Global Robo taxi Market Size, Share, and COVID-19 Impact Analysis, By Application Type (Goods and Passenger), By Propulsion (Electric, Fuel Cell and Hybrid Electric Vehicle), By Component (LiDAR, RADAR, Camera & Sensor) and Region (North America, Europe, Asia Pacific, Middle East & Africa, South America) Insights, Growth, Size, Comparative Analysis, Trends and Forecast, 2021-2030

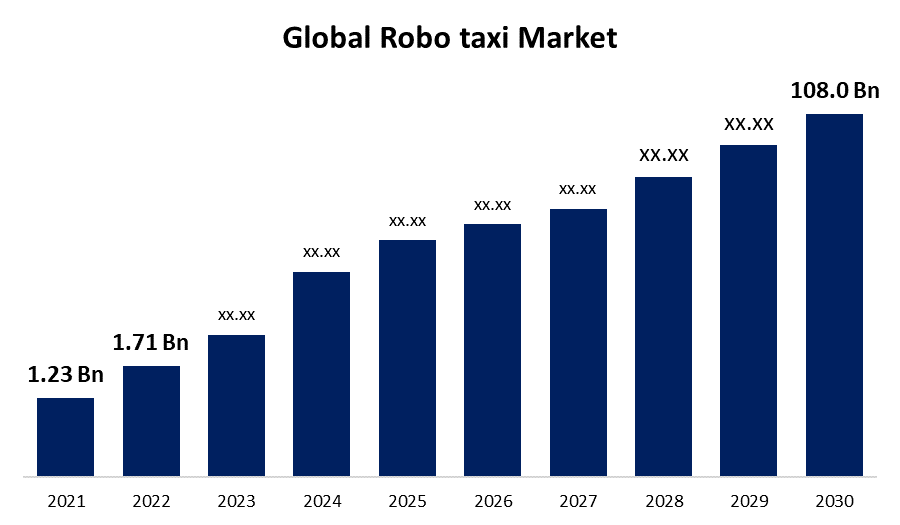

Industry: Automotive & TransportationThe Gobal Robo taxi Market business size valued at USD 1.23 billion in 2021. The market is anticipated to increase by 80.8% CAGR from 2022 to 2030, from USD 1.71 billion to USD 108.0 billion.

Get more details on this report -

Robo-taxi is a self-driving/autonomous taxi driving idea that uses ride-sharing platforms and operates without human intervention. For future development while driving, a high-fidelity platform in Robo-taxi servers collects ground-truth data utilising various sensors. NVIDIA processors are heavily rely on by businesses in the autonomous transportation sector for the creation, implementation, and testing of Robo-taxi. For the development, training, validation, and testing in simulation of self-driving Deep Neural Networks, NVIDIA Corporation provides NVIDIA DRIVE, an open, unified, and high-performance computing infrastructure powered by GPU technology (DNN)

In order to receive real-time information and decrease fatalities, autonomous cabs are additionally connected to the internal and external V2X environment through reliable internet connections. Additionally, large corporations are using this technology to produce autonomous taxis in developing nations, which will accelerate industry expansion in the years to come.

Driving Factor

Increasing (ADAS) implementation in autonomous vehicles is anticipated to fuel market expansion throughout the forecast period. In road obstacle mapping systems, cutting-edge ultrasonic sensors, cameras, and software are frequently used.

Governments in developing nations have imposed severe safety rules on automakers to create vehicles with ADAS functions as a result of growing worries about passenger safety. Thus, the market growth during the forecast period has been positively impacted by the growing implementation of ADAS features in automobiles.

Governments in a number of nations have already relaxed the legal constraints on conducting self-driving vehicle testing. The Finnish Ministry of Transport and Communications has advanced by creating a legislative framework for testing autonomous vehicles.

Global Robo taxi Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2021 |

| Market Size in 2021: | USD 1.23 Billion |

| Forecast Period: | 2021 - 2030 |

| Forecast Period CAGR 2021 - 2030 : | 80.8% |

| 2030 Value Projection: | USD 108.0 Billion. |

| Historical Data for: | 2017 - 2020 |

| No. of Pages: | 195 |

| Tables, Charts & Figures: | 119 |

| Segments covered: | By Application, By Propulsion, By Component, By Region |

| Companies covered:: | Waymo LLC(U.S), Tesla Inc.(U.S), Uber Technologies Inc(U.S), Lyft, Inc(U.S), Baidu(China), Cruise LLC(U.S), Aptiv(Ireland), Didi Chuxing Technology co(China), Zoox, Inc(U.S) |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Restraining Factor.

Due to the high cost of components like ultrasonic sensors, cameras, and LiDAR, deploying a full-fledged robotaxi service necessitates significant investments. Robotaxi fleet implementation and adoption are difficult and time-consuming processes. There aren't many level 4 and level 5 autonomous vehicles accessible for testing as of June 2021. As a result, it is challenging to adopt robo-taxi services completely.

