Global Secure Digital Card Market Size, Share, and COVID-19 Impact Analysis, By Size (Micro SD Card, SD Card, and Mini SD Card), By Application (Digital Cameras, Tablets, Mobile Phones, and Others), By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2022 – 2032).

Industry: Electronics, ICT & MediaGlobal Secure Digital Card Market Insights Forecasts to 2032

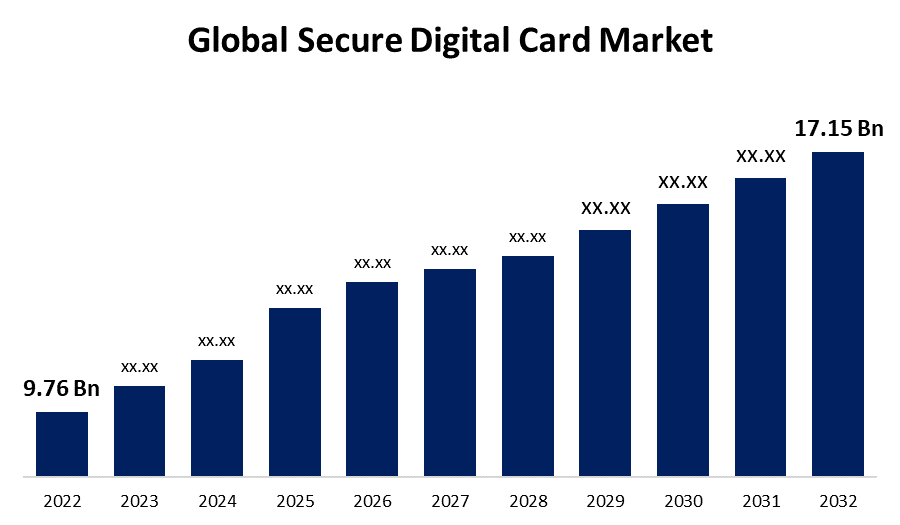

- The Global Secure Digital Card Market was valued at USD 9.76 Billion in 2022.

- The Market is growing at a CAGR of 5.8% from 2023 to 2032.

- The Worldwide Secure Digital Card Market is expected to reach USD 17.15 Billion by 2032.

- Asia-Pacific is expected to grow significant during the forecast period.

Get more details on this report -

The Global Secure Digital Card Market is expected to reach USD 17.15 Billion by 2032, at a CAGR of 5.8% during the forecast period 2023 to 2032.

Market Overview

The secure digital (SD) card is a popular form of removable flash memory storage used in a wide range of devices, including digital cameras, smartphones, tablets, and portable gaming consoles. It is designed to securely store and transfer data, making it ideal for applications that require reliability and data protection. The SD card comes in various capacities, ranging from a few gigabytes to terabytes, providing ample space for storing photos, videos, music, and other files. It utilizes advanced encryption and security protocols to protect sensitive information from unauthorized access. With its compact size, durability, and compatibility with multiple devices, the SD card has become a ubiquitous storage solution for both personal and professional use.

Report Coverage

This research report categorizes the market for global secure digital card market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global secure digital card market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segments of the global secure digital card market.

Global Secure Digital Card Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 9.76 Bn |

| Forecast Period: | 2022 – 2032 |

| Forecast Period CAGR 2022 – 2032 : | 5.8% |

| 022 – 2032 Value Projection: | USD 17.15 Bn |

| Historical Data for: | 2018-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 140 |

