Global Sex Toys Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Vibrators, Dildos, Penis Rings, Anal Toys, Masturbation Sleeves, Sex Dolls, Harnesses, and Others), By Distribution Channel (Specialty Stores, Supermarket/Hypermarket, E-commerce, and Mass Merchandizers), By End-User (Male, Female, Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2021 - 2030

Industry: Consumer GoodsGlobal Sex Toys Market Insights Forecasts to 2030

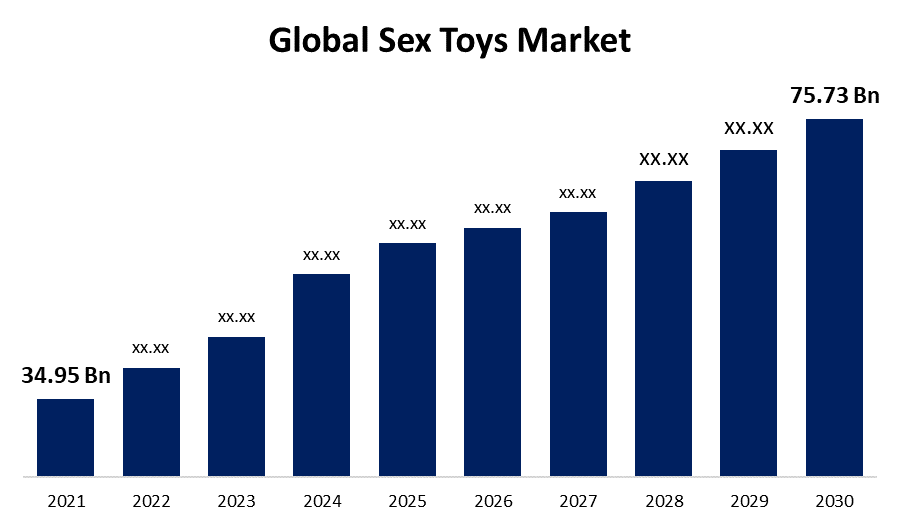

- The Global Sex Toys Market Size was valued at USD 34.95 billion in 2021.

- The Market is growing at a CAGR of 12.97% from 2021 to 2030

- The Worldwide Sex Toys Market is expected to reach USD 75.73 billion by 2030

- Europe is expected to grow the fastest during the forecast period

Get more details on this report -

The Global Sex Toys Market Size is expected to reach USD 75.73 billion by 2030, at a CAGR of 12.97% during the forecast period 2021 to 2030. In 2021, the global market for sex toys was valued at 1,482 million toys, with a projected increase to 3,508 million toys by 2030. The sex toy market grows at an average annual rate of 18% and doubles roughly every eighth year. In 2021, nearly 10% of people are using sex toys on a daily basis, which is double, compared to 5% in 2018. Sex toys are popular with both younger and older generations: 65% of 18-35 year aged uses them on an occasional basis or more, and 35% of those 51 and aged use them at least every other week. Globally, 78% of individuals over the age of 18 have at least one sex toy, with younger generations being more susceptible to purchasing and owning adult toys.

A sex toy, also known as an adult toy or a martial aid, is a device or item that is majorly used to facilitate human sexual desires, such as a dildo, sex doll, or vibrator. If an individual has a sexual dysfunction or a medical condition, sex toys can have medical applications. There are different varieties of sex toys, and consumers use them for a variety of reasons. Most famous sex toys are designed to appear like human genitals and can be vibrating or not. Furthermore, the term sex toy can refer to BDSM equipment as well as sex furniture such as sex swings; however, it does not include products such as fertility drugs, pornographic materials, or contraceptives.

Individuals with disabilities or lack of mobility use sex toys to facilitate the ability for them to reach orgasm, have intimate relations, or do physical intercourse or positions that might otherwise be difficult or impossible for them. Sex toys can also aid in the treatment of symptoms associated with certain disorders such as sexual dysfunction, sexual arousal disorder, hypoactive sexual desire disorder (HSDD), and orgasm disorder. According to the National Institutes of Health, female hypoactive sexual desire disorder (HSDD) affects up to one-third of adult females in the United States. Female HSDD is distinguished by a lack of sexual fantasies and desire for sexual activity, which causes significant distress or intra - personal complexity. Similarly, some users experience that using sex toys helps them cope with the sexual side effects of certain medications, medical conditions, or menopausal symptoms, such as a lack of sexual willingness or lowered genital sensation.

