Singapore Diabetes Therapeutics Market Size, Share, and COVID-19 Impact Analysis, By Diabetes Type (Type 1 and Type 2), By Drug (Insulin, Sensitizers, SGLT-2 Inhibitors, and Alpha-Glucosidase Inhibitors), By Route of Administration (Oral, Subcutaneous, and Intravenous), By Distribution Channel (Online Pharmacies, Hospital Pharmacies, and Retail Pharmacies), and Singapore Diabetes Therapeutics Market Insights, Industry Trend, Forecasts to 2033

Industry: HealthcareSingapore Diabetes Therapeutics Market Insights Forecasts to 2033

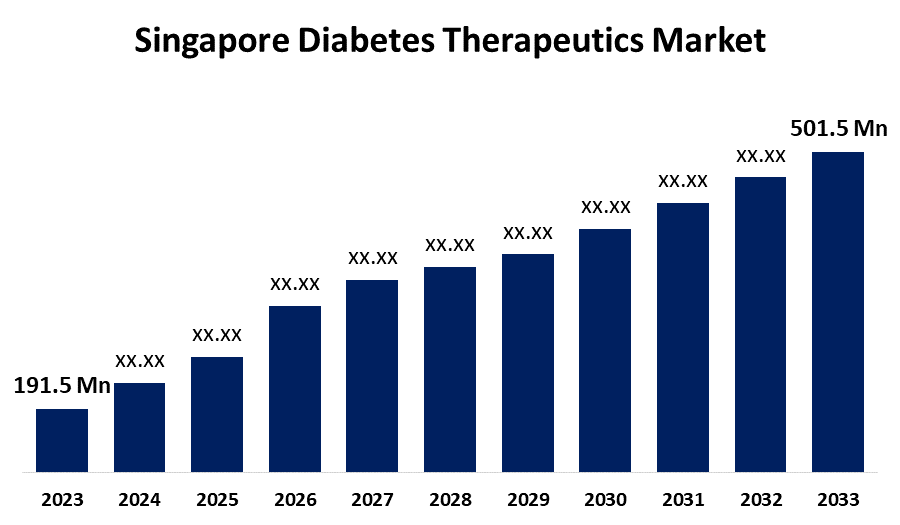

- The Singapore Diabetes Therapeutics Market Size was valued at USD 191.5 Million in 2023.

- The Market Size is growing at a CAGR of 10.11% from 2023 to 2033

- The Singapore Diabetes Therapeutics Market Size is expected to reach USD 501.5 Million by 2033

Get more details on this report -

The Singapore Diabetes Therapeutics Market Size is anticipated to exceed USD 501.5 Million by 2033, growing at a CAGR of 10.11% from 2023 to 2033. The increasing prevalence of diabetes, rising sedentary lifestyle, and R&D for the development of new & effective drug treatments are driving the growth of the diabetes therapeutics market in Singapore.

Market Overview

Diabetes is an increasing health problem characterized by the progressive dysregulation of carbohydrate metabolism due to insufficient insulin hormone, leading to consistently high blood glucose levels. From 8.3% in 2010 to 8.6% in 2017, the prevalence of diabetes mellitus among Singaporeans and permanent residents aged 18 to 69 years rose, and by 2030, the International Diabetes Federation projects that the country's total adult population is expected to have a DM prevalence of 13.7%. Thus, the growing diabetes cases in the country are significantly responsible for driving the market demand for diabetes therapeutics. The surging accessibility of diabetes therapies such as oral hypoglycemic medications among diabetes patients especially those who belong to the low/middle-income class are driving the market growth. Furthermore, several government initiatives for providing diabetes care facilities are creating lucrative market opportunities. For instance, the Ministry of Health (MOH) and the Institute of Policy Studies (IPS) launched the Citizens’ Jury (CJ) for the War on Diabetes to mobilize the public to increase awareness of diabetes and produce community-based recommendations on how to better prevent and manage diabetes.

Report Coverage

This research report categorizes the market for the Singapore diabetes therapeutics market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Singapore diabetes therapeutics market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Singapore diabetes therapeutics market.

