Global Shop Fitting Materials Market Size, Share, and COVID-19 Impact Analysis, By Material (Wood, Metal, Glass, Plastic, Others), By Price (High, Low, Mid-Range), By End-User (Retail Stores, Malls and Shopping Centers, Hospitality, Food Services), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Consumer GoodsGlobal Shop Fitting Materials Market Insights Forecasts to 2033

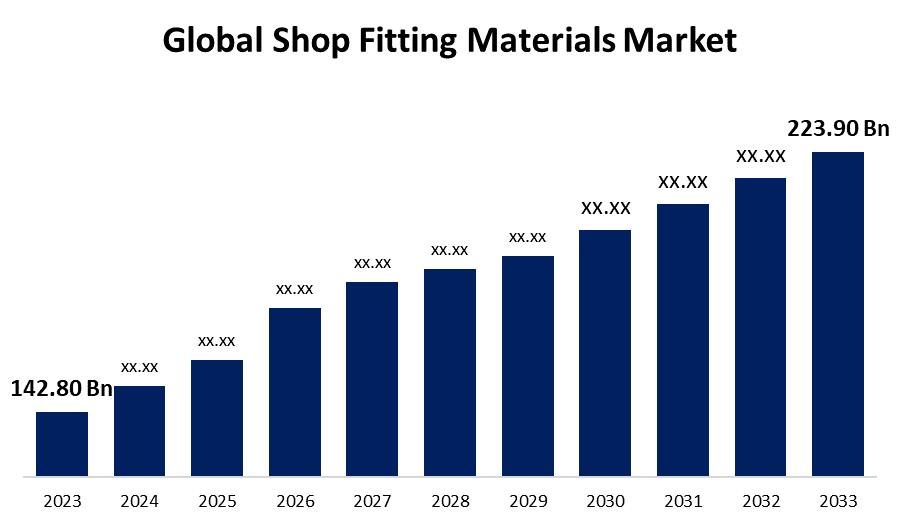

- The Global Shop Fitting Materials Market Size was Valued at USD 142.80 Billion in 2023

- The Market Size is Growing at a CAGR of 4.60% from 2023 to 2033

- The Worldwide Shop Fitting Materials Market Size is Expected to Reach USD 223.90 Billion by 2033

- North America is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Shop Fitting Materials Market Size is Anticipated to Exceed USD 223.90 Billion by 2033, Growing at a CAGR of 4.60% from 2023 to 2033.

Market Overview

The shop fitting materials market is the industry that supplies materials and solutions for designing, furnishing, and equipping retail spaces such as stores, malls, and shops. These materials are utilized to build functional and visually appealing interiors, fixtures, and displays that improve the shopping experience and drive sales.

The market for shop fitting materials has grown significantly as the retail sector expanded, consumer spending has increased, and demand for beautiful store environments that improve the shopping experience and promote sales. Shelving and racking systems, lighting and electrical components, flooring and wall coverings, display systems, counters and cash wrapping, and signage and branding materials are all examples of shop fit-out materials. Several trends are driving the shop fitting material industry, with an emphasis on sustainability, digital integration, customization and flexibility, minimalist and contemporary designs, and online retail influence.

Report Coverage

This research report categorizes the market for shop fitting materials based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the shop fitting materials market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the shop fitting materials market.

Global Shop Fitting Materials Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023 : | USD 142.80 Billion |

| Forecast Period: | 2023 – 2033 |

| Forecast Period CAGR 2023 – 2033 : | 4.60% |

| 023 – 2033 Value Projection: | USD 223.90 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 245 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Material, By Price, By End-User, By Region |

| Companies covered:: | Appvion, Inc., Australian Plastic Fabricators, Jacobs Construction Ltd., GCD Concepts Pty Ltd., MADE Retail Systems, TCK Retail Solutions Pty Ltd., SURTECO GmbH, Barnwood Group Ltd., Diller Corporation, Wood ’N’ Stamp Shopfitting Pty Ltd., Others |

| Pitfalls & Challenges: | Covid-19 Impact, Challenge, Future,Growth and Analysis |

Get more details on this report -

Driving Factors

The shop fitting materials market is propelled by retail expansion, e-commerce, technology advancements, consumer preferences, economic conditions, regulations, architectural design trends, sustainability, and supply chain dynamics. The retail sector is rapidly growing, leading to increased use of shop fitting materials in jewelry stores, food and beverage cafés, and optical stores. Retailers are integrating online and offline experiences, adopting new formats like concept stores and pop-up shops, requiring innovative materials. Consumer preferences are changing, leading to more memorable shopping experiences. Retailers are adopting omnichannel strategies, integrating physical stores with online channels, and promoting the importance of shop-fitting materials.

