Global Residential HVAC Equipment Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Heating Equipment, Cooling Equipment, Ventilation Equipment, Smart HVAC Systems), By Application (New Residential Construction, Replacement & Retrofit, Renovation & Upgrades), By Technology (Traditional HVAC Systems, Energy-efficient HVAC Systems, Smart HVAC Systems), and By Region (North America, Europe, Asia Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Machinery & EquipmentGlobal Residential HVAC Equipment Market Insights Forecasts to 2033

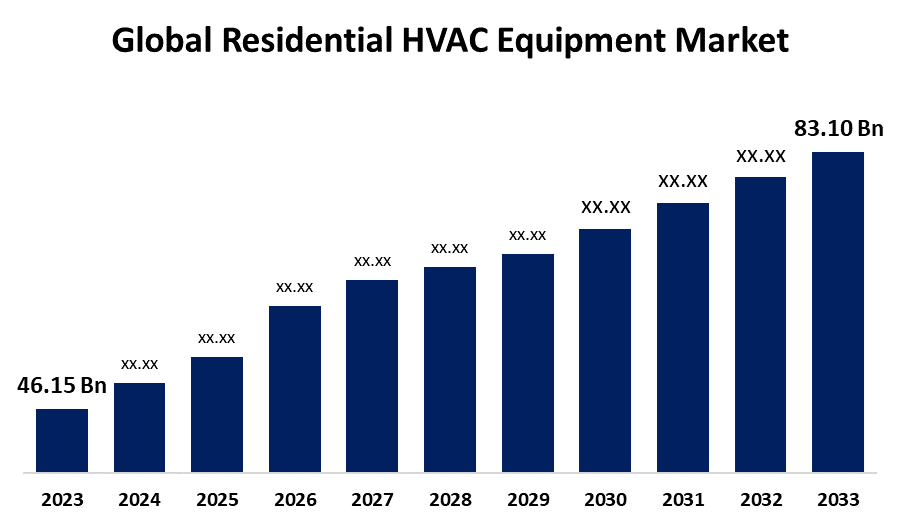

- The Global Residential HVAC Equipment Market Size was Valued at USD 46.15 Billion in 2023

- The Market Size is Growing at a CAGR of 6.06% from 2023 to 2033

- The Worldwide Residential HVAC Equipment Market Size is Expected to Reach USD 83.10 Billion by 2033

- Asia Pacific is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Residential HVAC Equipment Market Size is Anticipated to Exceed USD 83.10 Billion by 2033, Growing at a CAGR of 6.06% from 2023 to 2033. The global residential HVAC equipment market is quickly developing, driven by demand for energy-efficient, smart systems, and climate-resilient solutions. Key players and regions are advancing innovation, with North America dominating and Asia-Pacific experiencing the quickest growth.

Market Overview

Residential HVAC equipment market refers to the industry where work is done designing, manufacturing, distributing, and maintaining heating, ventilation, as well as air-conditioning systems used inside residential buildings. Such systems are specifically designed for the regulation of temperature, humidity, air quality, airflow, and therefore comfort and energy efficiency in homes. The products available in the market can be different, including heating systems and, as an outcome of both types, boilers, furnaces, and heat pumps; cooling systems and ventilation systems, including exhaust fans and air purifiers; and the latest generation of IoT enabled and AI driven systems, which are known as smart HVAC solutions. Energy efficiency solutions, consumer awareness over indoor air quality, the need for smart homes, and the replacement or upgradation of existing HVAC units are other major demand drivers of residential HVAC systems. Climate changes with extreme weather conditions in the form of heat waves and cold snaps are significantly rising demands for stable HVAC systems in residential homes.

Opportunities and Trends in the Residential HVAC Equipment Market:

Opportunities in the Residential HVAC Equipment Market are growing with prospects in energy-efficient and smart HVAC systems, due to increased consumer demand for sustainability and automation. This includes the adoption of IoT-enabled HVAC for better control and efficiency, more focus on air quality solutions, as well as incentives from the government on energy-efficient upgrades of such equipment due to climate change and extreme weather conditions.

Report Coverage

This research report categorizes the global residential HVAC equipment market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global residential HVAC equipment market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global residential HVAC equipment market.

Global Residential HVAC Equipment Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 46.15 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 6.06% |

| 2033 Value Projection: | USD 83.10 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 270 |

| Tables, Charts & Figures: | 115 |

| Segments covered: | By Product Type, By Application, By Technology, By Region and COVID-19 Impact Analysis |

| Companies covered:: | Carrier Corporation, Daikin Industries, Ltd., Trane Technologies, Lennox International Inc., Rheem Manufacturing Company, Mitsubishi Electric Corporation, Honeywell International Inc., Bosch Thermotechnology, Johnson Controls International plc, Fujitsu General Limited, American Standard, and others key players. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Rising demand for energy-efficient systems, growing awareness of consumers about indoor air quality, a rising smart home trend, extreme weather and its resultant climate change conditions all contribute positively to the Residential HVAC Equipment Market. Growth in the market is also driven by the current government regulations for promoting energy efficiency and the compulsion of replacing aged equipment along with the advancements in HVAC technology.

The residential HVAC equipment market is driven by innovation in the form of IoT-enabled smart systems and AI-driven temperature control, besides geothermal heating and solar-powered HVAC. New product launches, such as advanced air purifiers and ductless mini-split systems, are fueling growth. Government incentives to adopt green building standards and eco-friendly HVAC solutions accelerate growth. Besides, sustainability, besides total reduction in energy consumption, continues to drive growth.

