Singapore Dairy Alternative Market Size, Share, and COVID-19 Impact Analysis, By Source (Soy, Almond, Coconut, Rice, Oats, and Others), By Product Type (Non-dairy Milk, Butter, Cheeses, Yoghurts, Ice Cream, and Others), By Distribution Channel (Supermarkets/Hypermarkets, Convenience Stores, Online Retail, and Others), and Singapore Dairy Alternative Market Insights, Industry Trend, Forecasts to 2033

Industry: Food & BeveragesSingapore Dairy Alternative Market Insights Forecasts to 2033

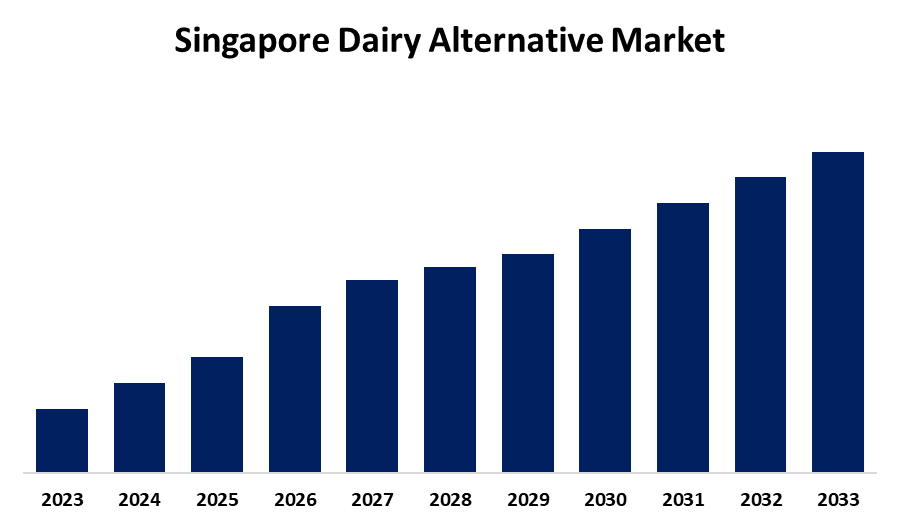

- The Market Size is growing at a CAGR of 13.5% from 2023 to 2033

- The Singapore Dairy Alternative Market Size is expected to hold a significant share by 2033

Get more details on this report -

The Singapore Dairy Alternative Market Size is anticipated to hold a significant share by 2033, growing at a CAGR of 13.5% from 2023 to 2033. The increasing prevalence of dairy allergies and lactose intolerance, demand for vegan foods, environmental awareness, availability of a wide range of flavors and packaging options, and concerns about animal welfare are driving the growth of the dairy alternative market in Singapore.

Market Overview

Dairy alternatives refer to the food and beverages that can be used as a substitute for dairy. These are made from plants and are thought to be a much healthier option than dairy. Almond milk, rice milk, and soy milk are some of the most widely used dairy substitutes. Because dairy substitutes contain several important vitamins and minerals, they are regarded as healthful. They also contain no lactose and are low in fat and cholesterol. There are lots of delicious and cruelty-free dairy alternatives available. Soy, almond, oat, rice, and coconut milk are examples of plant-based alternatives that are less harmful to the environment, use fewer resources to produce, and are frequently enriched with vitamins and minerals that are necessary for a balanced diet. The market for dairy alternatives is expected to rise as a result of the vegan population's increasing desire for these products as well as the introduction of new flavors and varieties.

Report Coverage

This research report categorizes the market for the Singapore dairy alternative market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Singapore dairy alternative market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Singapore dairy alternative market.

Singapore Dairy Alternative Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 13.5% |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 195 |

| Tables, Charts & Figures: | 102 |

| Segments covered: | By Source, By Product, By Distribution Channel |

| Companies covered:: | Sanitarium Health and Wellbeing Company, Danone, Nestle SA, and Other Key Vendors |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis |

Get more details on this report -

Driving Factors

It seems that food allergies are becoming more common, or at least that parents are becoming more aware of them. The increasing number of children with food allergies is responsible for driving the market demand. The growing trend of veganism owing to the environmental and health concerns on meat/fish consumption is propelling the market growth. The increasing popularity of dairy alternatives like soy milk in the country, facing intense competition among products providing a variety of flavors and nutritional benefits. The introduction of innovative flavors and packaging options to attract consumers is driving the market growth. The increasing priority on animal welfare, sustainability, and health consciousness embracing plant-based alternatives are propelling the market for dairy alternative.

Restraining Factors

The food allergies associated with the consumption of some dairy alternatives like soy and nuts among some people are challenging the Singapore dairy alternative market. Processors typically face difficulties with taste and solubility when creating non-dairy products which is responsible for low purchasing rates resulting in restraining the market growth.

Market Segmentation

The Singapore Dairy Alternative Market share is classified into source, product type, and distribution channel.

- The soy segment is anticipated to dominate the Singapore dairy alternative market during the forecast period.

The Singapore dairy alternative market is segmented by source into soy, almond, coconut, rice, oats, and others. Among these, the soy segment is anticipated to dominate the Singapore dairy alternative market during the forecast period. The most common alternative to dairy milk is soy milk which possesses high nutritional value. Since soy is rich in calcium and proteins, they are considered to be great dairy alternatives, particularly for people who are lactose intolerant.

- The non-dairy milk segment is expected to dominate the market during the projected timeframe.

The Singapore dairy alternative market is segmented by product type into non-dairy milk, butter, cheeses, yoghurts, ice cream, and others. Among these, the non-dairy milk segment is expected to dominate the market during the projected timeframe. To increase their nutritional value, non-dairy milk substitutes are frequently supplemented with calcium and certain vitamins and contain a higher water content. The rising awareness about health & wellness, environmental concerns about dietary production, lactose intolerance cases, and rising veganism are driving the market.

- The supermarkets/hypermarkets segment accounted for the largest market share during the forecast period.

The Singapore dairy alternative market is segmented by distribution channel into supermarkets/hypermarkets, convenience stores, online retail, and others. Among these, the supermarkets/hypermarkets segment accounted for the largest market share during the forecast period. Consumers find it simple to store, prepare, and consume these products, which have made a successful transition to the convenience market. The increasing urbanization and changing consumer lifestyles are responsible for driving the market in the supermarkets/hypermarkets segment.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Singapore dairy alternative market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Sanitarium Health and Wellbeing Company

- Danone

- Nestle SA

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In August 2023, Agrocorp International, a Singapore-based global agrifood supplier and parent company of the plant-based brand HerbYvore, launched HerbY-Cheese — the first vegan cheese range developed in Singapore that mimics dairy cheese.

- In September 2022, Singapore-based oatmilk company Oatside announced the closing of a $65.5m Series A funding round to expand its production output across Singapore and the greater Asia-Pacific region.

- In August 2021, mohjo, a Singapore-based direct-to-consumer brand focused on clean-label, plant based dairy-alternatives, announced that it had secured its seed funding.

Market Segment

This study forecasts revenue at Singapore, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the Singapore Dairy Alternative Market based on the below-mentioned segments:

Singapore Dairy Alternative Market, By Source

- Soy

- Almond

- Coconut

- Rice

- Oats

- Others

Singapore Dairy Alternative Market, By Product Type

- Non-dairy Milk

- Butter

- Cheeses

- Yoghurts

- Ice Cream

- Others

Singapore Dairy Alternative Market, By Distribution Channel

- Supermarkets/Hypermarkets

- Convenience Stores

- Online Retail

- Others

Need help to buy this report?