Global Shipbuilding Market Size, Share, and COVID-19 Impact Analysis, By Type (Vessel, Container, and Passenger), By End User (Transport Companies and Military), and By Region (North America, Europe, Asia Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Automotive & TransportationGlobal Shipbuilding Market Insights Forecasts to 2033

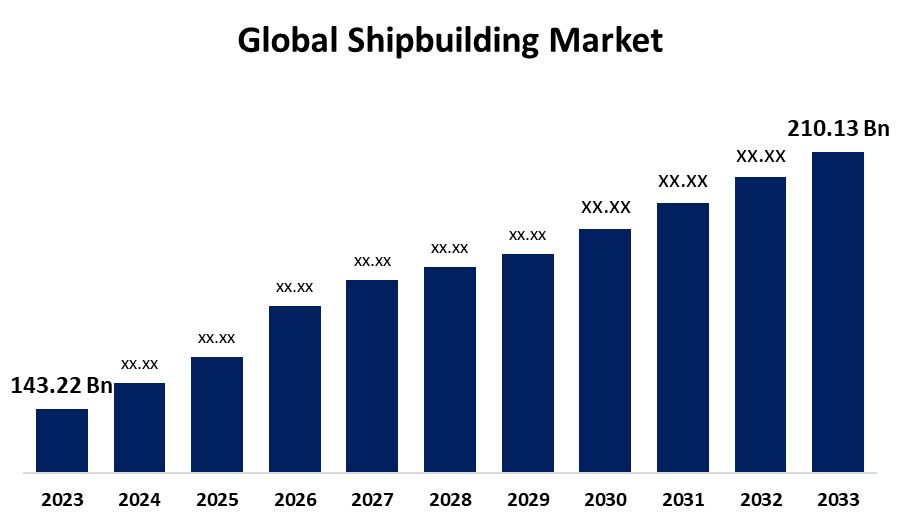

- The Global Shipbuilding Market Size was Valued at USD 143.22 Billion in 2023

- The Market Size is Expected to Grow at a CAGR of around 3.91% from 2023 to 2033

- The Worldwide Shipbuilding Market Size is Expected to Reach USD 210.13 Billion by 2033

- North America is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Shipbuilding Market Size is anticipated to exceed USD 210.13 billion by 2033, growing at a CAGR of 3.91% from 2023 to 2033.

Market Overview

Shipbuilding market involves construction of huge floating vessels or ships by utilizing steel, wood, and different other materials. This market includes different type of ships such as commercial ships (cargo ships and tankers), milltary ships, and recreational ships (like yachts and cruise ships). The market includes suppliers of the materials, parts, and technology needed in shipbuilding in addition to shipyards and other facilities where ships are constructed and maintained. Additionally, the global shipbuilding market is experiencing growth and development because of rise in trade agreements between lots of countries. These increasing agreements speedups the transportation of products, which causes suppliers to favor more effective waterway shipping. This increasing focus toward waterway transportation further increase the demand of shipbuilding market. Additionally, the execution of free trade agreements has resulted in lower taxes and levies, which has boosted commercial activity. Consequently, both importers and exporters are not required to pay some taxes to the government.

Report Coverage

This research report categorizes the global shipbuilding market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global shipbuilding market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global shipbuilding market.

Global Shipbuilding Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 143.22 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 3.91% |

| 2033 Value Projection: | to USD 210.13 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 115 |

| Segments covered: | By Type, By End User and COVID-19 Impact Analysis |

| Companies covered:: | Mitsubishi Heavy Industries Ltd, Hyundai Heavy Industries Co. Ltd, China State Shipbuilding Corporation, Daewoo Shipbuilding & Marine Engineering Co. Ltd, Samsung Heavy Industries, Sumitomo Heavy Industries, Hanjin Heavy Industries and Construction Co., Yangzijiang Shipbuilding Ltd, United Shipbuilding Corporation, STX Group, and Others Key Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The market is expanding due to increasing requirement or need for maritime transportation, which has promoted the number of imports and exports worldwide to rise. One of the important factors is increasing acceptance of ecommerce, which directly affects the demand for logistics service for shipping of products. Sometimes, this shipping is also conducted through cargo ship, which has further driven the shipbuilding market growth. Additionally, there is an increasing number of ships that include commercial, cruise and other in world which is further going to increase demand for maintenance service and ship construction service. The number of seagoing trade ships was 102,899 ships in total. In the anticipated timeframe, the growing global fleet of vessels is driving market expansion and growth even more. Furthermore, in 2024, contracts of 65.8 million compensated gross tonnes (CGT) were awarded to the global shipbuilding sector. Chinese shipbuilders received orders of around 22.8 million CGT, or 45.7 million CGT, during the year. One driving factor is the increasing number of contracts in the shipbuilding industry, which further develops the market.

Restraints & Challenges

Shipbuilding is a very cyclical business that experiences periods of growth and decline. Periods of overcapacity can result from changes in shipbuilding orders, economic conditions, and financial market instability. Shipbuilding companies are subject to fierce rivalry, price pressure, and diminished profit margins during periods of overcapacity.

Market Segmentation

The global shipbuilding market share is classified into type and end user.

- The vessel segment held the largest share in 2023 and is expected to grow at a significant CAGR during the forecast period.

