Global Self-testing Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Kits, Devices, and Strips), By Sample Type (Blood, Urine, Saliva, and Others), By Test Type (Laboratory Tests and Home-Based Tests), By Usage (Disposable and Reusable), By Distribution Channel (Brick-and-Mortar Stores and E-Commerce), By Application (Blood Glucose Test, Pregnancy Test, Allergy Test, STD/STI Test, Cancer Test, Drug Abuse Testing, Genetic Testing, Cholesterol & Triglycerides Tests, Urinary Tract Infection Testing and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: HealthcareGlobal Self-testing Market Insights Forecasts to 2033

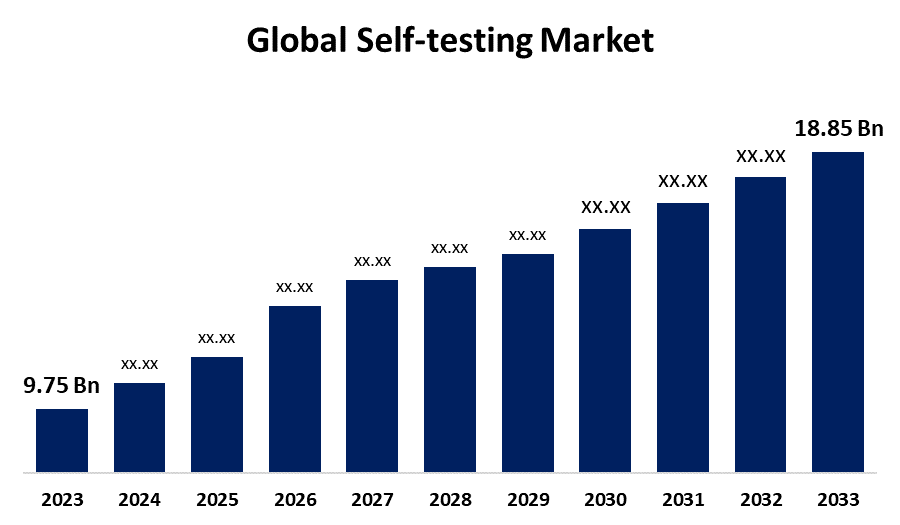

- The Global Self-testing Market Size was Valued at USD 9.75 Billion in 2023

- The Market Size is Growing at a CAGR of 6.81% from 2023 to 2033

- The Worldwide Self-testing Market Size is Expected to Reach USD 18.85 Billion by 2033

- Asia Pacific is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Self-testing Market Size is Anticipated to Exceed USD 18.85 Billion by 2033, Growing at a CAGR of 6.81% from 2023 to 2033.

Market Overview

Self-testing refers to a self-care approach that enables people to take their own sample, perform a simple test, and interpret the result themselves. WHO recommends self-care interventions for every country and economic setting as critical components on the path to reaching universal health coverage (UHC), promoting health, keeping the world safe, and serving the vulnerable. A self-test is quite simple in that self-test medical device allows quick test and receives a fast and accurate result within minutes, easy to gain access to the tests. There are numerous benefits to self-testing kits such as rapid and curated tests being performed in a short period lending a great advantage in the clinical management of illnesses. Modern advances such as immunochemistry and immunodiffusion have led to the creation of numerous testing strategies. It has become so rudimentary that without the requirement of any basic training, analytes can be tested in the confines of one’s home.

Report Coverage

This research report categorizes the market for the global self-testing market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global self-testing market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global self-testing market.

Global Self-testing Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 9.75 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 6.81% |

| 2033 Value Projection: | USD 18.85 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Product Type, By Sample Type, By Test Type, By Usage, By Distribution Channel, By Application, By Region |

| Companies covered:: | Piramal Enterprises Ltd., Johnson & Johnson Services, Inc., OraSure Technologies, Inc., B. Braun Melsungen AG, Cardinal Health, PRIMA Lab SA, F. Hoffmann-La Roche Ltd., ACON Laboratories Inc., bioLytical Laboratories Inc., Becton, Dickinson and Company, ARKRAY Inc, Bionime Corporation, Alere Inc., Assure Tech (Hangzhou) Co. Ltd., Geratherm Medical AG, and Others Key Vendors |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis. |

