Global Robotic Warfare Market Size, Share, and COVID-19 Impact Analysis, By Mode of Operation (Autonomous and Semi Autonomous), By Capability (Unmanned platforms & systems, Exoskeleton & wearables, Target acquisition systems, and Turret and weapon systems), By Application (Intelligence, Surveillance and Reconnaissance, Logistics and Support, Search and Rescue, Combat and Operations, Tracking and Targeting, and Training and Simulation), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Aerospace & DefenseGlobal Robotic Warfare Market Insights Forecasts to 2033

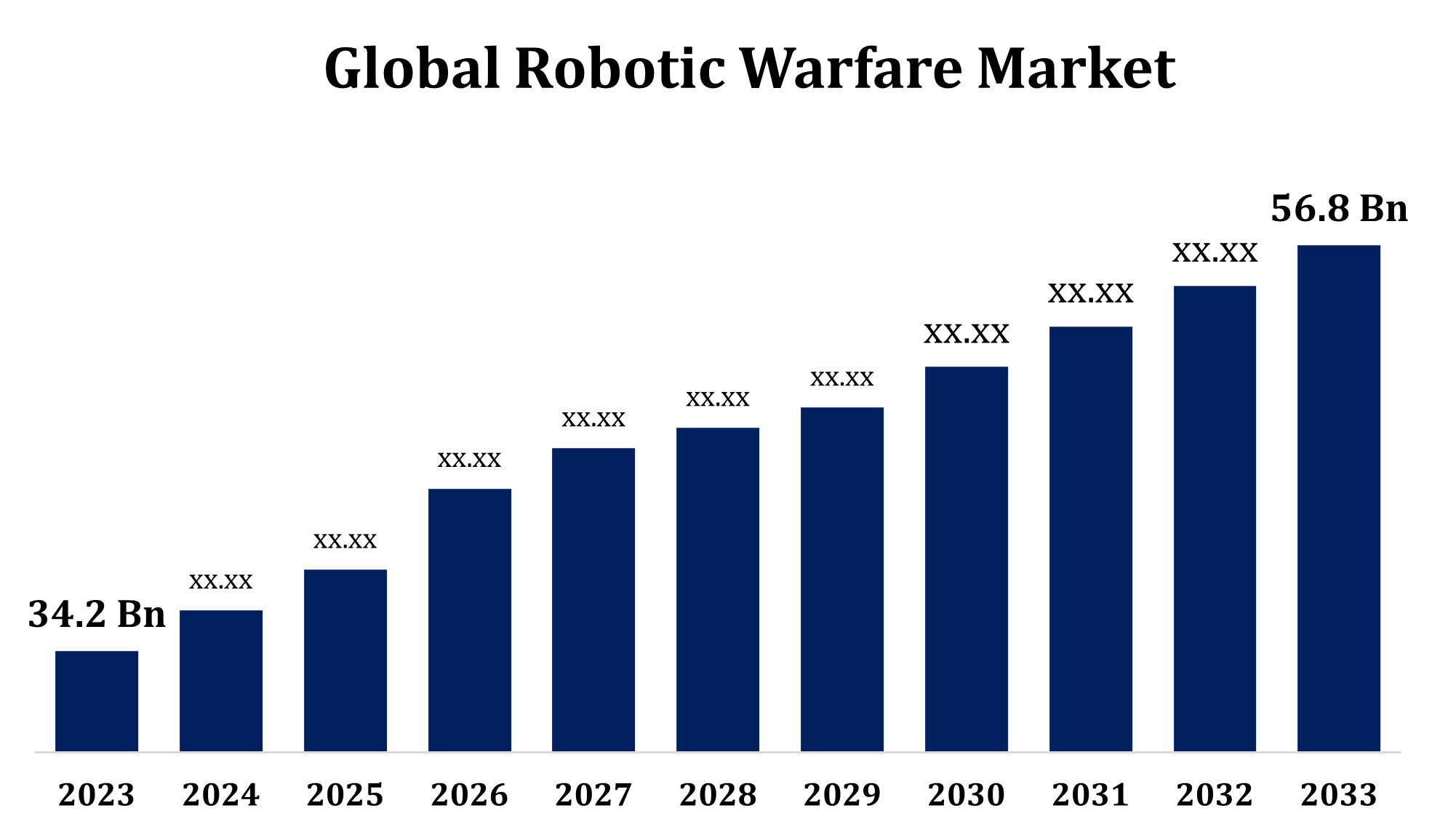

- The Global Robotic Warfare Market Size was valued at USD 34.2 Billion in 2023.

- The Market is Growing at a CAGR of 5.20% from 2023 to 2033.

- The Worldwide Robotic Warfare Market size is Expected to reach USD 56.8 Billion by 2033.

- Asia Pacific is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Robotic Warfare Market Size is expected to reach USD 56.8 Billion by 2033, at a CAGR of 5.20% during the forecast period 2023 to 2033.

