Singapore Chemical Logistics Market Size, Share, and COVID-19 Impact Analysis, By Mode of Transportation (Roadways, Railways, Airways, Waterways, and Pipelines), By Services (Transportation & Distribution, Storage & Warehousing, Customs & Security, Green Logistics, Consulting & Management Services, and Others), By End User (Chemical Industry, Pharmaceutical Industry, Cosmetic Industry, Oil & Gas Industry, Specialty Chemicals Industry, Food, and Others), and Singapore Chemical Logistics Market Insights, Industry Trend, Forecasts to 2033

Industry: Automotive & TransportationSingapore Chemical Logistics Market Insights Forecasts to 2033

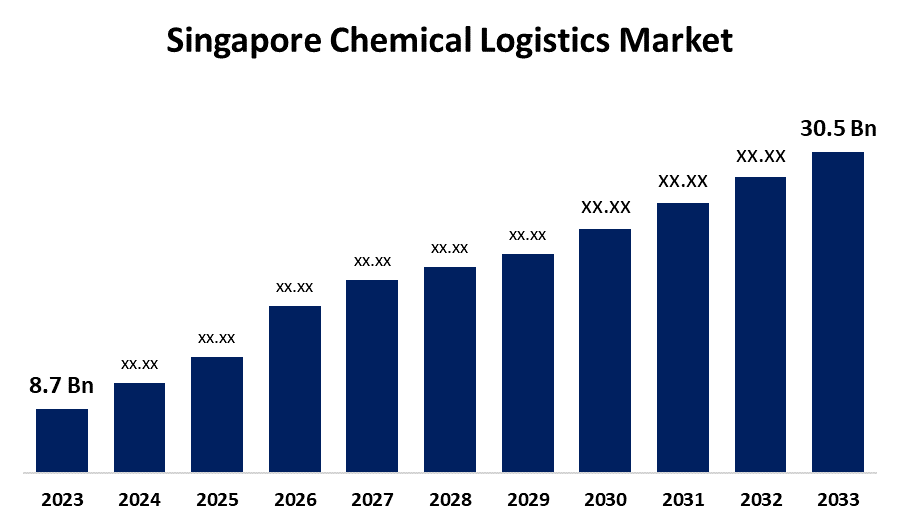

- The Singapore Chemical Logistics Market Size was valued at USD 8.7 Billion in 2023.

- The Market Size is Growing at a CAGR of 13.36% from 2023 to 2033

- The Singapore Chemical Logistics Market Size is Expected to reach USD 30.5 Billion by 2033

Get more details on this report -

The Singapore Chemical Logistics Market Size is anticipated to Exceed USD 30.5 Billion by 2033, Growing at a CAGR of 13.36% from 2023 to 2033. The increasing demand for petrochemicals, stringent regulatory requirements, and the increase in investments are driving the growth of the chemical logistics market in Singapore.

Market Overview

Chemical logistics is the process of organizing, and managing the flow of chemicals and related materials from suppliers to manufacturers and consumers. The rising demand for chemicals in several industries, including food, oil and gas, cosmetics, pharmaceuticals, and specialty chemicals is responsible for escalating the market growth for chemical logistics. Further, the investment in the development of sophisticated and safer chemical logistics systems to prevent any dangerous situations is augmenting market growth. Technological innovations including real-time tracking & visibility, predictive analytics for proactive decision-making, blockchain technology for transparency & traceability in the supply chain, autonomous vehicles & robotics, and environmental monitoring & sustainability are driving the market growth opportunities for chemical logistics.

Report Coverage

This research report categorizes the market for the Singapore chemical logistics market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Singapore chemical logistics market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Singapore chemical logistics market.

Singapore Chemical Logistics Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023 : | USD 8.7 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 13.36% |

| 2033 Value Projection: | USD 30.5 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 167 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Mode of Transportation, By Services, By End User |

| Companies covered:: | ALPS Global Logistics, Koyo Kaiun Co., Ltd., Iino Singapore Pte Ltd, Fairfield Chemical Carriers, MCL Logistics Asia Pte Ltd, Win-Bells Logistics & Services Pte. Ltd., Tatsumi Marine (Singapore) Pte Ltd, DHL, Aurora Tankers Management Pte. Ltd., Bertschi Singapore Pte Ltd., Kaplan Logistics, and Others. |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis. |

Get more details on this report -

Driving Factors

The rising investment in petrochemicals and their consumption, and refining capacities are the factors driving the petrochemical industry, thereby propelling the market demand for chemical logistics. The stringent regulatory requirements for ensuring the safe handling, storage, and transportation of hazardous materials are driving the market demand for chemical logistics.