An intense DNN training employing a significant amount of data is needed to operate robo-taxis in various environments around the world. Due to the rise in the number of robo-taxis on the roads, this data is anticipated to increase tremendously. For instance, a robotaxi fleet of 50 vehicles operating for six hours each day might generate about 1.6 petabytes of data each day. For cars to perform different tasks in different environments, this volume of data is challenging to store and process.

Covid-19 impact

Due to the COVID 19 outbreak's disruption of the entire ecosystem, the production and sales of new cars have stopped in all countries. OEMs' operations were hampered by the need to delay manufacturing until lockdowns were lifted. As a result, automakers had to change the volume of output. Lockdowns, a decline in the demand for ride-sharing services, and other factors led to market disruptions in the robotaxi sector during the early stages of Covid-19. However, because robotaxis have their own driving paradigm, demand has grown in more recent times.

Due to a shortage of funds and a cost-cutting strategy, the Companies also decreased or stopped investing in research and development of shared autonomous mobility, which ultimately delayed the development of robotaxi.

Lockdowns, a decline in the demand for ride-sharing services, and other factors led to market disruptions in the robotaxi sector during the early stages of Covid-19. However, because robotaxis have their own driving paradigm, demand has grown in more recent times. Considering that demand for ridesharing and ride-hailing decreased by 80% as a result of the pandemic, it is clear that these businesses could not afford to hire many drivers. Companies began putting more emphasis on adding robotaxis to their fleets as a result, which is anticipated to considerably reduce operating costs and increase profit margins.

Segmentation

ROBO-TAXI market is segmented into Application, Level of Autonomy, Vehicle Type, Propulsion, Component, Service Type, and Region.

Global Robo-taxi Market, By Application type

Based on Application the market is divided into two categories: Goods and passengers.

Road accidents are more likely to involve traditional taxis than autonomous passenger taxis. Furthermore, autonomous passenger taxis save money on transportation between destinations while incurring high fuel and driver costs.

During the forecast period, a greater CAGR is expected from the goods segment. Due to the fact that the majority of manufacturers are investing in autonomous vehicles, the products segment is predicted to increase reasonably throughout the course of the projected year.

Global Robo-taxi Market, By component

During the projected Period, the LiDAR segment is anticipated to grow the quickest. LiDAR is a technology that measures the separation between two vehicles by reflecting pulsed light. When advanced sensors are combined, it operates more precisely.

For collision prevention, vehicle & pedestrian avoidance, and other purposes, RADAR is one of the essential parts utilised in autonomous taxis.

Additionally, sensors make up the second-largest section of the global market as ability to detact both visible and invisible objects around the vehicle. Moreover, several car components are fitted with cutting-edge sensors, enhancing ADAS, one of the key components of autonomous vehicles.

Global Robo-taxi Market, By Propulsion

The demand for fuel-efficient vehicles has grown in response to growing pollution concerns. In addition to providing robotic help, robo-taxis would herald in an era of high fuel efficiency and zero carbon emissions. By 2021, self-driving vehicles in the mid-size luxury class are anticipated to be available thanks to a partnership between Volvo and Uber, 50% of which will be all-electric vehicles. Two-thirds of the world's population would live in cities by 2030. In Germany, Daimler and Bosch are developing self-driving electric vehicles that might be in use as early as 2020. Due to strict international government laws requiring an emission-free environment, full-electric robo-taxis are already in demand. A green and sustainable business model is the partnership between Volvo and Baidu for electric self-driving taxis in China.

