Global Sheet Molding Compound and Bulk Molding Compound Market Size, Share, and COVID-19 Impact Analysis, By Type (Glass Fiber, Carbon Fiber), By Application (Automotive, Electrical and Electronics, Building and Construction, Agriculture, Marine, Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Chemicals & MaterialsGlobal Sheet Molding Compound and Bulk Molding Compound Market Insights Forecasts to 2033

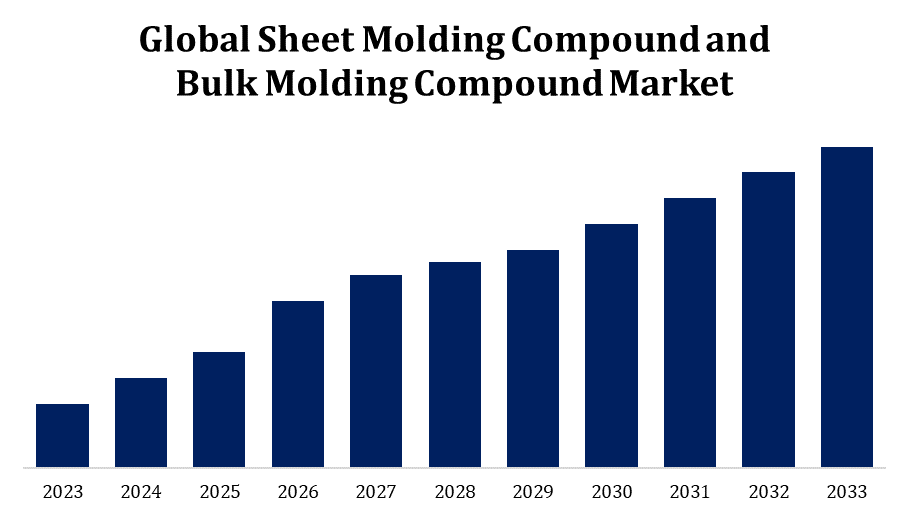

- The Sheet Molding Compound and Bulk Molding Compound Market Size was valued at USD 6.3 Billion in 2023.

- The Market is growing at a CAGR of 2.54% from 2023 to 2033.

- The Global Sheet Molding Compound and Bulk Molding Compound Market is expected to reach USD 8.1 billion by 2033.

- Asia Pacific is expected to grow the fastest during the forecast period.

Get more details on this report -

The Global Sheet Molding Compound and Bulk Molding Compound Market Size is expected to reach USD 8.1 Billion by 2033, at a CAGR of 2.54% during the forecast period 2023 to 2033.

The Sheet Molding Compound (SMC) and Bulk Molding Compound (BMC) market is experiencing significant growth, driven by increasing demand for lightweight, durable, and high-performance materials across various industries. SMC and BMC are composite materials made from thermosetting resins, glass fibers, and fillers, offering excellent mechanical properties, corrosion resistance, and design flexibility. The automotive, construction, and electrical industries are key end-users, leveraging these materials for components such as body panels, electrical housings, and structural parts. Growing environmental concerns have further propelled the adoption of SMC and BMC due to their recyclability and reduced carbon footprint. Advancements in manufacturing technologies, coupled with innovations in material compositions, are expected to bolster market growth, while stringent regulations favoring sustainable solutions enhance their appeal globally.

Sheet Molding Compound and Bulk Molding Compound Market Value Chain Analysis

The value chain of the Sheet Molding Compound (SMC) and Bulk Molding Compound (BMC) market comprises several stages, from raw material suppliers to end-users. Key raw materials include thermosetting resins, glass fibers, fillers, and additives, supplied by chemical manufacturers. These inputs are processed by compound manufacturers, who blend and form SMC or BMC sheets or pellets tailored for specific applications. Distributors and traders play a vital role in ensuring timely delivery to molding companies or fabricators. These manufacturers use techniques like compression or injection molding to produce finished components for industries such as automotive, electrical, construction, and aerospace. Research and development drive innovations at every stage, while regulatory bodies influence production practices. Collaboration across the chain enhances efficiency, quality, and sustainability in the market.

