Global RFID Tire Tag Market Size, Share, and COVID-19 Impact Analysis, By Components (Passive RFID Tags, Active RFID Tags, RFID Readers), By Application (Tire Tracking & Inventory Management, Tire Lifecycle Management, Anti-Theft Protection), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Automotive & TransportationGlobal RFID Tire Tag Market Insights Forecasts to 2033

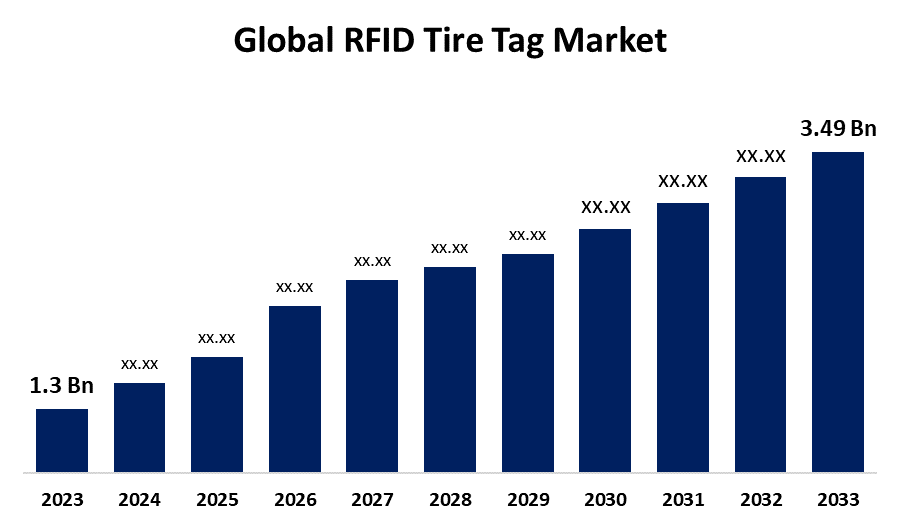

- The Global RFID Tire Tag Market Size was Valued at USD 1.3 Billion in 2023

- The Market Size is Growing at a CAGR of 10.38% from 2023 to 2033

- The Worldwide RFID Tire Tag Market Size is Expected to Reach USD 3.49 Billion by 2033

- Asia Pacific is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global RFID Tire Tag Market Size is Anticipated to Exceed USD 3.49 Billion by 2033, Growing at a CAGR of 10.38% from 2023 to 2033.

Market Overview

An RFID tire tag is a small electronic device embedded in or attached to a tire that uses radio frequency identification (RFID) technology to store and transmit information about the tire. The tag typically contains a unique identification number and might store other data such as manufacturing details, size, tread type, usage history, and maintenance records. The RFID tire tag market is gaining popularity due to improved tire management, fleet efficiency, and safety. They're becoming essential for optimizing tire life cycles and fleet management. The growth of the RFID tire tag market is driven by the increasing need for efficiency in tire management, safety improvements, cost savings, and technological advancements that enable smarter, data-driven operations. As industries continue to seek solutions for better fleet management, supply chain optimization, and compliance with safety regulations, RFID tire tags are becoming an essential tool in tire and fleet management strategies.

RFID tire tags are utilized in fleet management, inventory tracking, manufacturing, and maintenance, enhancing operational efficiency, safety, and sustainability. They help monitor tire performance, schedule maintenance, and reduce downtime. RFID tags also facilitate recalls, streamline inventory management, and support smart tire systems for real-time data.

Report Coverage

This research report categorizes the market for RFID tire tag based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the RFID tire tag market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the RFID tire tag market.

RFID Tire Tag Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023 : | USD 1.3 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 10.38% |

| 2033 Value Projection: | USD 3.49 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 231 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Components, By Application, By Region |

| Companies covered:: | HIdentification Technologies Inc., TireStamp Inc., Cimtec Automation Inc., Vanguard RFID Systems, Impinj Inc., Alien Technology, Avery Dennison Corporation, NXP Semiconductors, STMicroelectronics, Checkpoint Systems, and Others. |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis. |

Get more details on this report -

Driving Factors

The growth of the RFID tire tag market is propelled by several key factors including enhanced tire management efficiency, cost reduction in fleet operations, and the ability to comply with stricter vehicle safety and tire maintenance regulations. RFID technology improves fleet safety by enabling real-time tire tracking, condition monitoring, and predictive maintenance, reducing the risk of tire failures. The increasing adoption of RFID is also fueled by advances in RFID technology, such as smaller, more affordable passive tags, and the rising focus on sustainability, as RFID helps extend tire lifespan and reduce waste. Furthermore, RFID tags aid in preventing tire theft, providing traceability and security, and improving supply chain visibility. The growing automotive and logistics sectors, particularly in emerging markets, further boost demand for RFID tire tags.