Restraining Factors

The risk of transporting hazardous chemicals includes severe consequences such as environmental damage, injuries, or even fatalities. Thus, the complexity associated with transporting hazardous chemicals is challenging the Singapore chemical logistics market.

Market Segmentation

The Singapore Chemical Logistics Market share is classified into mode of transportation, services, and end user.

- The roadways segment is anticipated to hold the largest market share during the forecast period.

The Singapore chemical logistics market is segmented by mode of transportation into roadways, railways, airways, waterways, and pipelines. Among these, the roadways segment is anticipated to hold the largest market share during the forecast period. The chemical industry prefers road transport because it may utilize a variety of vehicle types, such as tanker trucks for liquid chemicals or dry van trailers for solid materials, guaranteeing the prompt and safe delivery of a wide range of chemical cargoes. The existence of well-developed road connectivity is driving the market in the roadways segment.

- The transportation & distribution segment dominated the Singapore chemical logistics market during the forecast period.

Based on the services, the Singapore chemical logistics market is divided into transportation & distribution, storage & warehousing, customs & security, green logistics, consulting & management services, and others. Among these, the transportation & distribution segment dominated the Singapore chemical logistics market during the forecast period. Transportation and distribution services include the connection of raw material suppliers, plants, warehouses, and channel members with the help of water, rail, motor carrier, air, and pipeline. The rise in the e-commerce industry is propelling the market growth.

- The chemical industry segment dominated the Singapore chemical logistics market through the forecast period.

The Singapore chemical logistics market is segmented by end user into chemical industry, pharmaceutical industry, cosmetic industry, oil & gas industry, specialty chemicals industry, food, and others. Among these, the chemical industry segment dominated the Singapore chemical logistics market through the forecast period. In chemical manufacturing, supply chain management is associated with managing and optimizing the flow of materials, information, and resources used in the production and delivery of chemical products. The specialized storage services required for hazardous chemicals and transportation of liquid and bulk raw materials in the chemical industry are driving the market.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Singapore chemical logistics market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- ALPS Global Logistics

- Koyo Kaiun Co., Ltd.

- Iino Singapore Pte Ltd

- Fairfield Chemical Carriers

- MCL Logistics Asia Pte Ltd

- Win-Bells Logistics & Services Pte. Ltd.

- Tatsumi Marine (Singapore) Pte Ltd

- DHL

- Aurora Tankers Management Pte. Ltd.

- Bertschi Singapore Pte Ltd.

- Kaplan Logistics

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In October 2024, PSA Singapore (PSA) unveiled the PSA Supply Chain Hub @ Tuas (PSCH), a central part of its strategic expansion within Tuas Port, at its groundbreaking ceremony. This facility, scheduled to be ready by 2027, is poised to transform the logistics and supply chain landscape in Singapore.

- In September 2024, DP World is expanding its specialist logistics service offering for customers in the retail and chemicals sectors, adding new capabilities and expertise.

- In September 2024, COSCO SHIPPING International (Singapore) Co., Ltd. announced the commencement of Phase 2 of its Jurong Island Logistics Hub, aiming to boost operational capacity and support Singapore’s sustainability efforts in the petrochemical and chemical logistics sector.

- In March 2023, Brenntag, the global market leader in chemicals and ingredients distribution, announced the acquisition of Aik Moh Group. The group offers a wide range of industrial chemicals with excellence in last-mile delivery, mixing and blending and offers value-added services such as repacking, warehousing, and logistics support with a focus on South-East Asia.

Market Segment

This study forecasts revenue at Singapore, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the Singapore Chemical Logistics Market based on the below-mentioned segments:

Singapore Chemical Logistics Market, By Mode of Transportation

- Roadways

- Railways

- Airways

- Waterways

- Pipelines

Singapore Chemical Logistics Market, By Services

- Transportation & Distribution

- Storage & Warehousing

- Customs & Security

- Green Logistics

- Consulting & Management Services

- Others

Singapore Chemical Logistics Market, By End User

- Chemical Industry

- Pharmaceutical Industry

- Cosmetic Industry

- Oil & Gas Industry

- Specialty Chemicals Industry

- Food

- Others

Need help to buy this report?