Global Silver Target Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Industrial Silver, Bullion, Jewelry, Coins, and Others), By Application (Industrial, Jewelry, Investment, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Consumer GoodsGlobal Silver Target Market Insights Forecasts to 2033

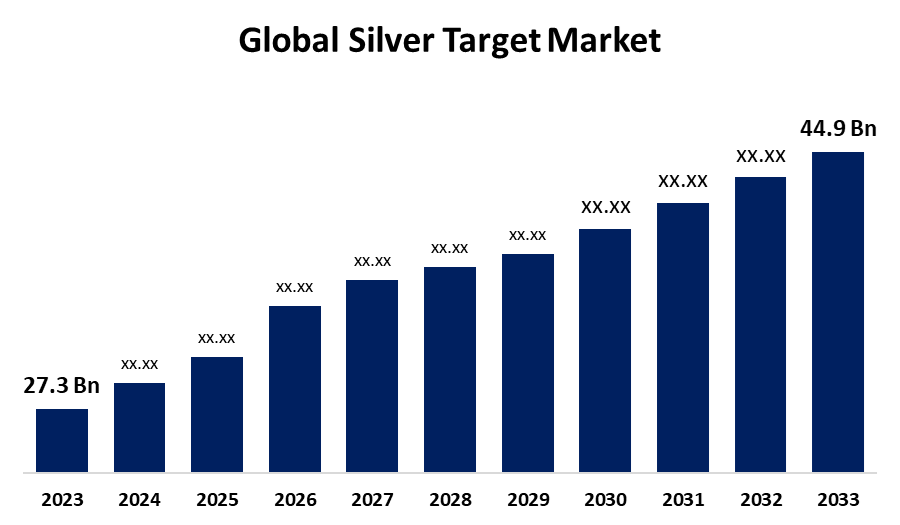

- The Global Silver Target Market Size was estimated at USD 27.3 Billion in 2023

- The Market Size is Expected to Grow at a CAGR of around 5.10% from 2023 to 2033

- The Worldwide Silver Target Market Size is Expected to Reach USD 44.9 Billion by 2033

- North America is expected to grow the fastest during the forecast period.

Get more details on this report -

The Global Silver Target Market Size is expected to cross USD 44.9 Billion by 2033, growing at a CAGR of 5.10% from 2023 to 2033. The silver target market has potential in renewable energy, electronics, and medical applications, owing to rising demand for solar panels, 5G technology, and antimicrobial coatings. Furthermore, the investment and jewelry sectors are expanding, with silver remaining a popular asset for wealth preservation and luxury consumption.

Market Overview

The silver target market refers to the specific consumer and industrial segments that drive demand for silver, including renewable energy (solar panels), electronics, jewelry, medical applications, and investment sectors. This market is shaped by factors such as industrial innovation, economic trends, and investor interest in silver as a precious metal. The silver target market is growing primarily due to increased industrial applications, increased investment interest, and an expanding jewelry industry. As industrial sectors continue to develop and expand, the demand for silver as a key component in many manufacturing processes is likely to rise. Furthermore, silver's dual status as a precious metal and an industrial commodity distinguishes it in the financial and manufacturing landscapes, increasing its appeal and propelling market growth. In addition, the silver target market is changing due to various growing trends, including increased industrial automation, where silver's conductivity makes it necessary for improved robotics and AI-driven technology. The shrinking of electronics is also increasing demand for ultra-thin silver coatings in microchips, wearables, and flexible displays.

Report Coverage

This research report categorizes the silver target market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the silver target market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the silver target market.

Global Silver Target Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 27.3 Billion |

| Forecast Period: | 2023 – 2033 |

| Forecast Period CAGR 2023 – 2033 : | 5.10% |

| 023 – 2033 Value Projection: | USD 44.9 Billion |

| Historical Data for: | 2019 - 2022 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 115 |

| Segments covered: | By Application, By Product Type and COVID-19 Impact Analysis |

| Companies covered:: | First Majestic Silver Corp., Endeavour Silver Corp., Fresnillo plc, MAG Silver Corp., Polymetal International plc, Hochschild Mining plc, Silvercorp Metals Inc., Hecla Mining Company, SSR Mining Inc., Pan American Silver Corp., Coeur Mining, Inc., Wheaton Precious Metals Corp., Fortuna Silver Mines Inc., and Other key players |

| Pitfalls & Challenges: | COVID-19 has the potential to impact the global market |

Get more details on this report -

Driving Factors

One of the key growth drivers for the silver target market is its widespread industrial uses, particularly in electronics, photovoltaics, and automotive industries. Silver's high electrical conductivity makes it indispensable for electronic devices, and as the world becomes more digital and connected, the need for such gadgets grows. Silver is an important component in the photovoltaics sector, helping to promote the global shift toward renewable energy sources. This change is expected to increase silver demand dramatically. Furthermore, investment demand is also a major contributor to the silver market's growth. With economic uncertainty and inflation fears, investors frequently resort to precious metals such as silver to protect against currency depreciation. Because silver is less expensive than gold, it appeals to a wider range of investors, including individuals and institutions. Silver's accessibility, paired with its potential for appreciation, makes it an attractive option for diversifying investment portfolios.