Adult toys as well as the dated slang term marital aid are two synonyms for the sex toy. Marital aid can also refer to drugs and herbs that are marketed to improve or prolong sex. Sex toys have a variety of benefits, including lowering the risk of unintended pregnancy, and STDs, and doubling the pleasure of sex with or without a companion. There are thousands of different sex toys on the market around the world. Vibrators, dildos, penis rings, anal toys, masturbation sleeves, sex dolls, and harnesses are among the most popular. Erotic furniture is a design that is built specifically for pleasure, stimulation, and penetration levels. The most common piece of furniture used for sexual activity is the bed, though couches and sofas are a close second. However, almost anything can be used for this purpose. Machines for spanking and flagellation, which include the Berkley horse, fisting slings, sex gliders, sex swings, and many others, are examples of specifically designed furniture for sexual purposes.

Covid-19 Impact on Sex Toys Market

COVID-19 had a strong influence on the sex toy market due to increased online activity and a massive increase in toy sales also during the early phase of the pandemic owing to social distancing and quarantine. Customers switched to app-enabled adult toys and Bluetooth-powered toys, also widely regarded as teledildonics, at COVID-19 to decrease their exposure to harmful chemicals in sex toys. In addition, the growing popularity of toys can be mainly ascribed to couples willing to experiment with their relationships. However many manufacturers and retailers are improving the user experience by developing modern technological toys. The Lovense Lush 3 vibrator, for example, provides powerful G-spot stimulation that is simple to control using the app.

In both 2019 and 2020, the sex toys market increased by more than 25.93%. According to previous estimates, the market would be worth nearly USD 27 billion in 2020. Furthermore, during the COVID time span, Germany's Adult toy online store quadrupled its sales; relatively similar patterns were noticed in Italy, France, the United States, and Mexico. In Asia Pacific, China the major manufacturer of electronics, as well as a significant producer of sex toys and adult toys, increased its production capabilities by threefold during the COVID-19 pandemic. Moreover, during the pandemic, India even had a surge in demand for various types of such products.

Driving Factors

Global Sex Toys Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2021 |

| Market Size in 2021: | USD 34.95 Billion |

| Forecast Period: | 2021-2030 |

| Forecast Period CAGR 2021-2030 : | 12.97% |

| 2030 Value Projection: | USD 75.73 Billion |

| Historical Data for: | 2017-2020 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Product Type, By Distribution Channel, By End-User and By Region. |

| Companies covered:: | AdamEve, Church & Dwight Co., Inc., Reckitt Benckiser Group plc, LELO, Bijoux Indiscrets, Tenga Co., Ltd., Fun Factory, Blue Rabbit, We-Vibe, Luvu Brands, Inc., OhMiBod, BMS Factory, Crystal Delights, Bad Dragon Enterprises, Inc., Hot Octopuss limited, Tantus, Inc., Spot of Delight, Ansell Healthcare, LifeStyles Healthcare Pte Ltd, Doc Johnson Enterprises, Lovehoney Group Ltd, BMS Factory, Happy Birds Inc., Lovetreats. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

In general, younger individuals are likely to buy the most sex toys. Furthermore, millennials have a greater probability compared to any other generation to purchase such products online. The e-commerce channel has become one of the most highly regarded distribution networks, with over 70% of global customers purchasing sexual wellness items there and 57% implying that they would purchase sex toys online again in the future.

Sex toys are becoming increasingly popular around the world. Women and couples are getting creative with adult toys such as Bluetooth sex toys, premium pleasure toys, intimate toys, and remotely controlled toys to boost the sexual experience while pleasuring or having intercourse. It is also well known that sex toys have health advantages. Sex toys can help men with sexual issues such as premature ejaculation, libido loss, and low testosterone. The increasing use of adult toys to approach these issues is projected to give rise to market expansion over the forecast period.

Furthermore, the acknowledgment of the LGBTQ+ community, as well as the rising preference among women in experimenting with associated sex wellness products without hesitation, is promoting the widespread use of such product types and, as a result, driving demand growth. As a result of economic liberalization, social media penetration, as well as the impact of contemporary culture, there is a greater grasp on the significance of sexual well-being.

