Global Reverse Factoring Market Size, Share, and COVID-19 Impact Analysis, By Category (Domestic, and International), By Financial Institution (Bank, and Non-Banking Financial Institution), By End-Use (Manufacturing, Healthcare, Transport and Logistic, Information Technology, Construction and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Banking & FinancialGlobal Reverse Factoring Market Insights Forecasts to 2033

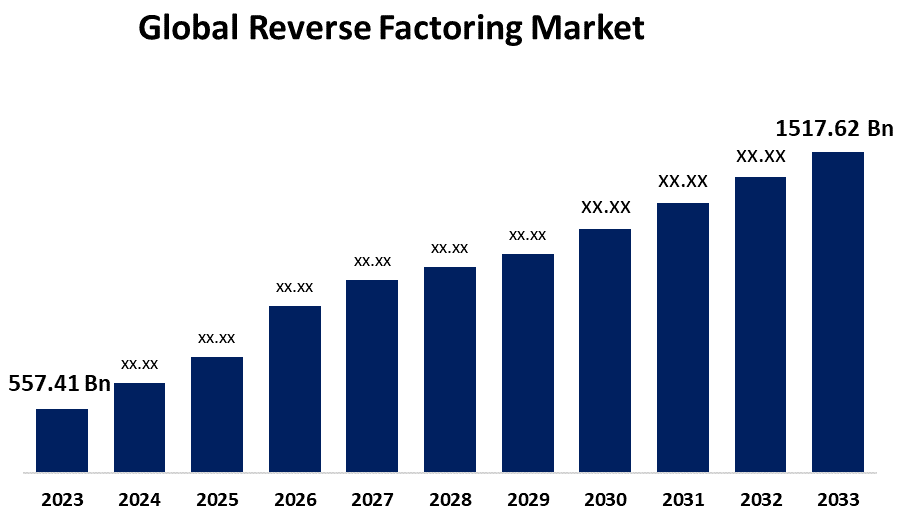

- The Global Reverse Factoring Market Size was Valued at USD 557.41 Billion in 2023

- The Market Size is Growing at a CAGR of 10.53% from 2023 to 2033

- The Worldwide Reverse Factoring Market Size is Expected to Reach USD 1517.62 Billion by 2033

- North America is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Reverse Factoring Market Size is Anticipated to Exceed USD 1517.62 Billion by 2033, Growing at a CAGR of 10.53% from 2023 to 2033.

Market Overview

A large company works with a financial institution to help its suppliers acquire financing at a lower interest rate than they would otherwise be able to secure. This financial arrangement is known as reverse factoring or supply chain finance. Under this arrangement, the financial institution pays the suppliers on behalf of the big business, frequently ahead of schedule. The suppliers give a discount on the total amount billed in exchange. This is advantageous to the suppliers as well as the large organization. The suppliers' cash flow and liquidity positions improve as a result of the suppliers' access to reasonable financing, which in turn assures a stable supply chain. For small and medium-sized businesses (SMEs), reverse factoring is especially helpful as it can be difficult for them to get reasonable finance through conventional channels. Because reverse factoring might help businesses manage their working capital more effectively, the market for it has grown significantly in recent years. Businesses are using reverse factoring as a strategic tool as they realize more and more how important effective supply chain management is. Stable finance solutions are becoming more and more in demand as a result of globalization and the complexity of contemporary supply chains. Reverse factoring is becoming a more appealing alternative for big businesses and their suppliers since financial institutions are getting better at designing creative, customized solutions.

Report Coverage

This research report categorizes the market for the global reverse factoring market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global reverse factoring market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global reverse factoring market.

Global Reverse Factoring Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 557.41 Billion |

| Forecast Period: | 2023 to 2033 |

| Forecast Period CAGR 2023 to 2033 : | 10.53% |

| 2033 Value Projection: | USD 1517.62 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 180 |

| Tables, Charts & Figures: | 95 |

| Segments covered: | By Category , By Financial Institution, By End-Use, By Region and COVID-19 Impact Analysis |

| Companies covered:: | Citibank, HSBC, Santander, Banco Bilbao Vizcaya Argentaria (BBVA), Caixabank, JPMorgan Chase, Bank of America, BNP Paribas, Deutsche Bank, Barclays, Société Générale, Credit Suisse, ING Group, Wells Fargo and Others Key Vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The growing necessity for businesses to maximize working cash in the face of growing operating expenses is a key factor propelling the global reverse factoring market. The growing emphasis on supply chain financing as a means of maintaining competitive supplier relationships on a worldwide scale is also driving the market. The B2B payment networks and procedures are becoming more digital, which is positive for the reverse factoring market. Transparency, automation, and faster reconciliation have all been achieved through the electronic presentation and payment of invoices. Businesses are concentrating on improving their working capital management due to escalating competition and economic uncertainty. Reverse factoring enhances overall working capital management by enabling buyers to extend their terms of payment while guaranteeing that suppliers are paid on schedule. The B2B payment networks and procedures are becoming more digital, which is positive for the reverse factoring market. Transparency, automation, and faster reconciliation have all been achieved through the electronic presentation and payment of invoices.

