Global Security Brokerage and Stock Exchange Market Size, Share, and COVID-19 Impact Analysis, By Type (Stock Exchanges, Derivatives & Commodities Brokerage, Equities Brokerage, Bonds Brokerage, and Others), By Establishment Type (Investment Firms, Banks, and Exclusive Brokers), By Mode (Online and Offline), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Banking & FinancialGlobal Security Brokerage and Stock Exchange Market Insights Forecasts to 2033

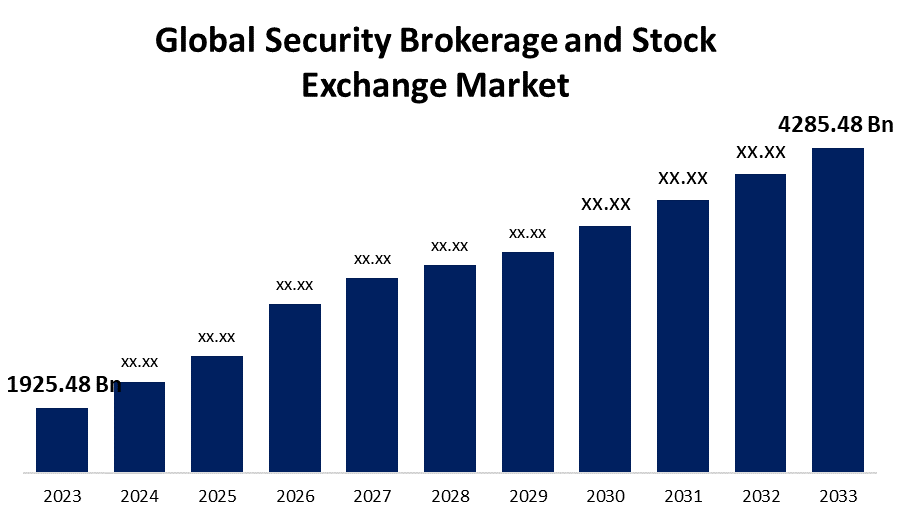

- The Global Security Brokerage and Stock Exchange Market Size was Valued at USD 1925.48 Billion in 2023

- The Market Size is Growing at a CAGR of 8.33% from 2023 to 2033

- The Worldwide Security Brokerage and Stock Exchange Services Market Size is Expected to Reach USD 4285.48 Billion by 2033

- Europe is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Security Brokerage and Stock Exchange Market Size is Anticipated to Exceed USD 4285.48 Billion by 2033, Growing at a CAGR of 8.33% from 2023 to 2033.

Market Overview

A financial company on the stock or commodity markets that purchases and sells assets on behalf of its clients in exchange for a brokerage fee is known as a stock brokerage. A regulated and standardized marketplace where traders and stockbrokers can purchase and sell stocks, bonds, and other assets is called a stock exchange. A securities brokerage is a business unit that assists an individual or an organization in buying, selling, or exchanging securities in exchange for a fee, commission, or other type of payment. Any financial instrument that has substantial value and can be traded between interested parties is referred to be a securities in the financial market. The term securities can be used to refer to any financial product or service, including stocks, bonds, mutual funds, exchange-traded funds, and funds that are available for purchase or sale. Conversely, stocks are a kind of security that, when purchased, grants the purchaser a portion of ownership in a business or corporation. A stock exchange is a platform where several buyers and sellers can join together to trade financial instruments within designated daily and weekly hours, which are typically from Monday through Friday. The world of stock exchanges and securities trading has drastically changed in recent years due to a combination of factors including legislative changes, technological developments, and shifting investor preferences.

Report Coverage

This research report categorizes the market for the global security brokerage and stock exchange market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global security brokerage and stock exchange market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global security brokerage and stock exchange market.

