Global Scramjet Market Size, Share, and COVID-19 Impact Analysis, By Type (Around Mach 3, Around Mach 6, Others), By Application (Supersonic or Hypersonic Transportation, Military Applications, Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Aerospace & DefenseGlobal Scramjet Market Insights Forecasts to 2033

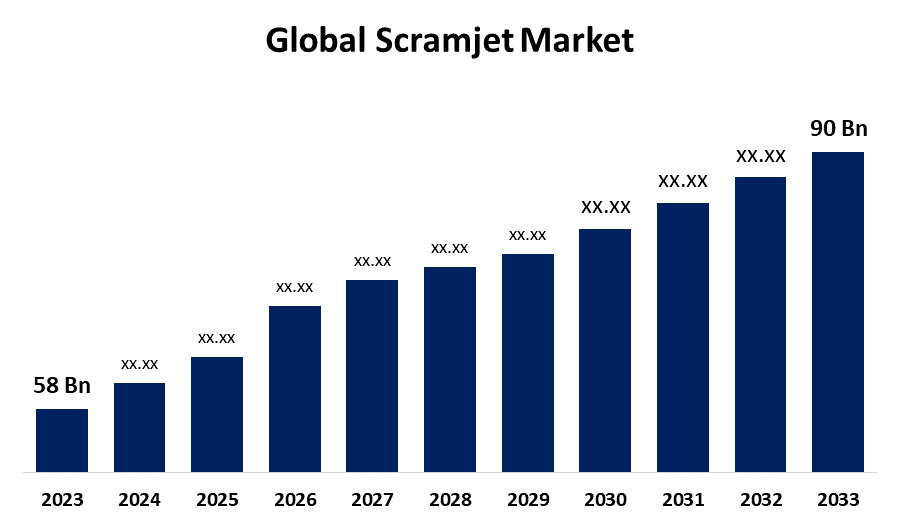

- The Global Scramjet Market Size was Valued at USD 58 Billion in 2023

- The Market Size is Growing at a CAGR of 4.49% from 2023 to 2033

- The Worldwide Scramjet Market Size is Expected to Reach USD 90 Billion by 2033

- Europe is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Scramjet Market Size is Anticipated to Exceed USD 90 Billion by 2033, Growing at a CAGR of 4.49% from 2023 to 2033.

Market Overview

The term scramjet, which stands for "supersonic combustion ramjet," refers to a sophisticated class of jet engine designed for effective operation at hypersonic speeds, usually higher than Mach 5. Scramjet engines rely on the vehicle's velocity to compress incoming air, in contrast to conventional jet engines that use turbines for this purpose. Faster access to space and the ability to conduct hypersonic flight inside Earth's atmosphere are made possible by this technology. The replacement of outdated products is expected to be driven by ongoing technology developments. The need for supersonic aircraft equipped with cutting-edge combat and surveillance technologies is rising as a result of changing mission objectives and threats, as well as the high cost of upgrades and the large number of obsolete aircraft fleets that require additional maintenance. Over the anticipated term, this spike in demand will be expected to have a significant effect on market expansion. Global technological developments and the growing requirement for shorter in-flight durations could propel the scramjet market's expansion. On the other hand, different strategic initiatives by the industry's private players and the growing need for aging military fleets might propel the scramjet market's expansion over the anticipated year.

Report Coverage

This research report categorizes the market for the scramjet market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the scramjet market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the scramjet market.

Global Scramjet Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 58 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 4.49% |

| 2033 Value Projection: | USD 90 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 198 |

| Tables, Charts & Figures: | 116 |

| Segments covered: | By Type, By Application, By Region. |

| Companies covered:: | MBDA, Aerojet Rocketdyne, Raytheon, Boeing, GenCorp, NASA, Northrop Grumma, Kratos, Hypersonix, and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The steady development of technological advancements is expected to lead to the replacement of conventional products. The evolving threats and completely new mission objectives, expensive upgrades, and many outdated aircraft fleets frequently need extra. The ongoing need for a supersonic aircraft outfitted with cutting-edge surveillance and combat technologies is anticipated to reach new heights in the forecasted timeframe. These factors are anticipated to propel market growth.

Restraining Factors

Scramjet are still forbidden in the US, despite the Federal Aviation Administration (FAA) and the US Department of Transportation having set strict guidelines as requirements for special authorizations for supersonic test flights. The definitive rules governing civil supersonic test flights in the nation have been released by the FAA.

Market Segmentation

The scramjet market share is classified into type and application.

- The around Mach 3 segment is expected to hold the largest share of the scramjet market during the forecast period.

