Global Servo Motors and Drives Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Servo Motors and Servo Drives), By Voltage Range (Low Voltage, Medium Voltage, and High Voltage), By System (Linear System and Rotary System), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033.

Industry: Energy & PowerGlobal Servo Motors and Drives Market Insights Forecasts to 2033

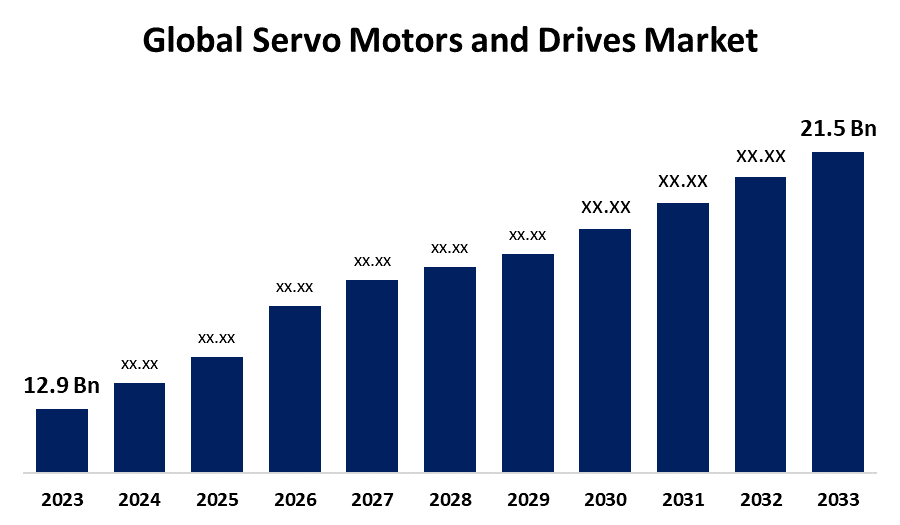

- The Global Servo Motors and Drives Market Size was Valued at USD 12.9 Billion in 2023

- The Market Size is Growing at a CAGR of 5.24% from 2023 to 2033

- The Worldwide Servo Motors and Drives Market Size is Expected to Reach USD 21.5 Billion by 2033

- North America is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Servo Motors and Drives Market Size is Anticipated to Exceed USD 21.5 Billion by 2033, Growing at a CAGR of 5.24% from 2023 to 2033.

Market Overview

Servo motors are rotary actuators that are very precise and efficient, allowing for control of angular position, velocity, and acceleration. Because of their capacity for accurate and swift movement control, they are commonly employed across a range of uses, from manufacturing equipment to robotics. However, servo drives are amplifiers of an electronic nature that control and provide power to the servo motors. Input signals, usually voltage or current, are received and converted into the exact movements carried out by the servo motor. Consequently, servo motors and drives are utilized across the globe in the automotive, packaging, robotics, semiconductors, electronics, and rubber and plastic industries. Currently, the increasing use of servo motors and drives, which guarantee improved accuracy and repeatability, is driving the market forward. With this in mind, the market is experiencing growth due to the rising use of servo motors and drives in generating renewable energy. Additionally, the increasing need for accuracy, quickness, and dependability in different sectors worldwide is having a positive impact on the market. Moreover, the increasing use of actuators to minimize maintenance expenses and operational interruptions is offering profitable prospects for business investors.

Report Coverage

This research report categorizes the market for the global servo motors and drives market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global servo motors and drives market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global servo motors and drives market.

Global Servo Motors and Drives Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 12.9 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 5.24% |

| 2033 Value Projection: | USD 21.5 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 201 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Product Type, By Voltage Range, By System, By Region |

| Companies covered:: | ABB Ltd., Bosch Rexroth AG, Delta Electronics, Inc., Emerson Electric Co., Fanuc Corporation, Mitsubishi Electric Corporation, Nidec Corporation, Rockwell Automation Inc., Schneider Electric SE, Siemens AG, Yaskawa Electric Corporation, Fuji Electric, Kollmorgen Corporation, Parker Hannifin Corporation, Omron Corporation, and Others |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis. |

Get more details on this report -

Driving Factors

The increasing acceptance of automation and robotics across different sectors is driving the expansion of the market. In the manufacturing industry, these technologies contribute to boosting production processes through enhanced precision and versatility. Servo motors and drivers play a crucial role in robots, delivering the precision and speed necessary for tasks like pick-and-place operations, welding, and assembly. Moreover, the rise in the e-commerce industry is driving market growth as there is a growing need for automated solutions in logistics and warehousing. Furthermore, there is an increase in the need for servo systems to operate conveyor belts, sorters, and automated guided vehicles (AGVs). Energy efficiency is a significant issue in various sectors because of environmental and financial factors. These motors and drives are well-known for their superior energy efficiency, making them an ideal option for businesses looking to decrease power usage and operational expenses. These systems have been created to provide power at exactly the right time, reducing energy waste when not in use or under low load.

Restraining Factors

Significant financial resources are required to incorporate new automation technologies into the existing framework. Incorporating new technologies into the existing infrastructure is part of factory automation. Improving the automation technologies requires a significant investment to update the entire infrastructure. Small and medium-sized businesses face challenges with securing funds to invest in Industry 4.0 technologies. Multiple manufacturers may find this investment to be a hindrance. Servo motors in this situation result in increased system and installation expenses relative to other motors because of the feedback components.

Market Segmentation

The global servo motors and drives market share is classified into product type, voltage range, and system.

- The servo motors segment is anticipated to hold the largest share of the market during the forecast period.