Additionally, manufacturers of sex toys are introducing a variety of initiatives, including public awareness campaigns and various strategies to advertise and market their products. Correspondingly, vendors are also providing special offers and add-on products. Manufacturers are expected to continue experimenting with aesthetics and components over the forecast period as demand and sales rise, particularly among a younger core market. The market for custom-designed versions of female sex toys is rising exponentially. Some make requests for dildos with unordinary shapes and sizes in order to have a one-of-a-kind experience. The increasing penetration of concepts such as bondage, discipline, sadomasochism, and sadism (or BDSM) has resulted in a broadening product category.

Restraining Factors

However, despite the fact that almost all regions authorize sex toys to be sold as specialty items, taboos and regulatory requirements in certain nations may have a negative effect on demand and revenue. Sex toys and associated products are considered obscene in some countries, often grouped in with pornography, and are thus illegal, particularly in the Middle East. Moreover, the high price tags on goods, as well as the chemical products used within adult toys, are substantial constraints on the expansion of the sex toys market. Additionally, adverse social perceptions regarding the use of adult toys, as well as the possibility of addiction to using sex toys, are restraining market growth.

Market Segmentation

By Product Type Insights

The vibrators segment is dominating the market with the largest revenue share over the forecast period.

On the basis of product type, the global sex toys market is segmented into vibrators, dildos, penis rings, anal toys, masturbation sleeves, sex dolls, harnesses, and others. Among these, the vibrators segment is dominating the market with the largest revenue share of 54.53% over the forecast period. Vibrators are further classified as anal vibrators, clitoral vibrators, bullet vibrators, butterfly vibrators, shockwave vibrators, finger vibrators, g-spot vibrators, classic vibrators, massage wand vibrators, mini vibrators, realistic vibrators, couples vibrators, pearl vibrators, rabbit vibrators, and strap-on vibrators. The demand for shockwave (clitoral suction) vibrators and anal vibrators are expected to increase significantly over the forecast period. Due to this, ownership of shockwave or suction vibrators is expected to elevate from 19% in 2021 to 35% in 2030.

Along with the rise in individuals possessing these two types of toys, the number of individuals who want to own them has also increased. This is primarily due to the increased fascination with sexuality and similar activities among the younger generations. The fact that vibrators can be used by themselves or with a partner is expected to encourage more individuals to use them. Furthermore, sex movies, pornographic materials, and social media have all had a significant impact on the use of sex toys like vibrators and dildos, particularly among the present-day generation.

Dildos are further segmented as silicone, glass, metal, double-ended, and others. Anal toys are further segmented as anal beads, plugs, anal penetration with a dildo, and others. BDSM toys are further segmented as ropes, crops, handcuffs, floggers, and others. Others are further segmented as cock rings, clitoral pumps, strap-ons, and among others.

By Distribution Channel Insights

The e-commerce segment accounted the largest market share over the forecast period.

On the basis of distribution channels, the global sex toys market is segmented into specialty stores, supermarkets/hypermarkets, e-commerce, and mass merchandisers. Among these, the e-commerce segment is dominating the market and is going to continue its dominance over the forecast period. The segment's market is primarily driven by growing internet adoption and the accessibility of numerous sex toys on e-commerce channels. Individuals who choose e-commerce transactions over traditional adult stores benefit from the confidentiality and privacy preserved in delivering the product. Furthermore, e-commerce provides numerous advantages, such as convenience and time savings, easy comparison shopping, increased variety, and door-to-door delivery.

With the global lockdown to mitigate the COVID-19 pandemic, online stores also experienced substantially increased demand for sex toys. Because it retains the confidentiality and anonymity of the customer's purchasing, the online store's category is anticipated to gain significant popularity in the global sex toys market. The growing adoption of numerous online store marketplaces in emerging markets, as well as the increased number of discounts or special offers made available by them, encourages individuals to purchase adult toy products through online major retailers.

By End-User Insights

The female segment accounted the largest revenue share of more than 63% over the forecast period.