Restraining Factors

The silver target market has various constraints, including high manufacturing costs and technological limits, which may limit its use in new applications such as nanotechnology and advanced electronics. Regulatory issues and environmental concerns surrounding silver mining and disposal impose compliance burdens on firms that use silver-based goods. Furthermore, market rivalry from synthetic and alternative materials in industries such as healthcare, electronics, and energy storage may limit silver's growth potential in specific applications.

Market Segmentation

The silver target market share is classified into product type and application.

- The bullion segment held the greatest share in 2023 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the product type, the silver target market is divided into industrial silver, bullion, jewelry, coins, and others. Among these, the bullion segment held the greatest share in 2023 and is anticipated to grow at a significant CAGR during the forecast period. Value storage and investment are the primary drivers of the growth in bullion. Bullion is considered to be an asset that most investors require during economic volatility worldwide. Currently, bullion prices are considered to be linked with the market dynamics and investor sentiment, thus increasing the demand for this product as more people and institutions diversify. Due to intrinsic value and liquidity, bullion offers a great opportunity for short-term and long-term investments alike.

- The investment segment accounted for the majority of the share in 2023 and is estimated to grow at the fastest CAGR during the projected timeframe.

Based on the application, the silver target market is divided into industrial, jewelry, investment, and others. Among these, the investment segment accounted for the majority of the share in 2023 and is estimated to grow at the fastest CAGR during the projected timeframe. This is attributable to its significant demand as a safe-haven asset during economic uncertainty, inflation, and currency changes. Silver bullion, coins, and exchange-traded funds (ETFs) are frequently employed by investors to protect their capital, making this market more stable than industrial or jewelry applications. Its lower cost compared to gold draws both institutional and retail investors, especially in emerging nations where tangible assets are preferred. Furthermore, the growth of digital silver investments and silver-backed financial products has increased market accessibility, driving up investment demand.

Regional Segment Analysis of the Silver Target Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

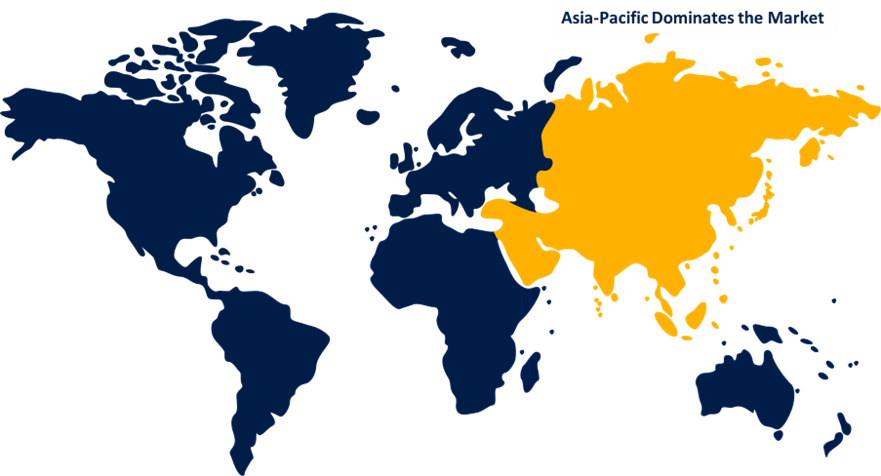

Asia Pacific is anticipated to hold the largest share of the silver target market over the predicted timeframe.

Get more details on this report -

Asia Pacific is anticipated to hold the largest share of the silver target market over the predicted timeframe. Countries such as China and India are major consumers of silver, both for industrial and jewelry purposes. Rapid industrialization and urbanization in these countries are likely to increase demand for silver in a variety of sectors. Additionally, cultural influences in India, where silver is traditionally utilized in jewelry and presents, have a considerable impact on the market.

North America is expected to grow at the fastest CAGR growth of the silver target market during the forecast period. The region is experiencing strong industrial growth, particularly in solar energy, electric vehicles (EVs), and advanced electronics, where silver plays an important role. Additionally, the expansion of the healthcare sector is increasing demand for silver in antimicrobial coatings, medical devices, and nanotechnology applications. This is due to rising investment demand, which is fueled by economic uncertainty and the growing adoption of silver-backed ETFs and digital assets.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the silver target market along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- First Majestic Silver Corp.

- Endeavour Silver Corp.

- Fresnillo plc

- MAG Silver Corp.

- Polymetal International plc

- Hochschild Mining plc

- Silvercorp Metals Inc.

- Hecla Mining Company

- SSR Mining Inc.

- Pan American Silver Corp.

- Coeur Mining, Inc.

- Wheaton Precious Metals Corp.

- Fortuna Silver Mines Inc.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the silver target market based on the below-mentioned segments:

Global Silver Target Market, By Product Type

- Industrial Silver

- Bullion

- Jewelry

- Coins

- Others

Global Silver Target Market, By Application

- Industrial

- Jewelry

- Investment

- Others

Global Silver Target Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the silver target market over the forecast period?The silver target market is projected to expand at a CAGR of 5.10% during the forecast period.

-

2. What is the market size of the silver target market?The Global Silver Target Market Size is Expected to Grow from USD 27.3 Billion in 2023 to USD 44.9 Billion by 2033, at a CAGR of 5.10% during the forecast period 2023-2033.

-

3. Which region holds the largest share of the silver target market?Asia Pacific is anticipated to hold the largest share of the silver target market over the predicted timeframe.

Need help to buy this report?