| Segments covered: | By Size, By Application, By Region. |

| Companies covered:: | Western Digital Corporation, SanDisk Corporation, Kingston Technology Company, Inc., Samsung Electronics Co., Ltd., Toshiba Corporation, Panasonic Corporation, Micron Technology, Inc., Transcend Information, Inc., ADATA Technology Co., Ltd., Sony Corporation, Strontium Technology Pte Ltd., Lexar, Verbatim Americas LLC, Patriot Memory, LLC, PNY Technologies, Inc., Silicon Power Computer & Communications Inc., Apacer Technology Inc., and Others. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The secure digital (SD) card market is driven by several factors, the increasing demand for storage in electronic devices such as smartphones, digital cameras, and tablets fuels the growth of the market. As the size and quality of digital files continue to expand, the need for larger storage capacities becomes crucial. The rapid adoption of IoT devices and smart home technologies contributes to the market's expansion. These devices generate and require substantial amounts of data storage for seamless functionality. Additionally, the rising trend of capturing high-resolution photos and videos, along with the popularity of content streaming services, creates a demand for larger storage capabilities. Overall, advancements in SD card technologies, including faster transfer speeds, higher data security, and enhanced durability, attract consumers and drive market growth. Overall, the drivers of the SD card market are fueled by the evolving digital landscape and consumers' increasing need for reliable and secure data storage solutions.

Restraining Factors

Despite the growth drivers, the secure digital (SD) card market also faces certain restraints. One major limitation is the increasing popularity of cloud storage solutions, which offer convenient and accessible storage options without the need for physical media. This shift towards cloud-based storage reduces the demand for SD cards. Additionally, the emergence of alternative storage technologies, such as solid-state drives (SSDs) and embedded memory solutions, poses a challenge to the SD card market. These technologies offer higher storage capacities and faster data transfer speeds, making them appealing alternatives to traditional SD cards. Overall, concerns over data privacy and security may also restrain the market, as users may be hesitant to store sensitive information on removable media.

Market Segmentation

- In 2022, the micro SD card segment accounted for around 48.3% market share

On the basis of the size, the global secure digital card market is segmented into micro SD card, SD card, and mini SD card. The micro SD card segment has emerged as the dominant player in the secure digital (SD) card market, capturing the largest market share for several compelling reasons. The ever-increasing popularity of smartphones and other portable devices is a key driver for the dominance of micro SD cards. With smartphones becoming an essential part of daily life, consumers seek to expand their device storage to accommodate larger media files, apps, and documents. Micro SD cards offer a convenient and cost-effective solution, providing substantial storage capacity in a small form factor that fits seamlessly into various devices.

Furthermore, the micro SD card's versatility and compatibility have contributed to its market leadership. It is widely used in smartphones, tablets, action cameras, drones, and other devices, catering to a broad user base across multiple industries. Additionally, advancements in micro SD card technology have played a crucial role in capturing the largest market share. Manufacturers have continuously improved storage capacities, data transfer speeds, and reliability of micro SD cards, meeting the demands of content creators, gamers, and professionals alike. These technological advancements have further solidified the micro SD card's position as the preferred removable storage option. The affordability of micro SD cards in comparison to other storage options makes them accessible to a wider audience, contributing to their widespread adoption and market dominance.

- In 2022, the digital cameras segment dominated with more than 41.5% market share

Based on the application, the global secure digital card market is segmented into digital cameras, tablets, mobile phones, and others. The digital cameras segment has emerged as the dominant force in the secure digital (SD) card market, commanding a significant market share for several compelling reasons, digital cameras have become increasingly popular among photography enthusiasts, professionals, and hobbyists. The demand for high-quality images and videos, coupled with the convenience and advanced features offered by digital cameras, has fueled the growth of this segment. Digital cameras often rely on SD cards as the primary storage medium, driving the demand for SD cards in the market over the forecast period.

Furthermore, the rising trend of vlogging, content creation, and social media sharing has contributed to the dominance of the digital cameras segment. Content creators and influencers require reliable and high-capacity storage solutions to store and transfer their multimedia files. SD cards, with their ample storage capacities and fast data transfer speeds, offer an ideal solution for these needs. Additionally, the professional photography industry heavily relies on digital cameras and SD cards. Professional photographers, wedding photographers, and videographers demand robust and high-performance storage solutions to capture and store large volumes of high-resolution images and videos. SD cards provide the necessary capacity and speed required to meet these demanding professional needs. Moreover, the advancements in digital camera technology, including higher megapixel counts, improved video recording capabilities, and advanced features such as RAW image formats, contribute to the dominance of the digital cameras segment. These technological advancements drive the need for SD cards with larger storage capacities and faster write speeds to handle the increasing file sizes. Overall, the growing availability and affordability of digital cameras across various price ranges and consumer segments have expanded the user base for this segment. As more consumers invest in digital cameras, the demand for SD cards as a storage solution increases proportionally.

