Global Retinal Imaging Devices Market Size, Share, and COVID-19 Impact Analysis By Device Type (Fundus Camera, Optical Coherence Tomography, and Fluorescein Angiography), By Application (Disease Diagnosis, Treatment Monitoring, and Research & Development), By End User (Hospitals, Ophthalmology Clinics, Ambulatory Surgical Centers (ASCs), and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033.

Industry: HealthcareGlobal Retinal Imaging Devices Market Insights Forecasts to 2033

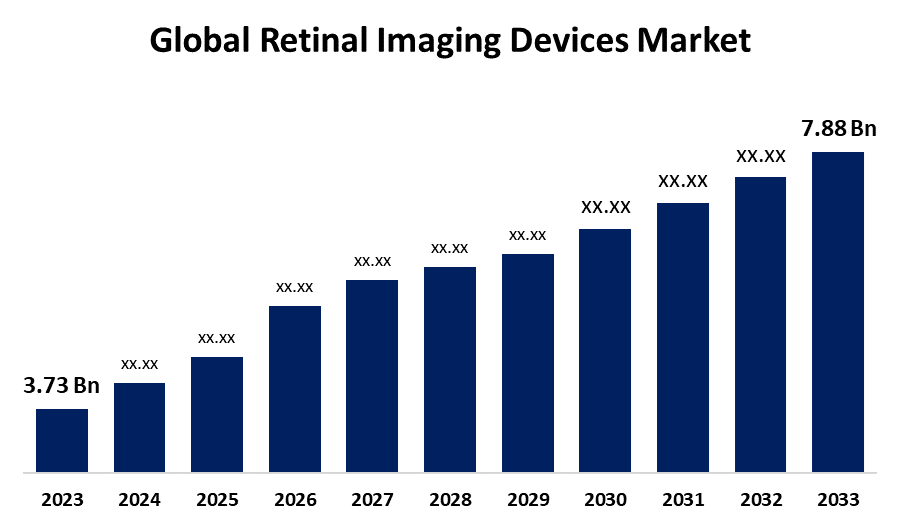

- The Global Retinal Imaging Devices Market Size was Valued at USD 3.73 Billion in 2023

- The Market Size is Growing at a CAGR of 7.77% from 2023 to 2033

- The Worldwide Retinal Imaging Devices Market Size is Expected to Reach USD 7.88 Billion by 2033

- Asia Pacific is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Retinal Imaging Devices Market Size is Anticipated to Exceed USD 7.88 Billion by 2033, Growing at a CAGR of 7.77% from 2023 to 2033.

Market Overview

A technique called retinal imaging is used to assess and identify a patient's retinal health. High-resolution imaging systems are used by retinal imaging devices (RID) to take internal images of the eye. The taken picture helps in evaluating retinal health by virtual private network (VSP) physicians. This assistance in the identification and treatment of many eye and medical disorders, including macular degeneration, glaucoma, and diabetes. OCT systems, cameras, and ophthalmic ultrasonography are among the equipment utilized in the fundus. Advanced diagnostic technologies are in high demand due to the rising prevalence of retinal diseases such as age-related macular degeneration and diabetic retinopathy. The increasing number of people suffering from retinal disorders such as glaucoma, age-related macular degeneration (AMD), and diabetic retinopathy (DR) is driving up demand for improved retinal imaging devices. Innovations including the integration of artificial intelligence (AI) and optical coherence tomography (OCT) will be driving the growth of the retinal imaging devices market.

For instance, in May 2024, Carl Zeiss Meditec AG announced that the CIRRUS 6000 now offers ophthalmologists a highly efficient and data-driven workflow, due to the largest OCT reference library available in the United States and significantly improved cybersecurity features.

Report Coverage

This research report categorizes the global retinal imaging devices market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global retinal imaging devices market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global retinal imaging devices market.

Global Retinal Imaging Devices Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 3.73 Billion |

| Forecast Period: | 2023 to 2033 |

| Forecast Period CAGR 2023 to 2033 : | 7.77% |

| 2033 Value Projection: | USD 7.88 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Device Type, By Application, By End User, By Region and COVID-19 Impact Analysis |

| Companies covered:: | Sony Electronics Carl Zeiss Meditec AG Topcon Corporation NIDEK CO., LTD. Canon Medical Systems Essilor Instruments Optomed Lumibird Medical Heidelberg Engineering Inc. Visionix OPTOPOL Technology Sp Imagine Eyes Epipole Ltd Forus Health Pvt Ltd Others Key Target Audience Market Players Investors End-users Government Authorities Consulting And Research Firm Venture capitalists Value-Added Resellers (VARs) |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The main factors driving the market for retinal imaging equipment is the rising incidence of retinal diseases such as diabetic retinopathy, age-related macular degeneration, and others. The retina can seen in higher resolution because of advancements in imaging technology, which helps in disease identification. One of the main reasons propelling the market for retinal imaging equipment is the aging population around the world. Due to advancements in healthcare and lifestyle, people are living longer, which means that the proportion of the aging population that is 60 years of age or more is increasing significantly.

Restraining Factors

Modern imaging techniques such as angiography systems and OCT have costly startup and ongoing costs, even though basic fundus cameras are affordable. The market adoption is restricted by the considerable capital expenditure needed, particularly in countries that are developing and smaller hospitals.

Market Segmentation

The global retinal imaging devices market share is classified into device type, application, and end user.

- The fundus camera segment is expected to hold the largest share of the global retinal imaging devices market during the forecast period.

