Global Restaurant Point of Sale Terminal Market Size, Share, and COVID-19 Impact Analysis, By Product (Fixed and Mobile), By Component (Hardware and Software), By Deployment (Cloud and On-Premise), By Application (Front-End and Back-End), By End-User (FSR, QSR, Institutional, and Others), By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2032

Industry: Semiconductors & ElectronicsGlobal Restaurant Point of Sale Terminal Market Insights Forecasts to 2032

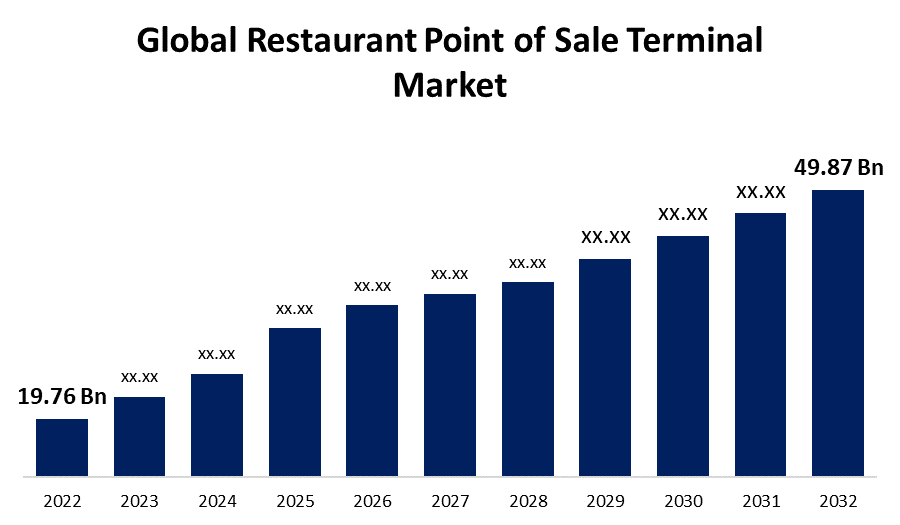

- The Restaurant Point of Sale Terminal Market was valued at USD 19.76 Billion in 2022.

- The Market is growing at a CAGR of 9.7% from 2023 to 2032

- The Worldwide restaurant point of sale terminal market is expected to reach USD 49.87 Billion by 2032

- Asia-Pacific is expected to grow the fastest during the forecast period

Get more details on this report -

The Global restaurant point of sale terminal market is expected to reach USD 49.87 Billion by 2032, at a CAGR of 9.7% during the forecast period 2023 to 2032.

Market Overview

A Restaurant Point of Sale (POS) Terminal is a computerized system that helps restaurant owners manage their businesses more efficiently. The POS terminal allows waitstaff to take orders and process payments, while also providing real-time data on inventory and sales. It can also integrate with other restaurant management systems, such as accounting and inventory management. By using a POS system, restaurant owners can improve their customer service, reduce errors in order-taking, and streamline their overall operations. POS terminals can also offer customer loyalty programs, menu customization, and mobile ordering capabilities.

Report Coverage

This research report categorizes the market for restaurant point of sale terminal market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the restaurant point of sale terminal market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segments of the restaurant point of sale terminal market.

Global Restaurant Point of Sale Terminal Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 19.76 Billion |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 9.7% |

| 2032 Value Projection: | USD 49.87 Billion |

| Historical Data for: | 2018-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Product, By Component, By Deployment, By Application, By End-User, By Region and COVID-19 Impact Analysis |

| Companies covered:: | PAX Technology Limited, Verifone Systems Inc., NCR Corporation, Revel Systems, Aireus Inc., Dinerware, Inc., Posist, EposNow, LimeTray, POSsible POS, Oracle Corporation, Posera, ShopKeep, Squirrel Systems, TouchBistro, Upserve, Inc |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The drivers of the restaurant point of sale terminal market include increasing demand for efficient and convenient payment systems, rising adoption of cloud-based POS solutions, and growing demand for analytics and data-driven insights. Additionally, the need for enhanced customer experiences, improved inventory management, and reduced operational costs are driving the growth of the market. The increasing use of mobile devices for ordering and payment, along with the adoption of artificial intelligence and machine learning, are also contributing to the expansion of the market. Furthermore, the growing trend of contactless payments and the emergence of integrated payment solutions are expected to drive the restaurant point of sale terminal market in the coming years.

