Global Seed Treatment Materials Market Size, Share, and COVID-19 Impact Analysis, By Crop Type (Cereals & Grains, Sugar Beets & Vegetables, and Oilseeds & Pulses), By Treatment Method (Biological Seed Treatment, Chemical Seed Treatment, and Physical Seed Treatment), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033.

Industry: Chemicals & MaterialsGlobal Seed Treatment Materials Market Insights Forecasts to 2033

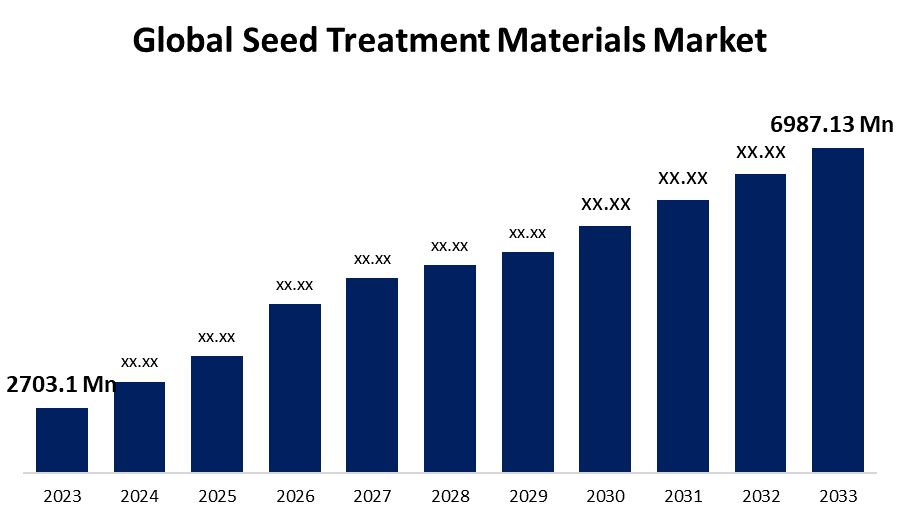

- The Global Seed Treatment Materials Market Size was Valued at USD 2703.1 Million in 2023

- The Market Size is Growing at a CAGR of 9.96% from 2023 to 2033

- The Worldwide Seed Treatment Materials Size is Expected to Reach USD 6987.13 Million by 2033

- Asia Pacific is expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Seed Treatment Materials Market Size is Anticipated to Exceed USD 6987.13 Million by 2033, Growing at a CAGR of 9.96% from 2023 to 2033.

Market Overview:

Seed treatment material refers to applying specific chemicals or techniques to seeds before they are sown to control or repel plant diseases. The efficiency of seed treatment and coatings can increase the usage of biostimulants which will provide a greater chance of improving stand establishment than foliar and soil treatment techniques. The three primary objectives of seed treatment are to increase agricultural output, boost seed germination, and shield seeds against pests and diseases. The market for seed treatment materials is anticipated to expand in years to come due to the fact that seed treatment is a crucial stage in the agricultural production process. The predicted period of market expansion could be accelerated by the growing public awareness of the seed treatment study. Due to the expanding population, there is a greater need for food, which in turn drives increased crop output requirements. There is a greater need for food demand due to the expanding population which in turn drives increased crop output requirements further increasing the market growth. The long-term advancement of nanoscale agrochemicals for seed treatment can be greatly aided by nanotechnology, which can also improve the efficiency of agricultural inputs, hence boosting market growth.

Report Coverage:

This research report categorizes the market for the global seed treatment materials based on various segments and regions forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global seed treatment materials market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global seed treatment materials market.

Global Seed Treatment Materials Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 2703.1 Million |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 9.96% |

| 2033 Value Projection: | USD 6987.13 Million |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Crop Type, By Treatment Method, By Region |

| Companies covered:: | BASF SE, Novozymes A/S, Clariant Specialty Chemicals, Syngenta AG, Croda International Plc, Germains Seed Technology, Tozer Seeds Ltd, Nufarm Limited, Centor Oceania, ADAMA Agricultural Solutions Ltd, UPL Limited, Jeevan Chemicals Pvt. Ltd, Tagros Chemicals India Ltd, Sumitomo Chemical, Corteva Agriscience, Eastman Chemical Company, FMC Corporation, Chromatech Incorporated, and other key companies. |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis. |

Get more details on this report -

Driving Factors:

The seed treatment industry is expected to move toward more accurate and personalized solutions that can boost market progress. A big step toward more ecologically friendly agriculture that will support market expansion is the incorporation of biologicals into seed treatments. It enables farmers to continue or even increase agricultural yield while lowering their need for artificial chemicals. For instance, Lavie Bio's ThrivusTM bio-inoculant seed treatment for wheat boosts crop output and promotes more environmentally friendly farming methods by improving the efficiency and availability of soil nutrients while reducing environmental stressors.

Restraining Factors:

With the growing raw material prices, it is anticipated that the cost of seed treatment materials will rise, which will limit market expansion. The strict laws governing the use of pesticides and other chemicals are impeding the market for seed treatment materials.

Market Segmentation:

The global seed treatment materials market share is classified into type and application.

- The sugar beets & vegetables segment has the highest share of the market over the forecast period.

