Singapore Blood Plasma Market Size, Share, and COVID-19 Impact Analysis, By Type (Albumin, Factor VIII, Factor IX, Immunoglobulin, Hyperimmune Globulin, and Others), By Application (Haemophilia, Hypogammaglobinemia, Immunodeficiency Diseases, Von Willebrand’s Disease, and Others), and Singapore Blood Plasma Market Insights, Industry Trend, Forecasts to 2033

Industry: HealthcareSingapore Blood Plasma Market Insights Forecasts to 2033

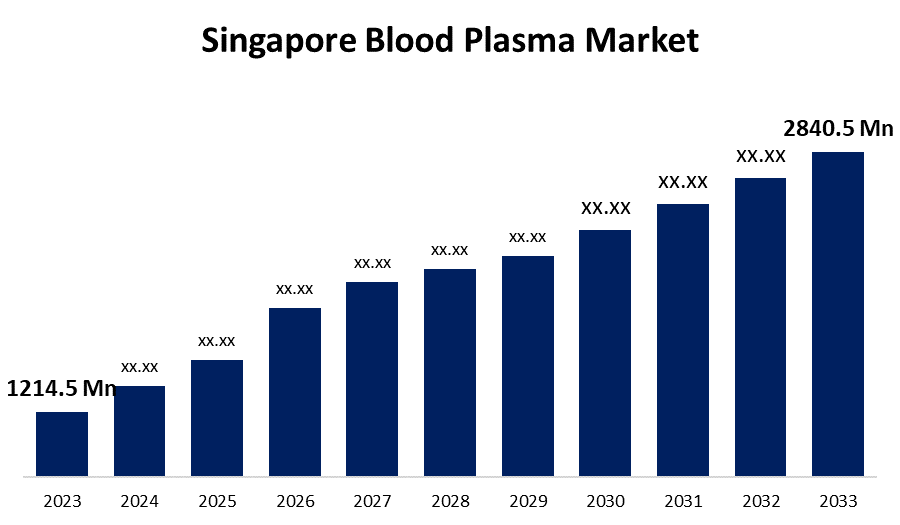

- The Singapore Blood Plasma Market Size was valued at USD 1214.5 Million in 2023.

- The Market Size is Growing at a CAGR of 8.87% from 2023 to 2033

- The Singapore Blood Plasma Market Size is expected to reach USD 2840.5 Million by 2033

Get more details on this report -

The Singapore Blood Plasma Market is anticipated to exceed USD 2840.5 Million by 2033, growing at a CAGR of 8.87% from 2023 to 2033. The increasing prevalence of chronic diseases, aging population, and technological advancements are driving the growth of the blood plasma market in the Singapore.

Market Overview

Blood plasma is the liquid component of blood, comprising 55% of blood’s total volume. It contains a variety of proteins, antibodies, clotting factors, and minerals and is essential for sustaining general health. They are needed to recover the body from injury and function to distribute nutrients, remove waste, and prevent infection while moving throughout the blood circulatory system. The blood plasma industry includes blood plasma collecting facilities, plasma fractionation, and the production of products derived from plasma, including albumin, clotting factors, immunoglobulins, and alpha-1 antitrypsin. In order to meet patients' medical demands, the blood plasma market aims to gather, process, and use blood plasma and its derivatives. The increased need for plasma based therapies owing to the rising number of diagnosed cases of blood-borne diseases along with public health initiatives and awareness campaigns ultimately leads to drive the demand for blood plasma products. Further, the growing development of plasma-derived products with the help of government support and favorable policies & regulations are promoting the blood plasma market in Singapore.

Report Coverage

This research report categorizes the market for the Singapore blood plasma market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Singapore blood plasma market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Singapore blood plasma market.

Singapore Blood Plasma Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023 : | USD 1214.5 Million |

| Forecast Period: | 2023 – 2033 |

| Forecast Period CAGR 2023 – 2033 : | 8.87% |

| 023 – 2033 Value Projection: | USD 2840.5 Million |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 230 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Type, By Application |

| Companies covered:: | CSL Limited, Grifols S.A., Octapharma AG, Takeda Pharmaceutical Company Ltd., Others |

| Pitfalls & Challenges: | Covid-19 Impact, Challenge, Future,Growth and Analysis |

Get more details on this report -

Driving Factors

The increasing prevalence of chronic diseases is surging the demand for blood plasma products. For instance, platelet-rich plasma (PRP) injections have been demonstrated to improve function and reduce pain in conditions of tendonitis conditions and also treat injuries to ligaments and muscles. The increasing aging population is also responsible for driving the market demand as these age groups are more susceptible to health conditions including immune disorders and blood disorders. Further, technological advancements such as the use of fractionation technologies for manufacturing large quantities of high-quality and safe medicine products are propelling the market growth.

Restraining Factors

Compliance with the stringent regulations and guidelines for ensuring safe and quality blood plasma products is challenging the blood plasma market. Further, the scarcity of eligible donors due to restrictive eligibility criteria is responsible for hampering the market growth.

Market Segmentation

The Singapore Blood Plasma Market share is classified into type and application.

- The immunoglobulin segment dominated the market with a significant market share in 2023.

The Singapore blood plasma market is segmented by type into albumin, factor VIII, factor IX, immunoglobulin, hyperimmune globulin, and others. Among these, the immunoglobulin segment dominated the market with a significant market share in 2023. Immunoglobulin blood plasma products are used in treatment as replacement therapy for immunodeficient patients or as immunomodulatory therapy for autoimmune and alloimmune disorders. The growing prevalence of chronic and autoimmune diseases and healthcare initiatives along with immunization programs are driving the market growth.

- The immunodeficiency diseases segment accounted for the largest market share in 2023.

The Singapore blood plasma market is segmented by application into haemophilia, hypogammaglobinemia, immunodeficiency diseases, Von Willebrand’s disease, and others. Among these, the immunodeficiency diseases segment accounted for the largest market share in 2023. Immunodeficiency diseases are characterized by the disruption of the body’s ability to defend itself against antigens including bacteria, viruses, cancer cells, and parasites. The increasing incidence of immune-deficient disorders and rising healthcare expenditure are propelling the market.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Singapore blood plasma market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- CSL Limited

- Grifols S.A.

- Octapharma AG

- Takeda Pharmaceutical Company Ltd.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In August 2023, Cambodian conglomerate Royal Group of Companies (RGC) entered into a joint venture (JV) with two Australian firms to collect plasma throughout Asia and build a new plasma fractionation facility in Singapore for $400 million to fractionate one million litres per year.

- In May 2023, Teva Pharmaceutical Industries Ltd. announced a new strategic framework with four main pillars to position the Company for a new era of growth. This strategy aims to bolster the Company’s strong commercial portfolio with AUSTEDO, AJOVY, UZEDYTM and biosimilars, amplify its innovative pipeline, sustain its generics powerhouse and focus the business.

Market Segment

This study forecasts revenue at Singapore, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the Singapore Blood Plasma Market based on the below-mentioned segments:

Singapore Blood Plasma Market, By Type

- Albumin

- Factor VIII

- Factor IX

- Immunoglobulin

- Hyperimmune Globulin

- Others

Singapore Blood Plasma Market, By Application

- Haemophilia

- Hypogammaglobinemia

- Immunodeficiency Diseases

- Von Willebrand’s Disease

- Others

Need help to buy this report?