Based on the type, the global shipbuilding market is categorized as vessel, container, and passenger. Among these, the vessel segment accounted for the largest share in 2023 and is expected to grow at a significant CAGR during the forecast period. Bulk carriers, traditional cargo ships, cattle transports, and other types of vessels are among them. Dry and loose goods including coal, cement, ores, cereal grains, and other commodities are transported by bulk carriers. The dry bulk freight prices have stayed constant because these commodities do not require specific packaging and have made it possible for greater adaption across the major economies.

- The transport companies segment held the largest share in 2023 and is expected to grow at a significant CAGR during the forecast period.

Based on the end user, the global shipbuilding market is categorized as transport companies and military. Among these, the transport companies segment held the largest share in 2023 and is expected to grow at a significant CAGR during the forecast period. One of the main factors propelling the expansion of the commercial shipbuilding market is the rise in international trade. In order to increase cargo capacity, lower operating costs, and improve efficiency, shipping companies are constantly trying to upgrade their fleets. The International Chamber of Shipping estimates that ships move 11 billion tons of cargo annually.

Regional Segment Analysis of the Global Shipbuilding Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

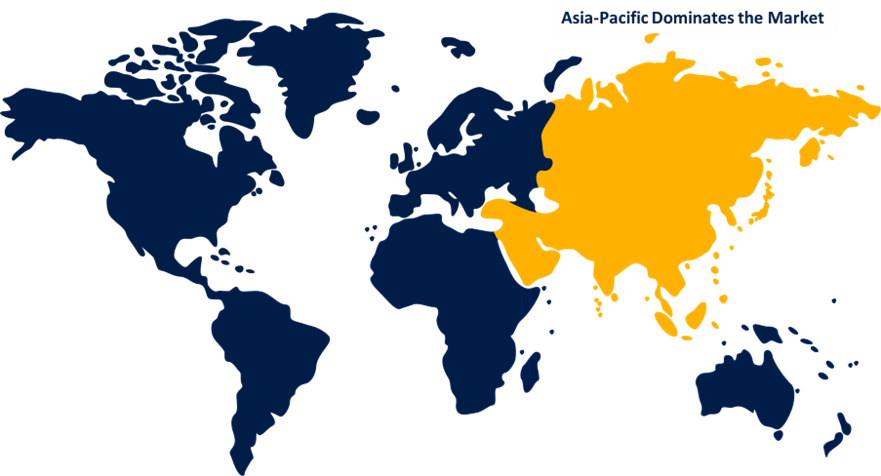

Asia Pacific is projected to hold the largest share of the global shipbuilding market over the forecast period.

Get more details on this report -

Asia Pacific is projected to hold the largest share of the global shipbuilding market over the forecast period. China, South Korea, and Japan are the leading nations in the Asia Pacific shipbuilding business. Their technological know-how, infrastructure, and cost advantages have allowed them to become important shipbuilding hubs. Commercial ships, naval ships, and offshore support boats are in high demand in the region. China's Ministry of Industry and Information Technology (MIIT) reports that the country holds a substantial share of the global market in terms of delivery orders and order books, with respective shares of 43.1%, 48.8%, and 44.7%.

North America is expected to grow at the fastest CAGR growth of the global shipbuilding market during the forecast period. This is due to a number of factors, such as fierce international competition bolstered by government subsidies, a drop in federal cargo, and commercial ship orders, the US shipbuilding industry has been losing ground. The government is currently the main customer of the domestic shipbuilding industry, which consists of more than 120 shipyards operating in the United States. US commercial shipbuilding of large merchant-type ships declined as a result of declining demand and a growing productivity and cost gap between domestic and overseas shipbuilding.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global shipbuilding market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Mitsubishi Heavy Industries Ltd

- Hyundai Heavy Industries Co. Ltd

- China State Shipbuilding Corporation

- Daewoo Shipbuilding & Marine Engineering Co. Ltd

- Samsung Heavy Industries

- Sumitomo Heavy Industries

- Hanjin Heavy Industries and Construction Co.

- Yangzijiang Shipbuilding Ltd

- United Shipbuilding Corporation

- STX Group

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Key Market Development

- In June 2024, Damen Shipyards signed a contract with the Portland Harbour Authority (PHA) in the United Kingdom to supply one of its newest tugs, Damen ASD Tug 2111. The incredibly agile and 21-meter-long ASD Tug 2111 has the capacity to pull 50 tons of bollards.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the global shipbuilding market based on the below-mentioned segments:

Global Shipbuilding Market, By Type

- Vessel

- Container

- Passenger

Global Shipbuilding Market, By End User

- Transport Companies

- Military

Global Shipbuilding Market, By Regional

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the global shipbuilding market over the forecast period?The global shipbuilding market size is expected to grow from USD 143.22 billion in 2023 to USD 210.13 billion by 2033, at a CAGR of 3.91% during the forecast period 2023-2033.

-

2. Which region is expected to hold the highest share of the global shipbuilding market?Asia Pacific is projected to hold the largest share of the global shipbuilding market over the forecast period.

-

3. Who are the top key players in the global shipbuilding market?Mitsubishi Heavy Industries Ltd., Hyundai Heavy Industries Co. Ltd., China State Shipbuilding Corporation, Daewoo Shipbuilding & Marine Engineering Co. Ltd., Samsung Heavy Industries, Sumitomo Heavy Industries, Hanjin Heavy Industries and Construction Co., Yangzijiang Shipbuilding Ltd., United Shipbuilding Corporation, STX Group, and others.

Need help to buy this report?