Global Robotics in Shipbuilding Market Size By Type (Articulated Robot, Cartesian Robot, SCARA Robot, Cylindrical Robot, and Others), By Application (Handling, Welding, Assembling, Inspection, and Others), By Lifting Capacity (Less than 500 kg, 500 to 1000 kg, and Over 1000 kg), By Region, And Segment Forecasts, By Geographic Scope And Forecast to 2033

Industry: Aerospace & DefenseGlobal Robotics in Shipbuilding Market Insights Forecasts to 2033

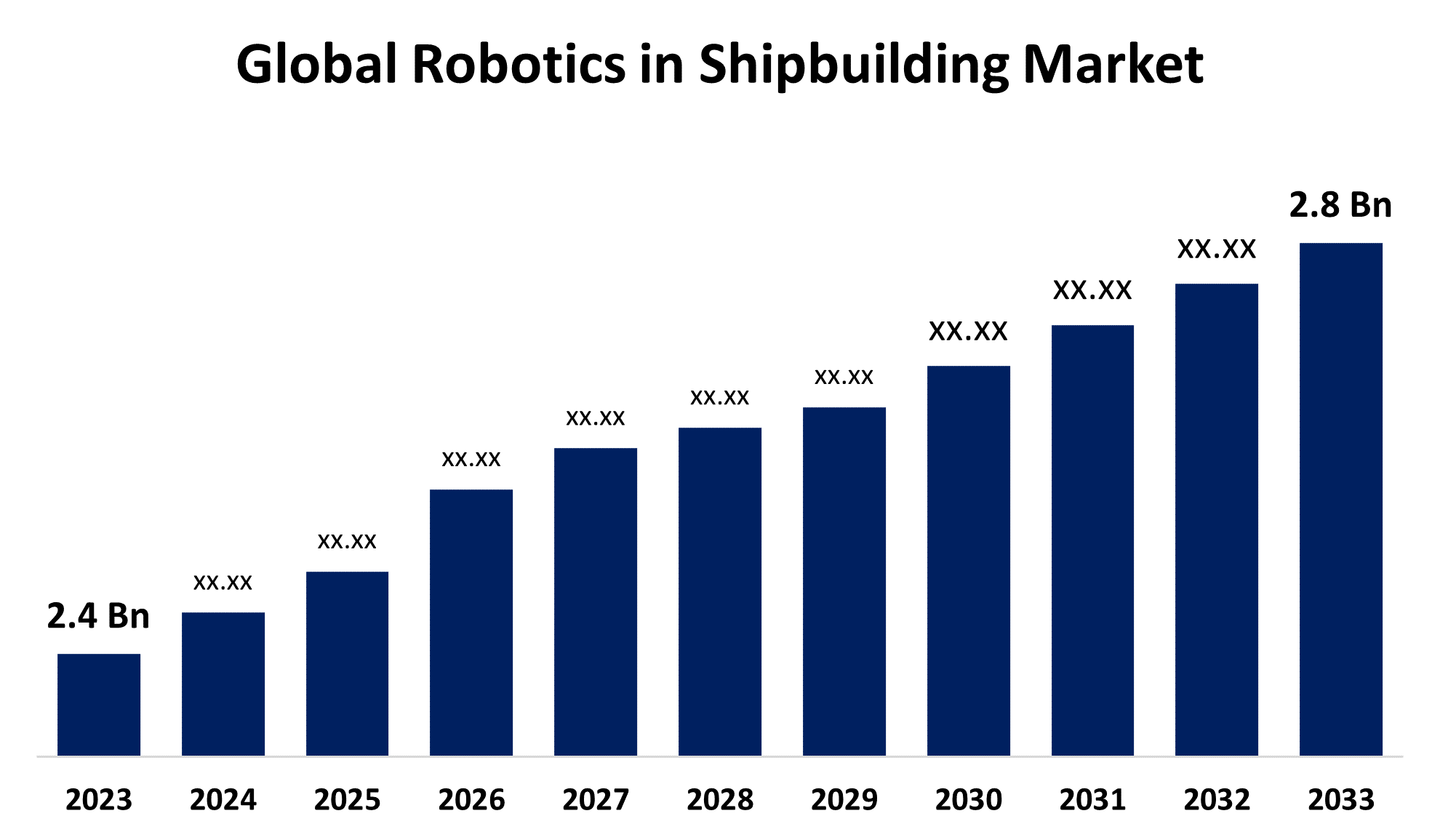

- The Global Robotics in Shipbuilding Market was valued at USD 2.4 Billion in 2023.

