Global Saturated Polyester Resin Market Size, Share, and COVID-19 Impact Analysis, By Material (Liquid, Solid), By End-use (Industrial Paints, Powder Coatings), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Chemicals & MaterialsGlobal Saturated Polyester Resin Market Insights Forecasts to 2033

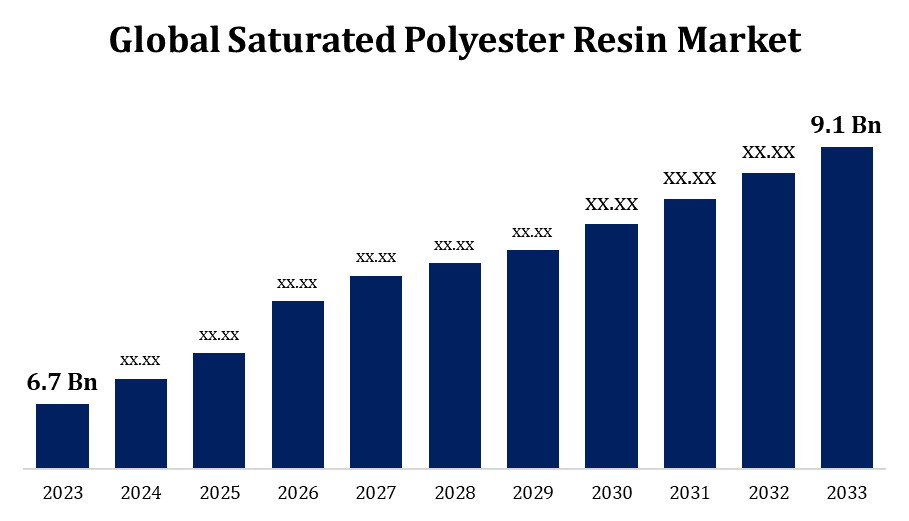

- The Saturated Polyester Resin Market Size was valued at USD 6.7 Billion in 2023.

- The Market Size is growing at a CAGR of 3.11% from 2023 to 2033.

- The Global Saturated Polyester Resin Market is expected to reach USD 9.1 Billion by 2033.

- Asia Pacific is expected to grow the fastest during the forecast period.

Get more details on this report -

The Global Saturated Polyester Resin Market Size is expected to reach USD 9.1 Billion by 2033, at a CAGR of 3.11% during the forecast period 2023 to 2033.

The saturated polyester resin market is experiencing steady growth due to its widespread use in various industries, including automotive, construction, and consumer goods. These resins are known for their excellent mechanical properties, chemical resistance, and durability, making them ideal for manufacturing coatings, adhesives, and composites. The increasing demand for eco-friendly and sustainable products has also contributed to market growth, with the introduction of bio-based and low-VOC formulations. Asia-Pacific dominates the market, driven by the rapid industrialization in countries like China and India. Additionally, the rise in construction and automotive sectors has further bolstered the market. However, fluctuations in raw material prices and stringent environmental regulations may present challenges for market expansion in the future.

Saturated Polyester Resin Market Value Chain Analysis

The value chain of the saturated polyester resin market encompasses several key stages, starting with the raw material sourcing. Key raw materials include diols, dicarboxylic acids, and polyols, which are sourced from petrochemical and renewable sources. In the production phase, these raw materials undergo polymerization to form the resin. The resins are then further processed into various forms, including solid or liquid, depending on the end-use application. The next stage involves distribution, where resins are delivered to manufacturers in industries like automotive, construction, and coatings. These manufacturers use the resins to create finished products such as paints, adhesives, and composite materials. Finally, the products reach end-users or consumers. Throughout this chain, factors like technological advancements, regulatory compliance, and supply chain efficiency play vital roles in determining market success.

Saturated Polyester Resin Market Opportunity Analysis

The saturated polyester resin market offers significant growth opportunities, driven by increasing demand across various end-use industries, particularly in automotive, construction, and coatings. The rising preference for lightweight, durable, and sustainable materials presents an opportunity for resins to replace traditional materials in composite manufacturing. The growing focus on eco-friendly products is spurring innovation in bio-based and low-VOC resins, opening doors for new market segments. Moreover, the rapid industrialization in emerging economies, especially in Asia-Pacific, is boosting demand. The development of advanced resins with improved performance characteristics, such as UV resistance and enhanced durability, further enhances market potential. Additionally, the trend towards electric vehicles and green buildings offers new opportunities for polyester resins in these niche applications.

Global Saturated Polyester Resin Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 6.7 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 3.11% |

| 2033 Value Projection: | USD 9.1 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 174 |

| Segments covered: | By Material, By End-use, By Region |

| Companies covered:: | Royal DSM N.V. (Netherlands), Allnex Belgium SA/NV (Belgium), Arkema S.A. (France), Nuplex Industries (New Zealand), Stepan Company (U.S.), Evonik Industries (Germany), Nippon Gohsei (Japan), Covestro AG (Germany), Megara Resins (Anastassios Fanis S.A.) (Greece), and other key companies. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics

Saturated Polyester Resin Market Dynamics

Increasing demand from the coatings industry and innovations in packaging solutions

The saturated polyester resin market is witnessing heightened demand from the coatings industry, driven by the need for durable, high-performance coatings in automotive, construction, and consumer goods applications. Polyester resins are favored for their excellent chemical resistance, weatherability, and ability to produce smooth finishes. Furthermore, innovations in packaging solutions are providing new opportunities for growth, as there is a growing trend towards sustainable and eco-friendly packaging materials. Saturated polyester resins, with their superior mechanical properties, are increasingly used in the development of biodegradable and edible packaging options. These advancements align with the global push for sustainability, as manufacturers aim to reduce environmental impact. Together, the rising demand from coatings and the evolving packaging solutions contribute significantly to the market's expansion.