Regional Segment Analysis of the Secure Digital Card Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

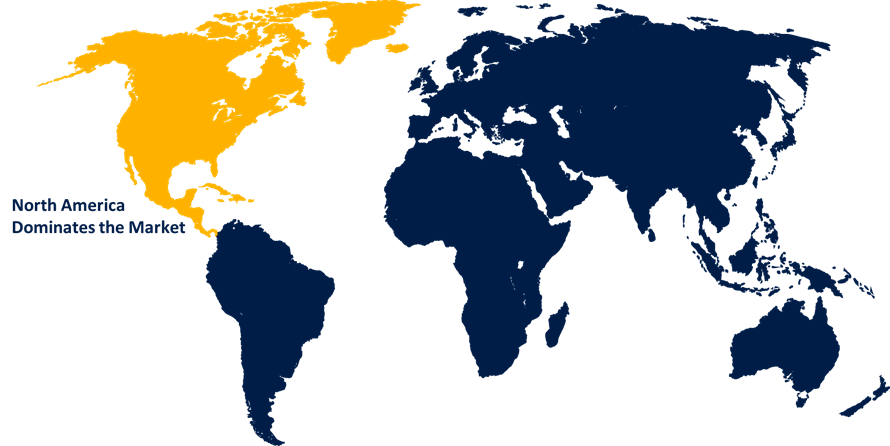

North America dominated the market with more than 37.4% revenue share in 2022.

Get more details on this report -

Based on region, North America region is anticipated to dominate the Secure Digital (SD) card market and hold the highest share of the market in 2022. This growth is due to presence of several prominent technology companies and is a hub for innovation and technological advancements across this region. As a result, it fosters a strong demand for SD cards in various consumer electronics, including smartphones, tablets, and digital cameras. The region has a high smartphone penetration rate, with a significant portion of the population relying on mobile devices for communication, entertainment, and productivity. This drives the need for expandable storage options provided by SD cards. Furthermore, the region has a robust e-commerce infrastructure and a digitally savvy population, which fuels the online sales of SD cards. Overall, the region's strong emphasis on data privacy and security creates a demand for reliable and secure storage solutions like SD cards. Overall, these factors contribute to North America's leading position in the SD card market.

Recent Developments

- In September 2022, to provide Fortnite SanDisk microSDXC card for Nintendo Switch, Western Digital Corporation partnered with Epic Games, an American business that develops video games and software, and Nintendo, a Japanese video game company. By providing memory cards with unique themes for the Fortnite community, this cooperation will enhance the game experience for fans.

- In May 2022, A microSD card called Samsung PRO Endurance was announced by Samsung Electronics. This item is specifically made for body cameras, doorbell cameras, security cameras, and dashboard cameras. The new card offers excellent performance for dependable, uninterrupted, and fluid recording and playback.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global secure digital card market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Companies:

- Western Digital Corporation

- SanDisk Corporation

- Kingston Technology Company, Inc.

- Samsung Electronics Co., Ltd.

- Toshiba Corporation

- Panasonic Corporation

- Micron Technology, Inc.

- Transcend Information, Inc.

- ADATA Technology Co., Ltd.

- Sony Corporation

- Strontium Technology Pte Ltd.

- Lexar

- Verbatim Americas LLC

- Patriot Memory, LLC

- PNY Technologies, Inc.

- Silicon Power Computer & Communications Inc.

- Apacer Technology Inc.

Key Target Audience

- Market Players

- Investors

- End-Users

- Government Authorities

- Consulting and Research Firm

- Venture Capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at global, regional, and country levels from 2019 to 2032. Spherical Insights has segmented the global secure digital card market based on the below-mentioned segments:

Secure Digital Card Market, By Size

- Micro SD Card

- SD Card

- Mini SD Card

Secure Digital Card Market, By Application

- Digital Cameras

- Tablets

- Mobile Phones

- Others

Secure Digital Card Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of Middle East & Africa

Need help to buy this report?