Singapore Architectural Coatings Market Size, Share, and COVID-19 Impact Analysis, By Resin (Acrylic, Alkyd, Epoxy, Polyester, Polyurethane, and Others), By Technology (Solventborne and Waterborne), By Sub End User (Commercial and Residential), and Singapore Architectural Coatings Market Insights, Industry Trend, Forecasts to 2033

Industry: Chemicals & MaterialsSingapore Architectural Coatings Market Insights Forecasts to 2033

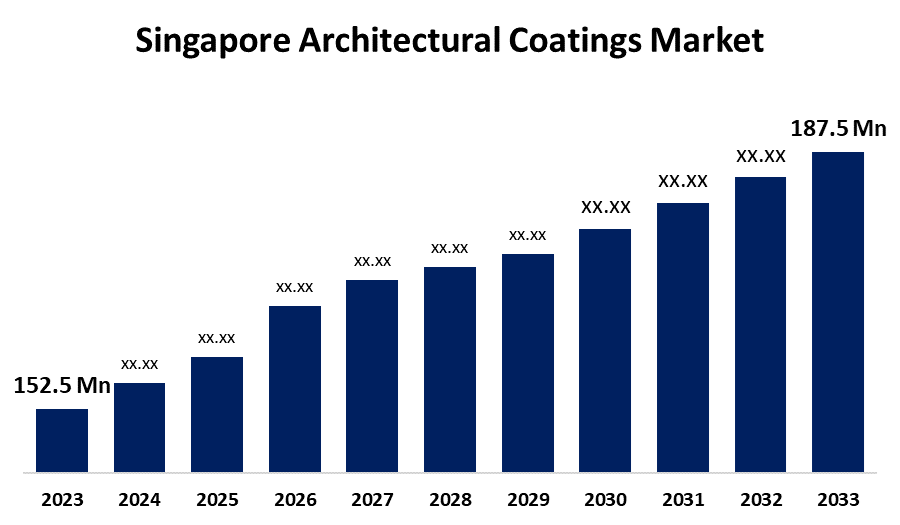

- The Singapore Architectural Coatings Market Size was valued at USD 152.5 Million in 2023.

- The Market is growing at a CAGR of 2.09% from 2023 to 2033

- The Singapore Architectural Coatings Market Size is expected to reach USD 187.5 Million by 2033

Get more details on this report -

The Singapore Architectural Coatings Market is anticipated to exceed USD 187.5 Million by 2033, growing at a CAGR of 2.09% from 2023 to 2033. The increasing adoption of waterborne coating formulations, demand for environmentally friendly features, growth in the construction industry, and urbanization & industrialization are driving the growth of the architectural coatings market in Singapore.

Market Overview

Architectural coatings refer to the paints, sealers, and specialty coatings for building and construction applications. They are intended to offer a layer of protection and/or aesthetic appeal to the exterior of an architectural feature or fixture in both interior and exterior applications. Architectural coatings promote sustainability, increase a building's longevity, and shield it from environmental influences in addition to improving its aesthetic appeal. Rapid urbanization, the thriving construction industry, remodeling and renovation projects, and rising consumer awareness of sustainable and eco-friendly coatings contribute to the market expansion. Technology breakthroughs, product innovation, and an emphasis on performance and quality have made the country's architectural coatings market more promising. Further, the inclination towards the use of low VOC coatings is offering market opportunities for architectural coatings.

Report Coverage

This research report categorizes the market for the Singapore architectural coatings market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Singapore architectural coatings market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Singapore architectural coatings market.

Singapore Architectural Coatings Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 152.5 Million |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 2.09% |

| 2033 Value Projection: | USD 187.5 Million |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 230 |

| Tables, Charts & Figures: | 95 |

| Segments covered: | By Resin, By Technology, By Sub End User and COVID-19 Impact Analysis |

| Companies covered:: | AkzoNobel N.V., Axalta Coating Systems, Jotun, Nippon Paint Holdings Co., Ltd., DAI NIPPON TORYO CO., LTD., Kansai Paint Co.,Ltd., Poly-Poxy Coatings Vietnam, Raffles paint pte ltd, Seamaster Paint (Singapore) Pte Ltd, SKK(S) Pte. Ltd and Others key players. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The increasing adoption of waterborne coating formulations along with their widespread application owing to their excellent durability, adhesion, and resistance properties are driving the market. The changing consumer inclination towards sustainable and eco-friendly products is responsible for propelling the market. The growth in the construction industry due to increased investments in infrastructure projects with the growing urbanization & industrialization in the country are contributing to driving the market demand.

Restraining Factors

The fluctuation in raw material prices affecting the overall price of architectural coatings is challenging the architectural coatings market. Further, the availability of alternative materials is responsible for restraining the market.

Market Segmentation

The Singapore Architectural Coatings Market share is classified into resin, technology, and sub end user.

- The acrylic segment dominated the Singapore architectural coatings market with the largest market share in 2023.

Based on the resin, the Singapore architectural coatings market is divided into acrylic, alkyd, epoxy, polyester, polyurethane, and others. Among these, the acrylic segment dominated the Singapore architectural coatings market with the largest market share in 2023. The industry's adherence to performance requirements and environmental norms is demonstrated by a preference for acrylics. The rising demand for aesthetically pleasing and long-lasting architectural coatings in order to protect and enhance the building's appearance is driving the market in the acrylic segment.

- The waterborne segment dominates the Singapore architectural coatings market during the forecast period.

The Singapore architectural coatings market is segmented by technology into solventborne and waterborne. Among these, the waterborne segment dominates the Singapore architectural coatings market during the forecast period. Any surface coating or finish that employs water as a solvent to spread the resin put to it to form the coating is referred to as a "waterborne coating". The benefits of waterborne coatings including longer pot life, flexibility, and low VOC content are contributing to driving the market.

- The residential segment is anticipated to hold the largest market share during the forecast period.

The Singapore architectural coatings market is segmented by sub end user into commercial and residential. Among these, the residential segment is anticipated to hold the largest market share during the forecast period. Singapore has seen a greater volume of residential building floor area relative to commercial floor area, which has led to significant consumption of architectural paint by the residential sector. The growing construction activities along with demand for eco-friendly coatings are significantly contributing to propel the market.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Singapore architectural coatings market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- AkzoNobel N.V.

- Axalta Coating Systems

- Jotun

- Nippon Paint Holdings Co., Ltd.

- DAI NIPPON TORYO CO., LTD.

- Kansai Paint Co.,Ltd.

- Poly-Poxy Coatings Vietnam

- Raffles paint pte ltd

- Seamaster Paint (Singapore) Pte Ltd

- SKK(S) Pte. Ltd

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In May 2024, Asian Paints said that its Singapore wholly owned subsidiary, Asian Paints International (APIPL) entered into a share purchase agreement with SCIB Chemicals S.A.E., Egypt (SCIB) to acquire 24.3% stake from minority shareholders of SCIB.

- In July 2022, Alora Paints earned U.S. Green Seal certification in August, becoming the first and only Singapore-based paint company to receive global environmental verification.

Market Segment

This study forecasts revenue at Singapore, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the Singapore Architectural Coatings Market based on the below-mentioned segments:

Singapore Architectural Coatings Market, By Resin

- Acrylic

- Alkyd

- Epoxy

- Polyester

- Polyurethane

- Others

Singapore Architectural Coatings Market, By Technology

- Solventborne

- Waterborne

Singapore Architectural Coatings Market, By Sub End User

- Commercial

- Residential

Need help to buy this report?