Get more details on this report -

Driving Factors

The growing adoption of business development strategies such as agreements, collaborations, and acquisitions. The increasing awareness of preventive healthcare and its key benefits is propelling the demand for routine tests, screenings, and immunizations that ultimately resulted in driving the global self-testing market. About 21% of the elderly in India reportedly have at least one chronic disease. Seventeen percent elderly in rural areas and 29% in urban areas suffer from a chronic disease. Hypertension and diabetes account for about 68% of all chronic diseases. Thus, the increasing number of chronic disease patients is anticipated to escalate the market demand for self-testing owing to the rising emphasis on self-monitoring applications that allow patients to measure their physical health parameters. The growing aging population is also responsible for propelling the market demand to manage health and wellness conveniently at home. The development of technologically advanced self-test kits to make self-testing more accurate and user-friendly leads to the adoption of self-testing among consumers.

Restraining Factors

Product recalls due to the safety and quality concerns related to a product's manufacturing design defect negatively affect a company’s stock, affecting the firm’s reputation and declining sales. For instance, the USFDA has recalled more than half a million COVID tests over significant bacterial contamination concerns. That causes the test to give an inaccurate result. Further, the limited test menu limits the usefulness of self-testing in certain situations that may hamper the global self-testing market.

Market Segmentation

The global self-testing market share is classified into product type, sample type, test type, usage, distribution channel, and application.

- The kits segment dominated the market with the largest revenue share in 2023.

Based on the product type, the global self-testing market is categorized into kits, devices, and strips. Among these, the kits segment dominated the market with the largest revenue share in 2023. Test kits are self-contained analytical kits that generally use a chemical reaction that produces color to identify contaminants, both qualitatively and quantitatively, having speed, portability, ease of use, low cost per sample, and the range of contaminants that can be analyzed. It is further categorized as self-testing kits and self-collection kits. The kits segment gives a wide range of tests and health parameters in a single product and offers better value for money over purchasing individual devices separately.

- The blood-based tests segment dominates the market with the largest revenue share of the global self-testing market in 2023.

Based on the sample type, the global self-testing market is categorized into blood, urine, saliva, and others. Among these, the blood-based tests segment dominates the market with the largest revenue share of the global self-testing market in 2023. A home blood collection test is a convenient way to get blood drawn from the comfort of own home. It is a convenient, accurate & hassle-free way of sampling in which users may perceive blood-based tests as more accurately analyzing biomarkers such as lipid profiles, and glucose levels, in blood. The increasing cases of chronic disorders such as diabetes and cardiovascular diseases are propelling the market demand in the blood-based tests segment.

- The home-based tests segment accounted for the largest share of the global self-testing market during the forecast period.

Based on the test type, the global self-testing market is categorized into laboratory tests and home-based tests. Among these, the home-based tests segment accounted for the largest share of the global self-testing market during the forecast period. At-home testing is frequently used to find or screen for disorders, such as high cholesterol or certain infections, before you have symptoms, diagnose pregnancy early, and monitor chronic diseases, such as diabetes and high blood pressure. Users can integrate testing into their daily routines, especially for chronic diseased patients who require frequent monitoring such as blood glucose levels. And fertility tracking.

- The disposable segment accounted for the largest revenue share of the global self-testing market in 2023.

Based on the usage, the global self-testing market is categorized into disposable and reusable. Among these, the disposable segment accounted for the largest revenue share of the global self-testing market in 2023. Sterility is inherently easier with single-use devices kept in sterile packaging until the time of use. Minimizes the risk of cross-contamination, maintaining accuracy and reliability of test results. The growing awareness of infection control during the COVID-19 pandemic has driven the market demand for the self-testing market in the disposable segment in at-home testing as well as in point-of-care settings.

- The brick-and-mortar stores segment dominated the market with the largest revenue share of the self-testing market in 2023.

Based on the distribution channel, the global self-testing market is categorized into brick-and-mortar stores and e-commerce. Among these, the brick-and-mortar stores segment dominated the market with the largest revenue share of the self-testing market in 2023. Brick-and-mortar businesses are physical establishments where customers purchase products or services and interact face-to-face with employees. Products are obtained instantly without waiting for shipping, especially for conditions when quick access is needed to test solutions.