Global Security Brokerage and Stock Exchange Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 1925.48 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 8.33% |

| 2033 Value Projection: | USD 4285.48 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 220 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Type, By Establishment Type, By Mode, By Region |

| Companies covered:: | Bank of America Corporation, Citigroup Global Markets Inc., Smith Barney, Northwestern Mutual Life Insurance Company, INVEST Financial Corporation, Ameriprise Financial Services Inc., Edward Jones & Co. L.P., Raymond James Financial Inc., Genworth Financial Inc., Wells Fargo Advisors LLC, H&R Block Financial Advisors Inc., H.D. Vest Financial Services Inc., Ameritas Investment Corp., Associated Securities Corporation., and other key companies. |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis. |

Get more details on this report -

Driving Factors

A few stock exchanges are exploring how blockchain technology can help with securities trading. Platforms built on blockchain technology might provide quicker and safer trading in addition to improved settlement procedures' efficiency and transparency. Increasingly, stock exchanges are attempting to enter new international markets through partnerships and acquisitions. Investors can now access securities from more companies and areas than in the past. Additionally, recent years have seen a rise in the popularity of environmental, social, and governance (ESG) investing, with numerous stock exchanges and securities brokerages now providing ESG-focused investment products. As long as investors continue to consider how their investments affect the world around them, this tendency is probably going to continue. In recent times, online trading systems have gained significant traction, enabling investors to purchase and sell stocks from the convenience of their homes. This is expected to increase the global stock exchanges and securities brokerages market.

Restraining Factors

Excessive market volatility can make it hard for investors to forecast future moves, which can cause hesitation and a decline in trading activity. Market uncertainty can result from geopolitical threats such as international trade disputes, political instability, reduced trading volumes, and investor confidence. The market share of global stock exchanges and securities brokerages might be adversely affected by cybersecurity breaches and other security issues.

Market Segmentation

The global security brokerage and stock exchange market share is segmented into type, establishment type, and mode.

- The stock exchanges segment dominates the market with the largest market share through the forecast period.

Based on the type, the global security brokerage and stock exchange market is segmented into stock exchanges, derivatives & commodities brokerage, equities brokerage, bonds brokerage, and others. Among these, the stock exchange segment dominates the market with the largest market share through the forecast period. Due to the increasing prevalence of advanced financial products and technology developments. High-frequency trading, algorithmic trading, and electronic trading platforms have all grown in popularity as a result of digital transformation, which has improved stock market efficiency and liquidity. In addition, the market now has a new dimension due to the development of thematic and sustainable investing. The embracing of cryptocurrencies and the establishment of Special Purpose Acquisition Companies (SPACs) are two further factors contributing to the changing environment. This expanding stock exchange sector illustrates how the financial industry is always changing and adapting as markets adjust to shifting investor tastes and developments in the world economy.

- The investment firms segment is anticipated to grow at the fastest CAGR growth through the forecast period.

Based on the establishment type, the global security brokerage and stock exchange market is segmented into investment firms, banks, and exclusive brokers. Among these, the investment firms segment is anticipated to grow at the fastest CAGR growth through the forecast period. The financial sector offers a wide range of investment options and concepts. Given the high risk associated with the finance business, selecting the best option from the available options can be scary and perplexing for the average person. Therefore, they frequently hire investment firms' services to receive guidance and assistance in making wise judgments.

• The online segment accounted for the largest revenue share through the forecast period.

Based on the mode, the global security brokerage and stock exchange market is segmented into online and offline. Among these, the online segment accounted for the largest revenue share through the forecast period. Stock exchanges and securities brokerages are rapidly expanding their online operations, changing how the financial markets operate as it has historically. Modern technology has made the shift to online platforms easier and more seamless, giving investors instant access to research materials, trading tools, and market data. People can now trade stocks and securities from the comfort of their homes or mobile devices, democratizing financial involvement.

