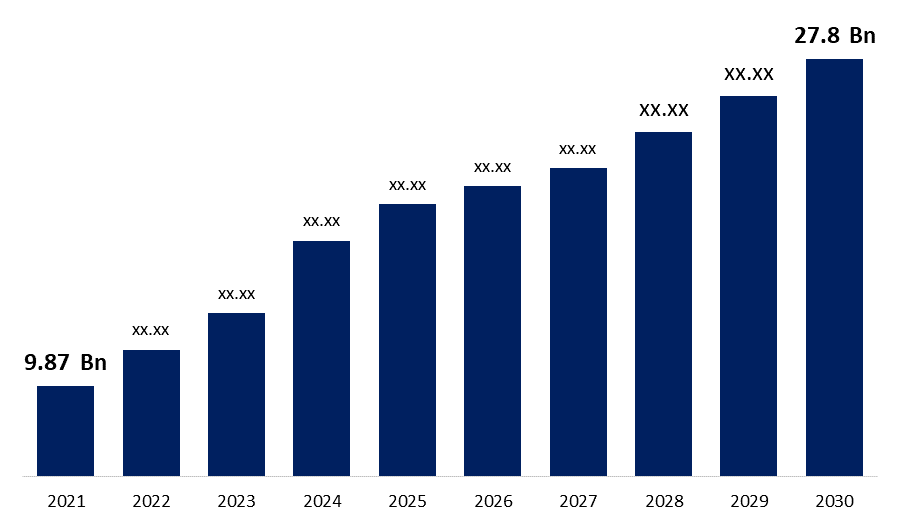

Industry: Energy & PowerThe Global Residential Battery Market was valued at USD 9.87 billion in 2021, and it is anticipated to reach USD 27.8 billion by 2030, at a CAGR of 17.26% during the forecast period, 2021-2030. Residential batteries are used to store energy in the form of electricity. To handle charging and discharging cycles well, the batteries are typically built of lithium-ion or lead-acid composition. These are employed in a variety of industries; for example, electric automobiles and smart meters both use them. These have shown to be particularly useful in locations where there is no reliable grid connection. With the development in rooftop solar installations in residential areas, the market for these batteries is likely to grow. These rooftop solar panels store energy and allow users to use it in the event of a power outage. Similarly, in the event of a power outage, these batteries are charged through the usual grid connection network and brought to work.

Get more details on this report -

COVID-19 Analysis

The COVID-19 pandemic had a moderate influence on the market in 2020, owing to lower electricity and energy use, as well as lower global economic growth. The residential battery market is expected to rise in the next years, owing to rising demand for energy storage solutions in the residential sector around the world and increased deployment of solar power generation. The constant increase of battery performance achieved by sustained R&D targeted at enhancing battery materials, reducing non-active materials and material costs, improving cell design and production yield, and speeding up production. As a result, the market is likely to be driven by the drop in lithium-ion battery prices over the forecast period. However, concerns such as complexity and a short life duration must be considered along with failure due to deep and continuous cycling, etc., are expected to hinder the growth of the market during the forecast period.

Global Residential Battery Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2021 |

| Market Size in 2021: | USD 9.87 Billion |

| Forecast Period: | 2021 - 2030 |

| Forecast Period CAGR 2021 - 2030 : | 17.26% |

| 2030 Value Projection: | USD 27.8 Billion |

| Historical Data for: | 2017 - 2020 |

| No. of Pages: | 195 |

| Tables, Charts & Figures: | 119 |

| Segments covered: | By Type, By Power Rating, By Operation, By Region |

| Companies covered:: | Duracell Inc, Energizer Holding Inc, BYD Co. Ltd, FIMER SpA, LG Energy Solution Ltd, Panasonic Corporation, Samsung SDI Co. Ltd, Siemens AG, Luminous Power Technologies Pvt. Ltd, Amara Raja Batteries Ltd, Delta Electronics Ltd, NEC Corporation, Tesla Inc. |

| Growth Drivers: | 1) The lithium-ion segment is expected to dominate the market share 2) The standalone is expected to dominate the market share |

| Pitfalls & Challenges: | The COVID-19 pandemic had a moderate influence on the market in 2020, owing to lower electricity and energy use, as well as lower global economic growth. |

Get more details on this report -

Type Outlook

The lithium-ion segment is expected to dominate the market share in 2020 of global residential battery market owing to due to the great efficiency offered in comparison to other alternatives In recent years, the market for lithium-ion batteries has been fueled by falling costs. The market is divided into two categories based on the power rating: 3kW to 6kW and 6kW to 10kW. Due to residential customers' demand for high-capacity batteries, the 3–6 kW segment is likely to hold the biggest market share. In addition, with the advent of numerous household equipment on the market, the average electricity usage per house has increased significantly in metropolitan areas.