Sheet Molding Compound and Bulk Molding Compound Market Opportunity Analysis

The Sheet Molding Compound (SMC) and Bulk Molding Compound (BMC) market offers substantial growth opportunities driven by advancements in lightweight and sustainable materials. Increasing demand for fuel-efficient vehicles has boosted the adoption of SMC and BMC in automotive applications such as body panels, bumpers, and structural components. The construction industry also presents growth potential, with these materials replacing traditional alternatives due to their durability and corrosion resistance. Expanding applications in electrical and electronics sectors, including housings and insulation components, further highlight their versatility. Additionally, heightened environmental awareness is propelling research into bio-based resins and recyclable composites, opening new avenues for innovation. Emerging markets in Asia-Pacific and Latin America provide untapped opportunities, fueled by urbanization, infrastructure development, and a growing industrial base.

Global Sheet Molding Compound and Bulk Molding Compound Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 2.54% |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 245 |

| Tables, Charts & Figures: | 116 |

| Segments covered: | By Type, By Application, By Region |

| Companies covered:: | IDI Composites International, MENZOLIT, Polynt (Polynt-Reichhold), Continental Structural Plastics Inc. (TEIJIN), ZOLTEK (Toray Group), Mitsui Chemicals, TORAY INTERNATIONAL., Core Molding Technologies, Devi Polymers Private Limited, Zhejiang Yueqing SMC & BMC Manufacture Factory, Huayuan Advanced Materials Co., Ltd, and other key companies. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics

Sheet Molding Compound and Bulk Molding Compound Market Dynamics

Rising demand for SMC and BMC products within the construction industry

The construction industry is witnessing a growing demand for Sheet Molding Compound (SMC) and Bulk Molding Compound (BMC) products due to their superior properties and versatility. These composite materials are increasingly replacing traditional materials like steel and wood in construction applications, offering benefits such as high strength-to-weight ratio, corrosion resistance, and design flexibility. SMC and BMC are used in roofing, cladding, doors, window frames, and structural reinforcements, meeting the industry's need for durable and lightweight materials. Additionally, their ease of molding and cost-effectiveness make them ideal for prefabricated construction components. The shift toward sustainable building practices further drives their adoption, as SMC and BMC contribute to energy efficiency and reduced carbon footprints. Innovations in material formulations are poised to expand their applications in modern construction.

Restraints & Challenges

The Sheet Molding Compound (SMC) and Bulk Molding Compound (BMC) market faces several challenges that may hinder growth. One significant issue is the high cost of raw materials, such as thermosetting resins and glass fibers, which can limit affordability for end-users. Additionally, the complexity of manufacturing processes and the need for specialized equipment may increase production costs and create barriers for smaller manufacturers. Recycling and disposal challenges also persist, as thermoset composites are not as easily recyclable as thermoplastics, raising environmental concerns. Regulatory pressures to develop sustainable and eco-friendly materials add to the need for innovation and investment in green alternatives. Furthermore, intense competition from alternative materials like aluminum and advanced plastics poses a threat, requiring continuous technological advancements to maintain market relevance.

Regional Forecasts

North America Market Statistics

Get more details on this report -

North America is anticipated to dominate the Sheet Molding Compound and Bulk Molding Compound Market from 2023 to 2033. The North American Sheet Molding Compound (SMC) and Bulk Molding Compound (BMC) market is poised for significant growth, driven by increasing demand across automotive, construction, and electrical industries. The region’s focus on lightweight and fuel-efficient vehicles has propelled the adoption of SMC and BMC in automotive applications, such as body panels, hoods, and structural components. In construction, these materials are gaining traction due to their strength, durability, and resistance to harsh environmental conditions. The thriving electrical sector also contributes to market expansion, with SMC and BMC used in producing insulation components and housings. North America’s advanced manufacturing infrastructure, coupled with ongoing research into recyclable and bio-based composites, positions the region as a leader in innovation. Government initiatives promoting sustainability further boost the market's prospects.