- The Market Size is Growing at a CAGR of 1.55% from 2023 to 2033

- The Worldwide Robotics in Shipbuilding Market is expected to reach USD 2.8 Billion by 2033

- Asia Pacific is Expected to Grow the fastest during the forecast period

Get more details on this report -

The Global Robotics in Shipbuilding Market Size is Expected to reach USD 2.8 billion by 2033, at a CAGR of 1.55% during the forecast period 2023 to 2033.

The use of robotics in shipbuilding has been a game changer in the marine industry, revolutionising many elements of ship construction and maintenance. Robots are rapidly being utilised in shipyards to automate a variety of processes, including welding, painting, blasting, material handling, and inspection. Automation not only increases productivity, but it also improves safety by minimising the need for human workers in dangerous areas. Drones and underwater robots outfitted with cameras and sensors are used to inspect ship hulls, pipelines, and other vital components. These robots can identify faults, corrosion, and other irregularities, allowing for prompt maintenance and repair actions. The market for robots in shipbuilding is predicted to rise steadily in the coming years, owing to increased demand for efficient and cost-effective manufacturing processes.

Robotics in Shipbuilding Market Value Chain Analysis

The value chain for robotics in shipbuilding encompasses research and development for tailored solutions, manufacturing of hardware components, integration into shipyard infrastructure, personnel training, deployment for various tasks, ongoing maintenance and upgrades, performance monitoring for optimization, and end-of-life management. This involves a collaborative effort between robotics manufacturers, shipyard engineers, and project managers to ensure seamless integration, operational efficiency, quality control, and safety throughout the lifecycle of robotic systems, ultimately driving innovation, cost reduction, and value creation within the maritime industry.

Robotics in Shipbuilding Market Opportunity Analysis

The robots in shipbuilding market offers substantial opportunities for stakeholders in the maritime industry. With rising need for efficient and cost-effective production processes, robotics provides a disruptive solution. This opportunity encompasses a variety of disciplines, including the automation of important processes such as welding, painting, blasting, and inspection, which leads to increased production and quality assurance. Furthermore, the use of robotics allows shipyards to improve workplace safety by minimising human exposure to dangerous situations. Furthermore, improvements in robotics technology, such as AI-powered automation and remote operation capabilities, provide opportunities for innovation and competitive advantage. Furthermore, the increased emphasis on sustainability encourages the use of robotics to optimise resource utilisation and reduce environmental effect in shipbuilding processes. Overall, the robots in shipbuilding market offers a great chance to transform old manufacturing techniques, drive operational excellence, and satisfy changing industry expectations.

Robotics in Shipbuilding Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023 : | USD 2.4 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 1.55% |

| 2033 Value Projection: | USD 2.8 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Type, By Application, By Lifting Capacity |

| Companies covered:: | ABB (Switzerland), The Fanuc Corporation (Japan), Comau (Italy), Yaskawa America, Inc. (U.S.), Kuka AG (Germany), Sarcos Technology and Robotics Corp. (U.S.), Epson (Japan), Universal Robots (Denmark), Kawasaki Robotics (Japan), Stäubli International AG (Switzerland), and Others Key Vendors. |

| Pitfalls & Challenges: | COVID-19 Empact,Challenges, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics

Robotics in Shipbuilding Market Dynamics

Increased use of robotics to fill labour gaps in the shipbuilding industry will boost market growth.

The rising use of robotics to alleviate labour shortages in the shipbuilding sector is expected to greatly expand the market for robotics in shipbuilding. With the maritime industry experiencing issues such as an ageing workforce, talent shortages, and the need for increased efficiency, robotics present an appealing solution. Robotics can supplement human labour by automating repetitive and labor-intensive operations like welding, painting, and inspection, as well as cover key labour gaps and optimise manufacturing processes. This not only increases operational efficiency, but also shortens project deadlines and improves overall project outcomes. Furthermore, robotics enable shipyards to overcome geographical limits by allowing for remote operation and monitoring, thereby increasing their talent pool and operational reach.

Restraints & Challenges

Shipbuilding requires complex procedures, from design to construction, which may not always be amenable to automation. The varying shapes, sizes, and materials of ships make it difficult to build robots that can meet these unique needs. Implementing robotics in shipbuilding necessitates major investment in both technology and infrastructure. The expense of purchasing, installing, and maintaining robotic devices, as well as educating individuals to use them, can be significant. Ships are frequently manufactured to meet special specifications, necessitating flexibility in production techniques. It is still difficult to develop robots that can handle this amount of customisation efficiently.

