Global Satellite Internet Market Size, Share, and COVID-19 Impact Analysis, By Orbit (LEO, MEO/GEO Orbit), By Connectivity (Two Way Service, One Way Service, and Hybrid Connectivity), By Verticals (Commercial, Government & Defense), By Frequency (C-Band, L-Band, X-Band, Ka-Band, Ku-Band), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Aerospace & DefenseGlobal Satellite Internet Market Insights Forecasts to 2033

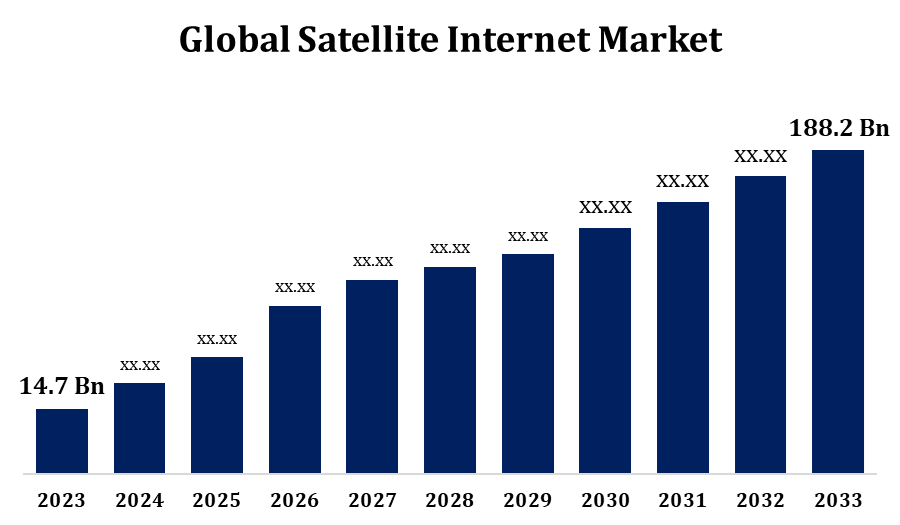

- The Satellite Internet Market was valued at USD 14.7 Billion in 2023.

- The Market is Growing at a CAGR of 29.04% from 2023 to 2033.

- The Worldwide Satellite Internet Market Size is Expected to reach USD 188.2 Billion by 2033.

- Asia Pacific is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Satellite Internet Market Size is Expected to reach USD 188.2 Billion by 2033, at a CAGR of 29.04% during the forecast period 2023 to 2033.

The satellite internet market is experiencing significant growth, driven by the increasing demand for high-speed internet in remote and underserved areas. With advancements in satellite technology, companies like SpaceX’s Starlink and Amazon’s Project Kuiper are deploying low Earth orbit (LEO) satellites, offering faster and more reliable connections. These services are particularly appealing in regions where traditional broadband infrastructure is limited or non-existent. The market is also expanding due to the rise in remote work, digital education, and IoT applications, which require reliable internet access. Additionally, innovations in satellite communication technologies, such as improved bandwidth and lower latency, are fueling market expansion. The satellite internet market is expected to continue evolving, providing an essential solution for global connectivity and bridging the digital divide.

Satellite Internet Market Value Chain Analysis

The satellite internet market value chain encompasses several key stages, beginning with satellite manufacturing. Companies design and build satellites, including both geostationary and low Earth orbit (LEO) models. These satellites are then launched into space, typically through partnerships with aerospace firms. Once in orbit, satellite operators manage and maintain the infrastructure, ensuring stable connectivity. The next stage involves service providers offering internet access to end users, often using ground stations to relay signals. They also manage customer subscriptions and technical support. Finally, end users such as individuals, businesses, and government entities—access the internet. Throughout the value chain, technology developers contribute by advancing satellite systems, communication protocols, and software platforms, enhancing service delivery. The market benefits from collaboration between aerospace, telecommunications, and technology sectors.

Satellite Internet Market Opportunity Analysis

The satellite internet market presents numerous opportunities, particularly in underserved and remote regions where traditional broadband infrastructure is limited. The growing demand for global connectivity, spurred by remote work, e-learning, and telemedicine, creates a substantial market for reliable internet access in rural and hard-to-reach areas. Advancements in low Earth orbit (LEO) satellite technologies, which offer faster speeds and lower latency, open new avenues for service providers to deliver competitive broadband solutions. Additionally, government initiatives supporting digital inclusion and bridging the digital divide present opportunities for collaboration and funding. The rise of IoT applications, autonomous vehicles, and smart cities further fuels demand for constant, high-speed internet, driving the market's growth. With continued technological innovation, satellite internet can cater to both commercial and residential needs, offering vast potential for expansion.