Restraining Factors

One of the biggest obstacles facing the reverse factoring sector is the intricacy of integrating platforms with the various IT systems that are used in international supply chains. Another challenge is ensuring the security and compliance of sensitive financial and payment data acquired on reverse factoring networks. SMEs' ignorance of and lack of comprehension of the concept might be impeding the growth of the worldwide reverse factoring market. There is little demand for reverse factoring because so many SMEs are not aware of its advantages.

Market Segmentation

The global reverse factoring market share is classified into category, financial institution, and end-use.

- The domestic segment is expected to hold the largest share of the global reverse factoring market during the forecast period.

Based on the category, the global reverse factoring market is divided into domestic, and international. Among these, the domestic segment is expected to hold the largest share of the global reverse factoring market during the forecast period. The effectiveness of SCF services has led to a growing number of domestic MSMEs adopting them, which is responsible for the category growth. The majority of suppliers worldwide are MSMEs or micro, small, and medium-sized enterprises. Consistent manufacturing cycles are challenging for suppliers to maintain when buyers withhold payments. The lack of alternative financing options for the suppliers exacerbates the problem even more and has an impact on their overall business operations. Reverse factoring is being used by MSMEs as a solution to these problems to maximize inventory stock and avoid business loss from a lack of funding.

- The bank segment is expected to hold the largest share of the global reverse factoring market during the forecast period.

Based on the financial institution, the global reverse factoring market is divided into bank and non-banking financial institutions. Among these, the bank segment is expected to hold the largest share of the global reverse factoring market during the forecast period. The increase in growth can be ascribed to the growing acceptance of digitization as a means of closing existing gaps in a range of financial services and to banks' increasing emphasis on providing improved customer experiences. Throughout the forecast period, rising cross-border transactions and a sizable uptake of mobile-based payment systems are anticipated to fuel the bank segment's expansion. Reverse factoring services are also becoming more widely available in banks as a result of the increasing usage of Blockchain technology by banks to overcome challenges with raising working capital and cash flows.

- The manufacturing segment is expected to hold the largest share of the global reverse factoring market during the forecast period.

Based on the end-use, the global reverse factoring market is divided into manufacturing, healthcare, transport and logistics, information technology, construction, and others. Among these, the manufacturing segment is expected to hold the largest share of the global reverse factoring market during the forecast period. By giving suppliers the choice of early invoice payments and extending a manufacturer's supplier payment terms, reverse factoring enhances cash flow. Manufacturing businesses in a variety of industries, including pallet, chemical, metal & machinery, welding, and plastics & polymers, use reverse factoring services, which improves the outlook for the supply chain financing services market. Reverse factoring also gives industrial organizations the chance to maintain numerous bank relationships and a liquidity provision option. Additionally, it gives manufacturing companies improved access to invoice status and payment processing, allowing them to know when payments are due. This reduces the possibility of sour relations with suppliers and boosts the prospects for the supply chain financing sector.

Regional Segment Analysis of the Global Reverse Factoring Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