Regional Forecasts

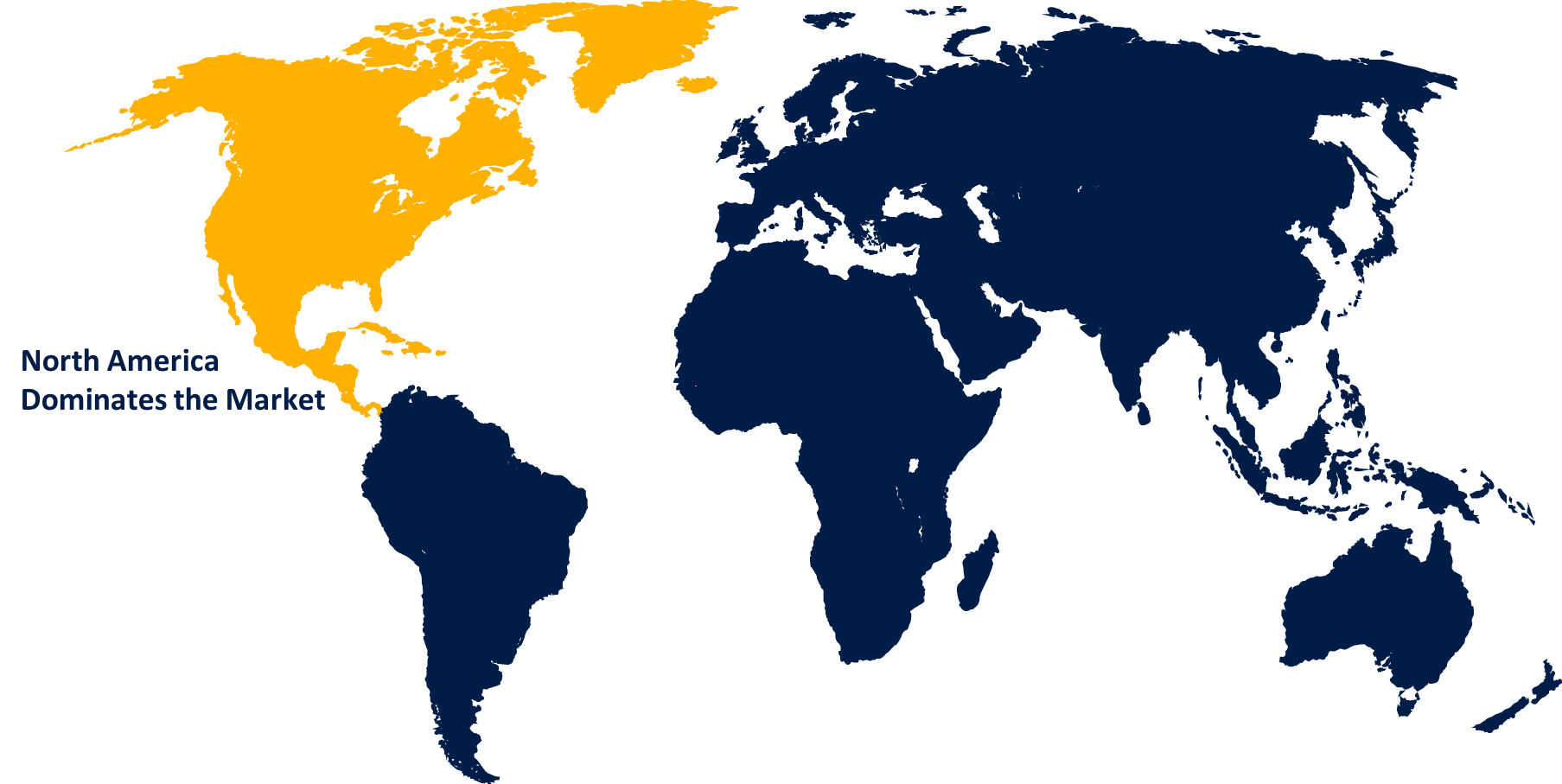

North America Market Statistics

Get more details on this report -

North America is anticipated to dominate the Robotics in Shipbuilding Market from 2023 to 2033. Labour expenses in North America are often greater than in other locations, making automation an appealing alternative for shipyards seeking to enhance efficiency and cut production costs. Robotics can help to reduce labour shortages and boost productivity in shipbuilding processes. The demand for ships, including commercial vessels, navy ships, and offshore structures, is driving investment in shipbuilding robotics solutions. North America's substantial marine sector, which includes shipyards, port facilities, and offshore energy production, presents chances for robotics businesses to provide novel ship construction and maintenance solutions. The presence of established shipbuilding and robotics firms, as well as rising startups, helps to create a competitive market environment in North America. Competition promotes innovation and the creation of cost-effective robotics solutions adapted to specific issues.