Based on the type, the scramjet market is categorized into around Mach 3, around Mach 6, and others. Among these, the around Mach 3 segment is expected to hold the largest share of the scramjet market during the forecast period. In contrast, Mach 3 is anticipated to offer a profitable growth rate in the future due to technology advancements that enable businesses to reach supersonic speed for their objectives in the scramjet market.

- The military applications segment is expected to grow at the fastest CAGR during the forecast period.

Based on the application, the scramjet market is categorized into supersonic or hypersonic transportation, military applications, and others. Among these, the military applications segment is expected to grow at the fastest CAGR during the forecast period. Because of fast expanding political concerns around the world, as well as the rising demand of scramjets in military application. Development and innovation in military aircraft have progressed significantly. Due to the increasing purchase of contemporary 4th, 5th, and 6th generation fighter aircraft, the military sector is anticipated to dominate the market in the forecast period.

Regional Segment Analysis of the Global Scramjet Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

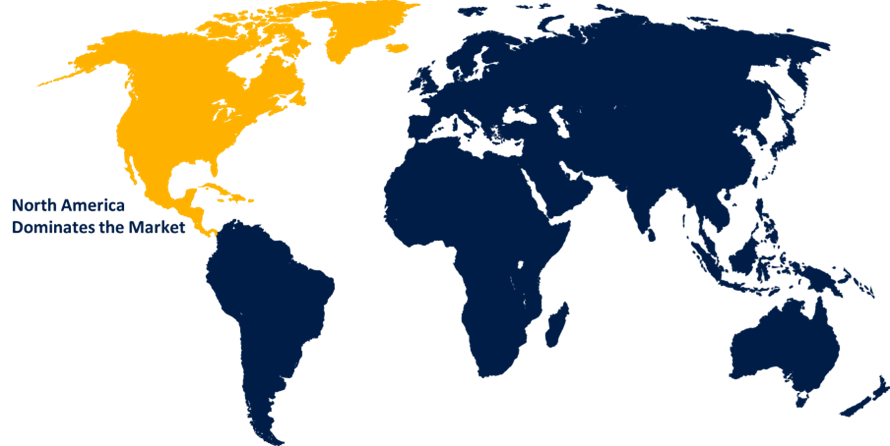

North America is projected to hold the largest share of the scramjet market over the forecast period.

Get more details on this report -

North America is projected to hold the largest share of the scramjet market over the forecast period. Because major businesses like the Boeing Company and Lockheed Martin Corporation are present. Furthermore, the increasing use of these planes for military purposes is credited with the expansion of the business in the area. Furthermore, all of the cutting-edge initiatives for the second-generation commercial supersonic airplane are being implemented in the North American continent.

Europe is expected to grow at the fastest CAGR growth of the scramjet market during the forecast period. Since the major market participants' pronounced presence in the area. On the other hand, Europe is growing at the fastest rate in the market since its governments there are allocating larger portions of their resources to military.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the scramjet market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- MBDA

- Aerojet Rocketdyne

- Raytheon

- Boeing

- GenCorp

- NASA

- Northrop Grumma

- Kratos

- Hypersonix

- Others

Key Market Developments

- In August 2023, A collaboration agreement has been signed by Kratos and Hypersonix Launch Systems to provide scramjet demonstrations to US clients. Through the agreement, the DART AE (additive manufacturing) drone will be seen in more places across the nation, and the US Department of Defense and other national security agencies will be made aware of the technology.

- In August 2023, Hypersonix has received a technology demonstrator version of their hydrogen-powered Spartan scramjet engine made in high-temperature ceramic matrix composite (HTCMC) from a major European aerospace company. HTCMC components are the preferred material for Hypersonix's reusable hypersonic vehicles because they can withstand multiple cycles of intense heating and cooling.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the global scramjet market based on the below-mentioned segments:

Global Scramjet Market, By Type

- Around Mach 3

- Around Mach 6

- Others

Global Scramjet Market, By Application

- Supersonic or Hypersonic Transportation

- Military Applications

- Others

Global Scramjet Market, By Regional

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the global scramjet market over the forecast period?The Scramjet Market Size is Expected to Grow from USD 58 Billion in 2023 to USD 90 Billion by 2033, at a CAGR of 4.49% during the forecast period 2023-2033.

-

2. Which region is expected to hold the highest share in the scramjet market?North America is projected to hold the largest share of the scramjet market over the forecast period.

-

3. Who are the top key players in the scramjet market?MBDA, Aerojet Rocketdyne, Raytheon, Boeing, GenCorp, NASA, Northrop Grumma, Kratos, Hypersonix, and others.

Need help to buy this report?