Global Retail Bank Loyalty Program Market Size, Share, and COVID-19 Impact Analysis, By Type (B2C Solutions, B2B Solutions), By Enterprise Size (Large Enterprise, Small & Medium Enterprises), By End-Use (Personal, Business), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033.

Industry: Banking & FinancialGlobal Retail Bank Loyalty Program Market Insights Forecasts to 2033

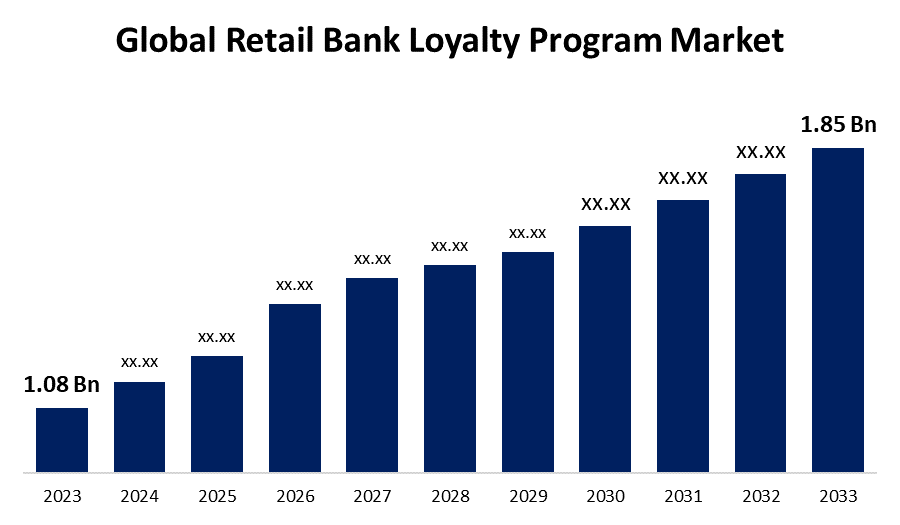

- The Global Retail Bank Loyalty Program Market Size was Valued at USD 1.08 Billion in 2023

- The Market Size is Growing at a CAGR of 5.53% from 2023 to 2033

- The Worldwide Retail Bank Loyalty Program Market Size is Expected to Reach USD 1.85 Billion by 2033

- Europe is Expected to Grow the fastest during the forecast period

Get more details on this report -

The Global Retail Bank Loyalty Program Market Size is Anticipated to Exceed USD 1.85 Billion by 2033, Growing at a CAGR of 5.53% from 2023 to 2033.

Market Overview

A retail bank loyalty program is a marketing strategy that rewards customers for their banking activities, helping banks build brand loyalty and foster stronger customer relationships. It includes points and rewards systems where customers earn points for activities like maintaining accounts, using credit cards, and taking loans. These points can be redeemed for lower interest rates, waived fees, travel perks, and merchandise. Some banks and financial institutions offer personalized offerings tailored to a customer's transaction history and previous reward usage, improving the overall customer experience. These programs can also include discounts at restaurants, retailers, events, and cashback on purchases made at certain retailers and restaurants. There are many opportunities, especially in emerging markets where the banking sector is undergoing rapid digital transformation and mobile banking is rising.

Retail banking, or consumer banking, includes services such as mortgages, certificates of deposit (CDs), savings and checking accounts, debit/credit cards, and personal loans. These services are offered through local branches of larger commercial banks, focusing on mass-market consumers. Due to the recent global economic slowdown, many banks have shifted their loyalty programs to cost-efficient networks like mobile platforms and social media.

Report Coverage

This research report categorizes the market for the global retail bank loyalty program market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global retail bank loyalty program market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global retail bank loyalty program market.

Global Retail Bank Loyalty Program Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 1.08 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 5.53% |

| 2033 Value Projection: | USD 1.85 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Type, By Enterprise Size, By End-Use, By Region |

| Companies covered:: | IBM, Oracle Corporation, Bank of America Corporation, Comarch SA, Exchange Solutions, Aimia, TIBCO Software, Customer Portfolios, HSBC Bank, Creatio, FIS Corporate, Citigroup Inc., Maritz, Royal Bank of Canada, Bank of India, and other key companies. |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis. |

Get more details on this report -

Driving Factors

The increasing competition among banks to retain and acquire customers necessitates innovative strategies like loyalty programs driving market growth. These programs help differentiate banks from competitors and solidify customer loyalty by offering personalized rewards and incentives. The rapid adoption of digital and mobile banking technologies has made it easier for banks to implement and manage these programs effectively. Using artificial intelligence and data analytics for loyalty programs enables banks to predict customer transactions and buying patterns and provide tailored offers that enhance customer satisfaction and engagement. Furthermore, the shift towards a customer-centric approach in the banking sector fuels the importance of understanding and responding to customer needs and preferences. Financial institutions continue to invest in new technologies to optimize their customer experience.

Restraining Factors

Some of the challenges anticipated to restrain the growth of the global retail bank loyalty program market include the high implementation costs of these programs, especially for smaller banks and financial institutions, limiting their adoption. Additionally, rising concerns over data privacy and security pose significant challenges as customers become more cautious about their personal information. Regulatory and compliance issues also add complexity, requiring banks to follow strict rules that can delay or restrict program deployment. Also, due to the dynamic nature of customer expectations and spending patterns, banks must constantly innovate their loyalty offerings, which can be resource-intensive and challenging to sustain long-term.