Global Satellite Internet Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 14.7 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 29.04% |

| 2033 Value Projection: | USD 188.2 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 115 |

| Segments covered: | By Orbit, By Verticals and COVID-19 Impact Analysis |

| Companies covered:: | Singtel Group, Freedomsat, EchoStar Corporation, Thuraya TelecommuniLEOions Company, Eutelsat CommuniLEOions SA, OneWeb.net, SpaceX, Viasat, Inc., Axess, DSL Telecom, and Others Key Players |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis, |

Get more details on this report -

Market Dynamics

Satellite Internet Market Dynamics

The increasing demand for satellite internet from the military is fueling the market growth

The growing demand for satellite internet from the military is significantly driving the expansion of the satellite internet market. Military operations require secure, reliable, and high-speed internet connectivity, especially in remote or conflict zones where traditional infrastructure is unavailable. Satellite internet provides a critical solution, offering global coverage and enabling effective communication, real-time data transfer, and surveillance. With the rise of advanced military technologies like drones, autonomous systems, and IoT devices, the need for robust satellite communication networks is increasing. Additionally, the military's interest in deploying low Earth orbit (LEO) satellites for improved bandwidth and reduced latency is further contributing to the market's growth. As nations continue to invest in defense modernization and global connectivity, the military's demand for satellite internet remains a key driver in the sector's development.

Restraints & Challenges

One primary issue is the high cost of satellite manufacturing and launch, which limits accessibility for smaller service providers and affects pricing for end-users. Additionally, while low Earth orbit (LEO) satellites offer lower latency, they require large constellations, resulting in significant infrastructure costs and regulatory hurdles. Limited bandwidth and signal interference, especially in dense urban areas or regions with harsh weather conditions, can also affect service quality. Furthermore, competition from traditional broadband providers and emerging technologies like 5G poses a challenge in terms of market share and customer adoption. Finally, regulatory concerns, including spectrum allocation and international cooperation, add complexity to expanding global satellite networks, slowing the pace of market penetration.

Regional Forecasts

North America Market Statistics

Get more details on this report -

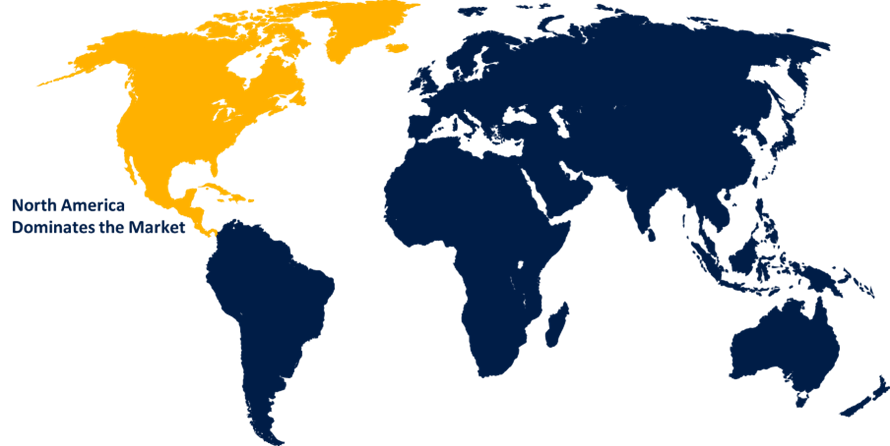

North America is anticipated to dominate the Satellite Internet Market from 2023 to 2033. With large portions of the population in these regions lacking reliable broadband access, satellite internet offers a viable solution. Companies like SpaceX’s Starlink and Viasat are at the forefront, providing affordable and fast satellite-based services. The growing adoption of satellite internet is further supported by government initiatives aimed at expanding broadband access through programs like the Federal Communications Commission’s (FCC) Rural Digital Opportunity Fund. Additionally, the military’s need for secure, global connectivity boosts the market. North America’s advanced technological infrastructure, coupled with a strong demand for reliable connectivity in remote areas, ensures that satellite internet will continue to thrive and evolve in the region.

Asia Pacific Market Statistics

Asia Pacific is witnessing the fastest market growth between 2023 to 2033. The region’s growing reliance on digital services, including e-learning, telemedicine, and e-commerce, further drives the need for robust connectivity. Companies like SpaceX’s Starlink and SES Networks are making inroads in the market, offering affordable high-speed internet via low Earth orbit (LEO) satellites. Additionally, government initiatives aimed at improving digital inclusion, alongside rising internet penetration, are accelerating satellite internet adoption. As Asia-Pacific continues to modernize, satellite internet will play a key role in bridging the digital divide and fostering regional economic development.

