Global Shredder Blades Market Size, Share, and COVID-19 Impact Analysis, By Blade Material (Carburizing Steel, Tool Steel, Case Hardened, and Chromium Low Alloy Steel), By Blade Design (Hook and Square), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Machinery & EquipmentGlobal Shredder Blades Market Insights Forecasts to 2033

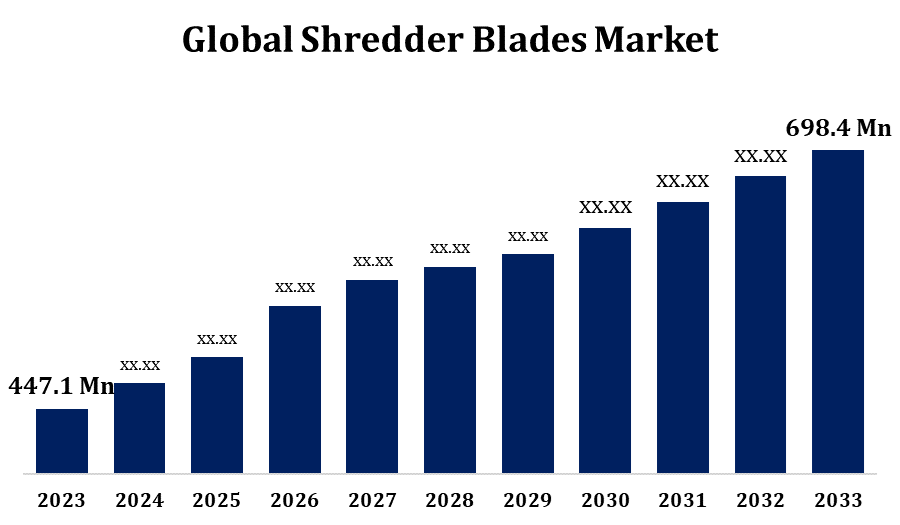

- The Shredder Blades Market Size was valued at USD 447.1 Million in 2023.

- The Market is growing at a CAGR of 4.56% from 2023 to 2033.

- The Global Shredder Blades Market Size is expected to reach USD 698.4 Million by 2033.

- Asia Pacific is expected to grow the fastest during the forecast period.

Get more details on this report -

The Global Shredder Blades Market Size is expected to reach USD 698.4 Million by 2033, at a CAGR of 4.56% during the forecast period 2023 to 2033.

The shredder blades market is driven by increasing demand across industries such as recycling, waste management, and manufacturing. These blades, integral to efficient shredding machines, cater to diverse applications including plastic, metal, and wood shredding. Growing environmental awareness and government regulations on waste disposal amplify demand for high-quality, durable blades that ensure precise shredding and reduce waste volumes. Technological advancements, such as the development of wear-resistant and energy-efficient blades, are reshaping the market landscape, appealing to eco-conscious companies seeking sustainable solutions. Asia-Pacific leads market growth due to rapid industrialization and expanding recycling activities, followed by North America and Europe. Key players focus on product innovation and strategic partnerships to strengthen market position, addressing rising needs for cost-effective, customized shredding solutions.

Shredder Blades Market Value Chain Analysis

The shredder blades market value chain includes multiple stages, from raw material sourcing to end-user distribution. Manufacturers source high-grade metals, such as alloy and stainless steel, that provide the necessary durability and wear resistance. Processing involves forging, machining, and heat treatment to create blades with precise cutting angles and hardness levels for various applications. The blades are then distributed through direct sales channels, third-party suppliers, and online platforms, catering to industries like recycling, waste management, and metal processing. Value is added at each stage through quality control and customization, allowing manufacturers to meet industry-specific demands for precision and efficiency. Aftermarket services, including sharpening and maintenance, contribute to the overall lifecycle, enhancing cost-effectiveness for end users and driving market growth through extended product usability.