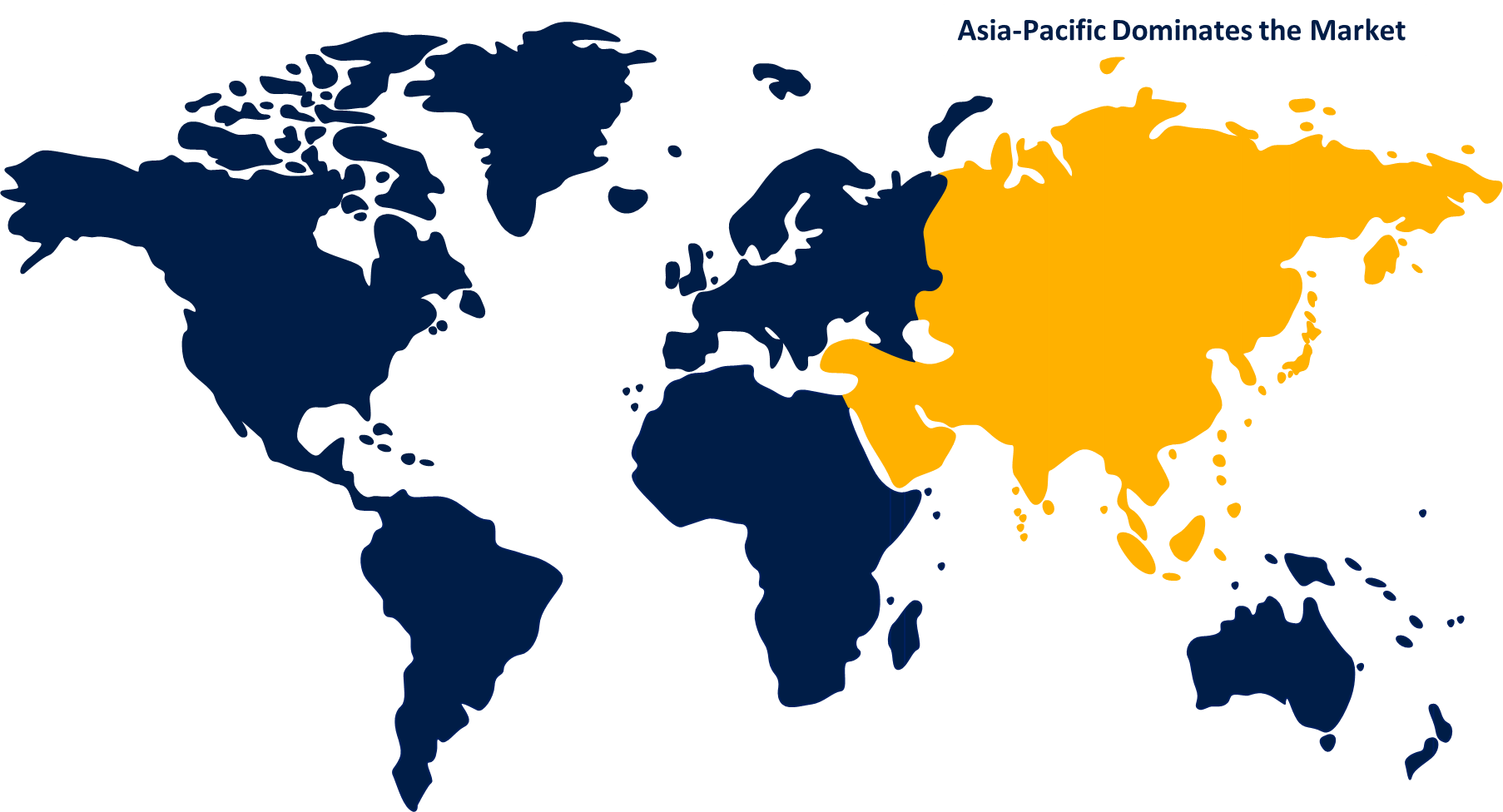

Global Robo-taxi Market, By Region

Get more details on this report -

Asia Pacific dominated The fleet operators have been able to test and deploy quickly in this area because to technological developments and an established and supported infrastructure. According to the European Commission, there are around 180 automotive facilities in the EU, and the industry is the biggest investor in R&D. The market will be significantly impacted by evolving technical trends for autonomous vehicles. This will increase demand for self-driving taxis in the area. Additionally, businesses including NAVYA, Aptiv, EasyMile, Moia, and Daimler have operations in the area.

Recent Developments In The Global Robo-Taxi Market

In August 2022=With the help of the autonomous vehicle business Motional, Lyft Inc., a ride-hailing company, will introduce its all-electric robo-taxi service in Las Vegas, Nevada.

In March 2022=Waymo LLC, an autonomous driving technology startup owned by Alphabet, announced intentions to provide completely driverless transportation for its employees in San Francisco, California

List of Key Market Players

- Waymo LLC(U.S)

- Tesla Inc.(U.S)

- Uber Technologies Inc(U.S)

- Lyft, Inc(U.S)

- Baidu(China)

- Cruise LLC(U.S)

- Aptiv(Ireland)

- Didi Chuxing Technology co(China)

- Zoox, Inc(U.S)

Segmentation

By Application

- Electric Vehicle

- Hybrid Electric Vehicle

- Fuel Cell Vehicle

By Propulsion Type

- Passenger

- Goods

By Component Type

- LiDAR

- RADAR

- Camera

- Sensor

By Region

North America

- North America, by Country

- U.S.

- Canada

- North America, by Application

- North America, by Propulsion

- North America, by Component

Europe

- Europe, by Country

- Germany

- U.K.

- France

- Rest of Europe

- Europe, by Application

- Europe, by Propulsion

- Europe, by Component

Asia Pacific

- Asia Pacific, by Country

- China

- India

- Japan

- South Korea

- Rest of Asia Pacific

- Asia Pacific, by Propulsion

- Asia Pacific, by Application

- Asia Pacific, by Component

Middle East & Africa

- Middle East & Africa, by Country

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of Middle East & Africa

- Middle East & Africa, by Application

- Middle East & Africa, by Propulsion

- Middle East & Africa, by Component

South America

- South America, by Country

- Brazil

- Argentina

- Colombia

- Rest of South America

- South America, by Application

- South America, by Propulsion

- South America, by Component

Need help to buy this report?