Global Satellite-as-a-Service (SataaS) Market Size, Share, and COVID-19 Impact Analysis, By Type (Small Satellites and Large Satellites), By Application (Internet Service, Communication Service, and Track Service), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Aerospace & DefenseGlobal Satellite-as-a-Service (SataaS) Market Insights Forecasts to 2033

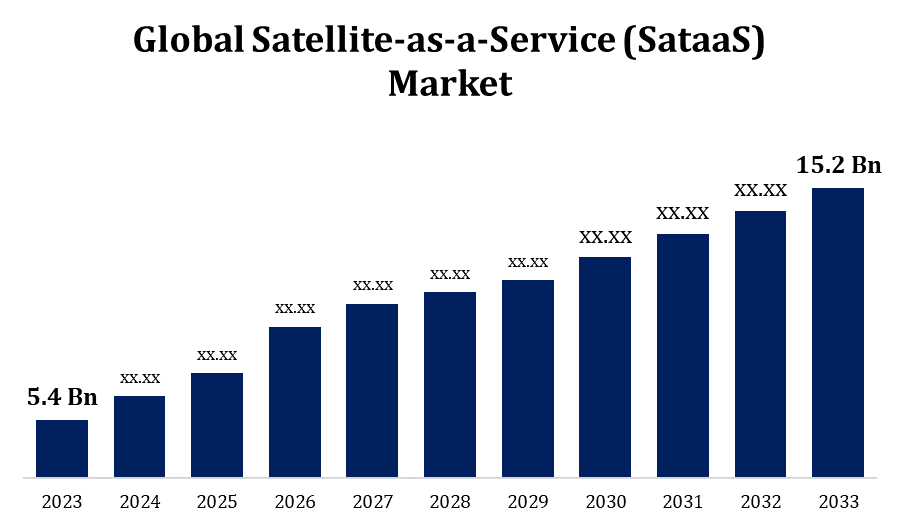

- The Satellite-as-a-Service (SataaS) Market Size was valued at USD 5.4 Billion in 2023.

- The Market Size is Growing at a CAGR of 10.90% from 2023 to 2033

- The Worldwide Satellite-as-a-Service (SataaS) Market Size is expected to reach USD 15.2 Billion by 2033

- Asia Pacific is expected to Grow the fastest during the forecast period

Get more details on this report -

The Global Satellite-as-a-Service (SataaS) Market Size is expected to reach USD 15.2 Billion by 2033, at a CAGR of 10.90% during the forecast period 2023 to 2033.

The Satellite-as-a-Service (SataaS) market is rapidly evolving, driven by the increasing demand for cost-effective and flexible satellite solutions. This model allows companies to leverage satellite capabilities without the high upfront costs and complexities of owning and operating satellite infrastructure. Key drivers include advancements in satellite technology, the growing need for global connectivity, and the expanding applications in sectors such as telecommunications, defense, and agriculture. The market is characterized by a diverse range of services, including data collection, analytics, and communication services, provided by both established aerospace firms and innovative startups. As the demand for real-time data and global coverage continues to grow, the SataaS market is poised for significant expansion, fostering new opportunities for businesses across various industries.

Satellite-as-a-Service (SataaS) Market Value Chain Analysis

The Satellite-as-a-Service (SataaS) market value chain encompasses multiple interconnected stages, each adding value to the end service. It begins with satellite manufacturers who design and produce the hardware, followed by launch service providers who deploy satellites into orbit. Ground station operators then manage the satellite’s communication with Earth. Data service providers process and analyze the information collected by satellites, transforming raw data into actionable insights. Finally, end-users across various industries, including telecommunications, agriculture, and defense, utilize these insights for decision-making and operational efficiency. Collaboration among these stakeholders ensures a seamless flow of services, driving innovation and cost efficiencies throughout the value chain, thereby enhancing the overall value proposition of SataaS solutions.