Asia Pacific Market Statistics

Asia Pacific is witnessing the fastest market growth between 2023 to 2033. The automotive sector’s push for lightweight and cost-effective materials has boosted the use of SMC and BMC in vehicle components, enhancing fuel efficiency and reducing emissions. In the construction sector, these materials are replacing traditional ones due to their superior durability, corrosion resistance, and design versatility. Additionally, the growing demand for electrical and electronic products supports market expansion. Increasing investments in manufacturing technologies and the availability of low-cost raw materials further strengthen the region’s position as a global production hub for SMC and BMC products.

Segmentation Analysis

Insights by Type

The glass fiber segment accounted for the largest market share over the forecast period 2023 to 2033. The glass fiber segment is witnessing robust growth in the Sheet Molding Compound (SMC) and Bulk Molding Compound (BMC) market, driven by its exceptional mechanical properties and cost-effectiveness. Glass fibers are widely used as reinforcement in SMC and BMC formulations, enhancing strength, durability, and resistance to environmental factors like corrosion and extreme temperatures. The increasing demand for lightweight and high-performance materials in automotive, construction, and electrical applications is propelling the adoption of glass fiber-reinforced composites. In the automotive sector, glass fiber contributes to fuel efficiency and structural integrity, while in construction, it supports durable and versatile components. Advancements in glass fiber technology, including improved tensile strength and compatibility with resins, further bolster its use, positioning the segment as a key driver of market growth.

Insights by Application

The automotive segment accounted for the largest market share over the forecast period 2023 to 2033. The growth is fueled by the industry's shift toward lightweight, fuel-efficient, and sustainable vehicles. SMC and BMC materials are increasingly used in manufacturing components such as body panels, hoods, bumpers, and underbody shields due to their high strength-to-weight ratio, durability, and design flexibility. These composites also help reduce vehicle weight, improving fuel economy and lowering emissions, aligning with stringent regulatory standards. The rise of electric vehicles (EVs) has further amplified demand, as SMC and BMC are ideal for battery enclosures and structural parts. Innovations in composite technology, such as enhanced impact resistance and thermal stability, continue to expand the automotive applications of these materials globally.

Recent Market Developments

- In March 2022, Evonik has launched the Pure Performance Battery, a new generation of battery packs designed for electric vehicles. This lightweight solution is made from synthetic sheets, offering enhanced performance for EV applications.

Competitive Landscape

Major players in the market

- IDI Composites International

- MENZOLIT

- Polynt (Polynt-Reichhold)

- Continental Structural Plastics Inc. (TEIJIN)

- ZOLTEK (Toray Group)

- Mitsui Chemicals

- TORAY INTERNATIONAL.

- Core Molding Technologies

- Devi Polymers Private Limited

- Zhejiang Yueqing SMC & BMC Manufacture Factory

- Huayuan Advanced Materials Co., Ltd

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2033.

Sheet Molding Compound and Bulk Molding Compound Market, Type Analysis

- Glass Fiber

- Carbon Fiber

Sheet Molding Compound and Bulk Molding Compound Market, Application Analysis

- Automotive

- Electrical and Electronics

- Building and Construction

- Agriculture

- Marine

- Others

Sheet Molding Compound and Bulk Molding Compound Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1.What is the market size of the Sheet Molding Compound and Bulk Molding Compound Market?The global Sheet Molding Compound and Bulk Molding Compound Market is expected to grow from USD 6.3 billion in 2023 to USD 8.1 billion by 2033, at a CAGR of 2.54% during the forecast period 2023-2033.

-

2.Who are the key market players of the Sheet Molding Compound and Bulk Molding Compound Market?Some of the key market players of the market are IDI Composites International, MENZOLIT, Polynt (Polynt-Reichhold), Continental Structural Plastics Inc. (TEIJIN), ZOLTEK (Toray Group), Mitsui Chemicals, TORAY INTERNATIONAL., Core Molding Technologies, Devi Polymers Private Limited, Zhejiang Yueqing SMC & BMC Manufacture Factory, Huayuan Advanced Materials Co., Ltd.

-

3.Which segment holds the largest market share?The automotive segment holds the largest market share and is going to continue its dominance.

-

4 Which region dominates the Sheet Molding Compound and Bulk Molding Compound Market?North America dominates the Sheet Molding Compound and Bulk Molding Compound Market and has the highest market share.

Need help to buy this report?