Asia Pacific Market Statistics

Asia Pacific is witnessing the fastest market growth between 2023 to 2033. Asia-Pacific is a major shipbuilding hub, with China, South Korea, and Japan dominating the industry. The region accounts for a sizable share of worldwide shipbuilding output, resulting in a high need for robotics solutions to improve efficiency and competitiveness in shipyard operations. Rapid urbanisation and infrastructural development in Asia-Pacific countries are increasing demand for a wide range of vessels, including commercial ships, offshore platforms, and navy vessels. Robotics technology can assist satisfy this increasing need by allowing for faster and more effective ship production, repair, and maintenance. The Asia-Pacific region's shipbuilding sector is highly competitive, with both established and rising enterprises vying for market dominance. Robotics manufacturers in the region are investing in R&D to create innovative solutions.

Segmentation Analysis

Insights by Type

The articulated robots segment accounted for the largest market share over the forecast period 2023 to 2033. Emerging markets in Asia-Pacific and other areas are seeing an increase in the use of articulated robots in shipbuilding as shipyards modernise operations to meet expanding vessel demand. As these markets engage in infrastructure development and maritime sectors, the need for articulated robots is likely to rise even higher. Articulated robots are rapidly being combined with digital technologies like 3D scanning, virtual reality, and simulation software to improve their performance and efficiency in shipbuilding applications. These digital technologies help shipbuilders design, plan, and execute robotic activities more efficiently, resulting in increased productivity and quality in shipyard operations.

Insights by Application

The handling segment is dominating the market with the largest market share over the forecast period 2023 to 2033. Shipbuilding entails the transportation of large and bulky materials, components, and structures inside the shipyard. Material handling robots can transfer these things efficiently around the production facility, eliminating the need for physical labour, optimising workflows, and lowering the danger of accidents or injuries. Handling robots help to boost production by automating repetitive and time-consuming processes including loading and unloading supplies, palletizing, and moving components between workstations. By optimising material flow and eliminating idle time, these robots assist shipyards in meeting production deadlines and increasing overall efficiency. Despite the initial investment necessary to adopt handling robots, shipyards gain from long-term cost benefits through lower labour costs, increased operational efficiency, and reduced material waste.

Insights by Lifting Capacity

The over 1,000 kg segment accounted for the largest market share over the forecast period 2023 to 2033. Shipbuilding entails working with massive, heavy materials including steel plates, ship parts, and machinery components. Lifting, manoeuvring, and positioning these big materials at various stages of the construction process requires robotics capable of managing payloads of more than 1,000 kg. Large payload robots make it easier to assemble larger ship components and structures, such as hull sections and superstructures. These robots can correctly place and align heavy components during welding, fitting, and assembling procedures, resulting in exact construction with minimal rework or faults. Emerging markets with thriving maritime sectors, notably in Asia-Pacific, are boosting demand for large payload robots in shipbuilding.

Recent Market Developments

- In Janjuary 2023, Daewoo Shipbuilding & Marine Engineering, a South Korean shipbuilding company, has created a collaborative robot (cobot) to increase efficiency.

Competitive Landscape

Major players in the market

- ABB (Switzerland)

- The Fanuc Corporation (Japan)

- Comau (Italy)

- Yaskawa America, Inc. (U.S.)

- Kuka AG (Germany)

- Sarcos Technology and Robotics Corp. (U.S.)

- Epson (Japan)

- Universal Robots (Denmark)

- Kawasaki Robotics (Japan)

- Stäubli International AG (Switzerland)

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2033.

Robotics in Shipbuilding Market, Type Analysis

- Articulated Robot

- Cartesian Robot

- SCARA Robot

- Cylindrical Robot

- Others

Robotics in Shipbuilding Market, Application Analysis

- Handling

- Welding

- Assembling

- Inspection

- Others

Robotics in Shipbuilding Market, Lifting Capacity Analysis

- Less than 500 kg

- 500 to 1000 kg

- Over 1000 kg

Robotics in Shipbuilding Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of Middle East & Africa

Need help to buy this report?