Global Semiconductor Fabless Market Size, Share, and COVID-19 Impact Analysis, By Type (Microcontrollers (MCUs), Digital Signal Processors (DSP), Graphic Processing Units (GPUs), Application Specific Integrated Circuits (ASIC), Power Management ICs (PMICs), and Others), By End-use (Consumer Electronics, Automotive, Industrial, Telecommunication, Healthcare, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033.

Industry: Semiconductors & ElectronicsGlobal Semiconductor Fabless Market Insights Forecasts to 2033

- The Global Semiconductor Fabless Market Size was estimated at USD 3.51 Billion in 2023

- The Market Size is Expected to Grow at a CAGR of around 10.29% from 2023 to 2033

- The Worldwide Semiconductor Fabless Market Size is Expected to Reach USD 9.35 Billion by 2033

- North America is expected to grow the fastest during the forecast period.

![]()

Get more details on this report -

The Global Semiconductor Fabless market size was worth around USD 3.51 Billion in 2023 and is predicted to grow to around USD 9.35 Billion by 2033 with a compound annual growth rate (CAGR) of approximately 10.29% between 2023 and 2033. The rapid advancement of artificial intelligence (AI) and machine learning (ML) technologies is driving the growth of the market.

Market Overview

Semiconductor fabless firms are those that deal with semiconductor design and development without having manufacturing lines. The semiconductor fabless industry is expanding effectively because of the elastic nature of the services, which are embracing new technologies that enable them to address market demand. The firms largely deal with R&D, product designing, and developing new technologies that can produce effective solutions. In addition, firms like NVIDIA, AMD, Qualcomm, and MediaTek are leading the semiconductor fabless industry, providing chips for various applications ranging from data centers and smartphones to automotive and consumer electronics. Furthermore, growing needs for highly efficient and integrated chips for different applications in IoT are driving the growth of the market. These include low-power communication modules, sensors, and microcontrollers that allow for smooth connectivity and data exchange. Also, 5G network expansion is yet another major driver of growth in the semiconductor fabless market. With further deployment of 5G technology across the globe, there will be a higher demand for semiconductor devices that provide high-speed data transmission, low latency, and improved connectivity.

Report Coverage

This research report categorizes the global semiconductor fabless market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global semiconductor fabless market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global semiconductor fabless market.

Global Semiconductor Fabless Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 3.51 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 10.29% |

| 2033 Value Projection: | USD 9.35 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 211 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Type, By End-use, By Region |

| Companies covered:: | Qualcomm Inc., Nvidia Corporation, Broadcom Inc., MediaTek Inc., Advanced Micro Devices Inc. (AMD), UNISOC (Shanghai)Technologies Co., Ltd., Novatek Microelectronics Corp., XMOS, LSI Corporation, SMIC, and other key players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The growth of the market is driven by the rising need for sophisticated semiconductor devices, especially in industries like consumer electronics, healthcare, and automotive electronics. Advances in semiconductor manufacturing processes also contribute significantly to the growth of the market. Furthermore, the growth of digital transformation in most industries is boosting the demand for semiconductor components, thus propelling market growth.

Restraining Factors

The rising cost and complexity of semiconductor design is one of the key drivers that may slow down the growth of the market. Furthermore, market companies rely significantly on third-party foundries for production, which may create supply chain risks and possible disruptions.

Market Segmentation

The global semiconductor fabless market share is classified into type and end-use.

- The application specific integrated circuits (ASIC) segment accounted for the largest share in 2023 and is projected to grow at a remarkable CAGR during the forecast period.

In the terms of type, the global semiconductor fabless market is divided into microcontrollers (MCUs), digital signal processors (DSP), graphic processing units (GPUs), application specific integrated circuits (ASIC), power management ICs (PMICs), and others. Among these, the application specific integrated circuits (ASIC) segment accounted for the largest share in 2023 and is projected to grow at a remarkable CAGR during the forecast period. The segment expansion is fueled by their specialization in processing exclusive tasks with improved efficiency and performance over general-purpose chips like digital signal processors (DSPs) or microcontrollers (MCUs).

- The consumer electronics segment accounted for the largest revenue share in 2023 and is anticipated to grow at a significant CAGR during the forecast period.

