Singapore Animal Feed Market Size, Share, and COVID-19 Impact Analysis, By Form (Pellets, Crumbles, Mash, and Others), By Species (Poultry, Ruminants, Aqua, Swine, and Others), and Singapore Animal Feed Market Insights, Industry Trend, Forecasts to 2033

Industry: Food & BeveragesSingapore Animal Feed Market Insights Forecasts to 2033

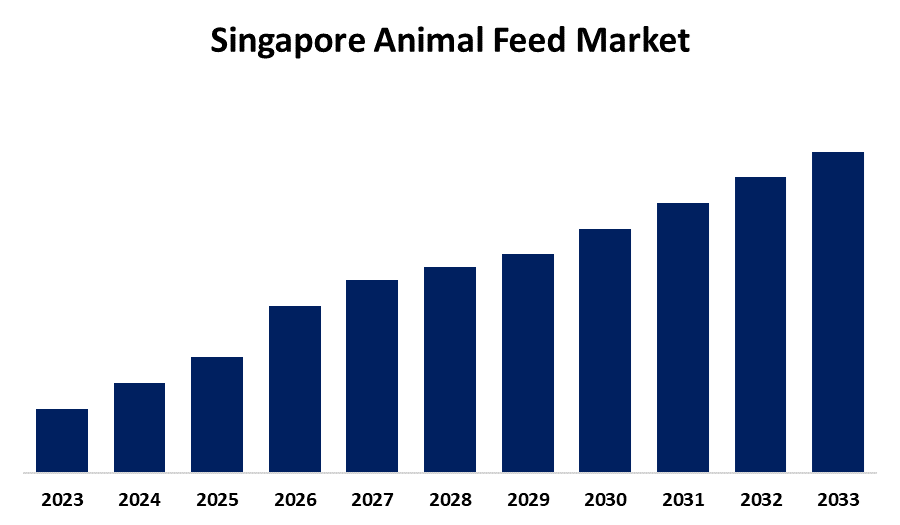

- The Market is growing at a CAGR of 3.9% from 2023 to 2033

- The Singapore Animal Feed Market Size is expected to hold a significant share by 2033

Get more details on this report -

The Singapore Animal Feed Market is anticipated to hold a significant share by 2033, growing at a CAGR of 3.9% from 2023 to 2033. The increasing need for high-quality meat & dairy products and the surging growth of pet food products are driving the growth of the animal feed market in the Singapore.

Market Overview

Animal feed has an important role in the production of safe and high-quality products derived from animals as well as the health and well-being of animals. Livestock production has increased due to the growing demand for animal-based proteins, primarily through the use of industrial compound feed. The increasing demand for animal protein with the growing population is providing lucrative market growth opportunities. It has been estimated that there are 14,000 farmers keeping pigs and poultry either singularly or in mixed farms, which contributes to a large proportion of the total protein requirements of the 2.2 million population in Singapore. Further, the surging development of high-performance marine aquaculture feeds and emphasis on a more sustainable and profitable aquaculture sector in the country are upsurging the market growth opportunity.

Report Coverage

This research report categorizes the market for the Singapore animal feed market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Singapore animal feed market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Singapore animal feed market.

Singapore Animal Feed Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 3.9% |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 230 |

| Tables, Charts & Figures: | 115 |

| Segments covered: | By Form, By Species and COVID-19 Impact Analysis |

| Companies covered:: | Charoen Pokphand Group, Cargill, Archer Daniels Midland Company, New Hope Liuhe Co. Ltd. and Others key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The annual production of 1,379,000 pigs, 28 million poultry, and 378 million hen eggs not only meets the total requirements of the country for these items but also provides a surplus for exports. The increased production of pet food products is propelling the market growth. The surging growth of pet food products owing to the increasing number of pet owners, innovation in pet food formulations, and applications in pet stores and veterinary clinics are significantly driving the animal feed market.

Restraining Factors

An increase in the production of greenhouse gases during the production of feed products is challenging the animal feed market.

Market Segmentation

The Singapore Animal Feed Market share is classified into form and species.

- The pellets segment accounted for the largest market share during the forecast period.

The Singapore animal feed market is segmented by form into pellets, crumbles, mash, and others. Among these, the pellets segment accounted for the largest market share during the forecast period. Compared to other forms of animal feed, feed pellets in cattle (cow) improve palatability, reduce eating time and the separation of feed, and also decrease waste while for chicken (broilers), pellets spend less time and need lower maintenance energy requirements on intake and digest. The high nutrition density, more comprehensive nutritional supply, and higher economic value of pellets are responsible for driving the market.

- The poultry segment dominated the Singapore animal feed market during the forecast period.

Based on the species, the Singapore animal feed market is divided into poultry, ruminants, aqua, swine, and others. Among these, the poultry segment dominated the Singapore animal feed market during the forecast period. To create balanced diets for various stages of chicken growth, including broilers (meat birds) and layers (egg-laying birds), poultry feed makers combine a variety of ingredients, including grains, oilseeds, protein meals, vitamins, minerals, and additives. The surging population growth, urbanization, and higher buying power and meat consumption in the country are responsible for propelling the market.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Singapore animal feed market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Charoen Pokphand Group

- Cargill

- Archer Daniels Midland Company

- New Hope Liuhe Co. Ltd.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In July 2024, FF, a global leader in bioscience-based solutions, announced the opening of its Shanghai Creative Center.

- In November 2023, Singapore-based Entobel has opened a black soldier fly larvae (BSL) production facility in Vietnam capable of producing 10,000 tons of protein meal a year.

- In September 2022, Nutrition Technologies, an agricultural technology company headquartered in Singapore and Malaysia, has raised $20 million in a funding round led by Thai state-owned oil and gas company PTT.

Market Segment

This study forecasts revenue at Singapore, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the Singapore Animal Feed Market based on the below-mentioned segments:

Singapore Animal Feed Market, By Form

- Pellets

- Crumbles

- Mash

- Others

Singapore Animal Feed Market, By Species

- Poultry

- Ruminants

- Aqua

- Swine

- Others

Need help to buy this report?