The robotic warfare market has witnessed significant growth, driven by advancements in robotics, artificial intelligence (AI), and automation technologies. Military organizations worldwide are increasingly adopting unmanned ground vehicles (UGVs), unmanned aerial vehicles (UAVs), and robotic systems for surveillance, reconnaissance, combat, and logistical support. These technologies offer enhanced precision, reduced human casualties, and greater operational efficiency. The market is also influenced by the growing demand for autonomous systems capable of performing complex tasks in dynamic and hazardous environments. Governments are investing heavily in defense robotics to maintain strategic advantages. Key factors contributing to market growth include advancements in AI, machine learning, and sensor technologies, along with rising defense budgets. However, ethical concerns and regulatory challenges remain significant barriers to broader implementation. The market is expected to continue evolving with innovations in autonomy and system integration.

Robotic Warfare Market Value Chain Analysis

The robotic warfare market value chain involves several stages, from research and development to end-use deployment. Initially, companies focus on R&D to design advanced robotic systems, incorporating artificial intelligence (AI), machine learning, and sensor technologies. The next stage involves manufacturing, where components like drones, sensors, and control systems are produced. Key players in this phase include hardware manufacturers and component suppliers. Once the systems are built, they undergo rigorous testing and integration, ensuring compatibility with military platforms and meeting defense standards. Following successful validation, the systems are deployed to armed forces for operational use. After deployment, continuous maintenance, software updates, and performance monitoring are necessary to ensure optimal functionality. The value chain is highly influenced by defense budgets, technological advancements, and government regulations.

Robotic Warfare Market Opportunity Analysis

The robotic warfare market presents significant opportunities driven by technological advancements and increasing defense needs. The rising adoption of unmanned aerial vehicles (UAVs), unmanned ground vehicles (UGVs), and autonomous robotic systems offers considerable growth potential. Key opportunities lie in the development of AI-powered systems that enhance decision-making, precision, and efficiency in combat situations, reducing human casualties and operational costs. The demand for next-generation robotic systems in surveillance, reconnaissance, logistics, and combat is expanding, particularly in countries modernizing their defense capabilities. Additionally, increasing defense budgets and investments in R&D present avenues for innovation and market expansion. Strategic collaborations between tech companies and defense contractors, along with government funding for defense robotics, further boost opportunities. Challenges such as regulatory hurdles and ethical concerns remain, but overall, the market is poised for substantial growth.

Global Robotic Warfare Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 34.2 Billion |

| Forecast Period: | 2023 – 2033 |

| Forecast Period CAGR 2023 – 2033 : | 5.20% |

| 023 – 2033 Value Projection: | USD 56.8 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 251 |

| Tables, Charts & Figures: | 125 |

| Segments covered: | By Mode of Operation, By Capability, By Application, By Regional Analysis |

| Companies covered:: | Aero Vironment, Inc., BAE Systems plc, Autonomous Solutions, Inc. (ASI), Boeing, General Atomics, Northrop Grumman Corporation, Cobham plc, Dassault Group, Elbit Systems Ltd., Textron Inc., Lockheed Martin Corporation, Thales Group, and Other Key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics

Robotic Warfare Market Dynamics

The increasing research and deployment of robotic systems in modern warfare

The growing research and integration of robotic systems in modern warfare are driving significant growth in the robotic warfare market. Military forces are increasingly adopting advanced unmanned aerial vehicles (UAVs), unmanned ground vehicles (UGVs), and autonomous systems for various functions, including surveillance, reconnaissance, logistics, and combat. These technologies offer enhanced precision, real-time decision-making capabilities, and reduced human involvement, contributing to improved operational efficiency and safety. The ongoing advancements in artificial intelligence (AI), machine learning, and sensor technologies further support the evolution of autonomous systems. As countries modernize their military capabilities, there is a rising demand for cutting-edge robotic systems, fueling investments in research, development, and procurement. This trend is expected to continue, ensuring sustained market growth in the coming years.

Restraints & Challenges

One major concern is the ethical implications of deploying autonomous systems in combat, including the potential for decision-making by machines that could lead to unintended consequences or loss of life. Regulatory challenges are also significant, as international laws and norms surrounding the use of robots in warfare are still evolving. Additionally, high development and procurement costs for advanced robotic systems can limit access for some nations, particularly those with smaller defense budgets. Technological limitations, such as the reliability of autonomous systems in complex, unpredictable environments, and cybersecurity risks also pose barriers. Finally, integration of these systems into existing military infrastructure and ensuring their interoperability with human-operated systems remain critical hurdles to overcome in the market.

Regional Forecasts

North America Market Statistics

Get more details on this report -

North America is anticipated to dominate the Robotic Warfare Market from 2023 to 2033. The U.S. Department of Defense is heavily focused on developing and deploying autonomous systems, such as unmanned aerial vehicles (UAVs), unmanned ground vehicles (UGVs), and robotic combat systems, to enhance military operations. Ongoing research and development in artificial intelligence (AI), robotics, and machine learning further support the region’s leadership in defense innovation. Additionally, Canada is also investing in defense robotics, contributing to the market's growth. North America's strong defense infrastructure, coupled with strategic partnerships between government agencies and private companies, accelerates technological advancements and deployment of robotic systems. The region’s high focus on modernization, combat readiness, and military superiority ensures the continued expansion of the robotic warfare market.