Restraints & Challenges

Fluctuations in the prices of raw materials, such as petrochemicals, can lead to price volatility, affecting production costs and profit margins. Additionally, the environmental impact of some polyester resins, especially those derived from petrochemical sources, raises concerns as industries shift towards greener, more sustainable alternatives. Stringent regulations related to volatile organic compound (VOC) emissions and waste disposal further complicate production processes. The need for significant investment in research and development to create eco-friendly formulations adds to the financial burden on manufacturers. Furthermore, intense competition from alternative materials, such as epoxy resins and bio-based resins, challenges the market’s ability to maintain a competitive edge. These factors may limit the expansion of the market in the long term.

Regional Forecasts

North America Market Statistics

Get more details on this report -

North America is anticipated to dominate the Saturated Polyester Resin Market from 2023 to 2033. The region's focus on infrastructure development and the growing trend of green building practices are major contributors to the market's expansion. In the automotive sector, polyester resins are used for lightweight composite materials, supporting the shift toward fuel-efficient and electric vehicles. Additionally, North America is seeing increased demand for eco-friendly coatings and packaging solutions, in line with sustainability goals. However, challenges such as fluctuating raw material costs and strict environmental regulations around VOC emissions may impact growth. The U.S. dominates the market, with Canada and Mexico also contributing significantly. Overall, North America's market outlook remains positive, driven by innovation, industrial growth, and environmental initiatives.

Asia Pacific Market Statistics

Asia Pacific is witnessing the fastest market growth between 2023 to 2033. The saturated polyester resin market in Asia-Pacific is experiencing rapid growth, driven by strong industrialization and rising demand across sectors like automotive, construction, coatings, and packaging. The region's growing urbanization, particularly in countries like China and India, has spurred the need for durable, high-performance materials, boosting the demand for polyester resins. The automotive industry's shift towards lightweight composites for electric vehicles and fuel-efficient designs further contributes to market growth. Additionally, the increasing preference for eco-friendly solutions is driving innovations in sustainable and bio-based polyester resins. Asia-Pacific's market is also supported by cost-effective manufacturing, which allows for competitive pricing. However, the region faces challenges such as fluctuating raw material prices and stringent environmental regulations, which may impact the pace of growth. Despite this, the market remains poised for significant expansion.

Segmentation Analysis

Insights by Material

The solid saturated polyester resins segment accounted for the largest market share over the forecast period 2023 to 2033. These resins are widely used in powder coatings, which offer excellent corrosion resistance, chemical stability, and a smooth finish, making them ideal for automotive, architectural, and appliance coatings. The demand for solid polyester resins is also rising due to their environmental advantages, as powder coatings contain no solvents, reducing VOC emissions and supporting sustainability initiatives. The growth of end-use industries, particularly in Asia-Pacific and North America, further fuels the segment’s expansion. Additionally, ongoing advancements in resin formulations, improving properties like UV resistance and adhesion, are contributing to increased adoption. As industrialization accelerates globally, the solid polyester resin segment is expected to continue growing.

Insights by End Use

The powder coatings segment accounted for the largest market share over the forecast period 2023 to 2033. Powder coatings, which utilize solid saturated polyester resins, are favored for their low volatile organic compound (VOC) emissions, making them a sustainable alternative to traditional liquid coatings. These coatings offer excellent resistance to corrosion, abrasion, and weathering, making them ideal for applications in automotive, appliances, architectural, and industrial products. The shift towards eco-friendly solutions and stringent environmental regulations are major drivers of growth in this segment. Furthermore, advancements in powder coating technology, including improved curing processes and enhanced performance properties, are fueling further adoption. With growing industrialization and rising environmental concerns, the powder coatings segment is expected to continue its upward trajectory in the saturated polyester resin market.

Recent Market Developments

- In April 2021, Covestro AG has announced the completion of its acquisition of the Resins & Functional Materials (RFM) business, including the production of saturated polyester resins, from DSM. The deal is valued at USD 1.07 billion and is expected to boost Covestro AG’s revenue by this amount.

Competitive Landscape

Major players in the market

- Royal DSM N.V. (Netherlands)

- Allnex Belgium SA/NV (Belgium)

- Arkema S.A. (France)

- Nuplex Industries (New Zealand)

- Stepan Company (U.S.)

- Evonik Industries (Germany)

- Nippon Gohsei (Japan)

- Covestro AG (Germany)

- Megara Resins (Anastassios Fanis S.A.) (Greece)

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2033.

Saturated Polyester Resin Market, Material Analysis

- Liquid

- Solid

Saturated Polyester Resin Market, End Use Analysis

- Industrial Paints

- Powder Coatings

Saturated Polyester Resin Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the market size of the Saturated Polyester Resin Market?The global Saturated Polyester Resin Market is expected to grow from USD 6.7 billion in 2023 to USD 9.1 billion by 2033, at a CAGR of 3.11% during the forecast period 2023-2033.

-

2. Who are the key market players of the Saturated Polyester Resin Market?Some of the key market players of the market are Royal DSM N.V. (Netherlands), Allnex Belgium SA/NV (Belgium), Arkema S.A. (France), Nuplex Industries (New Zealand), Stepan Company (U.S.), Evonik Industries (Germany), Nippon Gohsei (Japan), Covestro AG (Germany), and Megara Resins (Anastassios Fanis S.A.) (Greece).

-

3. Which segment holds the largest market share?The powder coatings segment holds the largest market share and is going to continue its dominance.

-

4. Which region dominates the Saturated Polyester Resin Market?North America dominates the Saturated Polyester Resin Market and has the highest market share.

Need help to buy this report?