On the basis of end-user, the global sex toys market is segmented into male, female, and others. Among these, the female is dominating the market with the largest revenue share of 63% over the forecast period. Women are more sensitive to the negative consequences of using adult toys than men. Despite this, a wide range of women's products are conveniently accessible to consumers, despite the taboo and social stigma. During solo sex, 72% of women who have used sex toys in some capacity do so frequently. The increased usage of female contraception, safe sex, and increased sexual interest among women are expected to drive demand for goods including such vibrators, pregnancy testing products, female condoms, menstrual cups, diaphragm and cervical caps, and exotic lingerie and clothing and accessories. 82% of women who own sex toys use at least one sex toy more than other women who already own sex toys. The wellness section has products like vibrators, dildos, and anal beads on the showcase directly. Toys based on the female anatomy have typically been targeted at women by manufacturers.

Regional Insights

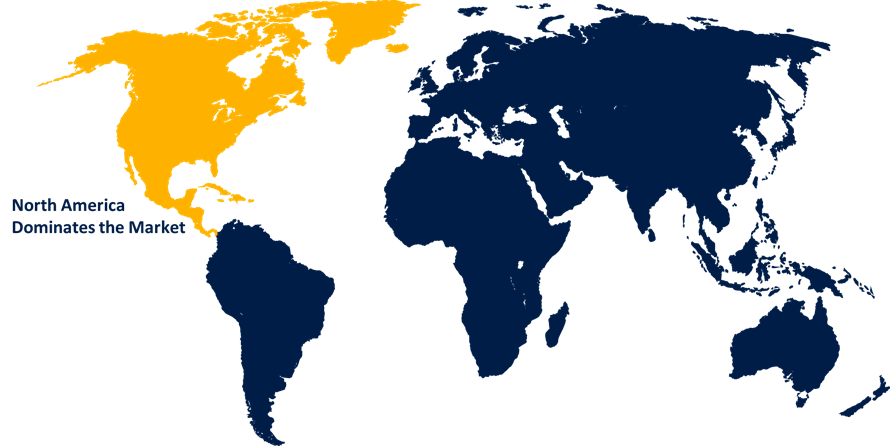

North America dominates the market with the largest market share over the forecast period.

Get more details on this report -

North America is dominating the market with more than 48.5% market share over the forecast period. The demand for sex toys is high in North America because the products are widely available and accepted, and because there is the little social stigma associated with sex, related products, etc. According to the findings of the research survey conducted in the United States, 86% of Americans between the ages of 25 and 29 possessed at least one sex toy. The same proportion of individuals aged 40 to 44 owned adult toys. With about 20% of the market for U.S. sexual wellness devices, dildos, and vibrators also had the largest market shares in 2021.

Additionally, the popularity of sex toys as gifts is rising, which is anticipated to support market expansion. Women are much more likely than men to have received a sex toy as a gift—35% of women versus 20% of men. Additionally, goods that are currently available have characteristics that are popularizing them. During the forecast period, it is anticipated that inclusivity and a liberal sexual living environment in the United States and Canada, as well as the availability of numerous adult stores, will result in an improvement in the sex toys market.

On the contrary, Europe sex toys market is expected to grow the fastest during the forecast period. Leading market contributors include European nations like Germany, Italy, France, the United Kingdom, Denmark, and Belgium. With a market share of roughly 27.9% across all major areas, Germany emerged as the largest market for the Europe sex toys market. The most famous products in these countries are traditional vibrators and dildos. There are many well-known brands in the industry, like LELO, Lovehoney, Durex, and Fun Factory, which all meet the needs of the European population. The Italy market is expected to grow at the fastest CAGR during the forecast period. With an increase in brands and production of sex toys, the Italy region is rapidly becoming more urbanized and industrialized.

Asia Pacific, on the contrary, is expected to grow moderately during the forecast period. Demand for sex toys in the Asia Pacific is anticipated to be driven by decreasing social stigma through altering consumer perceptions of sex and growing online retailers. Given the accessibility of these product offerings through e-Commerce channels as well as the rising confidentiality that is offered by such platform, users in nations like India, China, the Philippines, Pakistan, Nepal, Sri Lanka, and numerous others are gradually illustrating acceptance of all these products. Women's sexual needs are now being met in nations like Singapore and New Zealand along through the endorsement of the sex toys market.

List of Key Market Players

- AdamEve

- Church & Dwight Co., Inc.