Operation Outlook

The standalone is expected to dominate the market share in 2020 of global residential battery market owing to due to the solar power was introduced, stand-alone type batteries were being put in residential places. As a result, these stand-alone batteries account for a significant portion of the market. In recent years, the introduction of solar has fueled the growth of solar-connected battery installations, which is expected to continue at a healthy pace and have a favourable impact on the entire residential battery industry.

Get more details on this report -

Regional Outlook

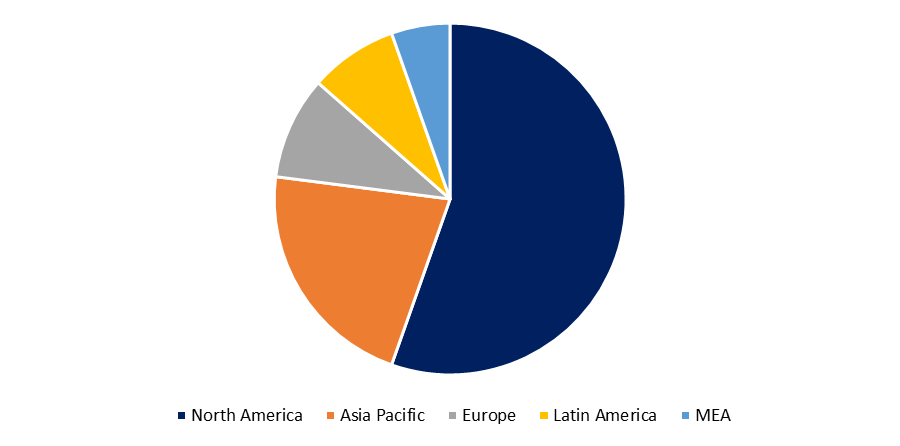

Asia Pacific dominated the global health medicine market owing to the massive growth in demand for uninterrupted electrical supplies from the last decade. As a result, many residential customers have been forced to build separate battery storage devices in the event of a power outage. Battery installations at residential locations in the region have also been fueled by recent investments in solar electricity generating. Customers' installation of these batteries has resulted in fewer outages and lower electricity bills, which has had a favourable impact on the whole market.

Europe is anticipated to emerge as the fastest-growing region over the forecast period. For the residential sector, Europe has the most solar power installations. The government's green energy targets and subsidies have aided the growth of the market for these batteries in the region. In terms of renewable energy generation, Germany, the United Kingdom, France, Spain, and Italy are among the region's leaders. Furthermore, with an increasing emphasis on solar and wind power, North America is likely to have significant market expansion.

Key Companies & Recent Developments

Partnerships, strategic mergers, and acquisitions are expected to be the most successful strategies for industry participants to get speedy access to growing markets while also improving technological capabilities. For instance, in February 2020, the ongoing growth of renewables in the global energy mix was investigated and studied by experts at China's Tianjin University. This is intimately related to grid-level energy storage, which can smooth out solar and wind generation's inherent intermittency. It ensures that the generated power is delivered to the grid in the proper location to fulfil demand and provide a variety of other services.

In addition, product differentiation and developments, as well as service expansion, are projected to help organizations thrive in the market. For instance, in September 2019, Panasonic has introduced a new residential battery and solar panels that are more efficient. EverVolt has a modular architecture and is available in AC and DC linked variants, making it a versatile solution that meets the energy needs and budgets of homeowners. It may be customised to a homeowner's specific needs and is compatible with any solar system or inverter.

Market Segmentation of Global Residential Battery Market

By Type

- Lithium-ion battery

- Lead-Acid battery

- Others

By Power Rating

- 3-6 kW

- 6-10 kW

By Operation

- Standalone

- Solar

Key Players

- Duracell Inc.

- Energizer Holding Inc.

- BYD Co. Ltd

- FIMER SpA

- LG Energy Solution Ltd

- Panasonic Corporation

- Samsung SDI Co. Ltd

- Siemens AG

- Luminous Power Technologies Pvt. Ltd

- Amara Raja Batteries Ltd

- Delta Electronics Ltd

- NEC Corporation

- Tesla Inc.

Need help to buy this report?