Global Shredder Blades Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 447.1 Million |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 4.56% |

| 2033 Value Projection: | USD 698.4 Million |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 235 |

| Tables, Charts & Figures: | 102 |

| Segments covered: | By Blade Material, By Blade Design, By Region and COVID-19 Impact Analysis |

| Companies covered:: | KAMADUR industrial knives B.V (Netherlands), SATURN MACHINE KNIVES LTD (UK), Servo International (India), Anhui Yafei Machine Tool Co. Ltd (China), Fordura China (China), WANROOE MACHINERY CO., LTD. (China), Povelato srl (Italy), Miheu d.o.0. (Slovenia), Fernite Of Sheffield Ltd. (UK), BKS Knives (Belgium), Nanjing Huaxin Machinery Tool Manufacturing Co., Ltd. (China), and others key players. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Shredder Blades Market Opportunity Analysis

The shredder blades market offers significant growth opportunities driven by rising environmental awareness and increasing demand for efficient waste management solutions. With stricter regulations on waste disposal and recycling, industries such as plastic, metal, and wood processing are investing in advanced shredding technology, creating a demand for high-performance blades. Opportunities lie in developing wear-resistant, energy-efficient, and customizable blades that meet specific industry requirements. Emerging markets, particularly in Asia-Pacific and Latin America, present growth prospects due to rapid industrialization and evolving waste management infrastructure. Additionally, innovations in blade materials and design for extended durability and reduced downtime can offer competitive advantages. Companies that invest in R&D for sustainable and specialized shredding solutions will likely capitalize on growing needs across diverse sectors, strengthening their market position.

Market Dynamics

Shredder Blades Market Dynamics

Growing awareness of waste recycling practices

In the shredder blades market, increasing awareness of waste recycling practices is driving demand for efficient, high-quality blades tailored for various industries. As recycling efforts expand, particularly in sectors such as plastic, metal, and paper, companies seek durable, precise blades that can handle high volumes and reduce waste effectively. Enhanced regulations around waste management further encourage businesses to adopt advanced shredding technology, promoting blades that minimize energy consumption and extend machine life. This shift is particularly prominent in regions like Asia-Pacific and Europe, where recycling initiatives are rapidly advancing. Manufacturers who prioritize sustainable blade materials and innovative designs find new growth opportunities, meeting the industry's evolving requirements and helping businesses achieve their waste reduction goals.

Restraints & Challenges

In the shredder blades market, increasing awareness of waste recycling practices is driving demand for efficient, high-quality blades tailored for various industries. As recycling efforts expand, particularly in sectors such as plastic, metal, and paper, companies seek durable, precise blades that can handle high volumes and reduce waste effectively. Enhanced regulations around waste management further encourage businesses to adopt advanced shredding technology, promoting blades that minimize energy consumption and extend machine life. This shift is particularly prominent in regions like Asia-Pacific and Europe, where recycling initiatives are rapidly advancing. Manufacturers who prioritize sustainable blade materials and innovative designs find new growth opportunities, meeting the industry's evolving requirements and helping businesses achieve their waste reduction goals.

Regional Forecasts

North America Market Statistics

Get more details on this report -

North America is anticipated to dominate the Shredder Blades Market from 2023 to 2033. Increasing regulatory pressure on environmental compliance has led companies to adopt advanced shredding technology, enhancing waste processing efficiency. In sectors like metal recycling and plastic waste management, high-performance blades are critical, as they enable precise, durable shredding to meet stringent quality standards. The U.S. and Canada lead in adopting eco-friendly and energy-efficient shredding solutions, driven by corporate sustainability goals and government incentives. Innovation in blade materials, such as alloy steels and heat-treated metals, is further bolstered by a demand for longer blade lifespans. Market players are focused on R&D and partnerships to deliver high-quality, tailored shredding solutions that cater to diverse industrial needs.