Based on the product type, the global servo motors and drives market is divided into servo motors and servo drives. Among these, the servo motors segment is anticipated to hold the largest share of the market during the forecast period. Servo motors can be easily found in both alternating current (AC) and direct current (DC) versions. AC servo motors function with alternating current and provide improved control over speed and torque. DC servo motors run on DC power and offer better torque performance at low velocities, making them ideal for robotics, conveyor systems, and precision-dependent tasks.

- The low voltage segment is estimated to dominate the market during the forecast period.

Based on the voltage range, the global servo motors and drives market is divided into low voltage, medium voltage, and high voltage. Among these, the low voltage segment is estimated to dominate the market during the forecast period. Low voltage servo motors are created to function at lower voltage levels, generally under 600 volts, which makes them appropriate for various applications with moderate power needs. Low voltage servo motors offer significant benefits in terms of safety and seamless integration with current electrical systems.

- The rotary system segment is anticipated to hold the largest share of the market during the forecast period.

Based on the system, the global servo motors and drives market is divided into linear system and rotary system. Among these, the rotary system segment is anticipated to hold the largest share of the market during the forecast period. Rotary systems are created to transform electrical signals into accurate rotary movement, making them suitable for a variety of uses in different industries. Moreover, they are extremely adaptable and extensively utilized in activities that need precise rotation, like powering conveyor belts, managing the motion of robotic arms, running CNC machinery, and others. They are appropriate for tasks that require accurate positioning and control of speed.

Regional Segment Analysis of the Global Servo Motors and Drives Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific is anticipated to hold the largest share of the global servo motors and drives market over the predicted timeframe.

Get more details on this report -

Asia Pacific is anticipated to hold the largest share of the global servo motors and drives market over the predicted timeframe. The Asia-Pacific region, including countries such as China, Japan, South Korea, and India, has experienced quick industrialization and expansion in manufacturing industries. Servo motors play a crucial role in industrial automation, robotics, and machinery utilized in manufacturing operations. The growth of sectors like automotive, electronics, consumer goods, and aerospace increases the need for servo motors to improve productivity, efficiency, and quality management. The car industry heavily relies on servo motors for different purposes such as assembly line automation, robotic welding, painting, and handling. The Asia-Pacific region is a center for automotive manufacturing, with growing demands for passenger vehicles, commercial vehicles, and electric vehicles driving the use of servo motors in automotive production plants. Countries in the Asia-Pacific region are at the forefront of manufacturing electronics, semiconductors, and electronic parts. Servo motors play a crucial role in electronics and semiconductor manufacturing for tasks like precision machining, pick-and-place operations, and wire bonding. The increasing need for servo motors in this region is being fueled by the expansion of consumer electronics, telecommunications, and semiconductor sectors.

North America is expected to grow at the fastest pace in the global servo motors and drives market during the forecast period. This is a result of the fast-growing need for energy, rising exploration and production efforts, reduced reliance on coal reserves, and efforts to boost the use of renewable sources like solar and wind power. This region also serves as the main production center for various products in different industries like electronics, and the increasing global demand for these products will support the utilization of these technologies.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global servo motors and drives market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- ABB Ltd.

- Bosch Rexroth AG

- Delta Electronics, Inc.

- Emerson Electric Co.

- Fanuc Corporation

- Mitsubishi Electric Corporation

- Nidec Corporation

- Rockwell Automation Inc.

- Schneider Electric SE

- Siemens AG

- Yaskawa Electric Corporation

- Fuji Electric

- Kollmorgen Corporation

- Parker Hannifin Corporation

- Omron Corporation

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In October 2023, Yaskawa Electric Corporation unveiled the extension of the GA700 series of advanced AC drives. The range of 400V-class capacities has been increased from 0.4 to 355 kW to 0.4 to 630 kW. By including the high-capacity band, the GA700 is now suitable for a wider variety of applications on larger general industrial machinery and equipment.

- In September 2023, Mitsubishi Electric Automation Inc. revealed the enhancement of its MELESRVO-J5 product lineup to offer additional choices for OEMs and end-users. The latest MR-J5 servo products feature two new servo models, HK-RT/ST, as well as the introduction of high-speed HK-KT/ST servo motors rated at 3,000 rpm.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the global servo motors and drives market based on the below-mentioned segments:

Global Servo Motors and Drives Market, By Product Type

- Servo Motors

- Servo Drives

Global Servo Motors and Drives Market, By Voltage Range

- Low Voltage

- Medium Voltage

- High Voltage

Global Servo Motors and Drives Market, By System

- Linear System

- Rotary System

Global Servo Motors and Drives Market, Regional

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. Which are the key companies that are currently operating within the market?The key companies that are currently operating within the market are ABB Ltd., Bosch Rexroth AG, Delta Electronics, Inc., Emerson Electric Co., Fanuc Corporation, Mitsubishi Electric Corporation, Nidec Corporation, Rockwell Automation Inc., Schneider Electric SE, Siemens AG, Yaskawa Electric Corporation, Fuji Electric, Kollmorgen Corporation, Parker Hannifin Corporation, Omron Corporation, and others.

-

2. What is the size of the global servo motors and drives market?The Global Servo Motors and Drives Market Size is Expected to Grow from USD 12.9 Billion in 2023 to USD 21.5 Billion by 2033, at a CAGR of 5.24% during the forecast period 2023-2033.

-

3. Which region is holding the largest share of the market?Asia Pacific is anticipated to hold the largest share of the global servo motors and drives market over the predicted timeframe.

Need help to buy this report?