Asia Pacific Market Statistics

Asia Pacific is witnessing the fastest market growth between 2023 to 2033. China, in particular, is at the forefront of deploying advanced robotic technologies, bolstering its military capabilities. Additionally, ongoing research and development in artificial intelligence (AI) and robotics are enabling faster deployment of autonomous systems across the region. The rising need for advanced surveillance, reconnaissance, and combat capabilities, coupled with evolving security challenges, further drives the market’s expansion. Collaborations between governments and defense contractors are also playing a key role in accelerating the adoption of robotic warfare technologies in the region.

Segmentation Analysis

Insights by Mode of Operation

The semi autonomous segment accounted for the largest market share over the forecast period 2023 to 2033. Semi-autonomous robots can operate with a high degree of independence while allowing for human intervention when necessary, making them ideal for missions where full autonomy may be impractical or undesirable. This segment includes unmanned aerial vehicles (UAVs), unmanned ground vehicles (UGVs), and robotic combat systems that can perform tasks like surveillance, reconnaissance, and logistics with minimal human oversight. The growth of this segment is driven by the increasing demand for precision, efficiency, and reduced risk to personnel. Additionally, advancements in artificial intelligence (AI), machine learning, and sensor technologies are enhancing the capabilities of semi-autonomous systems, making them more adaptable and reliable in complex combat environments.

Insights by Capability

The unmanned platforms & systems segment accounted for the largest market share over the forecast period 2023 to 2033. These platforms, including unmanned aerial vehicles (UAVs), unmanned ground vehicles (UGVs), and unmanned maritime systems, are pivotal for enhancing operational capabilities in surveillance, reconnaissance, combat, and logistics. The demand for unmanned platforms is fueled by their ability to operate in hazardous environments, reduce human casualties, and increase mission efficiency. Advances in artificial intelligence (AI), autonomy, and sensor technologies are driving improvements in their performance, enabling more complex, data-driven missions. Furthermore, the growing need for real-time intelligence, surveillance, and precision strike capabilities is accelerating the deployment of unmanned systems. The segment is expected to continue expanding as military forces seek cutting-edge, cost-effective solutions to meet evolving security challenges.

Insights by Application

The Intelligence, Surveillance and Reconnaissance segment accounted for the largest market share over the forecast period 2023 to 2033. The growth is driven by the increasing need for real-time data and enhanced situational awareness in modern warfare. Robotic systems, including unmanned aerial vehicles (UAVs), unmanned ground vehicles (UGVs), and drones, are being widely adopted for ISR operations, enabling militaries to gather critical intelligence without risking personnel. These platforms can conduct continuous surveillance, detect threats, and gather reconnaissance data in both conventional and asymmetric warfare environments. Advances in artificial intelligence (AI), machine learning, and sensor technologies are improving the accuracy and efficiency of ISR systems, making them more capable of handling complex tasks. The growing demand for enhanced battlefield awareness and strategic decision-making is expected to drive continued expansion of the ISR segment in the robotic warfare market.

Recent Market Developments

- In March 2023, General Dynamics Corporation presented a technology demonstration of their Tracked Robot 10-ton (TRX) at the Association of the U.S. Army's Force Symposium in the United States.

Competitive Landscape

Major players in the market

- Aero Vironment, Inc.

- BAE Systems plc

- Autonomous Solutions, Inc. (ASI)

- Boeing

- General Atomics

- Northrop Grumman Corporation

- Cobham plc

- Dassault Group

- Elbit Systems Ltd.

- Textron Inc.

- Lockheed Martin Corporation

- Thales Group

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2033.

Robotic Warfare Market, Mode of Operation Analysis

- Autonomous

- Semi Autonomous

Robotic Warfare Market, Capability Analysis

- Unmanned platforms & systems

- Exoskeleton & wearables

- Target acquisition systems

- Turret and weapon systems

Robotic Warfare Market, Application Analysis

- Intelligence, Surveillance and Reconnaissance

- Logistics and Support

- Search and Rescue

- Combat and Operations

- Tracking and Targeting

- Training and Simulation

Robotic Warfare Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the market size of the Robotic Warfare Market?The global Robotic Warfare Market is expected to grow from USD 34.2 billion in 2023 to USD 56.8 billion by 2033, at a CAGR of 5.20% during the forecast period 2023-2033.

-

2. Who are the key market players of the Robotic Warfare Market?Some of the key market players of the market are Aero Vironment, Inc., BAE Systems plc, Autonomous Solutions, Inc. (ASI), Boeing, General Atomics, Northrop Grumman Corporation, Cobham plc, Dassault Group, Elbit Systems Ltd., Textron Inc., Lockheed Martin Corporation, and Thales Group.

-

3. Which segment holds the largest market share?The semi autonomous segment holds the largest market share and is going to continue its dominance.

-

4. Which region dominates the Robotic Warfare Market?North America dominates the Robotic Warfare Market and has the highest market share.

Need help to buy this report?