Global Seasoned Chili Market Size, Share, and COVID-19 Impact Analysis, By Type (Whole Chili, Chili Powder, Chili Flake, Chili Paste, and Others), By Form (Processed, Raw, Oleoresins, and Others), By Distribution Channel (Retail, Foodservice, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033.

Industry: Food & BeveragesGlobal Seasoned Chili Market Insights Forecasts to 2033

- The Global Seasoned Chili Market Size was estimated to exceed a significant share in 2023

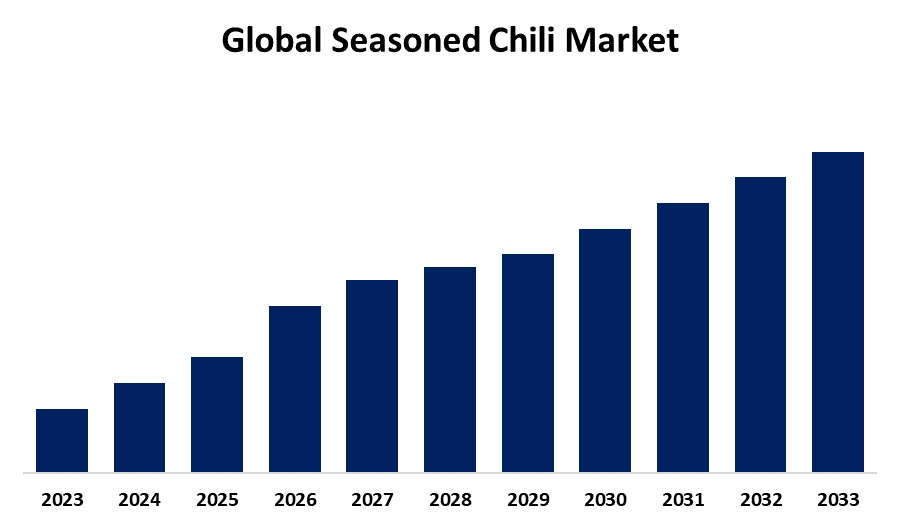

- The Market Size will Grow at a 6.3% CAGR from 2023 to 2033.

- The Worldwide Seasoned Chili Market Size is Expected to Reach a Significant Share by 2033.

- South America is expected to grow the fastest during the forecast period.

Get more details on this report -

The Global Seasoned Chili Market Size is anticipated to reach a significant share by 2033, at a 6.3% CAGR during the forecast period 2023-2033. The global seasoned chili market has substantial development potential, driven by rising consumer demand for flavorful and spicy meal options. Rising culinary creativity in households and restaurants, combined with the expanding popularity of ethnic cuisines, has increased global demand for seasoned chili products.

Market Overview

The global seasoned chili market refers to the commercial landscape that includes the production, distribution, and consumption of pre-seasoned chili-based products with complementary spices, herbs, and flavor-enhancing ingredients. Products are available in a variety of formats, including powders, flakes, pastes, and sauces, and service a wide range of applications within the food and beverage, food service, and retail sectors. Furthermore, growth in the market is primarily boosted by increasing demand for spicy and flavor-rich food items supported by the evolving preference of consumers toward ethnic cuisines and convenient ready-to-use seasoning solutions. Rising penetration of online retail platforms, coupled with increased demand for clean-label and organic products, are adding further to market expansion.

Additionally, the industry is becoming more competitive due to the launch of new varieties and products by major manufacturers. For instance, in December 2023, C.H. Guenther & Son announced the release of Hormel Chili Seasoning Mix Packets in collaboration with the Hormel Chili Company. This new product provides food manufacturers and home cooks with a new way to create chili dishes featuring Hormel Chili's familiar flavors. Furthermore, the seasoned chili market can grow through advertising and product awareness. For example, in October 2023, Suhana Masala, an Indian spice brand, launched its most recent advertising campaign to promote its new Chili Powder offering. With this initiative, the company expands its spice line presence in Gujarat. It has meticulously curated specific spice powders tailored to the region's unique flavor preferences.

Report Coverage

This research report categorizes the seasoned chili market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the seasoned chili market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the seasoned chili market.

Global Seasoned Chili Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Forecast Period: | 2023 – 2033 |

| Forecast Period CAGR 2023 – 2033 : | 6.3% |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 115 |

| Segments covered: | By Type, By Form, By Distribution Channel, By Regional Analysis |

| Companies covered:: | Givaudan McCormick & Company, Inc. Olam Group Ajinomoto Co., Inc. Tata Group (Tata Consumer Products) Kerry Group Associated British Foods plc Unilever Eden Foods, Inc. Conagra Brands, Inc. Schwartz (a subsidiary of McCormick & Company) DSM Nutritional Products Others |

| Pitfalls & Challenges: | COVID-19 Impact Analysis and Forecast 2023 - 2033 |

Get more details on this report -

Driving Factors

Several key factors contribute to the global seasoned chili market growth. Increasing consumer preference for bold, spicy flavors, as well as the growing popularity of ethnic cuisines, have significantly increased global demand for seasoned chili products. The convenience of ready-to-use chili powders, flakes, and pastes aligns with modern lifestyles, encouraging greater adoption in both the household and food service sectors. Health-conscious trends have also prompted the creation of organic, non-GMO, and preservative-free seasoned chili options, which appeal to a growing segment of conscientious shoppers.

