Singapore Beauty & Personal Care Market Size, Share, and COVID-19 Impact Analysis, By Type (Conventional and Organic), By Product (Skin Care, Hair Care, Color Cosmetics, Fragrances, and Others), and Singapore Beauty & Personal Care Market Insights, Industry Trend, Forecasts to 2033

Industry: Consumer GoodsSingapore Beauty & Personal Care Market Insights Forecasts to 2033

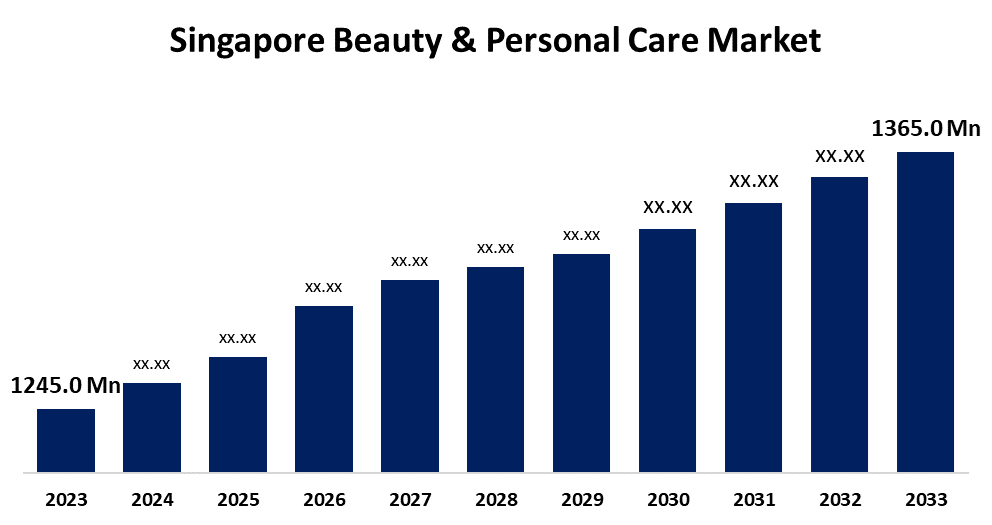

- The Singapore Beauty & Personal Care Market Size was valued at USD 1245.0 Million in 2023.

- The Market is growing at a CAGR of 0.92% from 2023 to 2033

- The Singapore Beauty & Personal Care Market Size is expected to reach USD 1365.0 Million by 2033

Get more details on this report -

The Singapore Beauty & Personal Care Market is anticipated to exceed USD 1365.0 Million by 2033, growing at a CAGR of 0.92% from 2023 to 2033. The increasing number of appearance-conscious consumers and the significance of grooming among millennials are driving the growth of the beauty & personal care market in Singapore.

Market Overview

Beauty & personal care refers to the consumer goods for cosmetics and body care. It encompasses a wide range of products including skincare, haircare, cosmetics, fragrances, and other related items that are designed to augment personal grooming, hygiene, and aesthetics. The evolving beauty standards, rising awareness about health & wellness, and the influence of social media are responsible for driving the demand for these products as they aid in promoting self-confidence, well-being, and self-expression. The increasing significance of sustainability leads to the development of eco-friendly beauty products. Further, the introduction of personalized beauty and skincare solutions as per the individual preferences, skin types, and specific concerns of the consumers are offering market opportunities for beauty & personal care.

Report Coverage

This research report categorizes the market for the Singapore beauty & personal care market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Singapore beauty & personal care market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Singapore beauty & personal care market.

Singapore Beauty & Personal Care Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 1245.0 Million |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 0.92% |

| 2033 Value Projection: | USD 1365.0 Million |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 95 |

| Segments covered: | By Type, By Product and COVID-19 Impact Analysis |

| Companies covered:: | L’Oreal, Estee Launder, Procter & Gamble, Maybelline, Clinique Singapore, Innisfree Singapore, Laneige Singapore, Kiehl’s Singapore and Others key players. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Singapore is one of the leading countries for spending on beauty and personal care products including mostly premium products, mass skincare, and color cosmetics. The penetration of various beauty brands such as Japanese & Korean beauty brands is bolstering the market growth for beauty & personal care. The increasing appearance-related consciousness especially related to social media is significantly responsible for driving the market demand for beauty & personal care. Further, the rising emphasis on grooming among millennials is escalating the beauty & personal care market.

Restraining Factors

The rising imposition of stringent regulations on the formulation, testing, and labeling of beauty products is challenging the market. Further, the high investment required for R&D, testing infrastructure, and product reformulation may lead to hamper product purchasing, thereby restraining the beauty & personal care market.

Market Segmentation

The Singapore Beauty & Personal Care Market share is classified into type and product.

- The conventional segment accounted for the largest revenue share of the Singapore beauty & personal care market in 2023.

The Singapore beauty & personal care market is segmented by type into conventional and organic. Among these, the conventional segment accounted for the largest revenue share of the Singapore beauty & personal care market in 2023. Conventional products are made from synthetic chemicals and artificial ingredients that are able to provide quick results and are often used to cover up skin imperfections. The affordability and accessibility of conventional beauty & personal care products are driving the market.

- The skin care segment dominated the Singapore beauty & personal care market with the largest market share in 2023.

Based on the product, the Singapore beauty & personal care market is divided into skin care, hair care, color cosmetics, fragrances, and others. Among these, the skin care segment dominated the Singapore beauty & personal care market with the largest market share in 2023. As per the survey by Daily Vanity, it is estimated that consumers frequently purchase skin care products every three months, and some every week. The rising consciousness of enhancing physical appearance and skin care is driving the market demand in the skin care segment.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Singapore beauty & personal care market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- L’Oreal

- Estee Launder

- Procter & Gamble

- Maybelline

- Clinique Singapore

- Innisfree Singapore

- Laneige Singapore

- Kiehl’s Singapore

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In July 2024, Syensqo and Allozymes, a Singapore-based enzyme engineering start-up, signed a Memorandum of Understanding to leverage both companies strengths in biotechnology to develop advanced solutions for the personal care (especially skincare) and home care markets.

- In May 2024, Wella Professionals expanded online in Singapore to grow its market presence and consumer reach.

- In April 2022, Singapore-based beauty and personal care products company Believe Pte Ltd raised $55 million in its Series C funding round.

Market Segment

This study forecasts revenue at Singapore, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the Singapore Beauty & Personal Care Market based on the below-mentioned segments:

Singapore Beauty & Personal Care Market, By Type

- Conventional

- Organic

Singapore Beauty & Personal Care Market, By Product

- Skin Care

- Hair Care

- Color Cosmetics

- Fragrances

- Others

Need help to buy this report?