Asia Pacific Market Statistics

Asia Pacific is witnessing the fastest market growth between 2023 to 2033. Countries of this region are experiencing heightened demand for shredder blades due to the growth of the recycling industry and stricter environmental regulations. With large-scale plastic, metal, and e-waste recycling operations, the region requires efficient, durable blades to handle high-capacity shredding. Government initiatives promoting recycling and sustainable waste disposal further drive the adoption of advanced shredding technology. Additionally, innovations in blade materials, such as wear-resistant alloys, and customized blade designs are meeting the region's diverse industrial needs. Key manufacturers are investing in local production facilities and partnerships to provide cost-effective solutions, catering to the strong market demand across various sectors.

Segmentation Analysis

Insights by Blade Material

The carburizing steel segment accounted for the largest market share over the forecast period 2023 to 2033. Carburizing steel, known for its enhanced surface hardness and impact resistance, is ideal for blades used in heavy-duty shredding of materials like metal and plastic. The process strengthens the blade’s exterior while maintaining a tough core, allowing it to endure continuous operation and harsh conditions typical in recycling and waste management industries. Increased emphasis on cost-efficiency and blade longevity in sectors such as metal processing has further spurred interest in carburized steel blades. Manufacturers are investing in carburizing technology to meet industry-specific needs, leveraging this steel’s high performance to reduce maintenance costs and improve shredding productivity across diverse industrial applications.

Insights by Blade Design

The hook segment accounted for the largest market share over the forecast period 2023 to 2033. Hook-shaped blades are especially popular in industries that deal with bulky or irregular materials, such as metal scrap, plastic waste, and wood. Their design allows for aggressive gripping and controlled tearing, making them ideal for applications requiring precise and consistent shredding performance. The rising demand for recycling solutions in sectors focused on sustainable waste management has increased the adoption of hook blades, which offer extended durability and superior cutting efficiency. Manufacturers are responding by enhancing hook blade materials and sharpening techniques, focusing on customized options that improve throughput and reduce operational downtime, aligning with industry needs for productivity and cost-effectiveness.

Recent Market Developments

- On Octobe 2022, AIShred launched a new version of its shredder machine featuring a single-shaft design.

Competitive Landscape

Major players in the market

- KAMADUR industrial knives B.V (Netherlands)

- SATURN MACHINE KNIVES LTD (UK)

- Servo International (India)

- Anhui Yafei Machine Tool Co. Ltd (China)

- Fordura China (China)

- WANROOE MACHINERY CO., LTD. (China)

- Povelato srl (Italy)

- Miheu d.o.0. (Slovenia)

- Fernite Of Sheffield Ltd. (UK)

- BKS Knives (Belgium)

- Nanjing Huaxin Machinery Tool Manufacturing Co., Ltd. (China)

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2033.

Shredder Blades Market, Blade Material Analysis

- Carburizing Steel

- Tool Steel

- Case Hardened

- Chromium Low Alloy Steel

Shredder Blades Market, Blade Design Analysis

- Hook

- Square

Shredder Blades Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the market size of the Shredder Blades Market?The Global Shredder Blades Market is expected to grow from USD 447.1 million in 2023 to USD 698.4 million by 2033, at a CAGR of 4.56% during the forecast period 2023-2033.

-

2. Who are the key market players of the Shredder Blades Market?Some of the key market players of the market are KAMADUR industrial knives B.V (Netherlands), SATURN MACHINE KNIVES LTD (UK), Servo International (India), Anhui Yafei Machine Tool Co. Ltd (China), Fordura China (China), WANROOE MACHINERY CO., LTD. (China), Povelato srl (Italy), Miheu d.o.0. (Slovenia), Fernite of Sheffield Ltd. (UK), BKS Knives (Belgium), and Nanjing Huaxin Machinery Tool Manufacturing Co., Ltd. (China).

-

3. Which segment holds the largest market share?The hook segment holds the largest market share and is going to continue its dominance.

-

4. Which region dominates the Shredder Blades Market?North America dominates the Shredder Blades Market and has the highest market share.

Need help to buy this report?