- Reckitt Benckiser Group plc

- LELO

- Bijoux Indiscrets

- Tenga Co., Ltd.

- Fun Factory

- Blue Rabbit

- We-Vibe

- Luvu Brands, Inc.

- OhMiBod

- BMS Factory

- Crystal Delights

- Bad Dragon Enterprises, Inc.

- Hot Octopuss limited

- Tantus, Inc.

- Spot of Delight

- Ansell Healthcare

- LifeStyles Healthcare Pte Ltd

- Doc Johnson Enterprises

- Lovehoney Group Ltd

- BMS Factory

- Happy Birds Inc.

- Lovetreats

Key Market Developments

- On March 2023, TENGA released the FLIP ZERO EVR - ELECTRONIC VIBRATION. By simply tilting the item, an internal gyroscopic sensor allows you to manipulate rotational stimulation. The dual motor vibrations complement the new internal details designed specifically for spinning vibration.

- On March 2023, Doc Johnson announced a new partnership with Fort Troff. Doc Johnson will oversee Fort Troff's b2b distribution and marketing, and the two companies will collaborate to develop co-branded products. The first of the new products debuted in January at the ANME Founders Show in Burbank. Six cock rings, four thrusting machines, and the Gunner System, a truly revolutionary multi-function fucking machine, were among the products.

- On September 2022, LELO introduces TIANITM Harmony, an app-controlled couples massager that provides intense, all-encompassing pleasure. The two vibrating motors in TIANITM Harmony work in tandem to provide a dual sensation, both inside and out. TIANITM Harmony is soft and flexible, and it fits a wide range of anatomies, making it suitable for everyone. The app control provides the best hands-free experience and allows you to fully immerse yourself in the moment you share with your partner.

- On August 2021, WOW Tech Group and Lovehoney, two global market leaders in sexual wellness, joined forces. They now form the Lovehoney Group, along with Swiss brand Amorana, which Lovehoney acquired in 2020. (LHG). The group's focus will be on providing exceptional B2B customer service, which will include creative and demand-driving marketing across all touchpoints, as well as buzz-worthy PR campaigns to raise awareness and keep the brands at the top of consumers' minds.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2019 to 2030. Spherical Insights has segmented the Global Sex Toys Market based on the below-mentioned segments:

Sex Toys Market, Product Type Analysis

- Vibrators

- Dildos

- Penis Rings

- Anal Toys

- Masturbation Sleeves

- Sex Dolls

- Harnesses

- Others

Sex Toys Market, Distribution Channel Analysis

- Specialty Stores

- Supermarket/Hypermarket

- E-commerce

- Mass Merchandizers

Sex Toys Market, End-User Analysis

- Male

- Female

- Others

Sex Toys Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of Middle East & Africa

Frequently Asked Questions (FAQ)

-

What is the market size of the Sex Toys market?The Global Sex Toys Market is expected to grow from USD 34.95 billion in 2021 to USD 75.73 billion by 2030, at a CAGR of 12.97% during the forecast period 2021-2030.

-

Which are the key companies in the market?AdamEve, Church & Dwight Co., Inc., Reckitt Benckiser Group plc, LELO, Bijoux Indiscrets, Tenga Co., Ltd., Fun Factory, We-Vibe, Luvu Brands, Inc., OhMiBod, BMS Factory, Crystal Delights, Bad Dragon Enterprises, Inc., Hot Octopuss limited, Tantus, Inc., Spot of Delight, Ansell Healthcare, LifeStyles Healthcare Pte Ltd, Doc Johnson Enterprises, Lovehoney Group Ltd, BMS Factory, Happy Birds Inc., Lovetreats

-

Which segment dominated the Sex Toys market share?The female segment in end-user dominated the Sex Toys market in 2021 and accounted for a revenue share of over 63%.

-

What are the elements driving the growth of the Sex Toys market?Growing customer demand to enhance sexual experience, liberalization, social media penetration, and the influence of pop culture are key factors driving the sex toys market growth.

-

Which region is dominating the Sex Toys market?North America is dominating the Sex Toys market with more than 48.5% market share.

-

Which segment holds the largest market share of the Sex Toys market?The vibrators segment based on product type holds the maximum market share of the Sex Toys market.

Need help to buy this report?