- The allergy test segment accounted for the largest revenue share of the global self-testing market in 2023.

Based on the application, the global self-testing market is categorized into blood glucose test, pregnancy test, allergy test, STD/STI test, cancer test, drug abude testing, genetic testing, cholesterol and triglycerides tests, urinary tract infection testing and others. Among these, the allergy test segment accounted for the largest revenue share of the global self-testing market in 2023. Allergies are becoming more common in urbanized communities. The most common testing being done by primary care physicians is serum IgE, as they are relatively easy to interpret and can be compared. An estimated 10% to 30% of the global population has an allergic disease.

Regional Segment Analysis of the Global Self-testing Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the global self-testing market over the predicted timeframe.

Get more details on this report -

North America is projected to hold the largest share of the global self-testing market over the forecast period. The growing focus on consumer empowerment surges the participation of patients in monitoring and managing their health. Further, the prevalence of chronic diseases contributed to the adoption of self-testing kits for proactive management of chronic diseases such as diabetes and cardiovascular disorders. Furthermore, the integration of technologies such as smartphone applications, and digital health platforms has made self-testing more attractive and accessible.

Asia-Pacific is expected to grow at the fastest CAGR growth of the global self-testing market during the forecast period. There is a growing awareness regarding several products of self-testing. Self-testing kits are easily accessible at pharmacies and the presence of various medical companies is driving the market. The growing population surges the demand for quality medical care. Further, the growing incidence of chronic diseases and The increasing number of key market players are also responsible for driving market growth in the region.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global self-testing market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Piramal Enterprises Ltd.

- Johnson & Johnson Services, Inc.

- OraSure Technologies, Inc.

- B. Braun Melsungen AG

- Cardinal Health

- PRIMA Lab SA

- F. Hoffmann-La Roche Ltd.

- ACON Laboratories Inc.

- bioLytical Laboratories Inc.

- Becton, Dickinson and Company

- ARKRAY Inc

- Bionime Corporation

- Alere Inc.

- Assure Tech (Hangzhou) Co. Ltd.

- Geratherm Medical AG

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In March 2022, An agreement was reached between Arlington Scientific, a Utah-based manufacturer of medical test kits, and the Brain Chemistry Labs, a not-for-profit research institute in Jackson Hole for the development of a rapid, easy-to-use test for the cyanobacterial toxin BMAA which has been implicated as a risk factor for ALS and other neurodegenerative diseases.

- In May 2022, Clinical Enterprise, Inc. d/b/a empowerDX, announced the launch of a revolutionary at-home Celiac Risk Gene Test. The launch, combined with becoming a sponsor of the Celiac Disease Foundation, puts empowerDX in a unique position to help a large population of Americans in debilitating physical and mental pain without clear answers.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the global self-testing market based on the below-mentioned segments:

Global Self-testing Market, By Product Type

- Kits

- Devices

- Strips

Global Self-testing Market, By Sample Type

- Blood

- Urine

- Saliva

- Others

Global Self-testing Market, By Test Type

- Laboratory Tests

- Home-Based Tests

Global Self-testing Market, By Usage

- Disposable

- Reusable

Global Self-testing Market, By Distribution Channel

- Brick-and-Mortar Stores

- E-Commerce

Global Self-testing Market, By Application

- Blood Glucose Test

- Pregnancy Test

- Allergy Test

- STD/STI Test

- Cancer Test

- Drug Abuse Testing

- Genetic Testing

- Cholesterol & Triglycerides Tests

- Urinary Tract Infection Testing

- Others

Global Self-testing Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the global self-testing market over the forecast period?The global self-testing market is projected to expand at a CAGR of 6.81% during the forecast period.

-

2. What is the projected market size & growth rate of the global self-testing market?The global self-testing market was valued at USD 9.75 Billion in 2023 and is projected to reach USD 18.85 Billion by 2033, growing at a CAGR of 6.81% from 2023 to 2033.

-

3. Which region is expected to hold the highest share in the global self-testing market?The North America region is expected to hold the highest share of the global self-testing market.

Need help to buy this report?