Furthermore, chili cultivation is critical to ensuring a consistent supply of raw materials for the market, with major production hubs concentrated in Asia-Pacific, specifically India, China, and Thailand. These regions benefit from favorable climatic conditions, traditional farming practices, and high-yield chili varieties that allow for large-scale production. For instance, in November 2023, the Pathanamthitta district unit of the Kudumbashree Mission launched a novel initiative known as Chilli Village. It has formed Joint Liability Groups (JLGs) to cultivate chilies in 25-cent plots known as 'agroecological plots'. The first phase of the project is currently underway in 20 panchayats across the district. Additionally, the growth of online retail channels has made seasoned chili products more accessible, boosting consumption in emerging markets. The versatility of these products, which enhance flavor across a wide range of applications, from snacks to gourmet dishes, combined with increased culinary experimentation, drives market growth.

Restraining Factors

The global market is impacted by cultural preferences, with some regions consuming a lower inclination towards spicy food, limiting the potential for growth in the seasoned chili market. Additionally, the market for conventional chili-based products may be constrained by the increased competition from substitute seasonings and the growing acceptance of plant-based diets. Furthermore, the market is affected by the increased health risks associated with eating highly processed or spicy foods, as more consumers choose milder or healthier substitutes. Barriers are also posed by regulatory issues pertaining to food safety standards and labeling requirements, especially in several jurisdictions where compliance can be expensive and complicated.

Market Segmentation

The seasoned chili market share is classified into type, form, and distribution channel.

- The chili powder segment held the greatest share in 2023 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the type, the seasoned chili market is divided into whole chili, chili powder, chili flake, chili paste, and others. Among these, the chili powder segment held the greatest share in 2023 and is anticipated to grow at a significant CAGR during the forecast period. Chili powder's ability to be easily incorporated into processed foods such as sauces, snacks, ready-to-eat meals, and seasonings, as well as its widespread use in a variety of cuisines, from Mexican and Indian to American and Southeast Asian, has contributed to its dominance. The rising popularity of processed and convenience foods, of which chili powder is essential, also contributes to its dominance in the market.

- The processed segment accounted for the majority of the share in 2023 and is estimated to grow at the fastest CAGR during the projected timeframe.

Based on the form, the seasoned chili market is divided into processed, raw, oleoresins, and others. Among these, the processed segment accounted for the majority of the share in 2023 and is estimated to grow at the fastest CAGR during the projected timeframe. The food and beverage industry makes extensive use of processed chili products in seasonings, condiments, sauces, soups, and snacks. The segment's dominance is largely due to its widespread adoption in commercial food production. The demand for processed chili products is also fueled by their adaptability, flavor consistency, and ease of handling and storage.

- The retail segment held the largest share in 2023 and is estimated to grow at the fastest CAGR during the predicted timeframe.

Based on the distribution channel, the seasoned chili market is divided into retail, foodservice, and others. Among these, the retail segment held the largest share in 2023 and is estimated to grow at the fastest CAGR during the predicted timeframe. This is primarily due to rising consumer demand for chili-based products for both home cooking and personal use. With the growing popularity of spicy foods and an interest in international cuisines, more consumers are purchasing chili products such as chili powder, flakes, and sauces for daily use. Retail outlets, such as supermarkets, grocery stores, and online platforms, respond to this demand by providing a diverse selection of chili-based seasonings and prepared products that are easily accessible to a large customer base.

Regional Segment Analysis of the Seasoned Chili Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia-Pacific is anticipated to hold the largest share of the seasoned chili market over the predicted timeframe.

Get more details on this report -

Asia-Pacific is anticipated to hold the largest share of the seasoned chili market over the predicted timeframe. This dominance stems primarily from the region's rich culinary tradition of using chili in a variety of dishes, both fresh and processed. India, China, Thailand, and Indonesia are not only large consumers of chili products, but also major producers of chili peppers. The region's preference for spicy food, combined with the widespread use of chili in everyday meals and traditional cooking, fuels demand for seasoned chili products such as chili powder, flakes, and pastes.

South America is expected to grow at the fastest CAGR growth of the seasoned chili market during the forecast period. This is largely due to the region's long culinary tradition of incorporating chili peppers and spicy flavors into daily meals. Chili has a strong cultural significance in Latin American countries such as Mexico, Brazil, and Argentina, where it is commonly used in traditional dishes such as salsas, sauces, and stews. As the global demand for chili-based products increases, Latin America has emerged as a key hub for chili production and consumption.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Seasoned Chili market along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Givaudan

- McCormick & Company, Inc.

- Olam Group

- Ajinomoto Co., Inc.

- Tata Group (Tata Consumer Products)

- Kerry Group

- Associated British Foods plc

- Unilever

- Eden Foods, Inc.

- Conagra Brands, Inc.

- Schwartz (a subsidiary of McCormick & Company)

- DSM Nutritional Products

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In March 2023, Kitchen Xpress's latest innovation, the Red Chilli Powder Plus, offers a fusion of flavor and nutrition. This one-of-a-kind offering is enriched with essential vitamins B12, D3, and E, all of which are intended to improve consumer health.

Market Segment

- This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the seasoned chili market based on the below-mentioned segments:

Global Seasoned Chili Market, By Type

- Whole Chili

- Chili Powder

- Chili Flake

- Chili Paste

- Others

Global Seasoned Chili Market, By Form

- Processed

- Raw

- Oleoresins

- Others

Global Seasoned Chili Market, By Distribution Channel

- Retail

- Foodservice

- Others

Global Seasoned Chili Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the seasoned chili market over the forecast period?The Market Size will Grow at a 6.3% CAGR from 2023 to 2033.

-

2. What is the market size of the seasoned chili market?The Global Steel Waste Management Market Size is expected to reach a significant share by 2033, at a 6.3% CAGR during the forecast period 2023-2033.

-

3. Which region holds the largest share of the seasoned chili market?Asia-Pacific is anticipated to hold the largest share of the seasoned chili market over the predicted timeframe.

Need help to buy this report?