Regional Segment Analysis of the Global Security Brokerage and Stock Exchange Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the global security brokerage and stock exchange market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of the global security brokerage and stock exchange market over the predicted timeframe. The region is home to important financial centers, including wall street in the US and bay street in Canada, where NASDAQ and the New York Stock Exchange (NYSE) are two of the most important stock exchanges. The prominence of North America in securities trading can be attributed to its strong regulatory framework, technological innovation, and concentration of important financial institutions. The region has been the birthplace and spreader of innovations like as computerized trading platforms and high-frequency trading, which have improved market efficiency and liquidity. Global investors are drawn to the wide range of companies listed in North American markets, which enhances the region's reputation as a financial powerhouse. The securities markets in North America are dynamic and resilient, which highlights the region's continuous supremacy in determining the direction of global finance.

Europe is expected to grow at the fastest CAGR growth of the global security brokerage and stock exchange market during the forecast period. Europe has an established financial infrastructure, which includes well-known exchanges like Euronext and the London Stock Exchange. The European Securities and Markets Authority (ESMA) and other powerful regulatory bodies, as well as a varied range of institutional and individual investors, are some of the factors that contribute to the stability of the geopolitical landscape in Europe. Another important influence is the financial infrastructure of the region. The advanced trading platforms and infrastructure of European exchanges enable significant trade volumes and liquidity. These exchanges are well-developed. These exchanges provide a variety of financial instruments and services and act as hubs for both domestic and foreign investors.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global security brokerage and stock exchange market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Bank of America Corporation

- Citigroup Global Markets Inc.

- Smith Barney

- Northwestern Mutual Life Insurance Company

- INVEST Financial Corporation

- Ameriprise Financial Services Inc.

- Edward Jones & Co. L.P.

- Raymond James Financial Inc.

- Genworth Financial Inc.

- Wells Fargo Advisors LLC

- H&R Block Financial Advisors Inc.

- H.D. Vest Financial Services Inc.

- Ameritas Investment Corp.

- Associated Securities Corporation.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In February 2023, A cloud-based platform called GS Strats was introduced by Goldman Sachs to provide clients with pre-configured algorithmic trading strategies. In addition to meeting the increasing need for automated trading solutions, this broadens Goldman Sachs' market penetration beyond conventional high-frequency trading firms.

- In January 2023, CME Group the top derivatives marketplace in the world announced that, subject to regulatory review, it will add monday, tuesday, wednesday, and thursday weekly options to its lineup of weekly options expiries for its Micro E-mini Nasdaq-100 and S&P 500 futures.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the global security brokerage and stock exchange market based on the below-mentioned segments:

Global Security Brokerage and Stock Exchange Market, By Type

- Stock Exchanges

- Derivatives & Commodities Brokerage

- Equities Brokerage

- Bonds Brokerage

- Others

Global Security Brokerage and Stock Exchange Market, By Establishment Type

- Investment Firms

- Banks

- Exclusive Brokers

Global Security Brokerage and Stock Exchange Market, By Mode

- Online

- Offline

Global Security Brokerage and Stock Exchange Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. Which are the key companies that are currently operating within the market?Bank of America Corporation, Citigroup Global Markets Inc., Smith Barney, Northwestern Mutual Life Insurance Company, INVEST Financial Corporation, Ameriprise Financial Services Inc., Edward Jones & Co. L.P., Raymond James Financial Inc., Genworth Financial Inc., Wells Fargo Advisors LLC, H&R Block Financial Advisors Inc., H.D. Vest Financial Services Inc., Ameritas Investment Corp., Associated Securities Corporation, and Others.

-

2. What is the size of the global security brokerage and stock exchange market?The Global Security Brokerage and Stock Exchange Market Size is Expected to Grow from USD 1925.48 Billion in 2023 to USD 4285.48 Billion by 2033, at a CAGR of 8.33% during the forecast period 2023-2033.

-

3. Which region is holding the largest share of the market?North America is anticipated to hold the largest share of the global security brokerage and stock exchange market over the predicted timeframe.

Need help to buy this report?