Market Segmentation

The global retail bank loyalty program market share is classified into type, enterprise size, and end-use.

- The B2C solutions segment is expected to hold the largest share of the global retail bank loyalty program market during the forecast period.

Based on the type, the global retail bank loyalty program market is divided into B2C solutions and B2B solutions. Among these, the B2C solutions segment is expected to hold the largest share of the global retail bank loyalty program market during the forecast period. This dominance is primarily due to the direct interaction banks have with individual customers, making it easier to implement and manage loyalty programs. B2C solutions are designed to reward personal banking activities such as credit card usage, account maintenance, and loan acquisitions, which are common and frequent. These programs significantly enhance customer experience by offering personalized rewards and benefits. The widespread adoption of digital banking platforms fuels the use of B2C loyalty solutions, allowing banks to track customer behaviour and offer tailored incentives and offers.

- The large enterprises segment is expected to hold the largest share of the global retail bank loyalty program market during the forecast period.

Based on enterprise size, the global retail bank loyalty program market is divided into large enterprises and small & medium enterprises. Among these, the large enterprises segment is expected to hold the largest share of the global retail bank loyalty program market during the forecast period. Large enterprises have extensive resources and capabilities that enable them to implement comprehensive loyalty programs. Large banks and financial institutions have substantial budgets to invest in newer technologies, data analytics, and personalized customer engagement strategies. They can offer a wider range of rewards and incentives for attracting and retaining a vast customer base. Additionally, large enterprises have established brand recognition, trust, and extensive customer data, allowing more effective targeting and customization of loyalty programs.

- The business segment is expected to grow at the fastest CAGR in the global retail bank loyalty program market during the forecast period.

Based on enterprise size, the global retail bank loyalty program market is divided into personal and business. Among these, the business segment is expected to grow at the fastest CAGR in the global retail bank loyalty program market during the forecast period. This rapid growth is driven by the increasing emphasis on corporate banking relationships and the growing need for banks to differentiate themselves in the competitive business banking landscape. Business or merchant loyalty programs offer benefits such as tailored financial products, enhanced customer service, and exclusive rewards that cater specifically to the needs of businesses. By building better relationships with business clients, banks create more stable revenue streams. As businesses recognize the value of these tailored banking solutions, the demand for business loyalty programs is expected to rise, making this segment the fastest-growing.

Regional Segment Analysis of the Global Retail Bank Loyalty Program Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the global retail bank loyalty program market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of the global retail bank loyalty program market over the predicted timeframe. The North American region’s market is driven by the well-established banking infrastructure, which facilitates the seamless implementation and management of retail bank loyalty programs. The high competition among banks in this region drives the continuous innovation and enhancement of customer engagement strategies. Additionally, consumers are receptive to digital banking solutions and personalized customer experiences. The strong focus on technological advancements, such as blockchain, artificial intelligence (AI), machine learning (ML), and data analytics, allows banks to offer more tailored and appealing rewards to customers. Moreover, the economic stability and higher disposable incomes of North American consumers lead to a high number of banking activities, boosting the adoption of loyalty programs.

Europe is expected to grow at the fastest pace in the global retail bank loyalty program market during the forecast period. This growth is driven by the rapid digital transformation in the banking sector across various European countries. European banks and financial firms are adopting innovative technologies and software to enhance loyalty programs. Additionally, there is a strong regulatory push towards improving customer transparency and experience. The diverse and highly competitive banking landscape encourages financial institutions to adopt more attractive loyalty strategies to retain and attract customers. Furthermore, the growing trend of personalized banking services aligns well with the goals of loyalty programs, contributing to market growth.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global retail bank loyalty program market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- IBM

- Oracle Corporation

- Bank of America Corporation

- Comarch SA

- Exchange Solutions

- Aimia

- TIBCO Software

- Customer Portfolios

- HSBC Bank

- Creatio

- FIS Corporate

- Citigroup Inc.

- Maritz

- Royal Bank of Canada

- Bank of India

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In June 2024, Commonwealth Bank of Australia (CBA) has announced new products, services and features for business customers, aimed at meeting more of their banking needs.

- In April 2024, PayU, one of India's leading digital financial services providers, has announced its partnership with the country's largest customer engagement & loyalty solutions provider, Loylty Rewardz.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the global retail bank loyalty program market based on the below-mentioned segments:

Global Retail Bank Loyalty Program Market, By Type

- B2C Solutions

- B2B Solutions

Global Retail Bank Loyalty Program Market, By Enterprise Size

- Large Enterprise

- Small & Medium Enterprises

Global Retail Bank Loyalty Program Market, By End-Use

- Personal

- Business

Global Retail Bank Loyalty Program Market, Regional

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. Which are the key companies that are currently operating within the market?IBM, Oracle Corporation, and Bank of America Corporation. Other notable companies in this market are Comarch SA, Exchange Solutions, Aimia, TIBCO Software, Customer Portfolios, HSBC Bank, Creatio, FIS Corporate, Citigroup Inc., Maritz, Royal Bank of Canada, and Bank of India.

-

2. What is the size of the global retail bank loyalty program market?The global retail bank loyalty program market is expected to grow from USD 1.08 Billion in 2023 to USD 1.85 Billion by 2033, at a CAGR of 5.53% during the forecast period 2023-2033.

-

3. Which region is holding the largest share of the market?North America is anticipated to hold the largest share of the global retail bank loyalty program market over the predicted timeframe.

Need help to buy this report?