Global Rocket Propulsion Market Size, Share, and COVID-19 Impact Analysis, By Type (Rocket Motor, Rocket Engine), By Propulsion (Solid Propulsion, Liquid Propulsion, Hybrid Propulsion), By Launch Vehicle (Manned, Unmanned), By End User (Commercial, Military & Government), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2022 – 2032

Industry: Aerospace & DefenseGlobal Rocket Propulsion Market Insights Forecasts to 2032

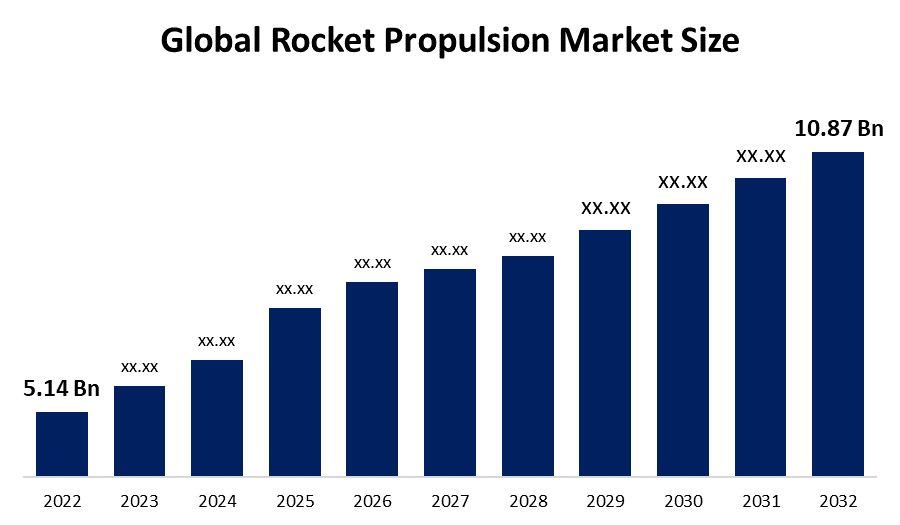

- The Global Rocket Propulsion Market Size was valued at USD 5.14 billion in 2022.

- The Market is growing at a CAGR of 7.8% from 2022 to 2032

- The Worldwide Rocket Propulsion Market Size is expected to reach USD 10.87 billion by 2032

- Asia Pacific is expected to grow the fastest during the forecast period

Get more details on this report -

The Global Rocket Propulsion Market is anticipated to exceed USD 10.87 billion by 2032, growing at a CAGR of 7.8% from 2022 to 2032. The increase in expenditure on the aerospace sector and launch operations, the country's greater attempt to develop domestic production capabilities, efforts to minimize the carbon footprint contributed by rocket propulsion systems, improvements in technology to reduce manufacturing costs and improve efficiency, and the development of retrievable propulsion systems are the key factors affecting the global rocket propulsion market.

Market Overview

A rocket is an airplane, missile, spaceship, or other vehicle that generates propulsion. The rocket's propulsion mechanism generates thrust. Rocket engines use three types of propellants: solid, liquid, and hybrid (a combination of both liquid and solid propellants). Solid fuels can be utilized in solid rocket engines, which produce a lot of thrusts and are more reliable than traditional propulsion systems. However, solid rocket engines cannot be restarted. Rockets use a solid propellant, whereas liquid jet engines utilize liquid fuel, produce more thrust, and are more controlled. However, liquid-engine rockets are costly due to their complex designs. Rockets supported by hybrid propulsion use both solid and liquid fuel in two stages. In hybrid rocket engines, both solid and liquid propulsion techniques can be utilized.

Some of the factors fueling the growth of the rocket propulsion system market include an increase in rocket propulsion demand due to an increase in space expeditions, high efficiency and advancements in technology in rocket propulsion, and an increase in commercial space applications. The advancement of reusable rocket technology, as well as the introduction of space tourism, are projected to significantly boost demand for rocket propulsion in the coming years.

Report Coverage

This research report categorizes the market for the global rocket propulsion market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the rocket propulsion market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the rocket propulsion market.

Global Rocket Propulsion Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 5.14 Billion |

| Forecast Period: | 2022 - 2032 |

| Forecast Period CAGR 2022 - 2032 : | 7.8% |

| 2032 Value Projection: | USD 10.87 Billion |

| Historical Data for: | 2018 - 2021 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 130 |

| Segments covered: | By Type Vehicle, By End User, By Region |

| Companies covered:: | SpaceX, Rocket Lab USA, Virgin Galactic, Safran S.A., Northrop Grumman, Boeing Company, Blue Origin, Airbus, Aerojet Rocketdyne, Orbital ATK, Antrix, Mitsubishi Heavy Industries, Others |

Get more details on this report -

Driving Factors

Mission expansion in space exploration

Across the past decade, countries such as the United States, China, India, Japan, Russia, and organizations such as the European Space Agency have launched 19 space exploration or planetary missions. Every year, the global government budget grows larger. Governments are making investments in space exploration projects and infrastructure support. A company's capital expenditure is the acquisition of physical assets for the purpose of furthering its long-range company objectives and goals. As reported by Space Capital LP, a venture capital firm based in the United States that invests in space-based methods, venture capital made investments of $17.1 billion into 328 space companies in 2021, which amounts to 3% of total global venture capital flows. As reported by USA Spending, a US-based official open data source of federal spending data, the National Aeronautics and Space Administration (NASA) had $30.44 billion in available budgetary resources in FY 2022 to propel advances in technology, aeronautics, and space exploration in order to enhance knowledge and innovation. As a result, rising government spending and capital investment by space agencies are projected to increase demand for rocket propulsion systems throughout the projected period.