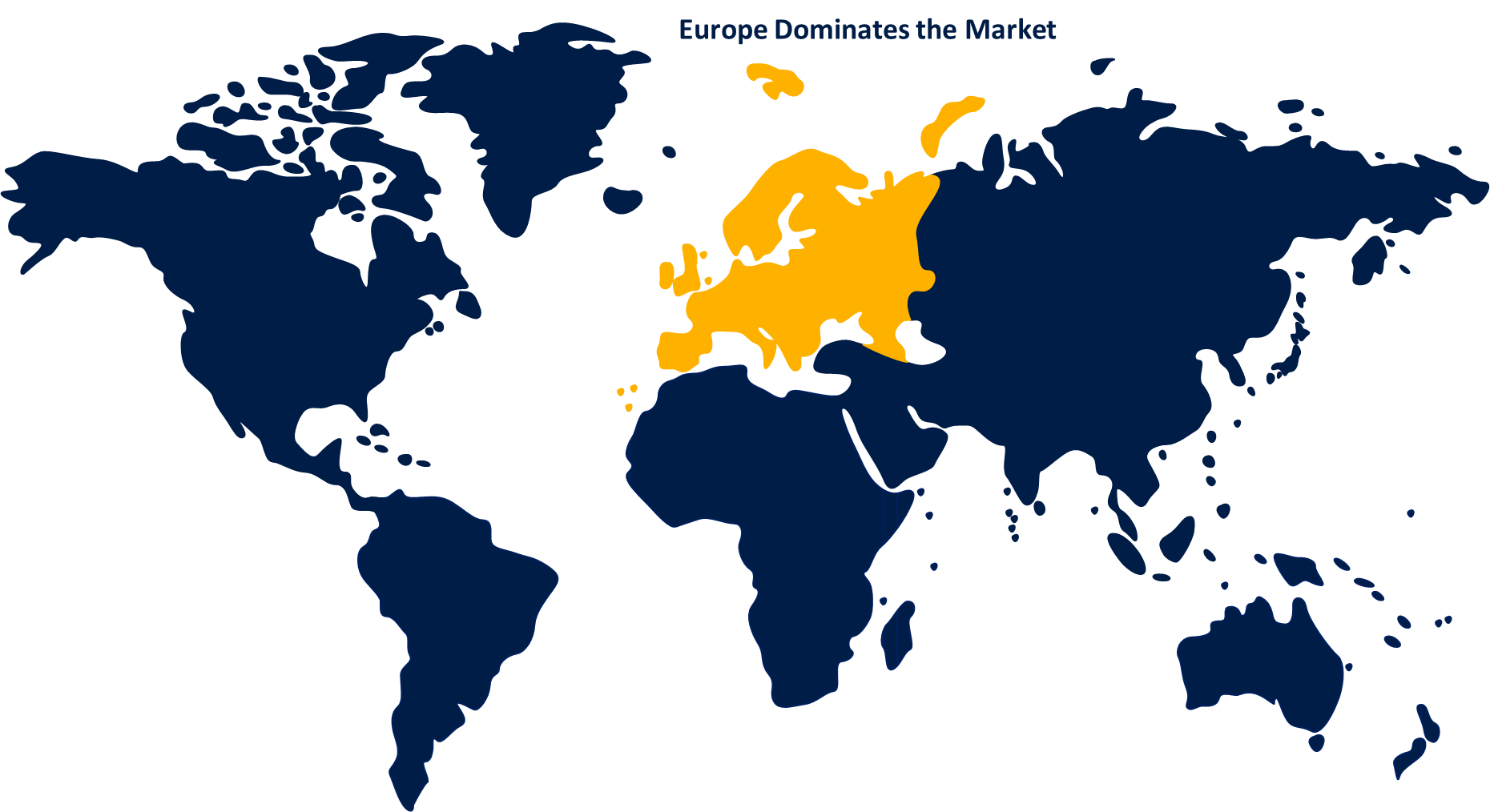

Europe is anticipated to hold the largest share of the global reverse factoring market over the predicted timeframe.

Get more details on this report -

Europe is anticipated to hold the largest share of the global reverse factoring market over the predicted timeframe. This is attributed to its broad acceptance and advantageous regulatory framework. Reverse factoring has been adopted by European companies, particularly those in Germany and the UK, to optimize working capital, strengthen ties with suppliers, and guarantee a stable supply chain. Reverse factoring is just one of many supply chain finance options provided by the region's well-established banking institutions, which are part of a thriving financial services industry. The market has grown as a result of initiatives and supporting legislative frameworks in Europe that have promoted the use of supply chain financing techniques. Furthermore, Europe's position as a major participant in the industry is further cemented by the region's varied industrial base and strong trade links, which create a favorable environment for the implementation of reverse factoring programs across multiple sectors.

North America is expected to grow at the fastest pace in the global reverse factoring market during the forecast period. Businesses are increasingly focusing on handling cash flow and optimizing working capital, leading to a growing interest in innovative financing solutions such as reverse factoring. Moreover, the rise of large corporations has led to a greater adoption of supply chain financing methods like reverse factoring, particularly within the manufacturing, technology, and healthcare sectors. Moreover, the presence of advanced financial infrastructure and technological advancements has simplified the implementation and expansion of reverse factoring solutions in various sectors in North America.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global reverse factoring market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Citibank

- HSBC

- Santander

- Banco Bilbao Vizcaya Argentaria (BBVA)

- Caixabank

- JPMorgan Chase

- Bank of America

- BNP Paribas

- Deutsche Bank

- Barclays

- Société Générale

- Credit Suisse

- ING Group

- Wells Fargo

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In September 2023, To transform supply chain financing, Bank of America introduced the CashPro Supply Chain Solutions, the first of a multi-year project. Through this initiative, the bank will be able to better serve its clients who are involved in supply chain management and financing by giving creative and effective solutions.

- In December 2022, Endesa unveiled a circular reverse factoring solution in association with Santander, Caixabank, and Banco Bilbao Vizcaya Argentaria. By providing incentives and prizes for sustainable behaviors, this creative project raises their level of competitiveness in the market.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the global reverse factoring market based on the below-mentioned segments:

Global Reverse Factoring Market, By Category

- Domestic

- International

Global Reverse Factoring Market, By Financial Institution

- Bank

- Non-Banking Financial Institution

Global Reverse Factoring Market, By End-Use

- Manufacturing

- Healthcare

- Transport and Logistic

- Information Technology

- Construction

- Others

Global Reverse Factoring Market, Regional

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. Which are the key companies that are currently operating within the market?Citibank, HSBC, Santander, Banco Bilbao Vizcaya Argentaria (BBVA), Caixabank, JPMorgan Chase, Bank of America, BNP Paribas, Deutsche Bank, Barclays, Société Générale, Credit Suisse, ING Group, Wells Fargo, and Others.

-

2. What is the size of the global reverse factoring market?The Global Reverse Factoring Market is expected to grow from USD 557.41 Billion in 2023 to USD 1517.62 Billion by 2033, at a CAGR of 10.53% during the forecast period 2023-2033.

-

3. Which region is holding the largest share of the market?Europe is anticipated to hold the largest share of the global reverse factoring market over the predicted timeframe.

Need help to buy this report?