Restraining Factors

The shop fitting materials market is hindered by several factors including high costs associated with premium and custom materials, economic downturns that lead to reduced retail spending, and supply chain disruptions impacting material availability and pricing. Regulatory compliance and market saturation can also hinder growth. Furthermore, technological obsolescence and shifting consumer trends might affect demand.

Market Segmentation

The shop fitting materials market share is classified into material, price, and end-user.

- The wood segment is estimated to hold the highest market revenue share through the projected period.

Based on the material, the shop fitting materials market is classified into wood, metal, glass, plastic, and others. Among these, the wood segment is estimated to hold the highest market revenue share through the projected period. Wood is favored for its versatility, aesthetic appeal, and durability, making it a popular choice for a wide range of retail and commercial environments. Its natural look and customizable options allow businesses to create inviting and stylish interiors.

- The mid-range segment is anticipated to hold the largest market share through the forecast period.

Based on the price, the shop fitting materials market is divided into high, low, and mid-range. Among these, the mid-range segment is anticipated to hold the largest market share through the forecast period. The dominance of the mid-range segment is due to mid-range prices offering a favorable balance of cost and quality, making them a popular choice for a wide range of businesses. They provide durability and aesthetic appeal without the high expense associated with premium options, making them suitable for various retail environments and applications.

- The retail stores segment dominates the market with the largest market share through the forecast period.

Based on the end-user, the shop fitting materials market is categorized into retail stores, malls and shopping centers, hospitality, and food services. Among these, the retail stores segment dominates the market with the largest market share through the forecast period. The dominance of the retail stores segment is due to the constant demand for updates and renovations in retail environments to keep up with changing trends and consumer preferences. Retail stores require a diverse range of shop fitting materials, such as shelving, displays, and lighting, which contributes to their significant share in the market.

Regional Segment Analysis of the Shop Fitting Materials Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific is anticipated to hold the largest share of the shop fitting materials market over the predicted timeframe.

Get more details on this report -

Asia Pacific is anticipated to hold the largest share of the shop fitting materials market over the predicted timeframe. The dominance of the Asia Pacific region is primarily due to the region's rapid economic growth, expanding retail sector, and increasing urbanization. The rise in disposable income, urbanization, and consumer spending in countries like China, India, Japan, and South Korea drives demand for modern retail spaces, which in turn fuels the demand for shop-fitting materials. Furthermore, significant investments in commercial real estate and the proliferation of new shopping malls and retail outlets across the region contribute to Asia Pacific's leading market position. Top of Form

North America is expected to grow at the fastest CAGR growth of the shop fitting materials market during the forecast period. The rapid expansion is propelled by robust economic performance, increasing consumer spending, and ongoing retail sector expansion. Technological advancements in materials and design, along with urbanization and commercial real estate development, further fuel the growth. The US and Canada are experiencing a surge in demand for innovative, visually appealing shopfitting materials, focusing on sustainable and eco-friendly practices to enhance customer experiences.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the shop fitting materials market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Appvion, Inc.

- Australian Plastic Fabricators

- Jacobs Construction Ltd.

- GCD Concepts Pty Ltd.

- MADE Retail Systems

- TCK Retail Solutions Pty Ltd.

- SURTECO GmbH

- Barnwood Group Ltd.

- Diller Corporation

- Wood 'N' Stamp Shopfitting Pty Ltd.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In September 2024, Westwood Hart, a bespoke tailoring company with over 50 years of experience, announced the introduction of its new retail e-commerce portal. This move represents a substantial expansion in the company's operations, allowing it to offer its hand-made tailored suits, sports coats, and dress shirts to a global clientele through digital means.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the shop fitting materials market based on the below-mentioned segments:

Global Shop Fitting Materials Market, By Material

- Wood

- Metal

- Glass

- Plastic

- Others

Global Shop Fitting Materials Market, By Price

- High

- Low

- Mid-Range

Global Shop Fitting Materials Market, By End-User

- Retail Stores

- Malls and Shopping Center

- Hospitality

- Food Services

Global Shop Fitting Materials Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the shop fitting materials market over the forecast period?The shop fitting materials market is projected to expand at a CAGR of 4.60% during the forecast period.

-

2. What is the market size of the shop fitting materials market?The Global Shop Fitting Materials Market Size is Expected to Grow from USD 142.80 Billion in 2023 to USD 223.90 Billion by 2033, at a CAGR of 4.60% during the forecast period 2023-2033.

-

3. Which region holds the largest share of the shop fitting materials market?Asia Pacific is anticipated to hold the largest share of the shop fitting materials market over the predicted timeframe.

Need help to buy this report?