Singapore Cold Chain Market Size, Share, and COVID-19 Impact Analysis, By Type (Storage, Transportation, Packaging, and Monitoring Components), By Temperature Range (Chilled, Frozen, and Deep-frozen), By Application (Food & Beverages, Pharmaceuticals, and Others), and Singapore Cold Chain Market Insights, In By Temperature Range dustry Trend, Forecasts to 2033

Industry: Automotive & TransportationSingapore Cold Chain Market Insights Forecasts to 2033

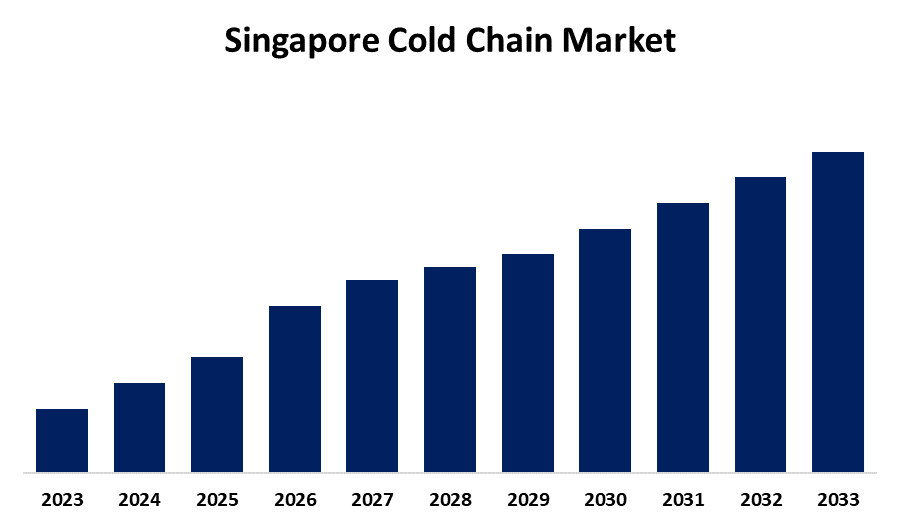

- The Market is growing at a CAGR of 12.80% from 2023 to 2033

- The Singapore Cold Chain Market Size is expected to hold a significant share by 2033

Get more details on this report -

The Singapore Cold Chain Market is anticipated to hold a significant share by 2033, growing at a CAGR of 12.80% from 2023 to 2033. The increasing demand for perishable goods, the growth of pharmaceutical & biotech industries, stringent regulations, the expanding food retail sector, and advancements in refrigeration technology are driving the growth of the cold chain market in Singapore.

Market Overview

Cold chain is a temperature-controlled supply chain, comprising of storage, transportation, and distribution of temperature-sensitive products including pharmaceutical and food products. Cold chain is necessary for maintaining the quality and safety of the product throughout the process from production to distribution. They are commonly used in the food and pharmaceutical industries, as well as in chemical shipments. In order to prevent product spoilage, contamination, or deterioration, effective cold chain operations depend on refrigeration technology, effective packaging, and stringent quality control procedures. The introduction of automatic software solutions and integration of advanced algorithms, IoT sensors, and predictive analytics boost the efficiency of cold chain management, offering lucrative market opportunities.

Report Coverage

This research report categorizes the market for the Singapore cold chain market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Singapore cold chain market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Singapore cold chain market.

Singapore Cold Chain Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 12.80% |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 188 |

| Tables, Charts & Figures: | 106 |

| Segments covered: | By Type, By Temperature Range, By Application, and COVID-19 Impact Analysis |

| Companies covered:: | DB Schenker Logistics Company, DHL Logistics, MNX Global Logistics, Yusen Logistics Service, Pan Ocean, and Others Key players. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The increasing demand for perishable goods due to various factors including consumer preferences, seasonality, and economic conditions are driving the market. There is an evolving need for cold chain in pharma shipments and transits for transporting and storing products like vaccines, biologics, and drugs. The evolving supply chain management activities in pharmaceutical companies like GSK, MSD, and Roche are responsible for driving market demand. Further, the stringent regulations for transporting perishable food items (Singapore Food Agency) and pharmaceutical products like vaccines are responsible for driving market demand. For instance, the Health Sciences Authority (HSA) in May 2021 approved new storage conditions for the Pfizer-BioNTech COVID-19 vaccine. The expanding food retail sector including rising disposable income, nations’s heavy reliance on food imports, and e-commerce retail are contributing to escalate market growth. The advancements in refrigeration technology including temperature-controlled supply chain are driving the market growth.

Restraining Factors

The high energy costs due to the increased need for substantial energy consumption for maintaining low temperatures may be responsible for hindering the market. Further, the substantial capital investments required for maintaining a robust cold chain infrastructure are challenging the Singapore cold chain market.

Market Segmentation

The Singapore Cold Chain Market share is classified into type, temperature range, and application.

- The storage segment dominated the market with a significant market share during the forecast period.

The Singapore cold chain market is segmented by type into storage, transportation, packaging, and monitoring components. Among these, the storage segment dominated the market with a significant market share during the forecast period. Cold storage is a cold chain’s static part that aids in preserving perishable items. Consumer inclination towards packaged foods and changing dietary patterns and lifestyles are contributing to driving the market in the storage segment.

- The food & beverages segment dominated the Singapore cold chain market with the largest market share in 2023.

Based on the application, the Singapore cold chain market is divided into food & beverages, pharmaceuticals, and others. Among these, the food & beverages segment dominated the Singapore cold chain market with the largest market share in 2023. Food & beverages are preserved by cold storage facilities by slowing down microbial growth which is responsible for spoilage as well as maintaining the sensory qualities of the items. The increasing preference for processed foods is also driving the market demand.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Singapore cold chain market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- DB Schenker Logistics Company

- DHL Logistics

- MNX Global Logistics

- Yusen Logistics Service

- Pan Ocean

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In April 2024, Courier and logistic provider Ninja Van launched B2B and cold-chain delivery services. The services, Ninja B2B and Ninja Cold are part of the company's expansion plans beyond eCommerce.

- In September 2023, DP World is looking to expand its logistics and supply chain capabilities in the Southeast Asian region building on its existing terminal business.

- In May 2022, Lineage Logistics, LLC, the world’s largest and most innovative temperature-controlled industrial REIT and logistics solutions provider, announced it had acquired Mandai Link Logistics, marking the Company’s market entry into Singapore.

Market Segment

This study forecasts revenue at Singapore, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the Singapore Cold Chain Market based on the below-mentioned segments:

Singapore Cold Chain Market, By Type

- Storage

- Transportation

- Packaging

- Monitoring Components

Singapore Cold Chain Market, By Temperature Range

- Chilled

- Frozen

- Deep-frozen

Singapore Cold Chain Market, By Application

- Food & Beverages

- Pharmaceuticals

- Others

Need help to buy this report?