Restraints & Challenges

The residential HVAC equipment market suffers from high installation and maintenance costs, mainly for energy-efficient and smart products. Being inherently in violation of the minimum energy standards, these products increase operational costs. Not to mention, that complexity brings along with it advanced technologies being widely implemented in most of these devices, where low-cost, less efficient competition seems to be rampant, hence curbing full-scale adoption.

Market Segmentation

The global residential HVAC equipment market share is classified into product type, application and technology.

- The cooling equipment segment is expected to hold the largest share of the global residential HVAC equipment market during the forecast period.

Based on product type, the global residential HVAC equipment market is categorized as heating equipment, cooling equipment, ventilation equipment, and smart HVAC systems. Among these, the cooling equipment segment is expected to hold the largest share of the global residential HVAC equipment market during the forecast period. This is largely led by rising temperatures related to global warming, the ever-increasing demand for air conditioners in tropical climatic regions, and the rising use of energy-efficient cooling solutions. Air conditioners, ductless mini-split systems, and evaporative coolers are highly in demand, particularly in regions like North America, Europe, and Asia-Pacific.

- The replacement & retrofit segment is expected to grow at the fastest CAGR during the forecast period.

Based on the application, the global residential HVAC equipment market is categorized as new residential construction, replacement & retrofit, and renovation & upgrades. Among these, the replacement & retrofit segment is expected to grow at the fastest CAGR during the forecast period. As older HVAC systems become inefficient or outdated, more and more homeowners are looking to upgrade for better energy efficiency and comfort. Further, increased awareness of the benefits of modern, energy-efficient systems and government incentives for upgrading to eco-friendly solutions are driving the demand for replacement and retrofit applications. It is very strong in developed regions where the housing stock is ageing.

- The energy-efficient HVAC systems segment is expected to hold the largest share of the global residential HVAC equipment market during the forecast period.

Based on technology, the global residential HVAC equipment market is categorized as traditional HVAC systems, energy-efficient HVAC systems, and smart HVAC systems. Among these, the energy-efficient HVAC systems segment is expected to hold the largest share of the global residential HVAC equipment market during the forecast period. Increasing demand is now being driven by consumers and governments looking for sustainability and reducing energy consumption, and thus HVAC systems are in the pipeline to minimize energy use while delivering optimal performance. Energy-efficient solutions such as high SEER air conditioners, geothermal systems, and heat pumps attract more attention because of long-term cost savings and lower environmental impacts.

Regional Segment Analysis of the Global Residential HVAC Equipment Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is projected to hold the largest share of the global residential HVAC equipment market over the forecast period.

Get more details on this report -

North America is projected to hold the largest share of the global residential HVAC equipment market over the forecast period. This is further driven by the market for energy-efficient and smart HVAC systems, as well as rising home automation trends. Huge investments in residential HVAC upgrades are being witnessed in the U.S. and Canada due to regulatory pressures, government incentives, and consumer awareness about energy savings and environmental concerns. The region also faces extreme climatic conditions where summer seasons are extremely hot and winter seasons are bitterly cold, which increases the demand for reliable heating and cooling of residential homes.

Asia Pacific is expected to grow at the fastest CAGR growth of the global residential HVAC equipment market during the forecast period. Growth in the region has been driven by rapid urbanization, increasing disposable incomes, and rising temperatures in countries such as China, India, and Southeast Asia. Increased attention to energy-efficient HVACs and better indoor air quality is adding to the pace of demand for advanced HVAC solutions. Growth in smart home adoption and government initiatives promoting energy-efficient technologies will also contribute to the region's strong growth in this market.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global residential HVAC equipment market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Carrier Corporation

- Daikin Industries, Ltd.

- Trane Technologies

- Lennox International Inc.

- Rheem Manufacturing Company

- Mitsubishi Electric Corporation

- Honeywell International Inc.

- Bosch Thermotechnology

- Johnson Controls International plc

- Fujitsu General Limited

- American Standard

- Others

Key Market Developments

- In June 2023, Johnson Controls-Hitachi Air Conditioning introduced air365 Max, a cost-effective HVAC solution for professionals, architects, and building owners.

- In June 2022, Hitachi's new residential air conditioner received the red dot design award & the Red Dot Design Award is a German international design award for product, brand, and communication ideas and concepts. Among the winning items is airHome400, which is intended to suit the air conditioning aesthetic and utility needs of a diverse variety of consumers and markets.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the global residential HVAC equipment market based on the below-mentioned segments:

Global Residential HVAC Equipment Market, By Product Type

- Heating Equipment

- Cooling Equipment

- Ventilation Equipment

- Smart HVAC Systems

Global Residential HVAC Equipment Market, By Application

- New Residential Construction

- Replacement & Retrofit

- Renovation & Upgrades

Global Residential HVAC Equipment Market, By Technology

- Traditional HVAC Systems

- Energy-efficient HVAC Systems

- Smart HVAC Systems

Global Residential HVAC Equipment Market, By Regional

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the global residential HVAC equipment market over the forecast period?The global residential HVAC equipment market size is expected to grow from USD 46.15 Billion in 2023 to USD 83.10 Billion by 2033, at a CAGR of 6.06% during the forecast period 2023-2033.

-

2. Which region is expected to hold the highest share of the global residential HVAC equipment market?North America is projected to hold the largest share of the global residential HVAC equipment market over the forecast period.

-

3. Who are the top key players in the global residential HVAC equipment market?Carrier Corporation, Daikin Industries, Ltd., Trane Technologies, Lennox International Inc., Rheem Manufacturing Company, Mitsubishi Electric Corporation, Honeywell International Inc., Bosch Thermotechnology, Johnson Controls International plc, Fujitsu General Limited, American Standard, and Others.

Need help to buy this report?