Singapore Bunker Fuel Market Size, Share, and COVID-19 Impact Analysis, By Type (High Sulfur Fuel Oil (HSFO), Low Sulfur Fuel Oil (LSFO), Marine Gas Oil (MGO), and Others), By Commercial Distributor (Oil Majors, Large Independent, and Small Independent), By Application (Container, Bulk Carrier, Oil Tanker, General Cargo, Chemical Tanker, Fishing Vessels, Gas Tanker, and Others), and Singapore Bunker Fuel Market Insights, Industry Trend, Forecasts to 2033

Industry: Energy & PowerSingapore Bunker Fuel Market Insights Forecasts to 2033

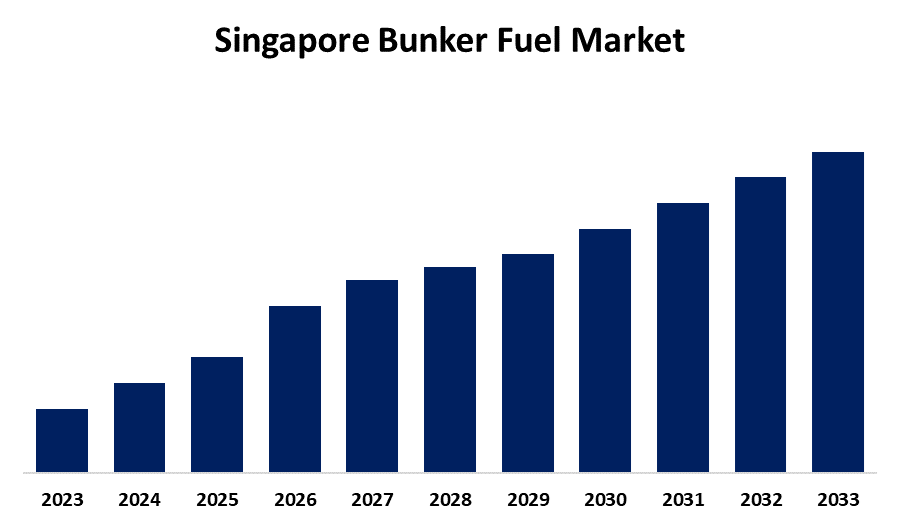

- The Market is growing at a CAGR of 14.2% from 2023 to 2033

- The Singapore Bunker Fuel Market Size is expected to hold a significant share by 2033

Get more details on this report -

The Singapore Bunker Fuel Market is anticipated to hold a significant share by 2033, growing at a CAGR of 14.2% from 2023 to 2033. The increasing marine transportation, stringent environmental regulations, and growing use of support vessels in offshore oil & gas development are driving the growth of the bunker fuel market in Singapore.

Market Overview

Bunker fuel is the marine fuel that is used to power ships and is classified based on viscosity, pour point, sulfur, carbon, and metal residue content. The expanding trade and maritime transportation necessitated the increasing number of ships and fuel consumption. The increased demand for bunker fuel results from larger and more frequent maritime routes. Further, the market expansion of bunker fuel is fueled by the growth of e-commerce and expanding markets, both of which demand strong logistical networks backed by significant maritime transportation. The surging adoption of low sulfur and alternative fuels including LNG and biofuels are offering market opportunities. The increasing investment in new infrastructure and supply chains and fuel technology innovation are enhancing the sustainability profile, thereby driving the market expansion.

Report Coverage

This research report categorizes the market for the Singapore bunker fuel market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Singapore bunker fuel market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Singapore bunker fuel market.

Singapore Bunker Fuel Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 14.2% |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 230 |

| Tables, Charts & Figures: | 105 |

| Segments covered: | By Type, By Commercial Distributor, By Application and COVID-19 Impact Analysis |

| Companies covered:: | Petrochina International, Sentek Marine & Trading Pte Ltd, Ocean Bunkering Services, Shell Eastern Trading (Pte) Ltd, Total Marine Fuels Pte Ltd., Equatorial Marine Fuel Management Services and Others key players. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Factors such as strategic location and connectivity, cutting-edge infrastructure, and port facilities are responsible for increasing marine transportation which ultimately leads to driving the market for bunker fuel. Further, the stringent environmental regulation is contributing to driving the market. Offshore support vessels are employed in high-seas construction and oil and gas exploration. A range of offshore vessels are used to transport equipment and rigs, service offshore wind turbines, and supply essential supplies to the excavation and construction units situated on the high seas. The growing use of support vessels in offshore oil and gas development is significantly contributing to propelling the market growth.

Restraining Factors

The stringent environmental regulations such as IMO 2020 regulations which are implemented to limit the sulfur content in marine bunker fuels may hamper the market growth. Further, the volatility in oil prices is responsible for restraining the Singapore bunker fuel market.

Market Segmentation

The Singapore Bunker Fuel Market share is classified into type, commercial distributor, and application.

- The low sulfur fuel oil (LSFO) segment accounted for the largest market share during the forecast period.

The Singapore bunker fuel market is segmented by type into high sulfur fuel oil (HSFO), low sulfur fuel oil (LSFO), marine gas oil (MGO), and others. Among these, the low sulfur fuel oil (LSFO) segment accounted for the largest market share during the forecast period. There is a rising launch of low sulfur fuel oil futures contract for helping shipping and energy forms to manage price fluctuations. Further, the implementation of stringent regulation for reducing the sulfur emission from ships is contributing to drive the market demand in the low sulfur fuel oil (LSFO) segment.

- The oil majors segment dominated the Singapore bunker fuel market during the forecast period.

Based on the commercial distributor, the Singapore bunker fuel market is divided into oil majors, large independent, and small independent. Among these, the oil majors segment dominated the Singapore bunker fuel market during the forecast period. Oil majors refer to a group of companies that control the chartering of the majority of oil tankers in the maritime industry. Bunker fuel oil is engaged in international navigation which takes place through sea, coastal waters, on waterways, and inland lakes.

- The container segment held the largest revenue share of the Singapore bunker fuel market in 2023.

The Singapore bunker fuel market is segmented by application into container, bulk carrier, oil tanker, general cargo, chemical tanker, fishing vessels, gas tanker, and others. Among these, the container segment held the largest revenue share of the Singapore bunker fuel market in 2023. The rising demand for cargo transportation through ships and trade-related agreements is contributing to propel the market in the container segment.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Singapore bunker fuel market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Petrochina International

- Sentek Marine & Trading Pte Ltd

- Ocean Bunkering Services

- Shell Eastern Trading (Pte) Ltd

- Total Marine Fuels Pte Ltd.

- Equatorial Marine Fuel Management Services

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In February 2024, Vitol Bunkers has taken delivery of the “Marine Future”, its first specialised bunker barge in Singapore, strengthening its position in Asia’s expanding biofuel bunker market.

- In August 2024, TotalEnergies Marine Fuels supplied its first B100 biofuel bunker in Singapore, marking a significant expansion in its low-carbon fuels offer as it supports the decarbonization goals of global shipping.

Market Segment

This study forecasts revenue at Singapore, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the Singapore Bunker Fuel Market based on the below-mentioned segments:

Singapore Bunker Fuel Market, By Type

- High Sulfur Fuel Oil (HSFO)

- Low Sulfur Fuel Oil (LSFO)

- Marine gasoil (MGO)

- Others

Singapore Bunker Fuel Market, By Commercial Distributor

- Oil Majors

- Large independent

- Small independent

Singapore Bunker Fuel Market, By Application

- Container

- Bulk Carrier

- Oil Tanker

- General Cargo

- Chemical Tanker

- Fishing Vessels

- Gas Tanker

- Others

Need help to buy this report?