Segmentation Analysis

Insights by Orbit

The LEO segment accounted for the largest market share over the forecast period 2023 to 2033. LEO satellites orbit closer to the Earth, typically at altitudes between 500 and 2,000 kilometers, allowing for more efficient data transmission. This results in improved service quality, especially for applications like video conferencing, gaming, and IoT communications. Companies such as SpaceX’s Starlink and Amazon’s Project Kuiper are leading the LEO satellite revolution, launching large constellations of small satellites to ensure global coverage. The growing demand for internet access in remote areas, coupled with advancements in satellite technology, further supports the rapid expansion of the LEO segment. As the cost of satellite deployment decreases, the segment is expected to dominate the satellite internet market.

Insights by Connectivity

The Two-Way Service segment accounted for the largest market share over the forecast period 2023 to 2033. This service allows users to send and receive data simultaneously, supporting real-time communication for activities like video conferencing, live streaming, and cloud-based services. With the increasing demand for reliable internet in remote areas, two-way satellite services are critical for both consumers and businesses in underserved regions. The segment is gaining traction as technological advancements, such as lower latency and higher bandwidth capabilities, improve service quality. Additionally, two-way services are essential for the growing Internet of Things (IoT) applications and remote operations, such as agriculture, logistics, and energy management. As demand for interactive, bidirectional communication grows, the Two-Way Service segment is expected to play a central role in the satellite internet market's expansion.

Insights by Verticals

The commercial segment accounted for the largest market share over the forecast period 2023 to 2033. The growth is driven by the increasing demand for reliable connectivity in sectors such as aviation, maritime, transportation, and enterprise applications. Businesses require high-speed, global internet access to support operations, enable remote work, and facilitate cloud services. In aviation, satellite internet is transforming passenger experience by providing in-flight connectivity, while in maritime, it supports communication on ships in remote areas. The rise in digital transformation and IoT applications across industries further fuels the demand for satellite internet solutions. Companies like Viasat and SES Networks are offering tailored commercial services, addressing sector-specific needs such as secure data transmission, high bandwidth, and low latency. As industries increasingly rely on global connectivity, the commercial segment is expected to continue expanding, becoming a key driver in the satellite internet market.

Insights by Frequency

The Ka-band segment accounted for the largest market share over the forecast period 2023 to 2033. The growth is driven by its ability to provide high throughput and greater bandwidth compared to traditional Ku-band and C-band frequencies. Operating in the 26.5 to 40 GHz frequency range, Ka-band enables faster data speeds and improved capacity, making it ideal for applications requiring high-speed internet, such as video streaming, cloud services, and large-scale data transfer. With advancements in satellite technology and the growing demand for reliable, high-speed internet in remote areas, Ka-band has become a key enabler for satellite internet providers like SpaceX’s Starlink and ViaSat. This frequency band’s higher capacity allows service providers to offer better performance and cost-effective solutions, fueling market growth. As demand for fast and scalable satellite internet increases, the Ka-band segment is expected to play a crucial role in shaping the market’s future.

Recent Market Developments

- In October 2022, Viasat has announced a strategic partnership with AXESS Maritime, which will enable Viasat's maritime operations to expand their global reach by offering a wide range of products and services through AXESS.

Competitive Landscape

Major players in the market

- Singtel Group

- Freedomsat

- EchoStar Corporation

- Thuraya TelecommuniLEOions Company

- Eutelsat CommuniLEOions SA

- OneWeb.net

- SpaceX

- Viasat, Inc.

- Axess

- DSL Telecom

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2033.

Satellite Internet Market, Orbit Analysis

- LEO

- MEO/GEO Orbit

Satellite Internet Market, Connectivity Analysis

- Two Way Service

- One Way Service

- Hybrid Connectivity

Satellite Internet Market, Verticals Analysis

- Commercial

- Government & Defense

Satellite Internet Market, Frequency Analysis

- C-Band

- L-Band

- X-Band

- Ka-Band

- Ku-Band

Satellite Internet Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the market size of the Satellite Internet Market?The global Satellite Internet Market is expected to grow from USD 14.7 billion in 2023 to USD 188.2 billion by 2033, at a CAGR of 29.04% during the forecast period 2023-2033.

-

2. Who are the key market players of the Satellite Internet Market?Some of the key market players of the market are Singtel Group, Freedomsat, EchoStar Corporation, Thuraya TelecommuniLEOions Company, Eutelsat CommuniLEOions SA, OneWeb.net, SpaceX, Viasat, Inc., Axess, DSL Telecom.

-

3. Which segment holds the largest market share?The commercial segment holds the largest market share and is going to continue its dominance.

-

4. Which region dominates the Satellite Internet Market?North America dominates the Satellite Internet Market and has the highest market share.

Need help to buy this report?