Based on the crop type, the global seed treatment materials market is categorized into cereals & grains, sugar beets & vegetables, and oilseeds & pulses. Among these, the sugar beets & vegetables segment has the highest share of the market over the forecast period. The growing demand for organic sugar beat & vegetables is fuelling expansion in the seed treatment material market. Priming is often done on sugar beet seeds as a pre-treatment practice. Priming helps to increase germination traits, particularly the uniformity and speed of emergence under adverse circumstances, which will help to boost the growth of the market. The rising technological advancement is also boosting the growth of the segment. For instance, Xbeet priming is the initial seed treatment for sugar beets carried out by Germain's seed technology. Researchers apply Xbeet to the seed to accelerate emergence and boost plant growth.

- The biological seed treatment segment holds the largest share of the market during the forecast period.

Based on the Treatment Method, the global seed treatment materials market is categorized into biological seed treatment, chemical seed treatment, and physical seed treatment. Among these, the biological seed treatment segment holds the largest share of the market during the forecast period. Prominent companies frequently recommend Trichoderma fertile, Penicillium bilabiate, Bacillus firmus, and Rhizobium leguminiosarium as biological seed treatment alternatives. Biologicals will keep growing alongside chemical seed treatment solutions as an integrated pest control approach. The natural substances found in biological seed treatments prevent the growth of harmful pathogens that can augment the growth of the segment. The active elements in biological seed treatment solutions, which protecting crops. These substances regulate primary soil and seed-borne insect and disease infestations. For instance, BASF derived product Votivo Prime is a biological contact nematicide that gives rice, cotton, maize, and soybeans resistance to worms.

Regional Segment Analysis of the Global Seed Treatment Materials Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Europe is projected to hold the largest share of the global seed treatment materials market over the forecast period.

Get more details on this report -

Europe accounted for the largest portion of the market for seed treatments, with Spain at the top, followed by France, Germany, and Russia. The main forces behind market expansion are the region's increased interest in agriculture and the demand for higher-quality seeds. To prevent anthrax diseases like decay and naked smut, seed treatments are necessary for main crops like cereals (corn, barley, etc.) and fodder plants (alfalfa, clover, rapeseed, etc.). Additionally, seed treatments might support the early growth of the crop. Therefore, seed treatments based on manganese and zinc that strengthen the plant's root system are becoming more popular in the area.

Asia Pacific region is also expected to fastest CAGR growth during the forecast period. The majority of countries in this region still lack an efficient framework for the registration, production, and distribution of biological seed treatments. Businesses that are well-established in the biological seed treatment industry in Asia-Pacific have plenty of opportunities to grow. Major players in the Asia-Pacific seed treatment market include Bayer CropScience, Syngenta, and local companies Tata Rallis and Shenghua Group Agrochemicals. Rice, cotton, maize, and soybeans are resistant to worms.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global seed treatment materials market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies:

- BASF SE

- Novozymes A/S

- Clariant Specialty Chemicals

- Syngenta AG

- Croda International Plc

- Germains Seed Technology

- Tozer Seeds Ltd

- Nufarm Limited

- Centor Oceania

- ADAMA Agricultural Solutions Ltd

- UPL Limited, Jeevan Chemicals Pvt. Ltd

- Tagros Chemicals India Ltd

- Sumitomo Chemical

- Corteva Agriscience

- Eastman Chemical Company

- FMC Corporation

- Chromatech Incorporated

- Others

Key Market Developments:

- In May 2022, the Seedcare division of Syngenta Crop Protection is pleased to introduce VICTRATO, a cutting-edge technology that offers growers a potent blend of disease and nematode management to enhance crop quality and production while promoting the long-term health of their soil.

- In April 2022, Corteva Agriscience opened a new Center for Seed Applied Technologies (CSAT) in southwest France with the goal of helping European farmers maximize crop yields and harvest them with success.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the global seed treatment materials market based on the below-mentioned segments:

Global Seed Treatment Materials Market, By Crop Type

- Cereals & Grains

- Sugar Beets & Vegetables

- Oilseeds & Pulses

Global Seed Treatment Materials Market, By Treatment Method

- Biological Seed Treatment

- Chemical Seed Treatment

- Physical Seed Treatment

Global Seed Treatment Materials Market, By Regional

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the global seed treatment materials market over the forecast period?The global seed treatment materials market size is expected to grow from USD 2703.1 Million in 2023 to USD 6987.13 Million by 2033, at a CAGR of 9.96 % during the forecast period 2023-2033.

-

2. Which region is expected to hold the highest share in the global seed treatment materials market?Europe is projected to hold the largest share of the global seed treatment materials market over the forecast period.

-

3. Who are the top key players in the seed treatment materials market?BASF SE, Novozymes A/S, Clariant Specialty Chemicals, Syngenta AG, Croda International Plc, Germains Seed Technology, Tozer Seeds Ltd, Nufarm Limited, Centor Oceania, ADAMA Agricultural Solutions Ltd, UPL Limited, Jeevan Chemicals Pvt. Ltd, Tagros Chemicals India Ltd, Sumitomo Chemical, Corteva Agriscience, Eastman Chemical Company, FMC Corporation, Chromatech Incorporated, and Others.

Need help to buy this report?