Singapore Diabetes Therapeutics Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 191.5 Million |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 10.11% |

| 2033 Value Projection: | USD 501.5 Million |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Diabetes Type, By Drug, By Route of Administration, By Distribution Channel |

| Companies covered:: | Raffles Medical Group, Astrazeneca, Boehringer Ingelheim, Eli Lilly, Novartis, Glaxosmithkline, Novo Nordisk, and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

According to the most recent National Population Health Survey, the crude prevalence of diabetes increased from 8.8% in 2017 to 9.5% in 2020. The increasing prevalence of diabetes in the country is responsible for driving the market demand. A sedentary lifestyle combined with an unhealthy diet might lead to type 2 diabetes which may develop as a result of insulin resistance brought on by these conditions. The rising sedentary lifestyle in the country is responsible for propelling the diabetes therapeutics market. Further, the increasing R&D activities for new and effective drug treatment of diabetes are driving the market growth for diabetes therapeutics.

Restraining Factors

The challenges associated with the compliance of stringent regulations that are required for the approval of diabetes therapeutic drugs are restraining the Singapore diabetes therapeutics market. The awareness about the side effects of anti-diabetic drugs is anticipated to restrain the market growth.

Market Segmentation

The Singapore Diabetes Therapeutics Market share is classified into diabetes type, drug, route of administration, and distribution channel.

- The type 2 segment accounted for the largest revenue share of the Singapore diabetes therapeutics market in 2023.

The Singapore diabetes therapeutics market is segmented by diabetes type into type 1 and type 2. Among these, the type 2 segment accounted for the largest revenue share of the Singapore diabetes therapeutics market in 2023. Oral anti-diabetic drugs such as metformin, sulfonylureas, DPP-4 inhibitors, and SGLT2 inhibitors are used to control blood sugar levels. It also includes insulin therapies, blood glucose monitoring devices such as glucometers, test strips, lancets, and control solutions. The rising number of drug development for the treatment of type 2 diabetes is driving the market.

- The insulin segment dominates the market with the largest market share during the forecast period.

The Singapore diabetes therapeutics market is segmented by drug into insulin, sensitizers, SGLT-2 inhibitors, and alpha-glucosidase inhibitors. Among these, the insulin segment dominates the market with the largest market share during the forecast period. Insulin is significantly used for diabetes treatment by keeping blood sugar under control and preventing diabetes complications. The rapidly increasing diabetic population in the country and the adoption of insulin analogs for treatment are driving the market in the insulin segment.

- The subcutaneous segment dominated the Singapore diabetes therapeutics market with the largest market share in 2023.

Based on the route of administration, the Singapore diabetes therapeutics market is divided into oral, subcutaneous, and intravenous. Among these, the subcutaneous segment dominated the Singapore diabetes therapeutics market with the largest market share in 2023. Diabetes therapeutic drug such as insulin is administered by subcutaneous route using a 25G (orange hub) needle. The rising use of subcutaneous insulin injections and the availability of generic & biosimilar insulin substitutes are anticipated to drive the market expansion in the subcutaneous segment.

- The retail pharmacies segment dominated the market with the largest market share in 2023.

The Singapore diabetes therapeutics market is segmented by distribution channel into online pharmacies, hospital pharmacies, and retail pharmacies. Among these, the retail pharmacies segment dominated the market with the largest market share in 2023. In retail pharmacies, pharmacists utilize their clinical expertise for monitoring and managing diabetes medication plans and ensuring safe, appropriate, cost-effective diabetes medication use. The availability of drugs in retail pharmacies at affordable costs is driving the market growth.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Singapore diabetes therapeutics market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Raffles Medical Group

- Astrazeneca

- Boehringer Ingelheim

- Eli Lilly

- Novartis

- Glaxosmithkline

- Novo Nordisk

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In March 2023, BetaLife acquired the rights to human induced pluripotent stem cell (iPSC) technology from Singapore’s Agency for Science, Technology, and Research (A*STAR) for use in the treatment of diabetes.

- In January 2022, Digital health firm ConnectedHealth unveiled a new disease management app targeting patients with type 2 diabetes mellitus and sub-optimal to poor blood glucose control.

Market Segment

This study forecasts revenue at Singapore, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the Singapore Diabetes Therapeutics Market based on the below-mentioned segments:

Singapore Diabetes Therapeutics Market, By Diabetes Type

- Type 1

- Type 2

Singapore Diabetes Therapeutics Market, By Drug

- Insulin

- Sensitizers

- SGLT-2 Inhibitors

- Alpha-Glucosidase Inhibitors

Singapore Diabetes Therapeutics Market, By Route of Administration

- Oral

- Subcutaneous

- Intravenous

Singapore Diabetes Therapeutics Market, By Distribution Channel

- Online Pharmacies

- Hospital Pharmacies

- Retail Pharmacies

Need help to buy this report?