Satellite-as-a-Service (SataaS) Market Opportunity Analysis

The Satellite-as-a-Service (SataaS) market presents significant opportunities driven by the increasing demand for satellite data and services across diverse sectors. Advancements in miniaturization and cost reduction of satellite technology have lowered entry barriers, enabling more companies to offer tailored satellite solutions. Key opportunities lie in enhancing global connectivity, supporting IoT networks, and providing critical data for climate monitoring, disaster management, and precision agriculture. Emerging markets and developing regions, with their growing need for reliable communication and data services, offer substantial growth potential. Furthermore, the trend towards privatization and commercial use of space is opening new avenues for innovation and collaboration, positioning the SataaS market as a crucial enabler of the next wave of technological and industrial advancements.

Global Satellite-as-a-Service (SataaS) Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 5.4 Billion |

| Forecast Period: | 2023 - 2033 |

| Forecast Period CAGR 2023 - 2033 : | 10.90% |

| 2033 Value Projection: | USD 15.2 Billion |

| Historical Data for: | 2019 - 2022 |

| No. of Pages: | 225 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Type, By Application, By Region. |

| Companies covered:: | SpaceX, Planet Labs Inc., OneWeb, Spire Global Inc., BlackSky, Capella Space, ICEYE, HawkEye 360, Astro Digital Inc., Loft Orbital, Orbital Insight, Satellogic, and Others |

| Growth Drivers: | Growing demand for satellite data and services across numerous businesses and populations |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics

Satellite-as-a-Service (SataaS) Market Dynamics

Growing demand for satellite data and services across numerous businesses and populations

The Satellite-as-a-Service (SataaS) market is experiencing robust growth due to the surging demand for satellite data and services across various industries and populations. Businesses in sectors such as agriculture, telecommunications, defense, and environmental monitoring increasingly rely on satellite-derived data for real-time insights and enhanced decision-making. The proliferation of IoT devices and the need for ubiquitous connectivity further fuel this demand. Additionally, populations in remote and underserved areas benefit from improved communication and internet access provided by satellite services. As technology advances and costs decrease, more companies can offer specialized satellite solutions, expanding market reach. This growing reliance on satellite data and services underscores the critical role of SataaS in driving economic development and addressing global challenges.

Restraints & Challenges

The Satellite-as-a-Service (SataaS) market faces several challenges despite its growth potential. High initial capital expenditure and the complexity of satellite technology pose significant barriers to entry for new players. Regulatory hurdles and spectrum allocation issues can delay projects and increase costs. The market also contends with cybersecurity risks, as satellites and ground stations become targets for potential cyber-attacks. Additionally, the increasing congestion of orbital slots raises concerns about space debris and collision risks, necessitating robust space traffic management. The rapid pace of technological change demands continuous innovation and adaptation, which can strain resources. Finally, ensuring data accuracy and reliability remains critical, as inaccuracies can undermine the value of satellite services, impacting customer trust and market adoption.

Regional Forecasts

North America Market Statistics

Get more details on this report -

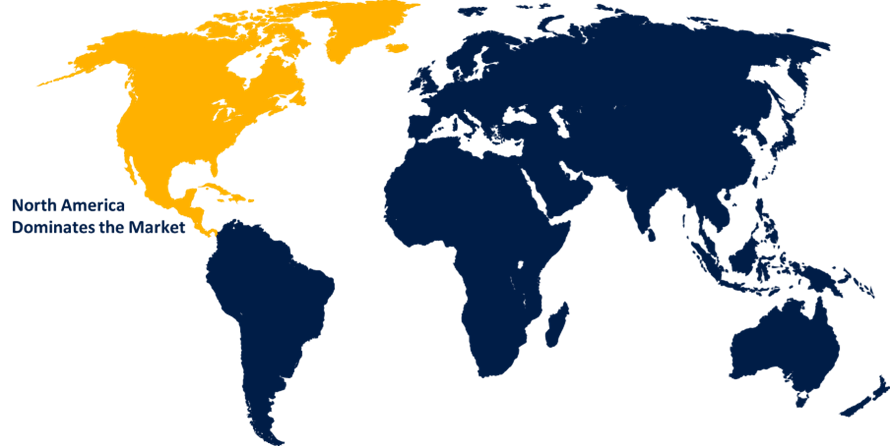

North America is anticipated to dominate the Satellite-as-a-Service (SataaS) Market from 2023 to 2033. Key factors include the presence of major aerospace companies and a thriving ecosystem of innovative startups. The U.S. government’s support for space exploration and commercialization, along with favorable regulatory policies, further accelerates market expansion. Sectors such as telecommunications, defense, agriculture, and environmental monitoring increasingly rely on satellite data for enhanced operational efficiency and decision-making. The growing need for broadband connectivity in remote areas also fuels demand. North America's leadership in space technology and investment in next-generation satellite solutions position it as a pivotal player in the global SataaS market.