Restraining Factors

The coronavirus outbreak's financial meltdowns and other unprecedented consequences have had negative effects on global industry verticals, including the aerospace industry. The Gaganyaan crewed orbital spacecraft mission in India was scheduled to launch in 2022. However, this space operation was postponed due to the COVID-19 crisis, primarily due to reduced Department of Space expenditure. Such obstacles may have resulted in a decrease in space launch vehicle manufacturing and harmed the companies of rocket propulsion system manufacturers around the world.

Market Segmentation

The Global Rocket Propulsion Market share is classified into type, propulsion, and end user.

- The rocket engine segment is expected to grow at the highest pace in the global rocket propulsion market during the forecast period.

The global rocket propulsion market is segmented by type into rocket motor and rocket engine. Among these, the rocket engine segment is expected to grow at the highest pace in the global rocket propulsion market during the forecast period. The growth of the rocket engine segment is frequently attributed to the increasing number of launch service providers worldwide, drop-in cost for launches, and thus increased demand for reusable launch vehicles.

- The hybrid propulsion segment is expected to hold the largest share of the global rocket propulsion market during the forecast period.

Based on the propulsion, the global rocket propulsion market is divided into solid propulsion, liquid propulsion, and hybrid propulsion. Among these, the hybrid propulsion segment is expected to hold the largest share of the global rocket propulsion market during the forecast period. The application of propellants that include polyethylene with a high density and nitrous oxide (NO) can also ensure extremely low manufacturing energy requirements, resulting in low carbon footprints for engines. The growing demand for environmentally friendly and safe rocket engine systems will consequently boost the use of hybrid fuel-propelled engines.

- The military & government segment is expected to hold the largest share of the global rocket propulsion market during the forecast period.

The global rocket propulsion market is divided into two segments based on end user: commercial, military & government. Among these, the military & government segment is expected to hold the largest share of the global rocket propulsion market during the forecast period. Rising defence expenditures by both developed and developing nations, and thus the need to support military operations and cyber operations through the use of various types of satellites, such as remote sensing satellites, communication and surveillance satellites, and a variety of others, will likely contribute to the growth of the global rocket propulsion market during the forecast period.

Regional Segment Analysis of the Global Rocket Propulsion Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is estimated to hold the largest share of the global rocket propulsion market over the predicted timeframe.

Get more details on this report -

North America is estimated to hold the largest share of the global rocket propulsion market over the forecast period. The rising demand for aerospace launch providers for different payloads including human spacecraft, satellites, missions to the International Space Station, and testing probes is projected to fuel the expansion of the rocket propulsion market in North America. The region is investing significantly in the development of space tourism and exploration and space probe missions, which is adding to the growth of the rocket propulsion market.

Asia Pacific is expected to grow at the fastest pace in the global rocket propulsion market during the forecast period. The Asia Pacific region is expected to grow rapidly as the region's research and development (R&D) activities increase. Furthermore, countries such as China, India, Japan, South Korea, and Russia are expanding their scientific capabilities. As a result, the number of space missions and rocket launches is increasing, boosting the growth of the region's rocket propulsion industry. For instance, the Indian government's NewSpace India Ltd disclosed in March 2021 that it intends to invest INR 10,000 crore to improve rocket launches and the operation of satellites.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global rocket propulsion along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- SpaceX

- Rocket Lab USA

- Virgin Galactic

- Safran S.A.

- Northrop Grumman

- Boeing Company

- Blue Origin

- Airbus

- Aerojet Rocketdyne

- Orbital ATK

- Antrix

- Mitsubishi Heavy Industries

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In August 2021, Phantom Space Corporation, an aerospace transportation and rocket production company based in the United States, purchased Micro Aerospace Solutions for an undisclosed sum. This agreement will allow Phantom Space Corporation to increase space access by mass-producing launch vehicles, satellites, and space propulsion technologies.

- In June 2022, Ursa Major, a U.S. rocket engine manufacturer, has developed a new medium to heavy-lift rocket engine to serve a growing market of potential customers.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2032. Spherical Insights has segmented the Global Rocket Propulsion Market based on the below-mentioned segments:

Global Rocket Propulsion Market, By Type

- Rocket Motor

- Rocket Engine

Global Rocket Propulsion Market, By Propulsion

- Solid Propulsion

- Liquid Propulsion

- Hybrid Propulsion

Global Rocket Propulsion Market, By Launch Vehicle

- Manned

- Unmanned

Global Rocket Propulsion Market, By End User

- Commercial

- Military & Government

Global Rocket Propulsion Market, By Region

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of Middle East & Africa

Need help to buy this report?