Restraining Factors

The restraints of the restaurant point of sale terminal market include high initial investments and maintenance costs, concerns regarding data security and privacy, and interoperability issues with existing systems. Furthermore, the complex installation process and the need for staff training may pose challenges for small and medium-sized restaurants. Additionally, the lack of standardization and compatibility among different POS systems may limit their adoption. Finally, the ongoing COVID-19 pandemic has also impacted the market, with reduced demand due to closures and restrictions on restaurant operations.

Market Segmentation

- In 2022, the fixed segment accounted for more than 57.6% market share

On the basis of product, the global restaurant point of sale terminal market is segmented into fixed and mobile. The fixed segment is dominating with the largest market share in 2022, due to its established presence and reliability. Fixed POS systems offer robust features such as inventory management, menu customization, and data analytics, making them suitable for larger restaurant chains and businesses. Additionally, fixed POS systems offer better security features, with fewer vulnerabilities to cyber-attacks compared to mobile POS systems. The fixed segment also offers a wider range of hardware options such as terminals, printers, and scanners, allowing for greater customization and scalability. As a result, the fixed segment is expected to continue dominating the market in the near future.

- In 2022, the hardware segment dominated the market with more than 65.8% market share

Based on components, the global restaurant point of sale terminal market is segmented into hardware and software. Out of this, the hardware is dominating the market with the largest market share in 2022, due to its critical role in enabling payment processing and order management. The hardware segment includes devices such as terminals, printers, scanners, and cash drawers, which are essential for restaurant operations. Moreover, the demand for hardware devices is expected to remain high due to the increasing adoption of contactless payment methods and the need for faster order processing. The hardware segment also offers greater customization options, allowing businesses to choose devices that fit their specific needs. Therefore, the hardware segment is expected to continue dominating the market in the near future.

Regional Segment Analysis of the Restaurant Point of Sale Terminal Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia-Pacific dominated the market with more than 33.7% revenue share in 2022.

Get more details on this report -

Based on region, the Asia Pacific region has remained the largest market for restaurant POS terminals due to several factors. The region has a large population, increasing urbanization, and a growing middle class with higher disposable incomes, leading to increased demand for dining out. Moreover, the adoption of digital payment systems, especially in countries such as China and India, has significantly contributed to the growth of the market. Additionally, the rapid expansion of the restaurant industry, driven by changing consumer preferences and a growing tourism sector, has fueled the demand for POS terminals. The increasing focus on enhancing customer experience, reducing waiting times, and improving operational efficiency has also boosted the adoption of POS terminals in the region.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global restaurant point of sale terminal market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Companies:

- PAX Technology Limited

- Verifone Systems Inc.

- NCR Corporation

- Revel Systems

- Aireus Inc.

- Dinerware, Inc.

- Posist

- EposNow

- LimeTray

- POSsible POS

- Oracle Corporation

- Posera

- ShopKeep

- Squirrel Systems

- TouchBistro

- Upserve, Inc.

Key Target Audience

- Market Players

- Investors

- End-Users

- Government Authorities

- Consulting and Research Firm

- Venture Capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In May 2022, to enhance the point-of-sale and payment experience for their clients, Verifone, a provider of payment solutions, partnered with Lavu, a seller of restaurant software. The partnership aims to enable the cross-distribution of a unified point-of-sale system and high-end payment solutions.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2019 to 2032. Spherical Insights has segmented the global restaurant point of sale terminal market based on the below-mentioned segments:

Restaurant Point of Sale Terminal Market, By Product

- Fixed

- Mobile

Restaurant Point of Sale Terminal Market, By Component

- Hardware

- Software

Restaurant Point of Sale Terminal Market, By Deployment

- Cloud

- On-Premise

Restaurant Point of Sale Terminal Market, By Application

- Front-End

- Back-End

Restaurant Point of Sale Terminal Market, By End-User

- FSR

- QSR

- Institutional

- Others

Restaurant Point of Sale Terminal Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of Middle East & Africa

Need help to buy this report?