In the terms of end-use, the global semiconductor fabless market is divided into consumer electronics, automotive, industrial, telecommunication, healthcare, and others. Among these, the consumer electronics segment accounted for the largest revenue share in 2023 and is anticipated to grow at a significant CAGR during the forecast period. The segment growth is driven by the steady demand for semiconductors applied in products like smartphones, tablets, and game consoles. Firms like Apple, Samsung, and Sony rely on energy-efficient, high-performance chips designed by fabless semiconductor companies to satisfy increasing consumer needs.

Regional Segment Analysis of the Global Semiconductor Fabless Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

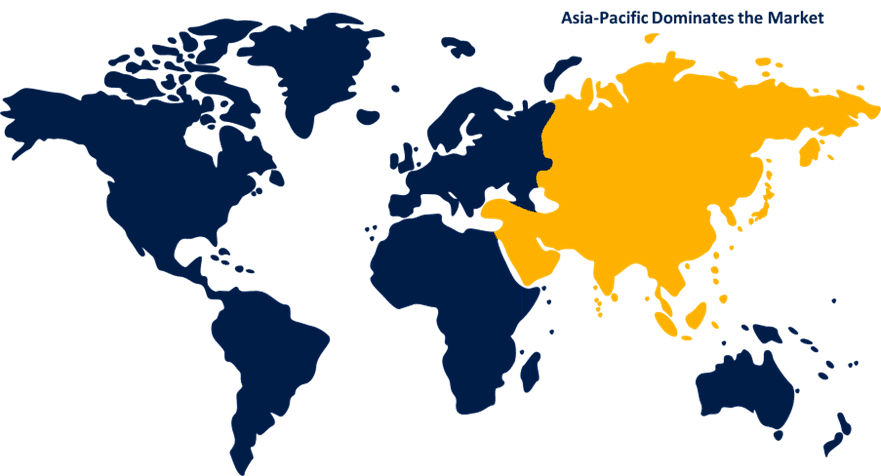

Asia Pacific is anticipated to hold the largest share of the global semiconductor fabless market over the predicted timeframe.

Get more details on this report -

Asia Pacific is anticipated to hold the largest share of the global semiconductor fabless market over the predicted timeframe. The growth of the market is driven by the region's strong focus on electronics manufacturing and technological innovation. Nations such as China, South Korea, Japan, and India are significant contributors, with a high concentration of both fabless companies and end-use industries. The region's increasing consumer electronics market, increasing IoT applications, and evolution in 5G technology are also fueling the demand for new semiconductor components in the market.

North America is expected to grow at the fastest CAGR in the global semiconductor fabless market during the forecast period. The region's growth is contributed by the increasing data centers in countries such as the United States and Canada. These nations are increasingly focusing on the implementation of technologies such as AI and ML, which bring various business opportunities to the region. The increasing adoption of cloud computing services based on the demand for data security is expected in the coming years.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global semiconductor fabless market along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Qualcomm Inc.

- Nvidia Corporation

- Broadcom Inc.

- MediaTek Inc.

- Advanced Micro Devices Inc. (AMD)

- UNISOC (Shanghai)Technologies Co., Ltd.

- Novatek Microelectronics Corp.

- XMOS

- LSI Corporation

- SMIC

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In August 2024, VanEck recently launched the VanEck Fabless Semiconductor ETF (SMHX). This ETF focuses on companies involved in semiconductor design and development but outsource their manufacturing1. By doing so, these companies can allocate more resources to innovation and R&D, making them well-equipped to adapt to new technologies and market demands.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the global semiconductor fabless market based on the below-mentioned segments:

Global Semiconductor Fabless Market, By Type

- Microcontrollers (MCUs)

- Digital Signal Processors (DSP)

- Graphic Processing Units (GPUs)

- Application Specific Integrated Circuits (ASIC)

- Power Management ICs (PMICs)

- Others

Global Semiconductor Fabless Market, By End Use

- Consumer Electronics

- Automotive

- Industrial

- Telecommunication

- Healthcare

- Others

Global Semiconductor Fabless Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

Which region held the largest share of the semiconductor fabless market revenue in 2023?Asia Pacific is anticipated to hold the largest share of the global semiconductor fabless market over the predicted timeframe.

-

Which segment, by end-use, led the semiconductor fabless market share in 2023?The consumer electronics segment accounted for the largest revenue share in 2023 and is anticipated to grow at a significant CAGR during the forecast period.

Need help to buy this report?