Asia Pacific Market Statistics

Asia Pacific is witnessing the fastest market growth between 2023 to 2033. Emerging economies are investing heavily in space technology, fostering a competitive and dynamic market landscape. The region's need for enhanced communication networks, especially in remote and underserved areas, propels growth in satellite internet and data services. Agricultural, environmental monitoring, and disaster management sectors are leveraging satellite data for improved decision-making and efficiency. Government initiatives and collaborations with private enterprises further stimulate market development. As technological advancements lower costs and enhance satellite capabilities, the Asia-Pacific SataaS market is set to become a major hub for innovation and growth in the global satellite industry.

Segmentation Analysis

Insights by Type

The small satellites segment accounted for the largest market share over the forecast period 2023 to 2033. These satellites, known for their lower launch costs and shorter development cycles, offer flexible and scalable solutions for various applications. Key drivers include the rising demand for real-time data in telecommunications, Earth observation, and IoT networks. Small satellites provide enhanced capabilities for environmental monitoring, disaster management, and agricultural planning. Their rapid deployment and ability to form constellations for improved coverage make them attractive to both commercial and governmental entities. As technology continues to evolve, the small satellites segment is expected to play a crucial role in expanding the accessibility and efficiency of SataaS offerings globally.

Insights by Application

The communication service segment accounted for the largest market share over the forecast period 2023 to 2033. This segment addresses the demand for high-speed internet, especially in remote and underserved areas where traditional infrastructure is lacking. Key applications include satellite broadband for rural communities, maritime and aviation communication, and emergency response services. Advancements in satellite technology, such as high-throughput satellites (HTS) and low Earth orbit (LEO) constellations, enhance capacity and reduce latency, making satellite communication more competitive. The growing reliance on satellite networks for backhaul support in telecommunications and the expansion of 5G networks further propel this segment. As global connectivity becomes more critical, the communication service segment is poised for sustained growth and innovation.

Recent Market Developments

- In Honeywell 2023, Honeywell has announced the acquisition of Satcom Direct, a provider of satellite communication solutions to the aviation industry. This acquisition boosts Honeywell's position in the fast-growing aerospace connectivity market.

Competitive Landscape

Major players in the market

- SpaceX

- Planet Labs Inc.

- OneWeb

- Spire Global Inc.

- BlackSky

- Capella Space

- ICEYE

- HawkEye 360

- Astro Digital Inc.

- Loft Orbital

- Orbital Insight

- Satellogic

- Others

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2033.

Satellite-as-a-Service (SataaS) Market, Type Analysis

- Small Satellites

- Large Satellites

Satellite-as-a-Service (SataaS) Market, Application Analysis

- Internet Service

- Communication Service

- Track Service

Satellite-as-a-Service (SataaS) Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the market size of the Satellite-as-a-Service (SataaS)?The global Satellite-as-a-Service (SataaS) Market is expected to grow from USD 5.4 billion in 2023 to USD 15.2 billion by 2033, at a CAGR of 10.90% during the forecast period 2023-2033.

-

2. Who are the key market players of the Satellite-as-a-Service (SataaS) Market?Some of the key market players of the market are SpaceX, Planet Labs Inc., OneWeb, Spire Global Inc., BlackSky, Capella Space, ICEYE, HawkEye 360, Astro Digital Inc., Loft Orbital, Orbital Insight, and Satellogic.

-

3. Which segment holds the largest market share?The communication service segment holds the largest market share and is going to continue its dominance.

-

4. Which region dominates the Satellite-as-a-Service (SataaS) market?North America dominates the Satellite-as-a-Service (SataaS) market and has the highest market share.

Need help to buy this report?