Based on the device type, the global retinal imaging devices market is divided into fundus cameras, optical coherence tomography, and fluorescein angiography. Among these, the fundus camera segment is expected to hold the largest share of the global retinal imaging devices market during the forecast period. An inexpensive substitute for a conventional fundus camera is the smartphone-based fundus imaging technique. It is useful for the screening of diseases including DR, AMD, ROP, and glaucoma due to its ability to take pictures with both dilated and undilated pupils.

For instance, in October 2022, Samsung announced that it had joined forces with nearby medical facilities to fulfill its objective of deploying the EYELIKE fundus camera to test 150,000 Indians for eye conditions.

- The disease diagnosis segment is expected to hold the largest share of the global retinal imaging devices market during the forecast period.

Based on the application, the global retinal imaging devices market is divided into disease diagnosis, treatment monitoring, and research & development. Among these, the disease diagnosis segment is expected to hold the largest share of the global retinal imaging devices market during the forecast period. The primary factor driving the market for disease diagnosis is the rising incidence of retinal disorders including AMD and DR. The incidence of DR is increasing due to the global rise in diabetes rates, which indicates that early detection and routine screening are necessary to prevent vision loss.

- The hospitals segment is expected to hold the largest share of the global retinal imaging devices market during the forecast period.

Based on the end user, the global retinal imaging devices market is divided into hospitals, ophthalmology clinics, ambulatory surgical centers (ASCs), and others. Among these, the hospitals segment is expected to hold the largest share of the global retinal imaging devices market during the forecast period. Hospitals that use advanced imaging technologies can identify retinal diseases quickly, this means that treatment and intervention can start immediately. Moreover, hospital-business alliances and cooperation to address clinical needs drive market growth.

Regional Segment Analysis of the Global Retinal Imaging Devices Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the global retinal imaging devices market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of the global retinal imaging devices market over the predicted timeframe. The region's cutting-edge infrastructure and strong focus on research and development, among other things, have contributed to it easier for new technologies to be adopted quickly. Another factor driving this position of authority is the high incidence of retinal diseases. The need for retinal imaging devices is anticipated to increase as a result of government initiatives and awareness campaigns focused on the early diagnosis and treatment of eye diseases. The high prevalence of retinal illnesses, the developed healthcare system, and the inorganic increase in market participants in the region are all factors driving the market growth in North America.

Asia Pacific is expected to grow at the fastest pace in the global retinal imaging devices market during the forecast period. The retinal imaging devices market in the Asia-Pacific region is represented by the optical coherence tomography (OCT) systems sub-segment. Due to OCT imaging being able to produce high-resolution cross-sectional retinal pictures, its use among eye care experts in Asia-Pacific region. The Rising awareness of eye health, an aging population, and an increase in the prevalence of retinal diseases are driving the market in this region.

Europe is anticipated to hold a significant share of the global retinal imaging devices market over the predicted timeframe. One of the main reasons for this region's growth is the rise in both governmental and private investment in research and development. The growing frequency of eye diseases and rising healthcare device demand are two key factors expected to support regional market growth. Optical coherence tomography (OCT) systems have become the market leader in Europe within the retinal imaging devices market.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global retinal imaging devices market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Sony Electronics

- Carl Zeiss Meditec AG

- Topcon Corporation

- NIDEK CO., LTD.

- Canon Medical Systems

- Essilor Instruments

- Optomed

- Lumibird Medical

- Heidelberg Engineering Inc.

- Visionix

- OPTOPOL Technology Sp

- Imagine Eyes

- Epipole Ltd

- Forus Health Pvt Ltd

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In April 2024, Optomed announced that the FDA has approved the "Optomed Aurora" handheld fundus camera, which is outfitted with AEYE's artificial intelligence.

- In February 2023, HOYA Vision Care and NIDEK CO., LTD. launched a global cooperation. Through this partnership, eye care providers will have access to a wide range of cutting-edge optical devices and supplies from NIDEK and HOYA Vision Care.

- In March 2023, The DSC-HX99RNV kit, a novel retinal projection camera kit that aids individuals with visual impairments in seeing and capturing their surroundings, was launched by Sony Electronics, a division of Sony Corporation. This kit includes the tiny Sony DSC-HX99 camera and the laser retinal projection viewfinder RETISSA NEOVIEWERi from QD Laser.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the global retinal imaging devices market based on the below-mentioned segments:

Global Retinal Imaging Devices Market, By Device Type

- Fundus Camera

- Optical Coherence Tomography

- Fluorescein Angiography

Global Retinal Imaging Devices Market, By Application

- Disease Diagnosis

- Treatment Monitoring

- Research & Development

Global Retinal Imaging Devices Market, By End User

- Hospitals

- Ophthalmology Clinics

- Ambulatory Surgical Centers (ASCs)

- Others

Global Retinal Imaging Devices Market, By Regional

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. Which are the key companies that are currently operating within the market?Sony Electronics, Carl Zeiss Meditec AG, Topcon Corporation, NIDEK CO., LTD., Canon Medical Systems, Essilor Instruments, Optomed, Lumibird Medical, Heidelberg Engineering Inc., Visionix, OPTOPOL Technology Sp, Imagine Eyes, Epipole Ltd, Forus Health Pvt Ltd, and Others.

-

2. What is the size of the global retinal imaging devices market?The global retinal imaging devices market is expected to grow from USD 3.73 Billion in 2023 to USD 7.88 Billion by 2033, at a CAGR of 7.77% during the forecast period 2023-2033.

-

3. Which region is holding the largest share of the market?North America is anticipated to hold the largest share of the global retinal imaging devices market over the predicted timeframe.

Need help to buy this report?