Restraining Factors

The growth of the RFID tire tag market is constrained by several factors including high initial setup costs, which can be a barrier for small and medium-sized businesses. Compatibility issues with existing systems, along with a lack of standardization in RFID technology, might also slow adoption. Durability concerns, especially in harsh environments, along with technological limitations like short-range capabilities and the need for frequent tag replacements, increase the challenges.

Market Segmentation

The RFID tire tag market share is classified into components and application.

- The passive RFID tags segment is estimated to hold the highest market revenue share through the projected period.

Based on the components, the RFID tire tag market is classified into passive RFID tags, active RFID tags, and RFID readers. Among these, the passive RFID tags segment is estimated to hold the highest market revenue share through the projected period. The segment dominance is primarily due to their cost-effectiveness, smaller size, and ease of integration into tires. Passive RFID tags do not require an internal power source, as they are activated by the electromagnetic field from an RFID reader, making them more affordable and widely used in tire applications. They are also durable and can withstand harsh conditions, such as extreme temperatures and wear, which is essential for tires. Furthermore, the increasing adoption of passive RFID tags in both automotive and logistics sectors, as part of efforts to improve fleet management, tire tracking, and maintenance, further contributes to the segment's dominant market share.

- The tire tracking & inventory management segment is anticipated to hold the largest market share through the forecast period.

Based on the application, the RFID tire tag market is divided into tire tracking & inventory management, tire lifecycle management, and anti-theft protection. Among these, the tire tracking & inventory management segment is anticipated to hold the largest market share through the forecast period. The segment's prominence is attributed to the increasing demand for efficient tire management solutions across industries, especially in fleet management and logistics. RFID tire tags enable real-time tracking of tire inventory, allowing businesses to optimize stock levels, reduce losses, and improve operational efficiency. They also help in tracking tire usage, location, and status, which enhances logistics, maintenance schedules, and the overall supply chain process.

Regional Segment Analysis of the RFID Tire Tag Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the RFID tire tag market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of the RFID tire tag market over the predicted timeframe. The region has a well-established automotive industry, with major players in vehicle manufacturing, tire production, and fleet management, creating a strong demand for advanced tire management solutions like RFID technology. The growing focus on improving fleet management efficiency, reducing maintenance costs, and increasing safety in commercial transportation also contributes to the region's dominance in the market.

Asia Pacific is expected to grow at the fastest CAGR growth of the RFID tire tag market during the forecast period. The Asia Pacific is a major manufacturing hub for the automotive industry, with countries like China, India, Japan, and South Korea driving the demand for advanced technologies such as RFID tire tags. The growing automotive market, along with increasing urbanization, rising disposable incomes, and the demand for smarter vehicle management, is further fueling adoption.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the RFID tire tag market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- HIdentification Technologies Inc.

- TireStamp Inc.

- Cimtec Automation Inc.

- Vanguard RFID Systems

- Impinj Inc.

- Alien Technology

- Avery Dennison Corporation

- NXP Semiconductors

- STMicroelectronics

- Checkpoint Systems

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In September 2024, Global tire company Michelin was researching, designing, and testing RFID tags in its tire products for years to create what it calls a connected tire that communicates to those with RFID readers.

- In March 2024, Hana, a leading innovator in RFID tire tag technology, announced the signing of a new license deal with Michelin, a world-renowned tire manufacturer. This arrangement allows Hana to manufacture and market the new and innovative 'Link Less' embeddable RFID Tire Tag (Rev4) in and outside of the tire market.

- In January 2024, The Murata was designed to showcase a range of the company’s chip and Internet of Things (IoT) products including tyre RFID. Specifically, Murata’s embeddable RAIN RFID Tire Tags add a digital ID to track tires throughout the entire supply chain.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the RFID tire tag market based on the below-mentioned segments:

Global RFID Tire Tag Market, By Components

- Passive RFID Tags

- Active RFID Tags

- RFID Readers

Global RFID Tire Tag Market, By Application

- Tire Tracking & Inventory Management

- Tire Lifecycle Management

- Anti-Theft Protection

Global RFID Tire Tag Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the RFID tire tag market over the forecast period?The RFID tire tag market is projected to expand at a CAGR of 10.38% during the forecast period.

-

2. What is the market size of the RFID tire tag market?The Global RFID Tire Tag Market Size is Expected to Grow from USD 1.3 Billion in 2023 to USD 3.49 Billion by 2033, Growing at a CAGR of 10.38% during the forecast period 2023-2033.

-

3. Which region holds the largest share of the RFID tire tag market?North America is anticipated to hold the largest share of the RFID tire tag market over the predicted timeframe.

Need help to buy this report?